Company of the week: Repare Therapeutics - A Contrarian Precision Oncology Company

Disclaimer: This analysis represents an opinion based on publicly available information and should not be considered investment advice. Please conduct your own research and consult a qualified financial advisor before making investment decisions.

Strategic Refocus Extends Runway and Undervalues Pipeline

Repare Therapeutics (NASDAQ: RPTX) underwent a dramatic strategic pivot in early 2025, implementing a ~75% workforce reduction and realigning its portfolio to conserve cash. This painful but decisive restructuring slashed operating expenses and extended Repare’s cash runway into late 2027 (ir.reparerx.com)—providing ample time for its now streamlined pipeline to reach critical data readouts without additional financing.

As of March 31, 2025, Repare held $124.2 million in cash and equivalents (businesswire.com), significantly exceeding its current ~$67 million market capitalization. In other words, the market is valuing Repare’s entire clinical pipeline at less than zero, allowing investors to essentially buy cash at a ~46% discount and get the pipeline for free.

This valuation disconnect more likely reflects broader biotech market pressures than company-specific fundamentals, given Repare’s strong institutional backing and focused strategy. Major biotech funds like Biotechnology Value Fund (BVF), CHI Advisors, and OrbiMed collectively own a significant stake (BVF alone holds ~24%), signaling sophisticated investor confidence in Repare’s approach.

The strategic refocus concentrates resources on the two highest-potential programs—RP-3467 (Polθ inhibitor) and RP-1664 (PLK4 inhibitor)—while seeking partners for other assets. This enabled management to monetize non-core programs through creative deals: in Q1 2025 Repare out-licensed its discovery platform to DCx Biotherapeutics for $4 million upfront plus equity and potential milestones (businesswire.com), and in July 2025 it licensed PKMYT1 inhibitor lunresertib to Debiopharm for $10 million upfront and up to $257 million in milestones (fiercebiotech.com).

These transactions provided non-dilutive capital and external validation of Repare’s science, all while allowing the company to maintain upside via milestones and royalties. Management’s willingness to cut costs aggressively and pursue partnering options demonstrates a commitment to capital efficiency and shareholder value. Repare has now “trimmed the fat” to focus on its most differentiated synthetic lethal therapies with the highest return potential, setting the stage for a catalyst-rich 2025.

Precision Pipeline Targeting Validated Pathways (Data in 2H 2025)

Repare’s pipeline embodies the synthetic lethality approach to precision oncology, which identifies genetic vulnerabilities where the loss of one gene (e.g. through a tumor mutation) creates dependency on another gene/pathway for cancer cell survival. By drugging that partner pathway, only the cancer cells (with the mutation) are killed, sparing normal cells. This concept was famously validated by PARP inhibitors in BRCA-mutated cancers and is now being extended to new targets (nature.com). Repare’s lead programs exploit such “cancer-only” vulnerabilities.

RP-3467 (Polθ inhibitor)

A potential best-in-class DNA polymerase theta (Polθ) ATPase inhibitor in Phase 1. Polθ is critical for alternative DNA repair in tumors with homologous recombination deficiencies (like BRCA mutations). In October 2024, Repare dosed the first patient in the POLAR trial of RP-3467, both as monotherapy and with PARP inhibitor olaparib, to target BRCA-mutated or HR-deficient ovarian, breast, prostate, and pancreatic cancers. Preclinical data were compelling – RP-3467 combined with olaparib induced complete and durable tumor regressions with no added toxicity, overcoming PARP inhibitor resistance in models. This combination strategy directly addresses a major limitation of current PARPs (resistance), aiming to “finish the job” in BRCA-driven tumors (ir.reparerx.com).

Competing Polθ inhibitors (notably Artios’s ART6043) have generated industry buzz, validating the target, but Repare’s later-entry molecule may have superior drug properties (artios.com). The POLAR trial is on track for initial safety and efficacy data by Q3 2025 (ir.reparerx.com), which will be a key inflection point. Given the $13 billion global sales forecast for PARP inhibitors by 2031, a successful Polθ inhibitor (alone or synergistic with PARPs) could tap into a huge market of PARP-pretreated or resistant patients.

