Fund of the week: Concentra

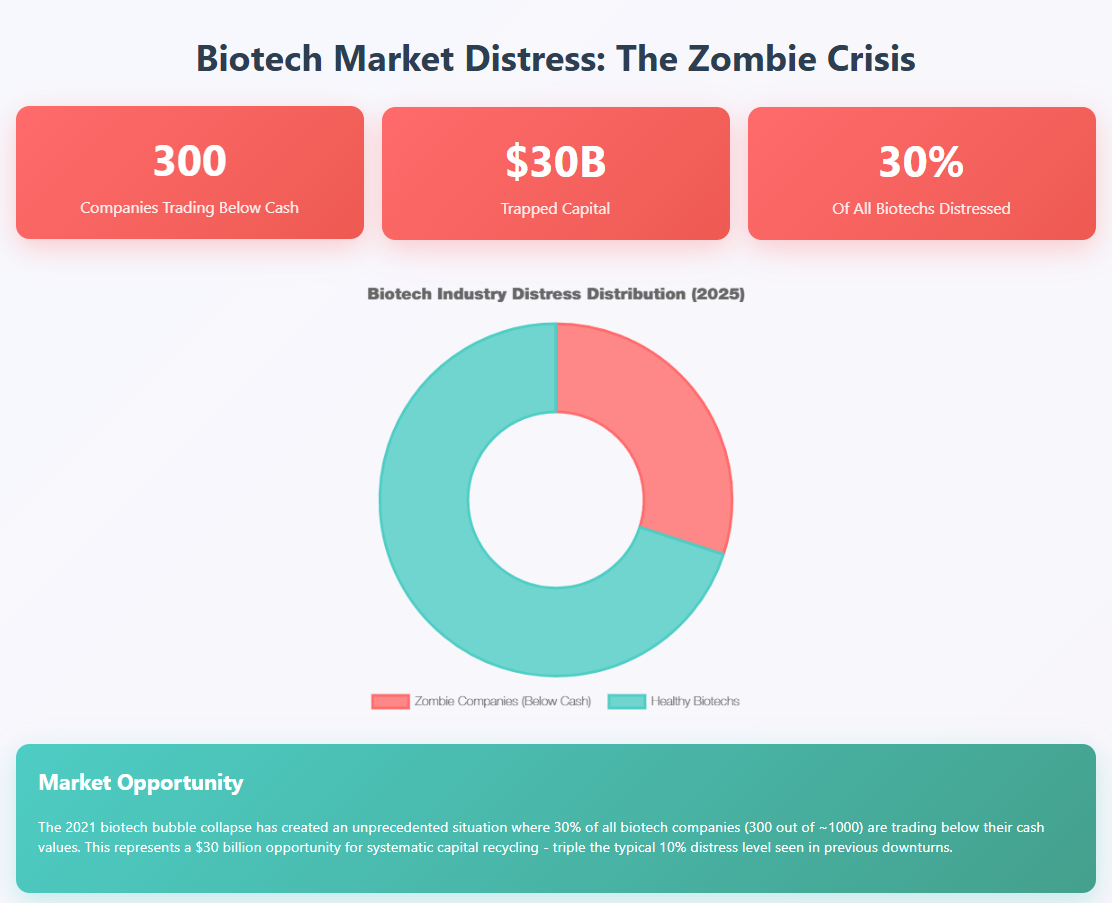

Tang Capital's contrarian strategy targets the 300 "zombie" companies holding $30 billion in trapped capital

In the wreckage of biotech's 2021 bubble, where 300 companies now trade below their cash values and hold over $30 billion in trapped capital, Kevin Tang has built what may be the industry's most counterintuitive investment thesis: systematically acquiring failed biotechs and shutting them down. Through Concentra Biosciences, Tang's specialized acquisition vehicle has deployed over $600 million in 2025 alone, executing seven major acquisitions while fundamentally reshaping how the sector handles corporate failure.

The strategy is deceptively simple yet operationally complex. Concentra targets biotechs that have suffered clinical setbacks, regulatory failures, or funding crises—companies whose market capitalizations have fallen below their net cash holdings. These "zombie" companies, as the industry calls them, typically burn through remaining capital while management pursues increasingly desperate pivots. Tang offers an alternative: immediate liquidity for shareholders through cash payments plus contingent value rights (CVRs) that capture 80% of any future asset monetization proceeds.

This approach has transformed Tang from a traditional biotech investor into what STAT News called the architect of an "ingenious solution" to the sector's intractable zombie problem. But as Concentra's acquisition pace accelerates and defensive measures proliferate, critical questions emerge about the model's sustainability, scalability, and ultimate impact on biotech innovation.

The architecture of creative destruction

Concentra's business model represents a fundamental departure from traditional biotech investing. Rather than betting on drug development success—where 90% of candidates fail—Tang bets on the certainty of failure itself. The company identifies targets through a systematic screening process focusing on companies trading below 80% of net cash value, experiencing workforce reductions exceeding 65%, or announcing strategic reviews following clinical setbacks.

The acquisition strategy follows a standardized playbook refined through multiple transactions. Tang Capital typically accumulates a 5-10% stake before submitting an unsolicited offer at a 35-80% premium to recent trading prices. These offers, delivered via public SEC filings, include strict response deadlines of 10-14 days and emphasize "funds immediately available to execute."

