Company of the week: Terray Therapeutics

Terray Therapeutics has assembled what may be the largest proprietary chemistry dataset in drug discovery—13+ billion target-molecule binding measurements, growing at 1 billion per quarter. The Los Angeles-based company has raised over $200 million at a reported $600 million valuation and secured partnerships with Bristol Myers Squibb, Gilead, and Calico. In December 2025, Terray achieved its first discovery milestone in the BMS collaboration—external validation of a platform betting that purpose-built experimental data, not algorithmic superiority, will determine winners in AI drug discovery.

Yet Terray faces the same fundamental challenge confronting all AI drug discovery companies: no AI-discovered drug has achieved FDA approval as of December 2025. The company's first clinical candidate is expected in 2026, making the next 12-18 months a critical proof point.

EMMI Platform: Where Experimentation Meets Machine Intelligence

Terray's EMMI platform (Experimentation Meets Machine Intelligence) is an integrated drug discovery engine that tightly weaves ultra-high-throughput chemical experimentation with a full stack of AI and computational models. The platform couples a high-throughput wet lab for massive target-ligand binding experiments with advanced machine learning, enabling rapid identification of novel compounds even for "difficult-to-drug targets" that had no starting chemical leads.

Terray scientists interact with EMMI daily in a design-make-test-analyze (DMTA) loop. A typical cycle—from designing a set of compounds, synthesizing and testing them on the microarray, to analyzing results—takes under one month per target, with millions of molecules assayed in each cycle. This rapid cadence, compared to the industry standard of 4-12 weeks, is enabled by EMMI's AI guiding each stage of the process.

The integration of hardware, software, wet lab, and AI is deliberate. Terray "places equal emphasis on wet lab science and AI" in a tightly coupled workflow. Scientists use EMMI through an intuitive interface daily, and the company is beginning to deploy it via an AI agent that can plan workflows toward a desired goal autonomously.

The tArray Platform: Unprecedented Binding Data Generation

At the heart of Terray's technology is the tArray, a silicon microarray that screens 32 million compounds in under 4 minutes. The platform's key innovation is spatial encoding: molecules are combinatorially synthesized on nanoparticle beads with DNA barcodes using "split-and-pool" synthesis, then randomly deposited into 32 million wells on a postage stamp-sized silicon chip. After sequencing to map each molecule's position, the DNA tags are cleaved using proprietary linker chemistry, leaving a reusable, DNA-free chip that generates quantitative fluorescence-based binding measurements.

This approach addresses a fundamental limitation of traditional DNA-encoded libraries (DEL). Conventional DEL provides binary hit/no-hit data and requires DNA tags throughout screening, which constrains chemistry options and introduces linker artifacts. Terray's spatial encoding enables quantitative binding affinity measurements with an average of 25 independent data points per measurement, providing the high-resolution data needed to train discriminative ML models.

| Metric | Value |

|---|---|

| Compounds per chip | 32 million |

| Screening time | <4 minutes per chip |

| Image data processed | 50 TB daily |

| Total dataset | 13+ billion interactions |

| Growth rate | 1 billion measurements/quarter |

| Compound library | 300+ million diverse molecules |

| Data point replication | ~25× per measurement |

Terray claims their dataset is 50× larger than all publicly available chemistry data combined. Over the past 12 months, the platform collected 50 billion individual measurements yielding 2 billion unique target-ligand binding affinity values. Each molecule is measured individually and quantitatively, yielding precise binding data that traditional pooled-library screens cannot provide.

tArray vs. Competitor Methods

| Feature | Terray tArray | X-Chem DEL | Traditional HTS |

|---|---|---|---|

| Library size | 300M+ compounds | Up to 60B compounds | ~1M compounds |

| Readout type | Quantitative Kd (fluorescence) | Semi-quantitative enrichment | Variable |

| Measurement replication | 25 data points each | Single selection | 1-3 replicates |

| Cost per compound | Very low (on-chip) | Low (pooled selection) | $0.05-1.00/well |

| DMTA cycle time | <1 month | Weeks to months | Months |

| DNA during screening | Removed before assay | Required throughout | Not applicable |

The critical advantage is quantitative binding affinity data (true Kd measurements) rather than binary enrichment signals from DEL or hit/miss results from HTS—directly enabling the high-quality training data that COATI and TerraBind require.