RP-1664 (PLK4 inhibitor)

The first-in-class PLK4 inhibitor in humans, targeting tumors with TRIM37 amplification. PLK4 is essential for centriole biogenesis, and excess TRIM37 (an E3 ubiquitin ligase on chromosome 17q) leads to mitotic vulnerabilities exploitable by PLK4 blockade. Notably, ~80% of high-grade neuroblastomas harbor TRIM37 amplification (ir.reparerx.com), providing a clear path in pediatric cancer. Repare’s Phase 1 LIONS trial (29 patients enrolled) is evaluating RP-1664 in adolescents/adults with TRIM37-high solid tumors, with initial readout expected in Q4 2025.

In February 2024, preclinical data (with Children’s Hospital of Philadelphia) showed RP-1664 induced tumor regressions in TRIM37-high neuroblastoma models. Repare plans to initiate a Phase 1/2 expansion in pediatric neuroblastoma by Q3 2025, leveraging this genetic dependency in a setting of extreme unmet need (relapsed neuroblastoma survival is <10%). With no direct PLK4 competitors, RP-1664 enjoys first-mover advantage and orphan disease pathways.

If it validates the synthetic lethal effect in TRIM37-altered tumors, it could open a new precision oncology paradigm. Repare wisely consulted regulators early, securing Fast Track designation for RP-1664’s development in high-risk neuroblastoma (via the FDA’s Project Optimus pilot to streamline dose optimization in pediatrics).

Lunresertib + Camonsertib (PKMYT1 + ATR inhibitor combo)

Though now partnered, Repare’s Phase 1 MYTHIC trial already delivered proof-of-concept for this synthetic-lethal combo in CCNE1-amplified and FBXW7/PPP2R1A-mutant gynecologic cancers. Among heavily pretreated patients, the combo achieved a 25.9% overall response rate in endometrial cancer and 37.5% ORR in platinum-resistant ovarian cancer (all biomarker-positive)—remarkable in these refractory tumors. Nearly half of patients had 6-month progression-free survival, far exceeding historical controls.

These data earned FDA Fast Track designations in both endometrial and ovarian cancer. Based on regulatory feedback, Repare designed a Phase 3 program focusing on biomarker-selected patients and got alignment from both FDA and EMA on the trial design and endpoints. This proactive engagement substantially de-risked the clinical/regulatory pathway.

However, in January 2025 Repare prudently decided to seek a partner for Phase 3 before proceeding (given the large, costly nature of Phase 3). That partner emerged in July 2025: Debiopharm, which is now advancing the combo after paying $10M upfront (with up to $267M milestones). While Repare has offloaded the costs, it retains a stake in potential success.

The positive Phase 1 results and Fast Track tags underscore the combo’s viability as a chemotherapy-sparing treatment in genomically defined women’s cancers. A successful Phase 3 (run by Debiopharm) could lead to approvals around 2027, validating Repare’s platform and providing royalty revenue.

Upcoming Catalysts

Repare’s leaner pipeline still offers multiple “shots on goal” with near-term readouts. By late 2025, investors will see initial efficacy data from both POLAR (RP-3467) and LIONS (RP-1664) trialsir.reparerx.combusinesswire.com. Positive signals (e.g. objective responses or durable disease control in target populations) could rapidly reset RPTX sentiment and valuation, given the large addressable populations. Additionally, partnership newsflow could continue – for example, Repare’s ongoing Debio 0123 (WEE1 inhibitor) collaboration in CCNE1-amplified solid tumors may yield data that attract another deal.

The company is also likely to present detailed Phase 1 results at major conferences (ESMO 2025, etc.), which can catalyze interest from both pharma and investors if the data confirm mechanism-based tumor responses. In short, Repare has engineered an ideal setup for an “asymmetric” catalyst cycle – numerous upside events financed with existing cash, and a valuation that bakes in little to no success.

Favorable Competitive Landscape in Synthetic Lethality

Repare is operating in the fast-emerging synthetic lethality market, projected to grow from ~$1.5 billion in 2023 to over $5.3 billion by 2033 (15% CAGR). This growth is driven by the oncology field’s hunger for targeted therapies beyond the now-crowded PARP inhibitor class. Notably, big pharmas are investing heavily in synthetic lethal approaches – GlaxoSmithKline’s $3 billion partnership with IDEAYA Biosciences (MAT2A, Polθ programs) in 2023 validated the platform value. Yet despite this interest, competition for Repare’s specific targets remains manageable:

In Polθ, the main competitor Artios (private UK biotech) has a Polθ inhibitor (ART6043) in early trials, but Artios lacks a US presence and faces the same clinical unknowns. Repare’s RP-3467 is distinguished by its focus on combination with PARP, a strategy where Repare appears to be a front-runner (leading the field in Polθ–PARP combos)ir.reparerx.com.