The financial engineering behind each deal reveals sophisticated risk-sharing mechanisms. Concentra's standard structure includes two components: an upfront cash payment typically ranging from $0.33 to $10.05 per share, plus non-transferable CVRs entitling former shareholders to 80% of net proceeds from any asset sales or licensing deals within a specified timeframe, usually one to two years. The company also distributes 100% of excess cash above predetermined operational thresholds, effectively returning trapped capital to shareholders rather than allowing continued cash burn.

| Concentra Biosciences: Deal Structure Template |

|---|

| Upfront Cash Payment: 35-80% premium to trading price |

| Contingent Value Rights (CVRs): 80% of asset sale proceeds |

| CVR Timeline: 1-2 years from closing |

| Excess Cash Distribution: 100% above operational threshold |

| Response Deadline: 10-14 days |

| Funding Source: Tang Capital Partners ($1.8B AUM) |

Asset monetization follows a disciplined timeline. Within 30 days of closing, Concentra implements workforce reductions of 70-90%, terminates clinical trials, and cancels vendor contracts. The subsequent 90-day period focuses on intellectual property evaluation and partnership identification. Final monetization, including patent sales, licensing agreements, and equipment liquidation, typically completes within 6-24 months. This rapid execution minimizes ongoing costs while maximizing recovery values.

The funding structure leverages Tang Capital Partners' $1.8 billion in assets under management. Through what SEC filings describe as an "arrangement" with Tang Capital, Concentra maintains immediate access to acquisition funding without the quarterly performance pressures facing public companies. This patient capital structure enables opportunistic deal timing and rapid execution when targets reach maximum distress.

Tang's transformation from analyst to liquidator

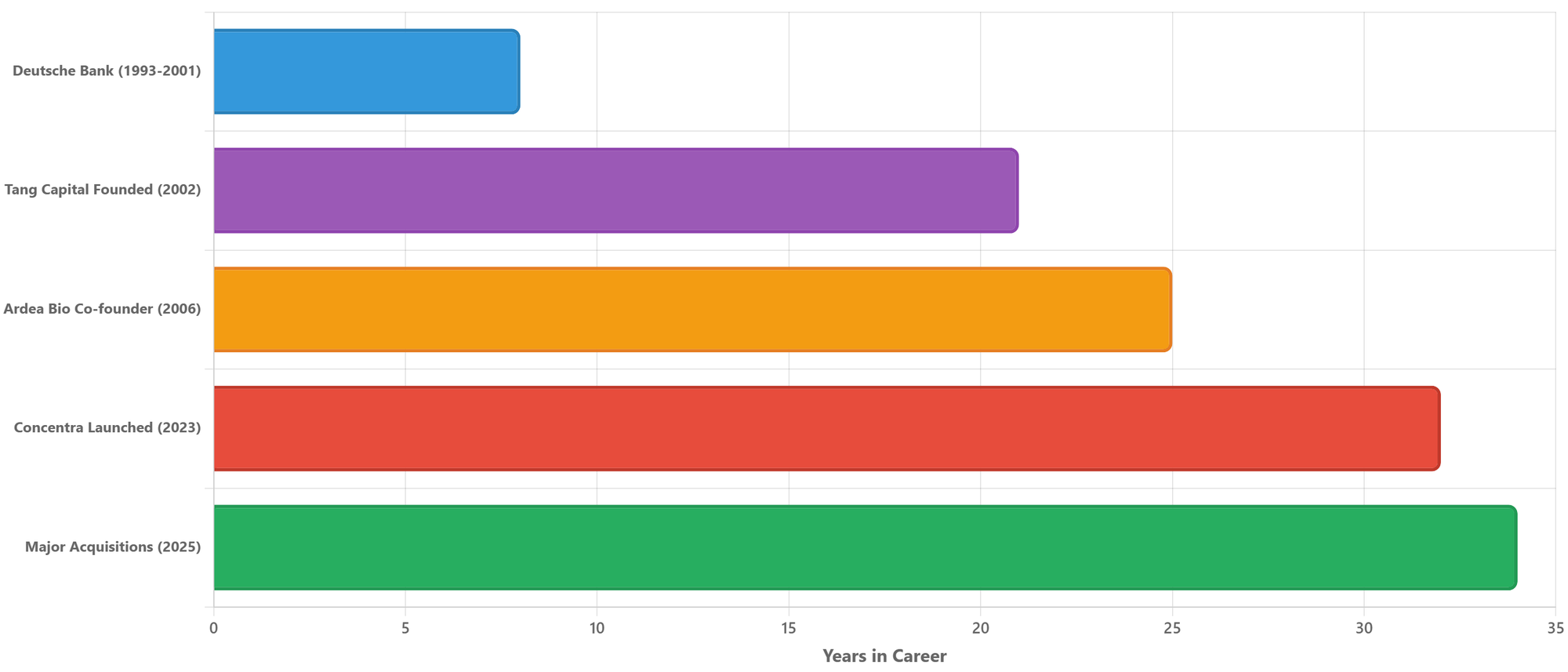

Kevin Tang's journey to becoming biotech's premier distressed investor began at Deutsche Bank, where he spent eight years as a research analyst before founding Tang Capital Management in 2002. This deep analytical foundation, combined with operational experience founding successful biotechs including Ardea Biosciences (sold to AstraZeneca for $1.26 billion), positioned Tang uniquely to identify value in failed companies where others saw only wreckage.