COATI: A Foundation Model for Chemistry

Terray has published and open-sourced its chemistry foundation model, COATI (Contrastive Optimization for Accelerated Therapeutic Inference), in the Journal of Chemical Information and Modeling (2024). The current COATI3 version produces 768-dimensional molecular embeddings and is trained on over 1 billion diverse molecules.

COATI is essentially a "GPT for molecules," learned via contrastive training to encode molecular structures as latent vectors that can be translated back into valid chemical structures. Unlike many molecular embeddings, COATI is designed to be invertible—molecules can be encoded to latent space and decoded back to valid SMILES. This gives EMMI a robust chemical language to reason about novel compounds in ways traditional fingerprints cannot.

Architecture Deep Dive

The encoder architecture employs three parallel pathways:

- 1D SMILES strings via transformer encoder

- 2D molecular graphs via graph neural networks

- 3D conformers via E(3)-equivariant graph neural networks (E3GNN)

The decoder uses a transformer-based autoregressive architecture with a "capping" procedure inspired by ClipCap to inject latent representations, enabling generation of valid SMILES strings from embeddings. Training combines contrastive loss (aligning different molecular representations) with autoregressive loss (reconstruction capability).

| Version | Embedding Dim | Training Data | Key Improvement |

|---|---|---|---|

| COATI1 (2023) | 256 | ~100M molecules | Initial release |

| COATI2 (2024) | 512 | ~2x more data | Chiral-aware 3D encoder |

| COATI3 (2025) | 768 | 1B+ molecules | Multi-modal (SMILES, 2D-graph, 3D) |

Against benchmarks, COATI performs competitively with ECFP6 fingerprints on ADMET prediction tasks from Therapeutics Data Commons, achieving R² ~0.77 on QED prediction with simple random forest. Unlike ChemBERTa-2 or MolBERT, COATI's invertibility enables generative optimization—traversing latent space to discover new molecules rather than just encoding existing ones.

The public GitHub repository (115 stars) provides model weights for COATI1/2 and pre-processed ADMET benchmark datasets under Apache-2.0 license, while COATI3 and TerraBind remain proprietary.

TerraBind: Two-Tier Prediction at Scale

TerraBind implements a unique two-tiered approach to protein-ligand binding prediction, prioritizing "potency over pose" to enable massive throughput.

Tier 1 (TerraBind-seq): Uses sequence-only protein representations to screen millions of generated molecules 20,000× faster and cheaper than public structure-based models. This ultra-fast initial filter identifies promising subsets for refined evaluation.

Tier 2 (TerraBind-struct): Deploys a structure-based multi-modal model combining three components:

- A Pairformer representation derived from AlphaFold3's architecture

- A protein language model for protein representations

- COATI3 molecular embeddings

This tier remains 20× faster than typical public docking or physics-based methods while producing both accurate potency predictions and useful binding poses. The speed advantage comes from deliberate architectural tradeoffs—poses are "useful" for pocket identification but not geometrically perfect.

Training leverages Terray's proprietary dataset of 13+ billion target-molecule binding measurements. Each measurement backed by an average of 25 independent data points provides signal quality unavailable from public sources. This data scale enables TerraBind to function as a "global potency model" covering diverse protein targets rather than being trained per-target.

Generative Models: From Diffusion to Reinforcement Learning

COATI-LDM: Latent Diffusion for Molecules

The COATI-LDM paper (bioRxiv 2024) introduces latent diffusion for conditional molecular generation—applying denoising diffusion probabilistic models (DDPM) to COATI's 512-dimensional latent vectors rather than directly to molecular structures. This approach trains a diffusion model to denoise latent representations, with the pre-trained encoder-decoder (trained on ~250M molecules) handling translation to/from chemical structures.

