Company of the week: Avalyn Pharma - Inhaled Therapeutics for Pulmonary Fibrosis

Avalyn Pharma represents a compelling yet high-risk opportunity in the rapidly evolving pulmonary fibrosis therapeutics market. The company's differentiated approach of reformulating proven oral antifibrotics into inhaled formulations addresses critical tolerability limitations that plague current standard-of-care treatments. With a recently completed $100 million Series D financing round in July 2025, Avalyn is well-positioned to advance its lead program AP01 (inhaled pirfenidone) through the ongoing Phase 2b MIST trial and develop its broader pipeline of inhaled therapeutics.

This blue and red team analysis rests on four key pillars: (1) a large and growing market opportunity valued at $4.9 billion in 2025 and projected to reach $6.9-8.9 billion by 2030, (2) a differentiated inhaled delivery platform that could capture 30-50% of patients who discontinue oral therapies due to intolerable side effects, (3) an experienced management team with deep respiratory drug development expertise and successful exit track records, and (4) multiple shots on goal with three clinical programs targeting different patient populations and treatment paradigms.

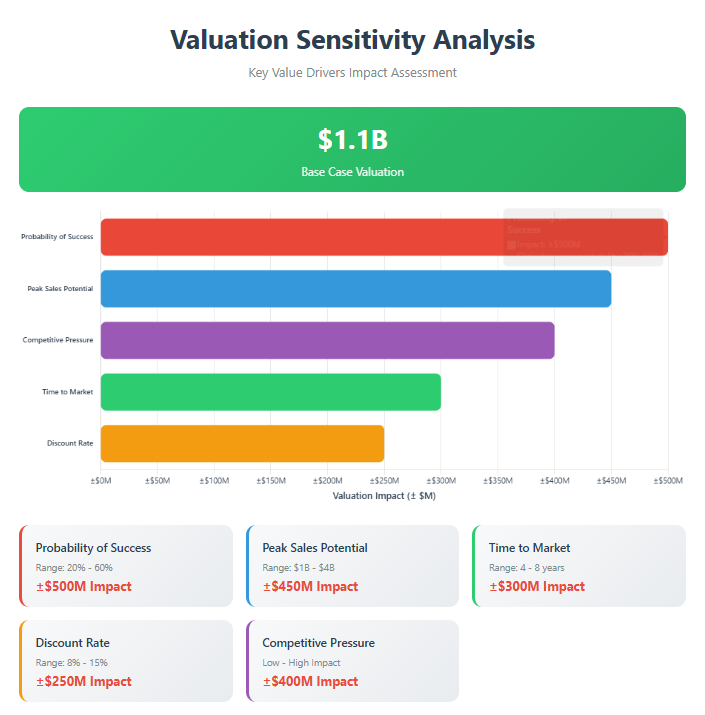

However, significant risks warrant careful consideration. The recent positive Phase 3 results for Boehringer Ingelheim's oral nerandomilast represent a major competitive threat that could fundamentally alter the treatment landscape. Additionally, the inherent challenges of pulmonary fibrosis drug development, where only two drugs have achieved FDA approval in decades of research, create substantial clinical development risk. Based on comprehensive analysis using multiple valuation methodologies, we estimate Avalyn's current valuation at $800 million to $1.5 billion, with a base case of $1.1 billion. The wide range reflects the binary nature of clinical outcomes and competitive dynamics that will crystallize over the next 12-18 months.

Company Background and Corporate Evolution

Founded in 2011 as Genoa Pharmaceuticals in Seattle, Avalyn Pharma emerged from the personal experience of co-founder Mark Surber, Ph.D., whose family history with idiopathic pulmonary fibrosis (IPF) inspired the development of inhaled pirfenidone. The company's foundational insight was elegantly simple yet potentially transformative: by delivering antifibrotic medications directly to the lungs via inhalation, therapeutic efficacy could be enhanced while minimizing the systemic side effects that limit oral therapy adoption.