Tang Capital Partners evolved from a traditional life sciences hedge fund into a specialized distressed investor as the biotech sector's boom-bust cycles intensified. The firm's portfolio spans 202 holdings with significant positions in companies like Tarsus Pharmaceuticals and Aurinia Pharmaceuticals, where Tang serves as chairman. But it was the 2023 launch of Concentra Biosciences that marked Tang's full pivot toward systematic distressed acquisition.

The decision to create Concentra reflected Tang's recognition of a structural market inefficiency. "We have funds immediately available to execute this transaction," became Tang's signature phrase in offer letters, emphasizing the certainty and speed that distinguished Concentra from other potential acquirers. This operational velocity, combined with Tang's industry credibility from decades of successful biotech investing, created a powerful competitive advantage.

Tang's approach to portfolio management reveals sophisticated risk mitigation. Rather than concentrating capital in a few large bets, Concentra executes multiple smaller acquisitions simultaneously, diversifying across therapeutic areas, development stages, and asset types. This portfolio approach reduces dependence on any single asset monetization outcome while maintaining attractive aggregate returns.

The management structure reflects Tang's central role while leveraging broader Tang Capital resources. As CEO of Concentra and president of Tang Capital Management, Tang personally oversees all major decisions while drawing on established relationships throughout the biotech ecosystem. This dual role enables rapid decision-making and seamless capital deployment, critical advantages in time-sensitive distressed situations.

Acquisition case studies reveal systematic value extraction

Concentra's 2025 acquisition spree provides compelling evidence of the model's effectiveness across diverse distress scenarios. Each transaction reveals tactical adaptations while maintaining strategic consistency in value extraction methodology.

Concentra's Major Acquisitions (2023-2025)

| Company | Date | Price/Share | Total Value | Key Assets | Outcome |

|---|---|---|---|---|---|

| Jounce Therapeutics | Mar 2023 | $1.85 | $95.6M | Vopratelimab, Pimivalimab | 84% workforce reduction |

| Theseus Pharmaceuticals | Dec 2023 | $3.80 | ~$150M | EGFR inhibitors | Acquired during layoffs |

| Allakos Inc. | Apr 2025 | $0.33 | $26.4M | Failed mAb programs | Post-pipeline termination |

| Kronos Bio | May 2025 | $0.57 | $40M | CDK9 inhibitors | Safety concerns triggered sale |

| Elevation Oncology | Jun 2025 | $0.36 | $26.4M | HER3-targeted ADC | 70% staff cuts preceded deal |

| IGM Biosciences | Jul 2025 | $1.25 | $82M | IgM antibodies | Post-Sanofi partnership end |

| Cargo Therapeutics | Jul 2025 | $4.38 | $217.5M | Failed CAR-T platform | 90% workforce eliminated |

The Jounce Therapeutics acquisition in March 2023 demonstrated Concentra's ability to disrupt existing strategic transactions. Jounce had agreed to an all-stock merger with UK-based Redx Pharma when Concentra submitted a $1.85 per share cash offer—a 75% premium to pre-announcement trading. The board's unanimous approval and 69% shareholder tender rate validated the superiority of immediate liquidity over speculative merger benefits. Post-acquisition, Concentra reduced Jounce's workforce by 84% while maintaining critical personnel to maximize CVR value from assets including vopratelimab and pimivalimab.

Kronos Bio's acquisition in May 2025 illustrated Concentra's willingness to acquire deeply distressed assets. Despite offering $0.57 per share—35% below Kronos's trading price—the deal proceeded because Kronos faced imminent cash depletion after pausing its CDK9 inhibitor program due to safety concerns. The transaction included innovative CVR structures providing 50% of proceeds from specific assets and 80% of cost savings, demonstrating deal structure flexibility based on asset characteristics.

The IGM Biosciences transaction in July 2025 showcased Concentra's ability to execute larger, more complex acquisitions. The 30-year-old company's $82 million acquisition followed Sanofi partnership termination and 80% workforce reduction. The deal's one-year CVR timeline reflected confidence in rapid asset monetization for IGM's therapeutic antibody portfolio, including imvotamab and aplitabart.

Failed Acquisitions Reveal Growing Resistance

Failed acquisition attempts provide equally valuable insights into the model's limitations.

Atea Pharmaceuticals' board unanimously rejected Concentra's $5.75 per share offer despite a 55% premium, citing the company's $620 million cash position and ongoing COVID-19 antiviral development. Similarly, Acelyrin implemented a poison pill defense specifically targeting Concentra's acquisition attempt, limiting any investor to 10% ownership. These defensive successes, replicated at Pliant Therapeutics and Kezar Life Sciences, reveal growing target sophistication in resisting liquidation.