The diffusion model supports multiple conditioning approaches:

- Classifier guidance (CG): Using gradients from property predictors to steer generation

- Classifier-free guidance: For flexible conditional generation

- Joint multi-property conditioning: Simultaneous optimization of TPSA, fsp3, potency, and LogP

A key innovation is particle guidance—adding repulsive forces between samples during each timestep to enhance diversity, outperforming autoregressive transformers and genetic algorithms on controlled generation benchmarks.

Partial diffusion enables local optimization around seed molecules by varying noise timesteps, controlling the Tanimoto similarity deviation from reference compounds. Training required ~20,000 GPU hours for the encoder-decoder and ~4,000 GPU hours for FID diffusion models on NVIDIA A100s. Code available at GitHub.

Reinforcement Learning Generators

More recently, Terray introduced an RL generator using policy-gradient methods, which tends to produce more synthetically accessible molecules while directly optimizing multiple objectives. These models leverage Terray's growing proprietary data to suggest novel chemical structures meeting potency and drug-likeness criteria.

Epistemic Neural Networks: Uncertainty-Aware Selection

The arXiv paper (2511.10590) addresses a critical gap: re-training large models like TerraBind for uncertainty quantification is computationally prohibitive. The solution is epistemic neural networks (ENNs)—small neural networks supplementing base predictors that produce joint predictions over multiple inputs, distinguishing epistemic uncertainty (lack of knowledge) from aleatoric uncertainty (inherent randomness).

The Epinet architecture takes privileged access to base network activations and computes uncertainty estimates via an epistemic index parameter. A key innovation is pretraining prior networks on synthetic reference processes to improve joint log-loss and batch Bayesian optimization performance.

The EMAX acquisition function (Expected Maximum over batch) scales as O(B²) where B equals batch size, making it practical for large screening pools. Rather than simply picking the top-scoring hits (which could all be similar and exploit the same model biases), this approach explicitly weighs uncertainty and novelty of candidates, avoiding the "greedy selection" pitfall where models might overestimate a particular chemotype.

| Metric | Epinet vs. Standard Selection |

|---|---|

| Time to target potency | 3× faster |

| IC50 improvement | 4× better |

| Computational cost | 13 seconds for 5,000 samples on 50K compounds (single A100) |

In practice, each batch of compounds EMMI sends to the lab is the most informative set to validate, tightening the closed-loop between ML and experiment.

Financial Structure and Investor Base

Terray has raised over $200 million across four funding rounds, building a carefully structured investor syndicate:

| Round | Amount | Date | Lead Investors |

|---|---|---|---|

| Seed | $20M | Pre-2022 | Digitalis Ventures, Two Sigma Ventures |

| Series A | $60M | Feb 2022 | Madrona Venture Group |

| NVIDIA Investment | Undisclosed | Nov 2023 | NVentures |

| Series B | $120M | Oct 2024 | Bedford Ridge Capital, NVentures |

The investor base includes quantitative finance firms (Two Sigma Ventures, XTX Ventures), healthcare specialists (Digitalis Ventures, Alexandria Venture Investments), and strategic NVIDIA backing through NVentures. Notable angel investors include John Maraganore (founding CEO of Alnylam Pharmaceuticals) and Bassil Dahiyat (founder/CEO of Xencor).

NVIDIA Strategic Value

The NVIDIA investment provides value beyond capital, including DGX Cloud access for foundation model training. Model training accelerated from 1 week to 1 day using DGX Cloud with 4× improved infrastructure utilization. NVIDIA's healthcare VP described the partnership as enabling a "molecule discovery and design flywheel" that can take on the toughest targets.

Estimated Burn Rate and Runway

Based on ~122 employees, the 52,000 sq ft Monrovia facility, and compute infrastructure, estimated burn rate is $35-48 million annually. Against $200M+ raised, this suggests runway of 3-5 years depending on milestone achievement and partnership revenues.

Partnership Economics and Deal Structures

Partnership economics remain largely undisclosed, though available data points suggest modest upfront payments:

Bristol Myers Squibb (December 2023)

The multi-target collaboration tasks Terray with discovering small-molecule therapeutics against BMS-nominated targets. Under the agreement, Terray handles discovery and early optimization, after which BMS can assume development and commercialization, with Terray eligible for milestone payments and royalties.