The company's evolution from a founder-led startup to a professionally managed clinical-stage biotechnology firm reflects the maturation of both its science and corporate strategy. The 2017 rebranding from Genoa to Avalyn—derived from old English meaning "a beautiful breath of life"—marked the transition from preclinical research to clinical development. This was followed by strategic leadership changes, including the 2022 appointment of Lyn Baranowski as CEO, bringing over two decades of respiratory therapeutics experience from successful companies including Pearl Therapeutics (acquired by AstraZeneca for $1.15 billion) and Altavant Sciences.

The 2023 relocation of corporate headquarters from Seattle to Cambridge, Massachusetts, positioned Avalyn at the epicenter of the biotechnology ecosystem, facilitating talent acquisition and investor engagement. This geographic pivot coincided with the company's largest financing round to date—a $175 million Series C that validated the clinical proof-of-concept demonstrated in the Phase 1b ATLAS trial. The subsequent $100 million Series D in July 2025, despite challenging market conditions, underscores continued investor confidence in the platform and management team.

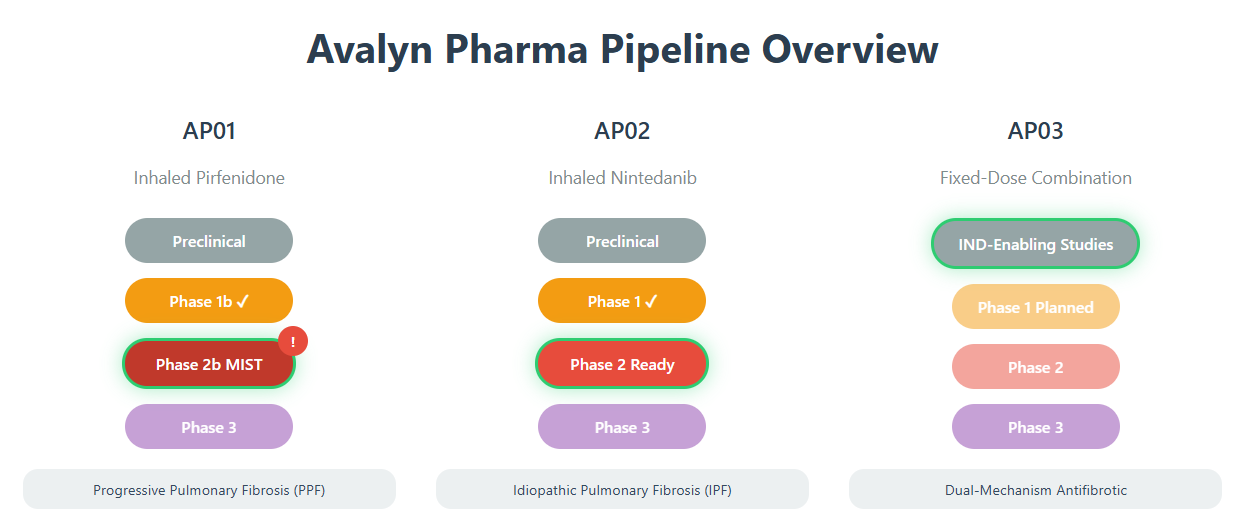

Pipeline Analysis: Three Shots on Goal

AP01 - Inhaled Pirfenidone: The Lead Asset

AP01 represents Avalyn's most advanced program, currently being evaluated in the global Phase 2b MIST trial for progressive pulmonary fibrosis (PPF). The completed Phase 1b ATLAS study demonstrated compelling proof-of-concept, with the 100 mg twice-daily dose achieving near-stabilization of lung function (-0.4% FVC decline at 48 weeks) compared to historical oral pirfenidone data showing substantially greater decline rates.