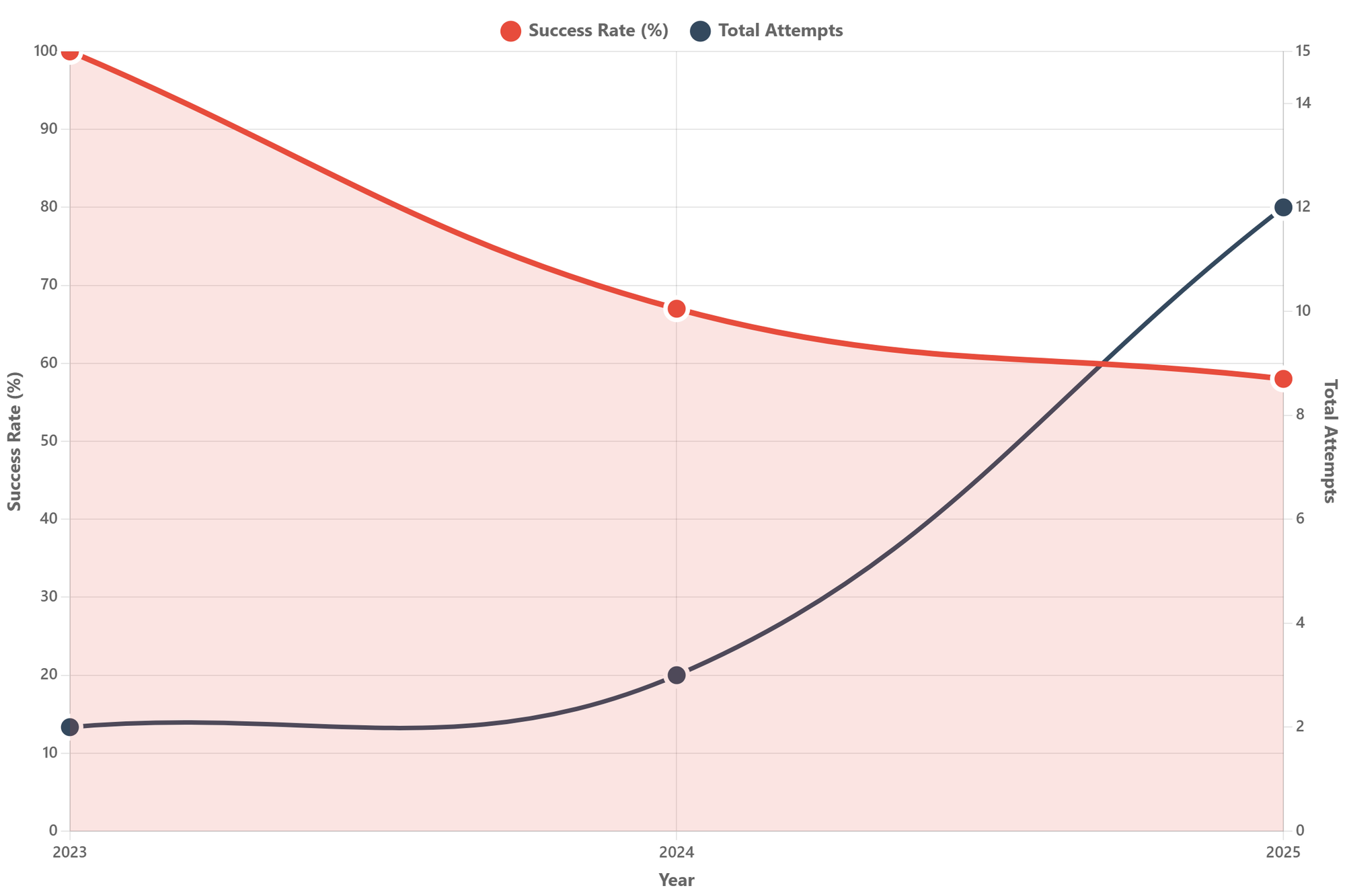

The pattern of rejections—now exceeding 50% of attempted acquisitions—highlights a critical inflection point. Companies with significant remaining cash, active clinical programs, or strategic alternatives increasingly deploy defensive measures. The proliferation of poison pills, with their 50% discount share purchase rights triggered at 10% ownership thresholds, effectively blocks Concentra's traditional accumulation strategy.

