BioPharma Credit PLC: Lending on Life Sciences under the Microscope

BioPharma Credit PLC (BPCR) is a London-listed investment trust specializing in debt financing for the life sciences sector. Managed by Pharmakon Advisors, it provides loans to pharmaceutical and biotech companies with marketed drugs, aiming for an 8–9% annual net return on NAV and paying a steady $0.07 per share dividend (yield ~8%) plus occasional specials.

The fund’s niche focus offers investors high-income exposure uncorrelated with equity markets, but its model also raises unique concerns. Below, we present a dual analysis: a Red Team critique questioning BPCR’s strategy, and a Blue Team defense highlighting its strengths, followed by a neutral summary.

Red Team: Skeptical View of Risks and Challenges

Business Model & Strategy – High Yield, High Risk? BPCR’s allure is in lending at double-digit yields to biopharma borrowers. Yet these juicy coupons may reflect elevated risks, as many borrowers are single-product biotech firms with uncertain fortunes. Unlike diversified corporate lenders, BPCR lends against future drug revenues and IP, which are volatile assets. A drug’s sales can disappoint or face competition, jeopardizing loan repayment. For instance, one BPCR investee, LumiraDx, underperformed and the loan realized a slight loss (net IRR ≈ –1%), underscoring that even secured loans can sour.

NAV stability is not guaranteed if a borrower defaults – loan fair values, carried at modelled DCF, could plummet if drug prospects falter. The portfolio’s concentration compounds this risk: the top four investments (Collegium, Insmed, BioCryst, Evolus) make up ~62% of assets. Idiosyncratic shocks – an FDA safety alert or patent loss – could significantly impair NAV despite its superficial steadiness.

Trading at $0.88 – Discount and “Penny Stock” Stigma

BPCR’s share price of ~$0.88 lingers ~10–15% below NAV (bpcruk.com). This persistent discount signals market skepticism. Some institutional investors may shun sub-$1 stocks, perceiving them as illiquid “penny stocks” unworthy of a position. The discount also reflects worries about BPCR’s niche risk profile and limited growth avenues. Notably, the fund cannot easily issue new shares for expansion when trading below NAV (that would dilute existing holders).