The MIST trial design reflects sophisticated clinical development strategy, enrolling 300 patients with progressive pulmonary fibrosis across multiple continents. The 2:1:2 randomization (100mg BID : 50mg BID : placebo) enables dose-response assessment while maximizing patient exposure to active treatment. Importantly, the trial incorporates Qureight's AI-powered imaging analytics—the first deployment of deep-learning technology in a PPF clinical study—potentially enhancing endpoint sensitivity and providing deeper mechanistic insights.

Long-term safety data from the ATLAS open-label extension study, now exceeding 4.5 years in some patients, provides unprecedented durability evidence for an investigational pulmonary fibrosis therapy. The favorable safety profile, with cough as the primary treatment-related adverse event (occurring in 15-30% of patients versus 80%+ GI side effects with oral therapies), suggests the potential for superior real-world adherence.

AP02 - Inhaled Nintedanib: Validating the Platform

AP02's successful completion of Phase 1 trials positions it as a critical platform validator. The pharmacokinetic profile demonstrates the elegance of inhaled delivery: achieving 9-fold higher lung exposure while reducing systemic exposure by 68-fold compared to oral nintedanib. This dramatic shift in drug distribution could enable therapeutic efficacy while eliminating the severe gastrointestinal side effects that cause over 60% discontinuation rates with oral nintedanib.

The Phase 1 program enrolled both healthy volunteers and IPF patients, with no serious adverse events reported across all dose cohorts. The most common side effects—mild headache, nausea, and cough—represent a marked improvement over the debilitating diarrhea associated with oral nintedanib. Plans to advance AP02 into Phase 2 development for IPF provide portfolio diversification and de-risk the overall analysis framework.

AP03 - Fixed-Dose Combination: The Moonshot

AP03 represents the most ambitious element of Avalyn's pipeline—a fixed-dose combination of inhaled pirfenidone and nintedanib. While oral combination therapy has proven infeasible due to additive toxicities, inhaled delivery could unlock synergistic efficacy by enabling dual-mechanism antifibrotic therapy for the first time. With IND-enabling studies underway and Phase 1 trials planned, AP03 offers transformative potential despite higher development risk.

Competitive Landscape: David vs. Multiple Goliaths

[Competitive Positioning Matrix - See Separate Graphic]

The pulmonary fibrosis treatment landscape is experiencing unprecedented innovation after decades of limited progress. Roche's Esbriet (oral pirfenidone) has seen dramatic revenue decline from over $1 billion to approximately $100 million following patent expiry and generic competition. Boehringer Ingelheim's Ofev (oral nintedanib) has emerged as the market leader with $3.6 billion in annual sales, but remains hampered by significant tolerability issues.

The most significant competitive threat comes from Boehringer Ingelheim's nerandomilast, an oral PDE4B inhibitor that achieved positive Phase 3 results in both IPF and progressive pulmonary fibrosis. The FIBRONEER trials demonstrated statistically significant FVC improvements (68.8mL in IPF, 67.2mL in PPF) with FDA Breakthrough Therapy Designation granted. Expected approval in late 2025 or early 2026 could establish nerandomilast as the new standard of care, though diarrhea rates exceeding 40% suggest continued unmet need for better-tolerated options.

Other notable competitors include Bristol Myers Squibb's BMS-986278 (LPA1 antagonist) showing strong Phase 2 efficacy signals, and United Therapeutics' inhaled treprostinil, which demonstrated unexpected antifibrotic activity in the INCREASE trial. The failure of FibroGen's pamrevlumab and safety issues leading to discontinuation of Pliant's bexotegrast Phase 2b/3 trial underscore the high-risk nature of pulmonary fibrosis drug development.

Financial Analysis: Well-Funded but Capital Intensive

Funding History and Investor Syndicate

Avalyn has raised over $375 million across five funding rounds, demonstrating consistent ability to attract top-tier life sciences investors. The investor syndicate reads like a "who's who" of biotech venture capital, including Suvretta Capital Management, SR One, Perceptive Xontogeny, Novo Holdings, and Surveyor Capital (a Citadel company).