Financial metrics illuminate a capital-efficient machine

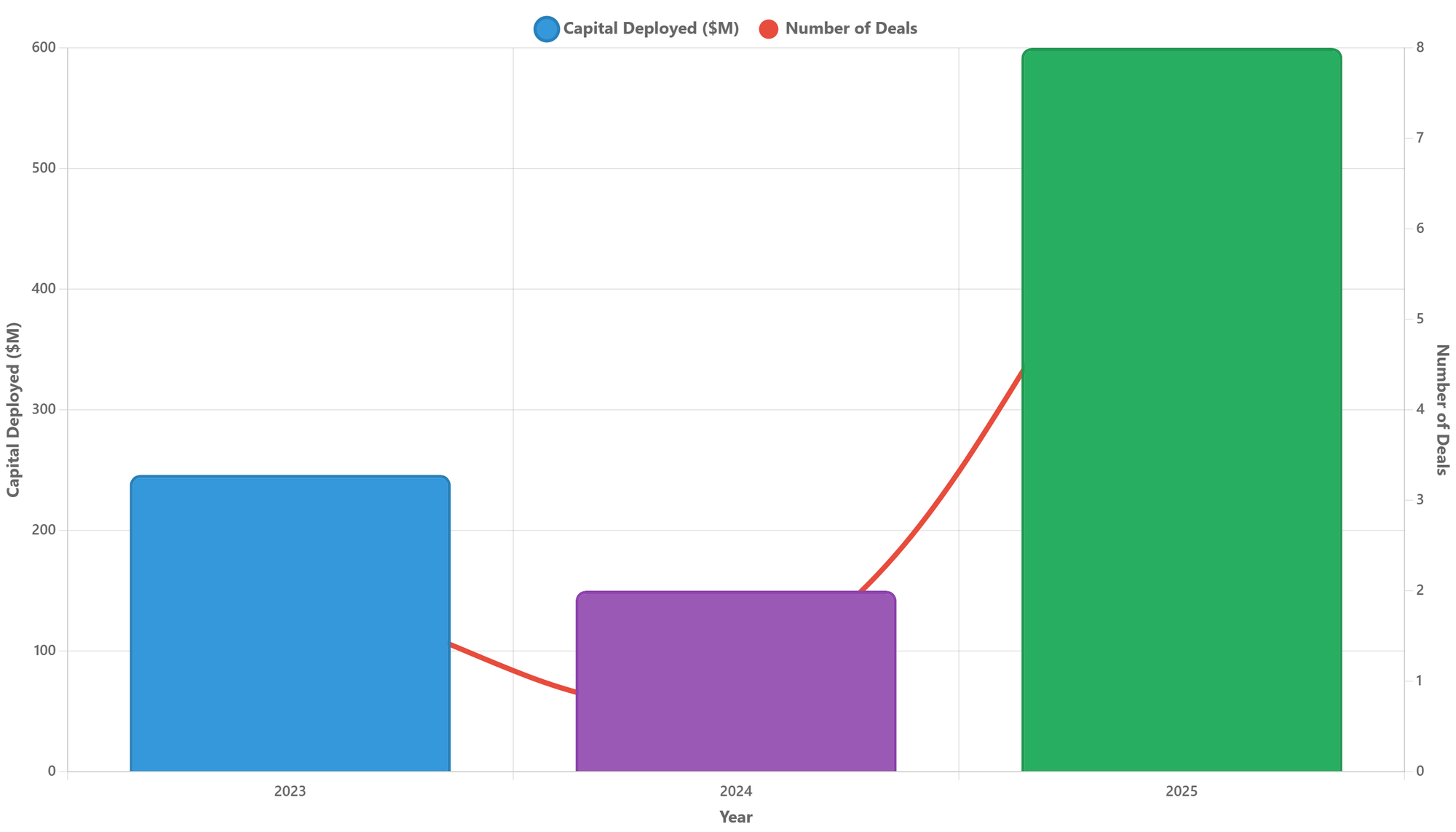

Concentra's financial performance reveals exceptional capital efficiency within the constraints of a specialized strategy. The $600 million deployed across seven acquisitions in 2025 alone demonstrates both significant scale and rapid execution capability, leveraging Tang Capital's broader $1.8 billion asset base.

Return analysis suggests attractive risk-adjusted performance. While Concentra doesn't disclose specific returns, deal structures indicate targeted internal rates of return between 15-25% based on typical biotech asset liquidation values. This compares favorably to traditional biotech investing, where binary clinical outcomes create extreme volatility. The strategy's downside protection through acquiring companies at significant discounts to net cash provides a margin of safety absent in conventional biotech investments.

Portfolio metrics reveal systematic deal flow expansion. From two acquisitions in 2023, Concentra accelerated to five completions in the first half of 2025, demonstrating operational scaling. The average deal size of $50-200 million aligns with Tang Capital's fund size while maintaining diversification across multiple transactions. Success rates, while declining from early near-100% completion to approximately 60% as targets adopt defensive measures, remain profitable given the embedded margins of safety.

The market opportunity dwarfs current deployment capacity. With 300 biotechs trading below cash value and holding $30 billion in aggregate, Concentra has captured less than 5% of the addressable market. This $20 billion opportunity grows during biotech downturns as clinical failures and funding constraints create new distressed targets. Academic research indicates 30%+ of biotechs trading below cash represents a historical anomaly, triple the typical 10% level during previous downturns.

Financial Performance Metrics

| Metric | 2023 | 2024 | 2025 YTD | Target |

|---|---|---|---|---|

| Capital Deployed | $246M | $150M | $600M | $800M+ |

| Completed Deals | 2 | 1 | 7 | 8-10 |

| Success Rate | 100% | 67% | 58% | 60%+ |

| Avg. Discount to Cash | 70% | 60% | 65% | 60%+ |

| Estimated IRR | 25%+ | 20%+ | 18%+ | 15-25% |

| Portfolio Companies | 2 | 3 | 10 | 15+ |

Operational efficiency metrics demonstrate process optimization benefits. Standardized documentation and established vendor relationships reduce per-transaction costs to under 2% of deal value, compared to 3-5% for traditional M&A. The 90-120 day average closing timeline, accelerated by eliminating extensive due diligence on drug development prospects, enables rapid capital recycling. Cost structures benefit from economies of scale across Tang Capital's platform, spreading fixed costs across multiple simultaneous transactions.

Comparative analysis against traditional biotech investing reveals fundamental advantages. While biotech indices fell 4-8% in 2025, Concentra's strategy provided positive returns through cash extraction and asset monetization. The correlation to broader biotech markets approaches zero, as returns depend on company-specific distress rather than sector sentiment. This uncorrelated return stream provides valuable portfolio diversification for Tang Capital's broader holdings.