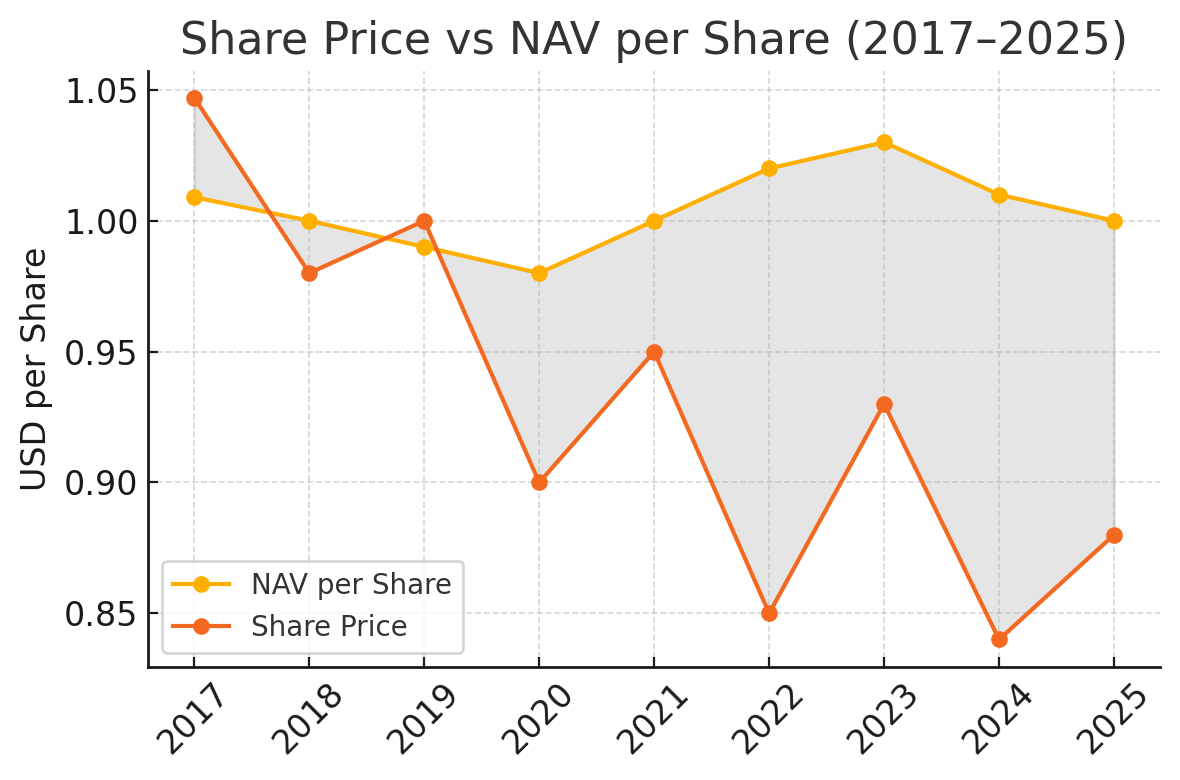

Thus, its ambitious equity raises of 2017–2018 (adding $623m) are unlikely to be repeated soon. The board’s buyback policy – triggered when discounts exceed 5–10% – has been invoked heavily: BPCR repurchased 116.6 million shares (~8.5% of float) at ~$0.91 in early 2025 (londonstockexchange.com). While accretive to NAV, buybacks tacitly acknowledge the lack of market appetite, and they consume cash that could fund new loans. The share price vs. NAV history (below) reveals that initial optimism (shares at premium in 2017) gave way to discounts in recent years, widening during periods of biotech volatility and only partly narrowing after aggressive buybacks.

Share price has consistently traded below NAV in recent years, with the discount widening to over 15% in 2022–2024 before modest improvement. Persistent NAV discounts indicate investor caution despite stable underlying valuations. The grey area shows the gap between NAV and market price.

Dividend Sustainability – Mind the Gap: BPCR’s attractive yield rests on interest and fee income from its loan portfolio. However, can earnings reliably cover the dividend? The fund targets ~$0.07 (7% yield) annually. In years with many early loan prepayments, BPCR earns extra fees (which funded special dividends like 2019’s). But prepayments also leave cash drag until reinvested. If multiple large loans repaid early or, worse, were impaired, BPCR’s net interest income could fall short.

Notably, ~15% of assets are currently in cash or undrawn commitments, yielding near zero – a drag on income until deployed. Meanwhile the management fee (1% of NAV) and incentive fee (10% of NAV gains) are ongoing overhead. There’s a risk BPCR might at times be “earning 5% but paying 7%”, effectively dipping into capital or one-off fees to sustain dividends. Over the long term, dividend coverage hinges on continually originating high-yield loans without major gaps or losses – a challenging mandate as credit conditions and biotech cycles fluctuate.

Borrower Quality & Default Risk

Unlike traditional high-yield bonds, BPCR’s loans lack public ratings and often involve sub-investment-grade counterparties. Many borrowers are R&D-heavy firms burning cash. While BPCR prudently restricts lending to companies with an approved drug, some are still loss-making biotechs reliant on one product. The risk of default or debt restructuring is real if a drug’s uptake disappoints. For example, UroGen (market cap $193 million) has a $50 million loan from BPCR – if its niche cancer therapy underperforms, UroGen’s limited balance sheet could make full repayment tenuous. Recovery on default might be low: BPCR’s collateral is often royalty rights or IP that may have uncertain value in distress (especially if the drug indication failed to gain traction).

Unlike hard assets, pharma IP can be binary – valuable if the drug succeeds, but worth little if it fails. Moreover, in a default scenario BPCR might face protracted legal processes to enforce claims on IP, during which time interest isn’t received. The secondary market for such loans is illiquid, so BPCR cannot easily sell a troubled loan (at anything above fire-sale pricing) to limit damage. This illiquidity also means NAV marks may lag deteriorating credit reality, as valuations rely on modelled cash flows. Investors thus face latent downside risk not apparent in quarter-to-quarter NAV figures.

Concentration and Limited Exit Options

BPCR holds a highly concentrated portfolio of 11 loans, and many are club deals where BPCR is a significant lender. This concentration magnifies impact of any single credit event. It also means few natural exit options short of full repayment or refinancing. If BPCR ever needed liquidity (to fund a sudden opportunity or meet redemption pressures in a wind-up scenario), it could not readily sell half a Collegium loan in the market – buyers for bespoke biopharma loans are limited.

The limited universe of co-lenders and buyers (specialty credit funds like Oaktree, Oberland, etc.) implies BPCR is often effectively “locked in” until maturity or borrower-driven refinance. This could be problematic if macro conditions change. For instance, rising interest rates might entice borrowers to refinance BPCR’s loans elsewhere (since many loans have prepayment after a lockout), resulting in sudden cash inflows that must be redeployed in a higher-rate environment – a good problem, except if new deals are scarce, then cash yields less.