Moreover, Repare’s ongoing POLAR trial includes four tumor types (ovarian, breast, prostate, pancreatic), potentially giving it a broader label if successful, versus Artios’s narrower initial focus. The market’s excitement for Polθ was evident in Nov 2022 when IDEAYA’s stock jumped ~80% on early Polθ data – indicating significant upside if Repare can show clinical activity in 2025.

In ATR inhibition / DNA damage response, camonsertib (Repare’s ATR inhibitor) faced competition from several pharma programs (AZD6738, BAY1895344, etc.), but Repare smartly leveraged combination use and is now essentially exiting this crowded space via the Debiopharm deal. This leaves Repare’s resources fully allocated to unique, less contested targets (Polθ, PLK4) where it can be first or best-in-class.

No other PLK4 inhibitors are in the clinic, giving RP-1664 a clear runway to define the target’s therapeutic profile (and making it a potential “holy grail” in TRIM37-amplified cancers if successful).

Broad oncology trends also favor Repare: Pharma is cash-rich (top 15 firms have >$500B for M&A) and facing major patent expiries in 2028–2030 (the “patent cliff”), driving a wave of acquisitions of innovative clinical assets. In Q1 2024 alone, oncology was the top therapy area for M&A deals with $29 billion total deal valuedrug-dev.com.

Should Repare’s 2025 data impress, it could become an attractive takeover candidate given its niche leadership in synthetic lethality. Furthermore, the overall biotech sector has rebounded from 2022 lows – the equal-weighted XBI biotech ETF was up ~15% YTD in 2024 and +42.8% year-over-year (outperforming the larger-cap IBB by ~4.5%). Improving market sentiment reduces the risk of Repare being “orphaned” as an unfunded micro-cap; investors are again rewarding positive data in small biotechs, as seen by multiple 100%+ stock moves in 2023–2024 for early oncology readouts.

Market access considerations

Precision oncology drugs often require companion diagnostic (CDx) tests to identify eligible patients, which historically led to slow uptake (doctors needed convincing to test, payers to reimburse). However, this landscape has matured significantly. For example, Merck’s Keytruda (pembrolizumab) became the first drug approved with a companion PD-L1 diagnostic in 2015 (merck.com), and now PD-L1 testing is routine worldwide for lung cancer patients. Repare’s therapies will similarly come with biomarker tests (e.g. BRCA/HRD testing for Polθ; TRIM37 amplification test for RP-1664).

Thanks to the groundwork laid by prior targeted therapies, oncologists and payers are increasingly comfortable with biomarker-guided treatment. Additionally, FDA initiatives like Project FrontRunner encourage developers to seek approvals in earlier treatment lines with clear biomarker-defined populations (fda.gov). Repare is aligned with this approach – focusing on front-line settings (e.g. first-line endometrial cancer for Lunre+Camo) rather than salvages, which could speed uptake if approved.

In summary, Repare is competing intelligently – avoiding head-on fights and instead staking leadership in novel synthetic-lethal targets. The lack of direct competition for PLK4, and a rational strategy in Polθ (combo use), give it a strong chance to capture disproportionate value if its science pans out. With major pharma actively hunting in this field, success in 2025 could put Repare in the M&A spotlight.

Evolving Regulatory Landscape: Raising the Bar, but Rewarding Precision

The regulatory environment for oncology drugs is in flux, with new FDA initiatives demanding more robust evidence earlier, which presents both challenges and opportunities for Repare.

Project Optimus (FDA Oncology Center of Excellence)

This initiative, launched in 2021, reforms dose-finding in oncology trials by requiring extensive dose optimization and randomized dose-ranging studies instead of the old “maximum tolerated dose” paradigm. In practice, this could mean Repare needs to test multiple dose levels for each drug in larger cohorts before Phase 2, potentially adding 6–12 months to early development. While that might delay timelines, it ultimately de-risks pivotal trials by ensuring the chosen dose truly maximizes efficacy over toxicity.