The Series D financing in July 2025, led by Suvretta Capital Management and SR One, was notably oversubscribed despite challenging market conditions. This vote of confidence from sophisticated healthcare investors, particularly Suvretta's David Friedman, M.D., joining the board, validates both the clinical progress and market opportunity.

Burn Rate and Cash Runway Analysis

Based on comparable clinical-stage biotechnology companies and Avalyn's current activities, we estimate an annual burn rate of $43-57 million, comprising:

- R&D expenses: $35-45 million (multiple clinical programs, CMC development)

- G&A expenses: $8-12 million (50 employees, public company readiness)

With $100 million in fresh capital, Avalyn has an estimated runway of 20-28 months, sufficient to:

- Complete the Phase 2b MIST trial and report topline data

- Initiate AP02 Phase 2 development

- Advance AP03 into Phase 1 trials

- Conduct critical CMC and regulatory activities

This positions the company to reach multiple value-inflection points before requiring additional capital, though Phase 3 development will necessitate either significant partnership revenues or additional financing of $150-250 million.

Market Analysis: Large and Growing Opportunity

Disease Burden and Epidemiology

Idiopathic pulmonary fibrosis affects approximately 100,000 Americans and 13-20 per 100,000 people globally, with incidence increasing as populations age. The broader category of progressive pulmonary fibrosis expands the addressable population 2-3 fold, representing patients with various interstitial lung diseases who develop a progressive phenotype.

[Market Size Projection Chart - See Separate Graphic]

The median survival of 2-5 years post-diagnosis and lack of curative therapies create persistent demand for new treatments. Importantly, diagnosis rates are improving due to increased awareness and better imaging technologies, expanding the treatable population.

Commercial Dynamics and Pricing

Current antifibrotic therapies command premium pricing at $110,000-115,000 annually in the United States, though cost-effectiveness analyses suggest these prices are not justified by clinical benefit. Generic pirfenidone availability has created a low-cost alternative, but adherence remains limited by tolerability.

The inhaled delivery paradigm could support premium pricing based on improved tolerability and potentially superior efficacy. We model Avalyn's therapies at $130,000-150,000 annually, reflecting the value of reduced hospitalizations and improved quality of life. Even at premium pricing, capturing 10-15% market share would generate $1.5-2.5 billion in peak annual revenues.

Reimbursement Landscape

Medicare covers the majority of IPF patients given the disease's age distribution. Commercial insurers typically require prior authorization but generally provide coverage given the lack of alternatives. Patient assistance programs from manufacturers help address the 20% Medicare co-insurance burden, though out-of-pocket costs remain a barrier for some patients.

The key reimbursement challenge for Avalyn will be demonstrating superior value versus generic oral pirfenidone. Real-world evidence generation showing reduced hospitalizations and improved adherence will be critical for payer negotiations.

Management Team and Governance

Leadership Excellence

Avalyn has assembled a world-class management team combining scientific innovation, clinical development expertise, and commercial acumen. CEO Lyn Baranowski brings a rare combination of big pharma experience (Novartis), biotech operational excellence (Pearl Therapeutics, Altavant Sciences), and successful exit execution. Her respiratory portfolio experience across multiple successful products provides invaluable strategic perspective.

The clinical development team, led by CMO Howard Lazarus, M.D., and SVP Craig Conoscenti, M.D., brings unparalleled expertise, having directly contributed to the development of oral nintedanib at Boehringer Ingelheim. This insider knowledge of the competing products provides strategic advantages in positioning Avalyn's inhaled formulations.

Board Composition and Governance

The board of directors reflects both investor representation and independent expertise. Notable additions include Chairman Heather Turner, J.D., who recently orchestrated Carmot Therapeutics' $3.1 billion acquisition by Roche, and independent director Erin Lavelle, whose track record includes multiple billion-dollar transactions. The gender diversity (50% of board and executive team) and mix of scientific, operational, and transactional expertise position the company well for value creation.