Conversely, if rates fall or credit spooks increase, BPCR might be stuck with lower-yielding or riskier loans it cannot offload. In short, liquidity risk is asymmetric – borrowers prepay when it’s advantageous to them (not BPCR), and won’t refinance when their credit deteriorates, leaving BPCR holding the bag.

Management Incentives and Conflicts

BPCR’s external manager, Pharmakon, also manages private credit funds (the BioPharma Private funds I–V) that often co-invest. This raises questions about allocation of deals and conflicts. Pharmakon’s private Fund V has taken the lion’s share of certain loans (e.g. 60% of the BioCryst $450m loan, leaving 40% to BPCR). One could ask, are the most attractive deals shared equally? The manager asserts co-investments align interests, but private funds’ fee structures might motivate channeling of high-return or longer-duration loans to those vehicles.

Additionally, performance fees based on NAV could incentivize short-term NAV boosts (via one-off special dividends or aggressive valuation assumptions) rather than long-term share price convergence. The fact that BPCR’s shares languish at a discount despite NAV stability suggests a misalignment – shareholders care about market value, but the manager is paid on NAV. Buybacks (executed via JPMorgan) help narrow the discount, but also reduce assets under management.

There’s an inherent tension between asset growth (boosting fee base) and share buybacks/dividends (returning capital to investors). The manager may prefer to reinvest capital into new loans, whereas shareholders might be better off with buybacks if the discount stays wide. Without a stronger mechanism to hold the discount near NAV (or an eventual wind-up if performance falters), investors bear the risk of permanently trapped value – a discounted dollar in NAV terms may only ever fetch $0.85–$0.95 in the market (research-tree.com).

Blue Team: Constructive Defense of the Investment Thesis

Underwriting Discipline & Portfolio Quality: Proponents argue that BPCR’s approach is high-yield with lower risk than typical junk debt. The manager’s strict criteria – lending only against approved, marketed therapies – avoids binary clinical trial risk and ensures borrowers have revenue streams. Unlike venture lenders, BPCR is financing drugs already benefitting patients and generating sales. For example, Insmed’s Arikayce for chronic lung infections and BioCryst’s Orladeyo for hereditary angioedema are on the market with growing revenue. Analyst sales forecasts for these drugs show robust trajectories (Insmed’s Arikayce projected to reach $563 million by 2029; BioCryst’s Orladeyo similarly ramping up).

These revenue projections, vetted by Wall Street and internal analysis, underpin the loans’ repayment capacity. Moreover, BPCR often structures in covenants, amortization and security to protect downside. For Collegium’s $646 million loan, the fund negotiated quarterly principal amortization (2.5% of original) and a stringent 1-year make-whole prepayment penalty. By requiring amortization, BPCR ensures its principal is gradually de-risked (Collegium’s outstanding balance is already down to $275.9 million from $290.4 million invested). Many loans have hefty make-whole and exit fee provisions, meaning if a borrower refinances early, BPCR still receives the bulk of intended interest. This mitigates reinvestment risk and has enabled BPCR to pay special dividends funded by prepayment fees without eroding base income.

Additionally, all current loans are senior secured (no junior or unsecured credit), often with claims on royalties or IP. While IP collateral value can be uncertain, these loans frequently include security interest in cash-rich Big Pharma partnerships or inventory. For instance, the BioCryst loan is secured in part by Orladeyo’s global sales proceeds, and the Bristol Myers royalty transaction gives BPCR a direct cut of diabetes drug royalties from BMS (quoteddata.com). Such structuring provides multiple ways to get paid – either via borrower’s own sales or, if needed, redirecting partner royalty payments.

NAV Resilience & Low Volatility

One of BPCR’s selling points is NAV stability. Debt instruments held at amortized cost (adjusted for expected credit loss) do not swing with market sentiment. Indeed, since inception the NAV per share has hovered around ~$1.00 with minimal volatility. Even during the 2020 pandemic turmoil, BPCR’s NAV barely budged, as its borrowers continued selling essential medicines and meeting interest payments. This contrasts with equity-based biotech funds that saw sharp drawdowns. The stability stems from the predictable cash flows of loan interest and principal amortization – “boring” but reliable. Management emphasizes that BPCR’s cash flows have low correlation to equity or broad credit markets.