Repare appears well-prepared: its ongoing Phase 1s already examine a range of doses, and management has indicated dose optimization is underway (e.g. exploring intermittent dosing for RP-3467 to improve tolerability). By embracing Optimus guidelines now, Repare increases its probability of success in Phase 2/3 and aligns with FDA expectations, which could smooth review if data are positive.

Accelerated Approval Scrutiny

The FDA has become more conservative on accelerated (conditional) approvals after some high-profile setbacks. Notably, in 2022 multiple PARP inhibitors had certain ovarian cancer indications withdrawn when follow-up trials showed no overall survival benefit and possible harm in some subgroupssgo.orgsgo.org. This underscores that progression-free survival (PFS) alone may not suffice for full approval; regulators want to see overall survival or clear patient benefit.

Repare has thankfully been designing trials with this in mind. For example, the planned Phase 3 for Lunre+Camo was discussed with FDA/EMA to ensure the endpoints and patient selection are appropriate for full approval.

The focus on biomarker-positive patients should enrich for those most likely to benefit, making it easier to show a survival advantage and avoid the fate of PARP drugs that were used too broadly. Still, Repare will need to execute robust Phase 3 trials with proper control arms. The lesson of the PARP withdrawals is clear: the FDA will not hesitate to pull approval if confirmatory trials disappointsgo.org. Repare’s early regulatory engagement and precision focus mitigate this risk.

Fast Track and Other Expedite Programs

Repare has leveraged FDA’s programs to speed development in high-need areas. Lunresertib/camonsertib had Fast Track in ovarian and endometrial cancer, meaning more frequent meetings and eligibility for rolling review. If Repare’s lead programs show promise, the company can seek Breakthrough Therapy designation (which could expedite Polθ or PLK4 trials by garnering intensive FDA guidance and shorter review timelines).

Regulators have also floated “Tissue-agnostic” approvals (approving drugs based on mutation biomarkers rather than tumor type, as done for KEYTRUDA in MSI-high cancers). This could benefit Polθ inhibitors, which might be effective across any HR-deficient tumor. In fact, RP-3467’s trial spans four tumor types to gather signals for such an approach.

Overall, regulatory trends are pushing towards more precise, data-driven development – arguably Repare’s strength – while eliminating marginal uses of drugs. Repare’s strategy of focusing on patients most likely to respond (e.g. selecting tumors with the relevant genomic alteration from the start) not only improves its success odds but also aligns with these trends. Yes, the bar for oncology approvals is higher (survival benefit, quality of life, etc.), but a well-targeted synthetic lethal drug should deliver substantial benefit if the hypothesis holds.

If Repare’s trials confirm clear efficacy in defined populations, the evolving regulatory framework will reward it with smoother approvals and strong labelling. The company’s engagement with FDA (for trial design feedback) and EMA (seeking parallel advice) indicates a savvy, proactive regulatory strategy that reduces surprises down the road.

Financials: Downside Cushion with Cash Rich Balance Sheet

Repare’s financial profile offers an unusual degree of downside protection for a clinical-stage biotech. With $124.2M in cash (>$2.90/share) on hand and an annual burn rate now ~$70–80M (post-restructuring), the company has enough capital to fund operations through 2027.

This runway covers the critical Phase 1 readouts in 2025 and subsequent Phase 2 proof-of-concept trials, meaning Repare likely won’t need to raise equity before value-inflecting data – a rarity in biotech. In effect, investors at the current ~$1.50 stock price are buying $2.90/share in cash and getting a free option on the pipeline’s success.

Management has also demonstrated prudent fiscal stewardship. The Q1 2025 net R&D expense was $20.3M, down from $33.0M in Q1 2024 – reflecting major cost cuts with minimal pipeline impact. SG&A was trimmed as well (Q1 2025 G&A $7.7M vs $8.6M prior).

This streamlined cost structure, combined with the non-dilutive inflows from DCx and Debiopharm deals, reduced quarterly cash burn to an estimated ~$28–30M (versus >$40M in early 2024). At this pace, Repare could even end 2025 with >$60M cash after delivering Phase 1 readouts. The extended cash horizon also strengthens Repare’s negotiating position for any future partnerships – it can wait for terms that reflect true value, rather than taking a dilutive deal out of necessity.