Regulatory Strategy and Pathway

505(b)(2) Advantages

Avalyn's programs qualify for the 505(b)(2) regulatory pathway, allowing reliance on FDA's previous findings for oral pirfenidone and nintedanib while requiring bridging studies for the inhaled formulations. This approach significantly reduces development time and cost compared to traditional 505(b)(1) new drug applications.

The key regulatory requirements include:

- Establishing pharmacokinetic bridges between oral and inhaled formulations

- Demonstrating appropriate lung deposition and systemic exposure

- Conducting abbreviated clinical programs focused on dose-finding and confirmatory efficacy

- Comprehensive CMC packages addressing the complexities of inhaled drug-device combinations

FDA Engagement and Designation Strategy

While specific FDA interactions remain confidential, Avalyn's programs are strong candidates for expedited development designations. The combination of serious unmet medical need in IPF/PPF and preliminary clinical evidence suggesting substantial improvement over existing therapies supports potential Breakthrough Therapy Designation. Strategic timing of designation requests after Phase 2b data would maximize benefit during Phase 3 planning.

Valuation Analysis

Methodology Integration

Our valuation analysis employs four complementary methodologies to triangulate fair value:

- Risk-Adjusted NPV Analysis: Modeling peak sales of $2.5 billion across the portfolio, with 40% probability of success and 11% discount rate yields $900 million - $1.3 billion

- Comparable Company Analysis: Applying 8-12x peak sales multiples from similar-stage respiratory biotechs suggests $700 million - $1.2 billion

- Precedent Transaction Analysis: The InterMune-Roche transaction ($8.3 billion for single IPF asset) provides upside context, though risk-adjustment yields $1.0 - $1.8 billion

- Private Market Comparables: Recent Series C/D rounds for Phase 2b biotechs support $600 million - $1.1 billion

Investment Returns Scenario Analysis

For Series D investors at an estimated $650 million post-money valuation:

- Bear Case (20% probability): Clinical failure or competitive displacement results in 50-75% loss

- Base Case (50% probability): Successful development leads to $2-3 billion exit, generating 3-5x returns

- Bull Case (30% probability): Breakthrough efficacy drives $4-5 billion acquisition, delivering 6-8x returns

Partnership and M&A Potential

Strategic Partnership Landscape

Avalyn's inhaled platform and clinical progress position it as an attractive partner for major pharmaceutical companies. Primary partnership candidates include:

Boehringer Ingelheim: Despite nerandomilast success, strategic interest in inhaled delivery for portfolio expansion and lifecycle management. Potential for regional partnership preserving Avalyn's US rights.

Roche/Genentech: Following Esbriet patent expiry, seeking next-generation IPF assets. Deep pockets and respiratory expertise make them ideal partners.

GSK: Recent $7 billion respiratory partnership with Flagship Pioneering demonstrates appetite for innovation. Inhaled delivery expertise from Advair/Breo franchises provides synergies.

M&A Scenarios and Valuation

Historical precedent suggests successful Phase 2b data could catalyze acquisition interest at significant premiums:

- Pre-Phase 3 acquisitions typically command $1.5-3 billion valuations

- Strategic premiums of 30-50% over market valuations common

- Multiple strategic buyers create competitive dynamics

The InterMune-Roche transaction at $8.3 billion pre-approval establishes ceiling valuations for transformative IPF therapies. While Avalyn unlikely to achieve similar valuations given competitive dynamics, the $2-4 billion range appears achievable with strong clinical data.