Whether the S&P 500 is rallying or tanking has little bearing on whether a cystic fibrosis patient takes their drug (and thus on the royalty/loan payment tied to that drug). BPCR has thus enjoyed low volatility – the annualized standard deviation of its share price total return since IPO is relatively low, reflecting the steadiness of underlying NAV. Supporters point out that a steady NAV floor plus high dividends create a total return profile akin to a bond – and the market’s discount provides an additional buffer. Should BPCR ever wind down, shareholders could reasonably expect to realize close to NAV (mostly in cash from loan repayments).

In the interim, buybacks at discounts accrete NAV for remaining holders, effectively capturing some of that upside. The chart below shows BPCR’s share price tracking NAV with a lag – the gap has narrowed at times when the market recognized improving fundamentals, and buybacks helped shrink the discount to single digits in 2023 (citywire.com). Long-term holders have earned high income without NAV erosion – an attractive proposition in volatile markets.

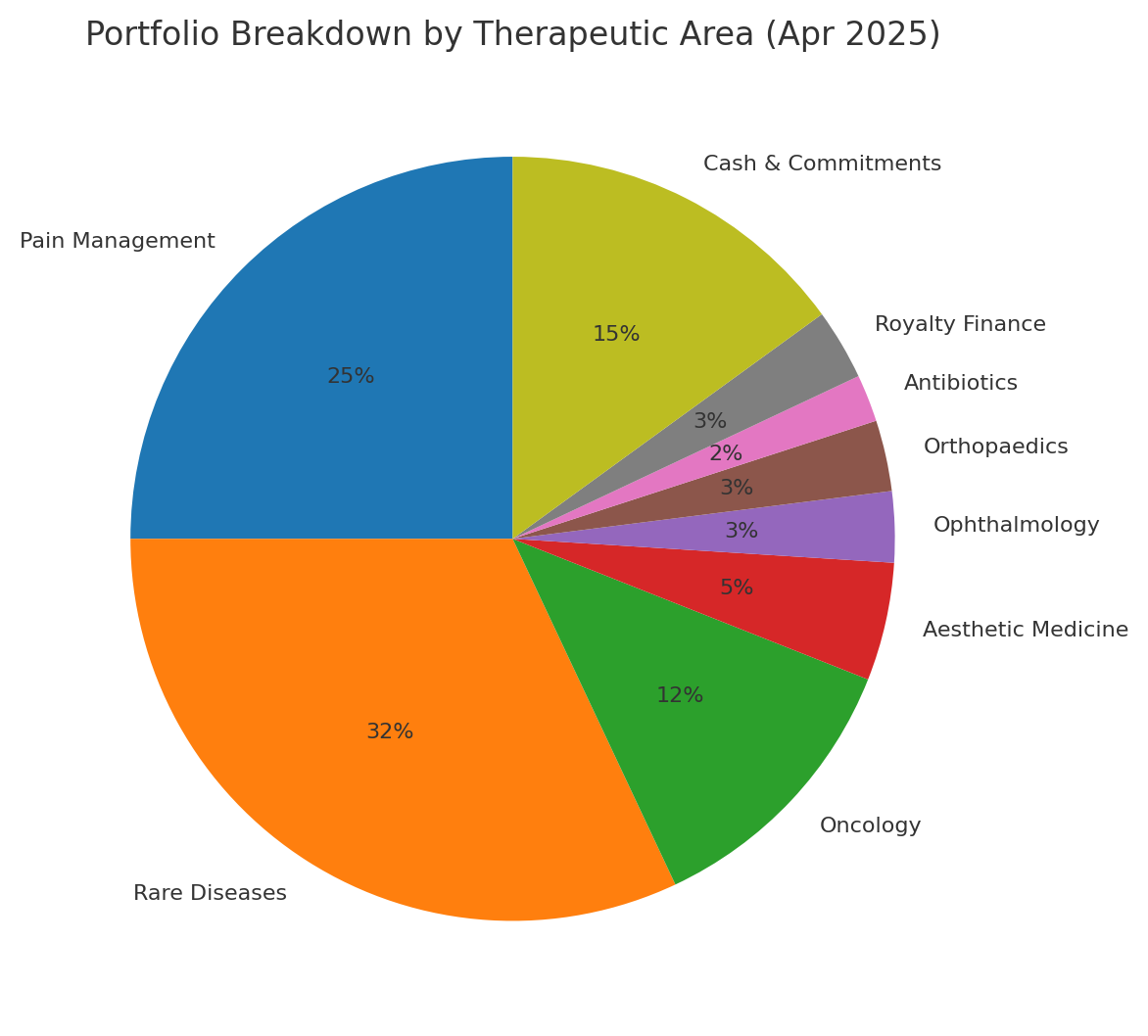

BPCR’s portfolio spans multiple therapeutic areas, reducing exposure to any single market. As of April 2025, the fund is diversified across pain management (25% of assets via Collegium’s pain drugs), rare diseases (32% via orphan disease therapies like Insmed’s and BioCryst’s), oncology (12% via cancer-focused loans), and other niches from ophthalmology to orthopedics. This breadth helps spread risk across healthcare subsectors.

High Coupon Yields Backed by Solid Credits

The current portfolio’s weighted average projected IRR is in the low teens, reflecting coupons often SOFR + 4.5–7.5% plus fees, or fixed ~9–10% in the one royalty note. These are high yields for predominantly floating-rate, senior-secured loans. In today’s interest rate environment, BPCR is benefitting from rising base rates – many loans have SOFR floors (e.g. Collegium at 4% floor) which were exceeded as rates rose, boosting income. Unlike a fixed-rate bond fund, BPCR has no duration risk – its floating coupons reset with rates, and short maturities (most loans due by 2027–29) limit interest rate exposure.

In fact, higher rates have increased BPCR’s gross income, bolstering dividend coverage. From a credit perspective, borrowers’ ability to pay these high rates is evidenced by their substantial equity capitalizations and cash reserves. Most of BPCR’s capital is lent to well-capitalized mid-sized biotechs – Insmed’s market cap is $12.3 billion with $1.2 billion cash; BioCryst $2.2 billion with $317 million cash; Novocure $2.1 billion with $929 million cash. These companies have diversified funding sources and are not solely reliant on BPCR’s loan (often the loans are a minority of their enterprise value). BPCR’s borrower base skews toward larger, established players – by design, the manager targets companies with at least ~$100 million in revenues or significant cash runway. Only a small portion of the portfolio is in micro-caps: e.g.