In December 2025, Terray announced reaching a key discovery milestone—the first publicly disclosed. The target was characterized as "novel and difficult to drug" with "no chemistry starting point," demonstrating the platform's ability to generate de novo chemical matter for challenging targets. That neither BMS nor Gilead filed 8-K material agreements for these deals suggests upfront payments were below SEC materiality thresholds.

Gilead Sciences (December 2024)

The Gilead partnership provides a rare financial disclosure: the transaction reduced Gilead's 2024 GAAP and non-GAAP EPS by approximately $0.01, implying an upfront payment of roughly $12-15 million based on Gilead's ~6.1 billion shares outstanding. Deal structure includes exclusive options to license, milestone payments (preclinical, clinical, sales), and tiered royalties.

Calico Life Sciences (October 2022)

The Calico partnership focuses on aging-related diseases including cancer. Terms undisclosed.

Odyssey Therapeutics (October 2024)

The Odyssey partnership stands apart as a true 50/50 co-development arrangement—parties share research, development, and commercialization responsibilities and split profits equally, rather than the typical platform-licensing model. The collaboration focuses on first-in-class transcription factor therapies for inflammatory diseases—historically "undruggable" targets.

| Partnership | Structure | Focus Area | Milestone Status |

|---|---|---|---|

| Bristol Myers Squibb | Traditional license | Multiple targets (undisclosed) | First milestone achieved Dec 2025 |

| Gilead Sciences | License with options | Multiple targets (undisclosed) | Discovery phase |

| Calico Life Sciences | Research collaboration | Aging-related diseases | Active |

| Odyssey Therapeutics | 50/50 co-development | Transcription factors (inflammatory) | Discovery phase |

The Data Flywheel Thesis

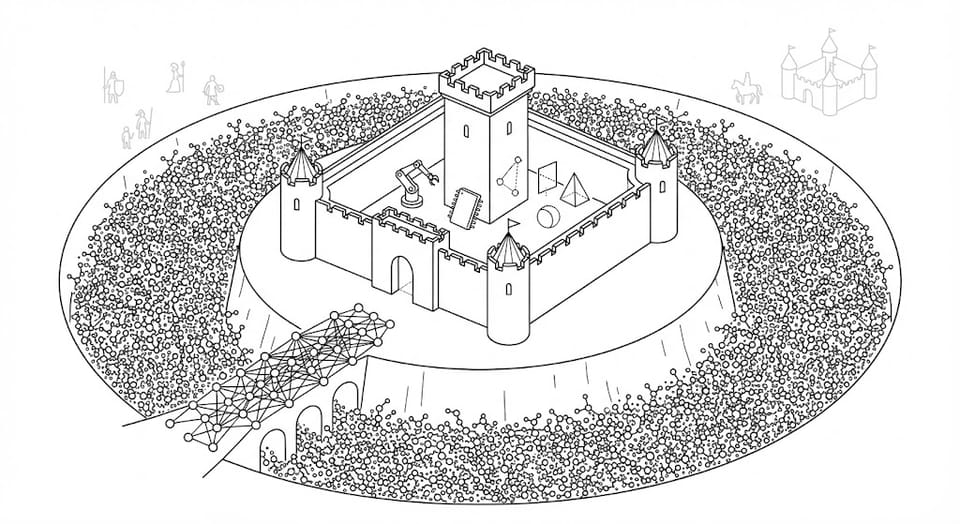

A central theme in Terray's story is the creation of a data flywheel in drug discovery—a self-reinforcing loop where more data leads to better AI models, which design better experiments yielding even more data. CEO Jacob Berlin puts it directly: "even the most powerful AI can't get past insufficient or unclear data."

Small-molecule discovery has traditionally been constrained by relatively limited structured data. Many AI efforts have stumbled training on the same public datasets of known molecules. Terray chose to break out of that mold by generating its own massive dataset in previously unexplored chemical space. By measuring billions of novel interactions (including in "dark" regions of chemical space not biased toward known drugs), Terray feeds its algorithms information that no one else has.