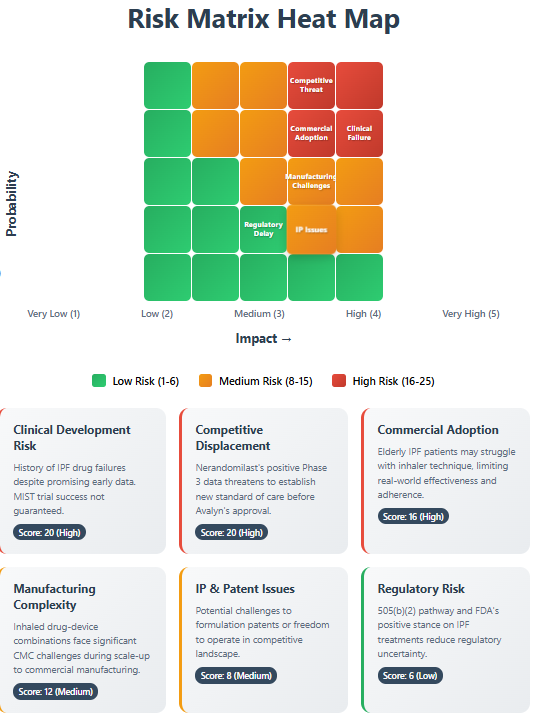

Risk Analysis and Mitigation

Critical Risk Factors

Clinical Development Risk (High - 70% probability): The history of IPF drug development is littered with Phase 3 failures despite promising early data. The MIST trial's success is far from guaranteed, particularly given the heterogeneous PPF patient population.

Competitive Displacement (Very High - 90% probability): Nerandomilast's positive Phase 3 data and likely 2025/2026 approval represents an existential threat. If nerandomilast becomes standard-of-care with acceptable tolerability, Avalyn's market opportunity shrinks dramatically.

Commercial Adoption (High - 70% probability): Historical data shows 20-73% compliance rates with inhaled medications versus higher oral adherence. Elderly IPF patients may struggle with inhaler technique, limiting real-world effectiveness.

Manufacturing Complexity (High - 70% probability): Inhaled drug-device combinations face significant CMC challenges. Scale-up from clinical to commercial manufacturing often encounters unforeseen difficulties that delay approval or require costly remediation.

Mitigation Strategies

Avalyn has implemented several risk mitigation approaches:

- Portfolio diversification across three programs reduces single-asset dependency

- Proven active ingredients lower efficacy risk versus novel mechanisms

- Experienced team with specific inhaled drug development expertise

- Strong IP portfolio protecting formulations and delivery methods

- Sufficient funding to reach multiple value inflection points

Blue and Red Team Analysis Conclusion

Avalyn Pharma represents a high-risk, high-reward opportunity at a critical juncture. The company's differentiated inhaled delivery platform addresses genuine unmet medical needs in pulmonary fibrosis, where 30-60% of patients discontinue current oral therapies due to intolerable side effects. With three shots on goal and an exceptional management team, Avalyn has multiple paths to value creation.

However, the analysis reveals significant headwinds. The looming approval of nerandomilast threatens to transform the competitive landscape before Avalyn's products reach market. The challenging history of pulmonary fibrosis drug development, where numerous promising therapies have failed in late-stage trials, adds clinical risk. Commercial adoption of inhaled therapies by elderly patients presents additional uncertainties.

Our base case valuation of $1.1 billion reflects these balanced risks and opportunities. For risk-tolerant stakeholders with portfolio diversification, Avalyn offers compelling upside potential of 3-8x returns if clinical and commercial execution succeeds. The next 12-18 months will prove pivotal, with MIST trial results and competitive developments likely determining the company's trajectory.

Analysis stance: CAUTIOUS OPTIMISM with significant risk factors

Key catalysts to monitor:

- MIST Phase 2b trial enrollment updates and interim analyses

- Nerandomilast regulatory decisions and launch dynamics

- Partnership announcements that could validate the platform

- AP02 Phase 2 trial initiation demonstrating pipeline progression

- Additional financing events indicating continued stakeholder confidence

Success requires threading the needle between clinical achievement and competitive threats, but the potential to transform pulmonary fibrosis treatment and generate exceptional returns justifies measured optimism for sophisticated healthcare stakeholders. The inhaled delivery revolution in respiratory medicine may well begin with Avalyn Pharma—if they can execute before the window of opportunity closes.

Member discussion