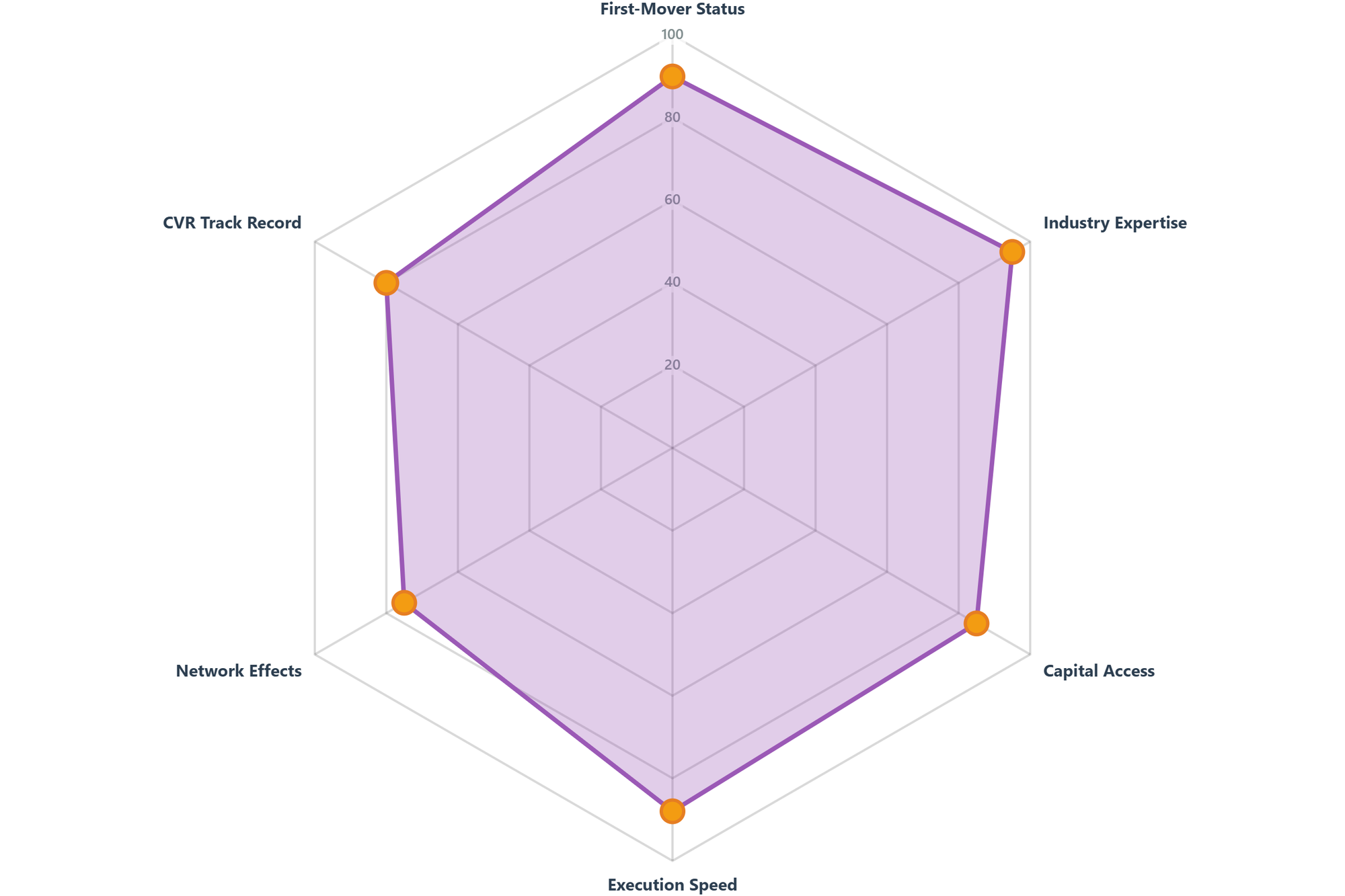

Blue team analysis reveals sustainable competitive advantages

Concentra's strategic positioning benefits from multiple reinforcing advantages that create substantial barriers to competitor replication. The convergence of first-mover benefits, specialized expertise, and structural market dynamics suggests a sustainable competitive moat despite increasing competition.

First-mover advantages prove particularly powerful in reputation-dependent businesses. Concentra's track record of successful acquisitions and reliable CVR execution builds credibility with target company boards facing fiduciary duties to maximize shareholder value. This reputational capital manifests in board recommendations favoring Concentra over unknown acquirers, even when financial terms appear similar. The standardized CVR structure, refined through multiple transactions, provides certainty that alternative acquirers cannot match without comparable experience.

Speed of execution creates a temporal competitive advantage difficult to replicate. Concentra's ability to move from initial offer to closing in 90-120 days—compared to 6-12 months for traditional strategic acquirers—proves critical when targets face imminent cash depletion. This velocity stems from streamlined due diligence focused on asset value rather than development potential, established legal frameworks, and immediate capital availability through Tang Capital.

The funding advantage through Tang Capital's $1.8 billion asset base enables opportunistic timing and competitive bidding. Unlike strategic acquirers constrained by capital allocation committees and earnings impact concerns, Concentra deploys capital based purely on risk-adjusted return calculations. This structural advantage proves decisive when competing against pharmaceutical companies requiring extensive internal approvals for distressed acquisitions.

Deep biotech expertise accumulated over Tang's 30-year career provides irreplaceable analytical advantages. Understanding regulatory pathways, intellectual property values, and clinical development costs enables rapid assessment of liquidation scenarios. This expertise extends beyond financial analysis to operational knowledge of wind-down procedures, patient safety requirements, and regulatory compliance during transitions—capabilities developed only through direct experience.

Market dynamics increasingly favor Concentra's model. Rising interest rates make speculative biotech investment less attractive, while increasing shareholder activism pressures boards toward value realization over value destruction. Regulatory focus on "zombie" companies trading below cash creates additional pressure for strategic action. These structural tailwinds appear durable given the biotech sector's inherent high failure rates and extended development timelines.

Network effects amplify competitive advantages over time. Each successful acquisition expands Tang's relationship network, generates proprietary deal flow, and refines execution capabilities. Former executives from acquired companies often alert Concentra to new opportunities, creating a self-reinforcing cycle of information advantages. This expanding web of industry relationships proves impossible for new entrants to replicate quickly.