The flywheel effect emerges from the loop: data → model → design → experiment → new data. Each iterative DMTA cycle generates more binding data (including negative results, SAR trends), which Terray mines to improve its models. Those improved models make the next round of compound selection smarter, focusing experimental resources on more promising regions of chemical space.

Critically, Terray recognized that the limiting factor in this flywheel is wet-lab throughput. Many AI drug discovery startups can generate thousands of virtual compounds, but physically testing them is the bottleneck—slow and costly to make and assay molecules one by one. Terray's innovation was removing this bottleneck by scaling up the "make/test" step via automation and parallelization.

From an investor's perspective, this data moat is highly attractive: an asset accruing value over time, not easily replicable without similar infrastructure. Moreover, Terray's data is proprietary and cumulative—every new experiment BMS or Gilead partners fund adds to Terray's knowledge base, improving the platform for all other projects including internal programs.

Competitive Landscape

AI drug discovery has attracted billions in capital across companies pursuing fundamentally different strategies:

| Company | Funding | Clinical Status | Technical Approach | Data Asset |

|---|---|---|---|---|

| Recursion (RXRX) | $865M+ | 10+ programs | Phenotypic screening + image ML | 65 PB phenomics data |

| insitro | $743M | Preclinical | iPSC disease models + ML | Patient-derived iPSC libraries |

| Insilico Medicine | Private | Phase 2 | End-to-end AI (target→clinic) | Multi-modal public + proprietary |

| Terray | $200M | Preclinical | Spatial binding data + generative AI | 13B+ binding measurements |

| Excelsior Sciences | $95M | Preclinical | Modular synthesis automation | Proprietary synthesis routes |

Key Competitive Dynamics

vs. Recursion (phenotypic): Recursion generates 65 petabytes of phenomics imaging data capturing trillions of gene-compound relationships. Their target-agnostic approach can identify novel targets that Terray—which requires defined protein targets—cannot discover. However, Recursion's imaging data is inherently lower resolution for binding affinity than Terray's direct measurements. Recursion acquired Exscientia in November 2024, combining phenotypic screening with chemistry-first design and creating the largest public AI drug discovery platform.

vs. insitro (iPSC-based): insitro uses patient-derived iPSCs to model disease states, with models trained to predict human clinical outcomes. This captures disease biology and functional effects that pure binding data cannot. However, iPSC line variability remains a limiting factor.

vs. Insilico Medicine (end-to-end): Insilico represents the most advanced clinical proof point: INS018_055, a TNIK inhibitor for idiopathic pulmonary fibrosis, completed Phase 2a enrollment with 30-month target-to-Phase 1 timeline at ~$2.6 million cost versus typical 6+ years and $400+ million.

vs. Excelsior Sciences (synthesis-first): Excelsior (December 2025, $95M Series A) represents the most direct competitive threat, emphasizing closed-loop synthesis automation with "Smart Bloccs" modular chemistry. Their thesis—that manufacturing-compatible chemistry matters more than data scale—directly challenges Terray's binding data moat.

vs. DEL platforms (X-Chem, HitGen): Traditional DEL companies like HitGen (1.2+ trillion compound libraries) and X-Chem (200B+ molecules) provide binding data at scale but lack Terray's quantitative affinity measurements. Terray's spatial encoding generates true dose-response curves rather than binary enrichment scores.

Leadership and Team

Founder and CEO Jacob Berlin holds a PhD in organometallic chemistry from Caltech, where he trained with Robert H. Grubbs (2005 Nobel laureate for olefin metathesis). His postdoctoral work at MIT and Rice focused on nanotechnology, and he ran an NIH-funded nanotechnology lab at City of Hope before spinning out Terray in 2018. He has 40+ publications, 20 patents, and 11,000+ citations. His background is strongest in synthetic chemistry and nanotechnology rather than pharmaceutical development.