UroGen and Paratek together are <7% of assets. Thus, credit risk is mitigated through borrower selection – the average borrower profile is a publicly traded, late-stage biotech with high-value drugs and substantial equity backing. Indeed, some loans have seen credit upgrades in effect: when ImmunoGen and Reata, two past borrowers, achieved positive drug outcomes, their enterprise values soared and both loans were prepaid early (yielding BPCR outsized IRRs of 45–120% net). Such outcomes underscore that BPCR’s interests often align with borrowers’ success – if a borrower’s fortunes improve, they refinance and BPCR redeploys capital at new attractive opportunities (with prepayment income as a bonus).

And if fortunes fade, BPCR’s senior liens on assets act as a safety net (for example, even when LumiraDx struggled, BPCR exited with most of its capital intact, cushioned by collateral and restructuring efforts).

Risk-Adjusted Returns & Track Record

Since inception, BPCR (and Pharmakon’s prior funds) have delivered ~10% unlevered net IRRs with no principal losses on any fully realized loan. The investment manager’s track record spans 13+ years, including four private funds that all achieved net IRRs around 10–11% – remarkable consistency for credit investments across varying cycles. The fund’s philosophy is “singles and doubles, not home runs” – prioritizing capital preservation and steady returns over stretch goals. This is evidenced by dozens of loans that have been repaid in full: e.g., 100% of BPCR’s loans made in 2017–2018 were repaid with interest by 2021, often via acquirers buying the borrowers (Tesaro, Novocure II, etc.).

The worst outcome to date (LumiraDx) still returned ~0.9x MOIC, while many others returned 1.2–1.4x. Over the long run, such loss avoidance and fee-enhanced returns give BPCR a strong Sharpe ratio relative to high-yield peers. Furthermore, BPCR’s low market correlation provides true diversification: in periods when equities or conventional bonds falter, BPCR’s loans march on. For example, during the 2022 biotech bear market, BPCR’s NAV rose slightly and dividends kept flowing, even as biotech equity funds fell 30–40%. This resilience is valuable to multi-asset investors.

Finally, management’s interests are aligned with shareholders’ in key ways: Pharmakon insiders own stakes in BPCR, and the firm’s reputation (as a leader in pharma debt) rides on BPCR’s success. The co-investment model with Private Fund V means BPCR gets access to larger deals (like the $547m Insmed loan, of which it took 40%) that it couldn’t alone fund – benefiting from scale while sharing risk. In such syndications, terms are often superior because Pharmakon can negotiate as lead arranger for the entire $500m+ facility (securing covenants, collateral, etc., that a smaller lender couldn’t).