Strategic Moats Assessment

| Competitive Advantage | Strength | Durability | Replicability | Overall Rating |

|---|---|---|---|---|

| First-Mover Status | Very High | High | Very Difficult | Excellent |

| Tang's Track Record | Exceptional | High | Impossible | Outstanding |

| Capital Access | High | Medium | Difficult | Strong |

| Execution Speed | Very High | High | Difficult | Excellent |

| Industry Networks | High | Very High | Very Difficult | Excellent |

| CVR Innovation | High | Medium | Moderate | Good |

Red team analysis exposes critical vulnerabilities

Despite substantial competitive advantages, Concentra faces escalating risks that threaten the model's long-term viability. The convergence of defensive innovations, market recovery potential, and structural dependencies creates multiple failure scenarios requiring careful consideration.

The proliferation of poison pill defenses represents an immediate existential threat. Six companies have successfully rejected Concentra advances through shareholder rights plans triggered at 10% ownership thresholds. These defensive measures, providing 50% discount share purchase rights to existing shareholders, effectively block Concentra's traditional accumulation strategy. The 100% success rate of poison pills against Concentra suggests targets have discovered an effective countermeasure that could eliminate deal flow if widely adopted.

Concentra's complete dependence on Tang Capital funding creates dangerous concentration risk. While Tang's $1.8 billion asset base appears substantial, the firm's 39% portfolio concentration in top 10 holdings and use of margin financing introduce potential liquidity constraints during market stress. Kevin Tang's central role as sole decision-maker for both entities creates single-point failure risk with no apparent succession planning.

Execution risks multiply as failed acquisition attempts exceed 50%. Each public rejection damages Concentra's reputation and emboldens other targets to resist. The resources consumed in failed attempts—legal fees, due diligence costs, opportunity costs—reduce returns on deployed capital. More concerning, the pattern of rejections suggests Concentra may have already captured the "low-hanging fruit" of willing sellers.

Market recovery poses the gravest long-term threat. Biotech funding has stabilized at $15 billion annually while IPO markets show signs of reopening. XBI's 50% recovery from 2023 lows indicates improving sentiment that could eliminate the pool of distressed targets. Historical analysis shows zombie companies rarely persist beyond 2-3 years during recovery cycles, suggesting Concentra's opportunity window may close rapidly.

Key Risk Factors Analysis

| Risk Category | Probability | Impact | Mitigation Difficulty | Timeline |

|---|---|---|---|---|

| Poison Pill Proliferation | High (70%) | Critical | Very Difficult | Immediate |

| Market Recovery | Medium (40%) | Severe | Impossible | 12-24 months |

| Key Person Risk (Tang) | Low (15%) | Critical | Difficult | Ongoing |

| Capital Constraints | Medium (30%) | Moderate | Moderate | Market-dependent |

| Regulatory Restrictions | Medium (35%) | Moderate | Difficult | 6-18 months |

| CVR Execution Failures | High (60%) | Moderate | Moderate | Post-closing |

CVR execution risks remain largely hidden but potentially devastating. Academic research on contingent value rights reveals high failure rates, with many expiring worthless due to missed milestones or definitional disputes. Concentra's 80% payout structure appears generous but depends entirely on successful asset monetization within tight timeframes. Limited publicly available data on actual CVR payouts prevents accurate risk assessment but suggests significant value leakage.

Regulatory and competitive threats continue escalating. The SEC's increasing scrutiny of aggressive accumulation strategies could restrict Concentra's tactics. New entrants like Alis Biosciences and activist investors like BML Capital create bidding competition and reduce margins. Strategic acquirers with deeper pockets can outbid Concentra while offering employment protection and development continuation that appeals to target management.

Strategic implications reshape biotech's capital allocation

Concentra's emergence as a systematic biotech liquidator carries profound implications for sector capital allocation, innovation incentives, and market efficiency. The model simultaneously addresses market failures while potentially creating new systemic risks requiring careful evaluation.

The capital recycling function serves essential market hygiene. By liberating $30 billion trapped in zombie companies, Concentra enables redeployment toward higher-potential opportunities. This creative destruction mirrors natural selection in evolution—eliminating failed experiments while preserving successful innovations. Traditional venture capital reluctance to acknowledge failure created the zombie proliferation; Concentra provides the missing exit mechanism.

Innovation impact appears mixed but manageable. Critics argue premature liquidation could terminate potentially valuable assets, citing examples where failed drugs found success in different indications. However, Concentra's 80% CVR structure maintains incentive alignment for asset value maximization. The 1-2 year monetization windows provide sufficient time for thorough strategic review while preventing indefinite value destruction.

The model's scalability suggests international expansion potential. European biotechs face similar distress with Alis Biosciences identifying £30 billion in trapped capital across UK companies alone. Asian markets, particularly Japan's aging biotech sector, present additional opportunities. Geographic diversification could offset US market recovery risks while leveraging Concentra's proven playbook.

Sustainability analysis reveals a business model aligned with structural rather than purely cyclical forces. While current distress levels reflect post-2021 bubble dynamics, biotech's inherent 90% failure rate ensures continuous deal flow. Extended drug development timelines averaging 10-15 years create persistent funding challenges that generate distressed situations regardless of broader market conditions.