Recent advisory board additions address the clinical development gap:

- Elliott Levy, MD (April 2025): Former head of clinical development at BMS and Amgen; involved in approval of 20+ medicines

- Brian Kotzin, MD: Former VP Global Clinical Development at Amgen; board-certified rheumatologist

- Wendy Young, PhD (September 2025, Board of Directors): 30+ years drug discovery leadership; co-inventor of fenebrutinib (BTK inhibitor in Phase III for MS at Roche); advisor at Google Ventures

The team of ~122 employees operates from a 52,000 sq ft facility in Monrovia, California. CTO Narbe Mardirossian leads computational/ML efforts, presenting at NVIDIA GTC24 on generative AI for drug discovery.

Internal Pipeline: Immunology Focus with 2026 Clinical Target

Terray's disclosed internal pipeline focuses on immunology and inflammatory diseases, with lead programs including a brain-penetrant inhibitor for multiple sclerosis. The October 2024 Series B ($120M) was explicitly intended to progress internal programs into clinical trials. Management has stated a target of first clinical candidate in 2026.

No specific target names have been disclosed for internal programs. The Odyssey co-development focuses on transcription factors—historically "undruggable" targets—for inflammatory diseases, suggesting Terray is pursuing technically challenging programs that could demonstrate platform differentiation.

The September 2025 board appointment of Wendy Young—co-inventor of fenebrutinib (a BTK inhibitor in Phase III for MS at Roche)—suggests relevant expertise, though does not confirm target identity for Terray's MS program.

Critical Assessment: Strengths

Unparalleled Data Moat

Terray's 13+ billion quantitative binding measurements form a data asset unmatched in the industry. This sheer scale (orders of magnitude beyond public data) and the high quality of each data point (multiple replicates per measurement) give Terray's AI models a unique training ground. The data covers "dark" chemical space—novel molecules and targets—which means Terray can attack problems that legacy approaches, relying on known chemistries, cannot. This growing proprietary dataset is a self-reinforcing moat: every new experiment makes the moat wider and deeper.

Integrated AI/Automation Platform

Terray has built a full-stack platform that tightly integrates hardware automation with AI. This end-to-end control—from synthesizing massive on-chip libraries to testing, followed by AI-driven analysis and design—is hard for others to replicate quickly. By inventing its core hardware and software in-house, Terray has both technology IP and know-how.

Advanced AI/ML Capabilities

Unlike some biotech startups licensing generic AI models, Terray has developed bespoke machine learning models tailored to its data and needs. The COATI foundation model, generative models (diffusion-based and RL-based), and the two-tier predictive pipeline demonstrate a sophisticated AI toolkit. Moreover, Terray embraces uncertainty modeling (epistemic NNs) in decision-making—an advanced concept seldom applied in traditional medchem but crucial for maximizing learning each cycle.

Successful Partnerships and Validation

Each collaboration underwent due diligence, indicating partners saw unique value. The BMS milestone achieved in 2025 is a particularly strong validation signal, showing that Terray's platform delivered results on a real pharmaceutical project. Notably, Gilead explicitly acknowledged that "AI-driven platforms using custom-generated large, relevant datasets will serve as important tools" for drug discovery—affirming Terray's core thesis.

Critical Assessment: Risks

Industry-Wide Clinical Reality

According to a December 2024 analysis in Clinical Pharmacology & Therapeutics, no novel AI-discovered drug has achieved FDA approval despite thousands of AI drug discovery companies emerging since 2014. High-profile failures include BenevolentAI's BEN-2293 (failed Phase 2a in atopic dermatitis; company valuation collapsed) and Sumitomo's ulotaront (AI-inspired schizophrenia drug that failed two Phase 3 trials). BCG analysis found AI-discovered molecules show 80-90% Phase 1 success but only ~40% Phase 2 success—comparable to traditional drug discovery.

DEL-Based Approaches Have Limitations

A 2025 Chemical Science study found "widespread false negatives in DNA-encoded library data" due to linker effects that "compromise the predictive power of DECL data for prioritizing hits...and training ML models." While Terray's spatial encoding removes DNA during screening, the initial library construction still uses DNA barcoding. False negative rates increase with library size, and binding hits frequently fail to translate to functional cellular activity.