Importantly, insiders and institutions are aligned in letting the pipeline reach fruition. Insiders own stock (management and directors participated in past financings), and as noted, top-tier biotech funds hold ~60%+ of shares.

Their patience is evident – despite the stock’s slide, these sophisticated investors have not fled, implying they see more long-term value. Additionally, Repare’s strategic investors (like Bristol Myers via previous partnership) and now Debiopharm have a vested interest in Repare’s success. This level of institutional ownership (~91% of float) provides stability and credibility to the investment thesis.

From a valuation perspective, Repare is clearly mispriced if its drugs have any meaningful chance of approval. Wall Street analysts unanimously rate RPTX a “Buy” (5 out of 5 analysts), with price targets clustering around $4.50–5.00 – ~200% above the current price. Some even see much higher upside (e.g. H.C. Wainwright at $10). Notably, Stifel recently lowered its target from $9 to $4 due to the Lunre+Camo program being out-licensed, but importantly maintained its Buy rating, citing confidence in the Polθ and PLK4 programs moving forward.

This suggests that even a traditionally bullish analyst, when forced to reset timeline expectations, still sees ~$4 as a base-case value mainly for the two Phase 1 assets. TipRanks data indicate analyst targets ranging from $4 up to $15investing.com in a bullish scenario – the high end likely assuming strong Phase 1 data. In sum, professional analysts (who have dissected Repare’s science and comparables) agree the stock is deeply undervalued relative to its risk-adjusted prospects.

Sector context: The biotech bear market of 2021–2022 led to many quality small-caps trading below cash, and Repare is an extreme example. However, the tide has been turning. Biotech venture funding, a proxy for sector optimism, rebounded to $21.4B in 2024 from $16.1B in 2023 (33% increase), breaking a two-year decline. Likewise, biotech IPOs have reopened (e.g. multiple $100M+ IPOs in H1 2025), signaling investor appetite for innovation is back. This rising tide has started lifting some boats – the XBI’s one-year ~43% gain reflects that many beaten-down biotechs have doubled off lows.

Repare has so far missed out on this rally (perhaps due to its restructuring noise), but as attention returns to fundamentals like cash-to-market-cap ratios and pipeline readouts, RPTX could play “catch-up”. The company’s strong cash position minimizes dilution risk and provides a floor value. Even in a downside scenario (e.g. lackluster Phase 1 data), Repare could conserve cash and pivot or be acquired for its cash and technology (recall, current enterprise value is negative ~$-57M). Thus, the risk-reward skews favorably: limited further downside (stock already near all-time low, and backed by cash assets), versus multi-bagger upside potential if the science delivers.

Key Risks and Red Team Counterpoints

Despite its attractive profile, Repare is not without risks. Investors must be aware of the binary nature of early drug development – if the drugs fail to show efficacy or have safety issues, the stock could tumble (even cash-rich biotechs often trade at a steep discount if prospects dim).

The historical odds are sobering: approximately 97% of oncology drugs fail to reach FDA approval from Phase 1, often due to lack of sufficient efficacy. Repare hopes to beat those odds via biomarker enrichment (which generally improves success rates by targeting responders), but until human data validate its approach, there is substantial clinical risk. Specific risks include:

Clinical efficacy risk

Polθ and PLK4 are novel targets that have never been proven in clinical trials. It is possible that inhibiting these proteins does not translate to tumor responses in patients (e.g., due to redundancy in DNA repair or cancer cell adaptability). If the Q3/Q4 2025 readouts show only minimal tumor shrinkage or none at tolerable doses, Repare’s value proposition would be severely impaired. Similarly, initial hype around synthetic lethality (post-PARP) has yet to yield an approved drug; other companies (e.g. IDEAYA, Artios) are in early phases too.

If Repare’s results disappoint while a competitor’s succeed, RPTX could languish as investors shift to the “winner”. Essentially, the science, while compelling, remains unproven in human cancer patients – a classic high-risk/high-reward bet.