Economies of scale and specialization thus give BPCR an edge in sourcing and structuring high-quality deals that generalist credit funds or banks overlook. In sum, the Blue Team contends that BPCR offers a rare combination: equity-like returns (10%+) with bond-like downside protection, managed by a team with a proven record in an esoteric but growing asset class.

Low Correlation, High Income – A Portfolio Balancer

Investors seeking income and diversification find BPCR compelling as a complement to equities. Healthcare debt has little correlation with macro cycles – people need medicines in good times and bad. BPCR’s loans are mostly indifferent to GDP growth or inflation, as interest rates are floating and demand for drugs is inelastic. Moreover, the healthcare sector’s R&D spending has been robust (from $81 billion in 2013 to $249 billion in 2021) and companies increasingly turn to debt financing to fund growth or acquisitions. BPCR, as the only UK-listed vehicle exclusively focused on life science credit, enjoys first-mover advantage and strong deal pipeline. Pharmakon reportedly reviews dozens of opportunities per year, selecting only a few – maintaining a high bar.

With Big Pharma flush with cash and biotech valuations recovering, more M&A and more licensing deals could occur, often triggering loan refinancing or providing BPCR new lending chances (such as financing buyouts or providing bridge loans for acquisitions). The fund’s structure (permanent capital) allows it to patiently participate in such opportunities without forced selling. Meanwhile, shareholders collect ~8% dividends quarterly. Those distributions have been stable (the $0.07 annual target has been met or exceeded every year since 2018) and are well-covered by net interest income in most periods.

The occasional specials (e.g. $0.0175 extra in early 2023 after ImmunoGen and Reata prepayments) are icing on the cake, illustrating how successful exits directly benefit shareholders. In an era when traditional bonds yield ~4–5%, BPCR’s yield near 8% (and total return potential ~10%+) is attractive – especially given the defensive, healthcare-backed nature of its assets. Some analysts have even called BPCR “a proxy for Big Pharma royalties”, since a portion of the portfolio (3%) is effectively a slice of BMS’s drug royalties (quoteddata.com), and the rest is secured by drugs sold by the likes of Novartis, Takeda, or other large firms (as partners of BPCR’s borrowers).

The diversification across therapeutic areas also strengthens the portfolio: BPCR isn’t betting on one disease or one company. Its loans span pain management, rare genetic diseases, oncology devices, ophthalmology, and more (see pie chart above), matching the broader healthcare universe. This reduces exposure to any single regulatory or competitive shock. For instance, aesthetic medicine (Evolus’s Botox-alternative) is unrelated to oncology (Novocure’s tumor therapy) or to rare diseases – so the portfolio can absorb a setback in one area while others perform.

In the Blue Team’s view, BPCR provides a well-managed, income-generating portfolio with prudent risk controls, making a compelling case for inclusion as a fixed-income alternative.

Neutral Summary

BioPharma Credit PLC stands at the intersection of biotech innovation and structured finance, offering loans that fuel drug development while aiming to deliver steady high income to investors. Skeptics highlight the fund’s concentrated bets on a handful of specialty pharma credits, the opaque nature of biotech loan risk, and a persistent market discount (~12%) that suggests investor caution regarding BPCR’s niche. They worry that borrower defaults, illiquid positions, or misaligned incentives could undermine the promise of stable NAV and dividends. Supporters, however, argue that BPCR has thus far navigated this complex sector adeptly – rigorously vetting borrowers, securing collateral, and achieving a 10%+ return profile with minimal volatility or losses.

The portfolio is diversified across therapeutic areas and mostly comprises established biotech companies with real revenue, which underpins repayment. Shareholders have enjoyed a high yield and seen NAV hold firm even through market turmoil, bolstered by an experienced manager and disciplined strategy. In sum, BioPharma Credit PLC offers a unique investment proposition: a way to earn equity-like returns from the growing life sciences industry, but through the lens of a lender rather than a shareholder. Its dual nature – part credit fund, part healthcare play – means that investors must weigh both sets of considerations outlined above.

Going forward, BPCR’s performance will be judged on its continued credit underwriting success and its ability to close the gap between NAV and share price. Whether the current discount represents a mispricing or a permanent feature remains a key question.

Member discussion