Binding Affinity Alone Poorly Predicts Clinical Success

Terray's core asset is billions of binding measurements, but the correlation between in vitro binding and clinical efficacy is historically weak. ADMET properties, selectivity, cell permeability, and off-target effects all contribute to the ~90% clinical failure rate in drug development—factors not captured in target-ligand binding assays. As Derek Lowe noted: "The real problem is having drug candidates fail in the clinic. All that other stuff is a roundoff error compared to the clinical failure rate."

The "Data Moat" Thesis Has Precedent Failures

Atomwise, which raised $170M+ and pursued 750+ partnership programs, has not advanced any molecules to clinic. CEO Abraham Heifets acknowledged: "Faster isn't better. Faster to failure is not success."

Target Class Limitations

Several target classes present structural challenges for binding-based screening:

- GPCRs (34% of FDA-approved drug targets): Require conformational stabilization; active versus inactive state conformations affect measured binding that may not reflect therapeutic relevance

- Protein-protein interactions: Involve shallow, large interaction surfaces rather than defined binding pockets, reducing hit rates

- Intrinsically disordered proteins: Lack stable conformations for binding measurement, including many transcription factors

Execution and Scalability Risks

Running billions of assays and synthesizing millions of compounds is operationally intensive and costly. As Terray scales up, maintaining quality and speed will be challenging. Any bottleneck in compound synthesis, drop in assay reliability, or hardware malfunction could slow the data flywheel. The model is capital-intensive, and if capital markets tighten or partnership funding ebbs, Terray could face a squeeze.

Dependence on Key Partners

Terray's business model leans on partnerships for revenue and validation. BMS might have rights of first refusal on certain target areas—potentially limiting Terray's ability to work on those targets elsewhere. The Gilead deal gives Gilead an exclusive option on any compounds from that collaboration. If BMS decided to pull back, it could affect both financials and market perception. BMS declined to advance some AI-designed candidates from another partner (Exscientia) in 2023, underscoring that pharma will make hard calls on partnered programs.

Dual-Use Considerations

The same capability that allows EMMI to explore vast chemical space for drugs could theoretically be misused to find harmful compounds. In 2022, researchers demonstrated that an AI model could be repurposed to generate 40,000 potentially toxic molecules (some more lethal than nerve agents like VX) in a matter of hours. While Terray operates in a controlled, proprietary environment, as they publish more AI research (e.g., COATI on GitHub), there could eventually be regulatory scrutiny on large chemical datasets and generative models.

Conclusion: Compelling Platform Awaiting Clinical Validation

Terray Therapeutics has assembled genuinely differentiated capabilities: the world's largest binding affinity dataset (13B+ measurements at 25 data points each), an invertible molecular foundation model enabling true generative optimization, and a two-tier prediction system achieving 20,000× speedup over public tools. The BMS milestone achievement and multi-pharma partnership portfolio provide external validation.

Yet the critical test lies ahead. Every AI drug discovery company—regardless of technical approach—has failed to achieve FDA approval for an AI-discovered drug. Terray's first clinical candidate, expected in 2026, will determine whether massive binding data translates to better drugs or merely faster identification of molecules that fail later.

The balance of evidence so far is encouraging—a hard-won BMS milestone, sophisticated technical publications, and diversifying partnerships. But caution is warranted given the competitive, unpredictable nature of biotech R&D. In the coming years, we will learn whether Terray's binding-data moat truly secures a lasting advantage in the pharmaceutical landscape—or whether the fundamental unpredictability of drug development reasserts itself despite 13 billion data points suggesting otherwise.

Disclaimer: This article is for informational purposes only and does not constitute investment advice, financial advice, or legal advice. The author is not a registered investment adviser, financial adviser, or attorney. Past performance does not guarantee future results. All investments involve risk, including potential loss of principal. Biotech investments are particularly volatile and may experience significant price fluctuations. Readers should conduct their own research and consult with qualified financial professionals before making any investment decisions.

Member discussion