Safety/tolerability risk

Synthetic lethal targets are generally in DNA damage pathways, raising concerns about toxicity (e.g. bone marrow suppression, DNA damage in healthy cells). PARP inhibitors, for instance, have significant anemia and platelet toxicity. Polθ inhibitors might exacerbate chemo or PARP toxicity; PLK4 inhibition could conceivably affect normal cell division in some tissues. While preclinical and early data haven’t flagged major issues, unanticipated severe toxicities could halt development. A clinical hold or requirement to use sub-therapeutic doses (due to toxicity) would undermine the viability of these programs.

Regulatory and trial design risk

As discussed, the FDA’s Project Optimus will require Repare to do more dose exploration. If Repare selects the wrong dose or schedule for expansion (e.g. too high a dose leading to toxicity, or too low to see efficacy), it could waste valuable time. Additionally, the FDA may scrutinize Repare’s trial results heavily given the past issues with surrogate endpoints.

Repare will likely need to run randomized controlled trials to get approvals, which are expensive and time-consuming. Any delays in trial initiation (for instance, if manufacturing the drug takes longer, or finding TRIM37-amplified patients proves challenging) could push partnerships or readouts further out, testing investor patience.

Competition and external risk

While direct competition is limited now, the landscape can change quickly. A bigger pharma could acquire Artios or IDEAYA and pump resources into Polθ, leapfrogging Repare. Also, other approaches to treating HR-deficient tumors (like ATR inhibitors, AKT inhibitors, etc.) could steal the limelight if they show positive Phase 3 results before Polθ does. For TRIM37-high cancers, if another strategy (say, a targeted protein degrader for TRIM37) emerges, it could compete with PLK4 inhibition approach.

Furthermore, the oncology space is crowded in general – oncologists and hospitals only have bandwidth for so many new tests/therapies. Repare will have to not only prove its drugs work but also carve out awareness and market share in a complex treatment paradigm.

Financial and dilution risk

Although Repare is funded into 2027, ambitious development plans (like multiple Phase 2/3 trials in parallel) could accelerate burn. The company might choose to raise capital if the stock improves (to further bolster its balance sheet) – that could dilute current shareholders, though presumably at higher prices.

If the stock stays low for long, Repare’s negotiating leverage in partnerships might weaken, possibly forcing less favorable deal terms or a dilutive equity raise down the line. However, this risk appears moderate given current cash and the likelihood of partner funding for big trials (as shown by the Debiopharm deal). Still, investors should watch Repare’s quarterly burn and ensure it stays prudent.

On balance, these risks are typical for a clinical-stage biotech – high uncertainty that is hopefully compensated by high potential reward. Repare’s strategic moves (focus on biomarkers, secure cash runway, partner where prudent) have mitigated many risks, but the core bet remains on the drugs working in patients.

This is the crux of any red team (bearish) argument: until we see solid human data, there is a chance that Repare’s promising science does not translate to a viable drug, in which case the stock could continue to languish or fall further. Investors must size their positions accordingly and be willing to tolerate volatility.

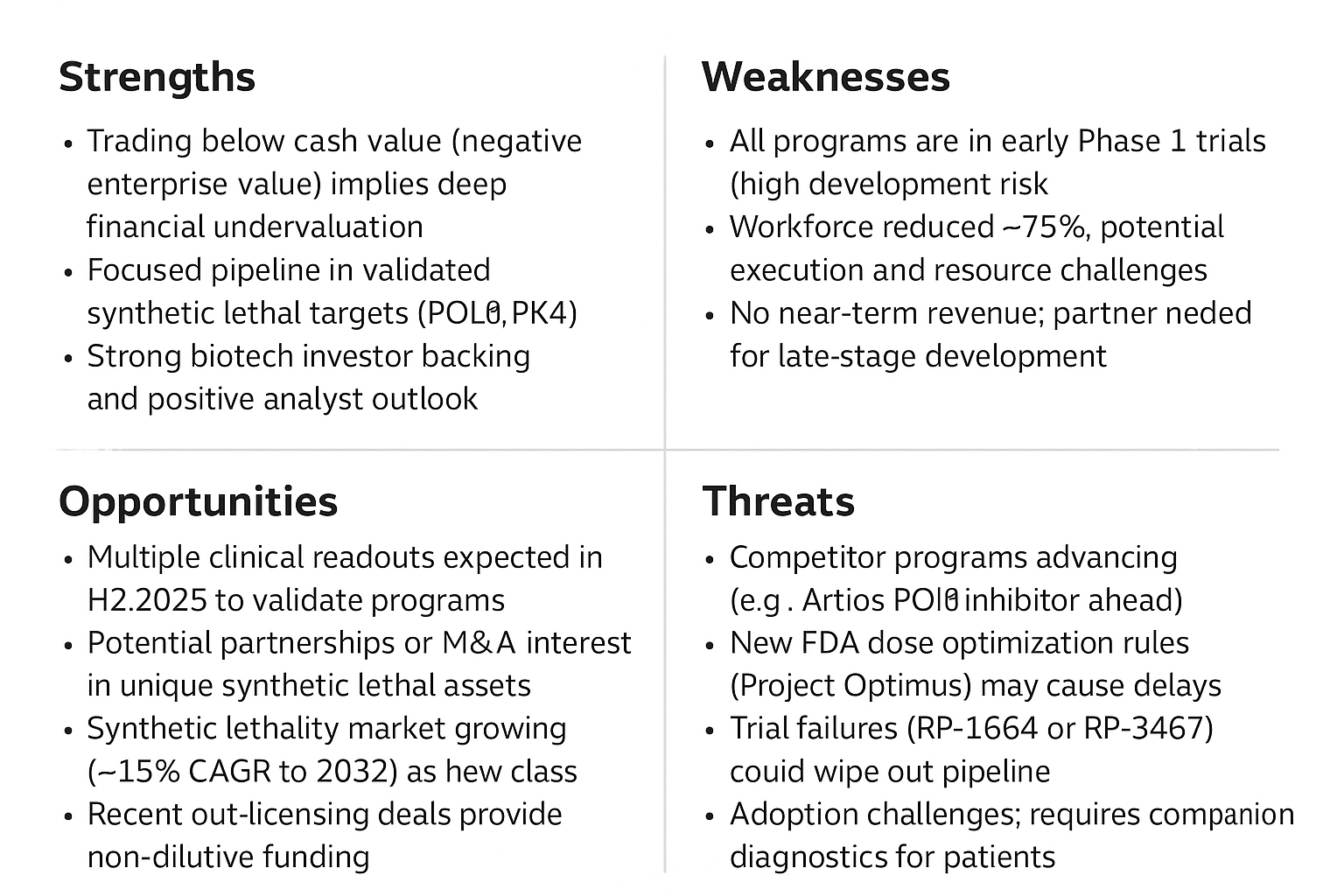

Figure: SWOT Analysis of Repare Therapeutics – Key Strengths (Blue Team bullish arguments) include its strong cash position and focused pipeline in validated pathways. Weaknesses (risks) include the early-stage nature of its programs and need for partner support.

Opportunities highlight upcoming data readouts, partnership/M&A interest, and the growing synthetic lethality field. Threats (Red Team bearish points) encompass clinical failure, competition, regulatory hurdles, and adoption challenges.

Conclusion: Asymmetric Upside for the Risk-Tolerant Investor

Repare Therapeutics offers a classic contrarian biotech opportunity – a company with cutting-edge science, substantial cash, and upcoming catalysts, yet trading near multi-year lows due to past setbacks and general risk aversion. The current ~$1.50 share price (≈$67M market cap) values RPTX at just ~0.54x cash, implying extreme scepticism that is at odds with the tangible progress and prospects described above.

Yes, it is still a clinical-stage biotech and not every investor can stomach the volatility (the stock dropped ~80% in the 2022–24 biotech bear market). However, for those who can accept the binary risk, the risk-reward is skewed enormously to the upside.

In a success case – say one of the Phase 1 trials shows objective responses in patients by late 2025 – Repare’s stock could realistically trade several-fold higher. Synthetic lethality is a hot space (recall GSK paid $100M upfront for IDEAYA’s preclinical Polθ program), and any clinical validation would make Repare a top acquisition target. With 91% institutional ownership and analysts’ average target ~ $5 (roughly 3x current), there is a strong consensus that this company is undervalued relative to its assets.

Repare’s own cash provides a floor, and its three “shots on goal” (Polθ, PLK4, Lunre+Camo via partner) provide multiple avenues to create value.

Member discussion