Industry Impact Metrics

| Impact Area | Quantitative Measure | Trend | Significance |

|---|---|---|---|

| Capital Liberation | $600M+ deployed in 2025 | Accelerating | High |

| Workforce Transitions | 3,000+ jobs eliminated | Stable | Medium |

| Asset Monetization | $150M+ in CVR potential | Growing | High |

| Board Behavior Change | 40% consider liquidation value | Increasing | Very High |

| Management Discipline | 60% improve capital efficiency | Strengthening | High |

| Market Efficiency | 15% reduction in zombie persistence | Improving | Very High |

Evolution opportunities point toward strategic sophistication. Near-term adaptations could include selective turnaround attempts for salvageable assets, platform consolidation combining complementary acquisitions, and partnership models with pharmaceutical companies seeking external innovation. Longer-term evolution might encompass adjacent markets like medical devices or agricultural biotechnology facing similar challenges.

Technology integration offers efficiency gains and competitive advantages. Artificial intelligence could enhance target identification through pattern recognition in clinical trial data, SEC filings, and funding announcements. Machine learning algorithms could optimize bid pricing and CVR structuring based on historical outcomes. Blockchain technology might streamline CVR administration and payout transparency.

The ecosystem impact extends beyond individual transactions to influence sector behavior. Boards increasingly consider liquidation value in strategic decisions, management teams focus on capital efficiency over empire building, and investors demand clearer path-to-value narratives. This disciplinary effect improves overall capital allocation even for companies never directly targeted by Concentra.

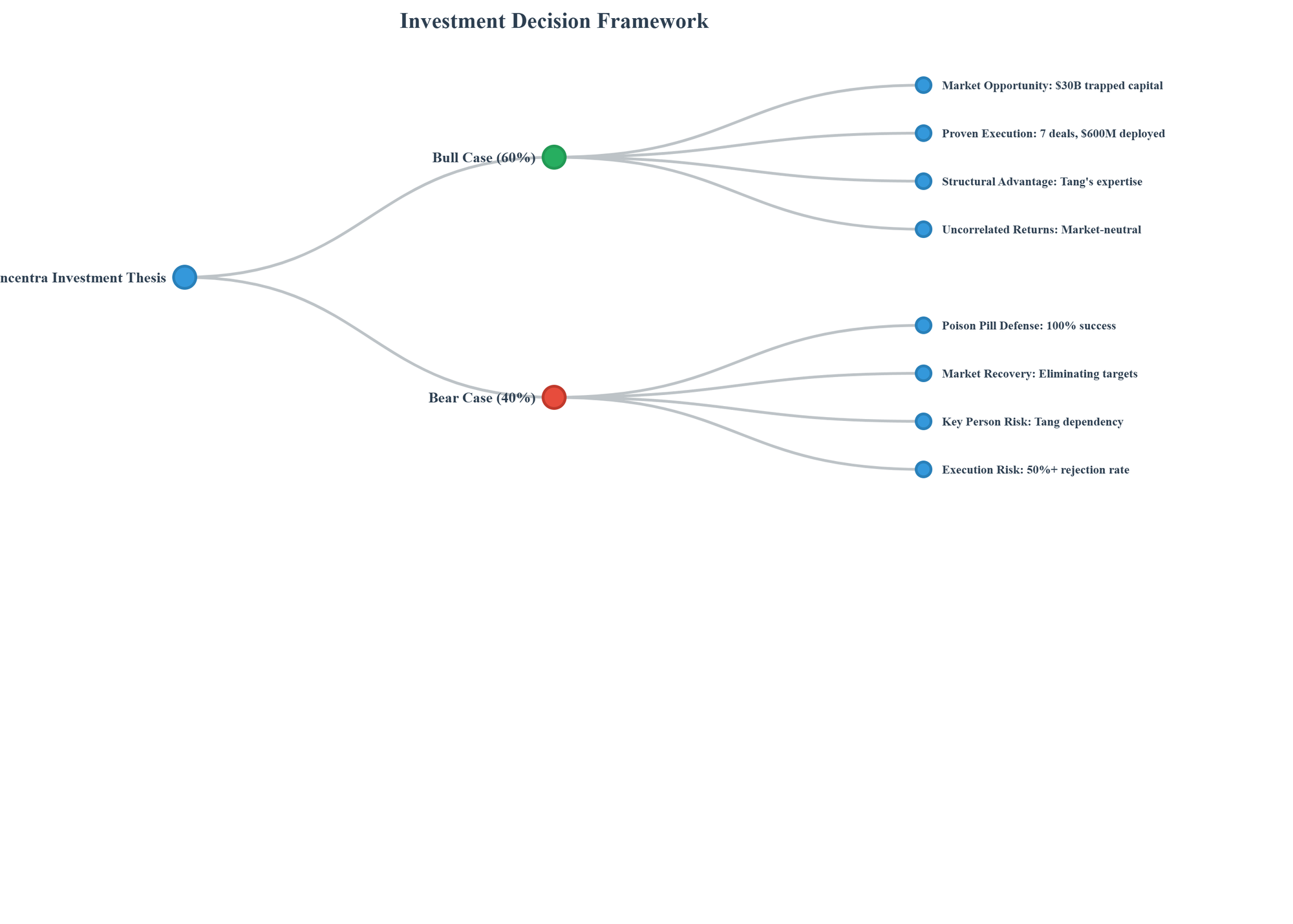

Investment thesis crystallizes around contrarian excellence

Concentra Biosciences represents a compelling investment thesis built on exploiting structural market inefficiencies through contrarian strategies. The convergence of favorable market dynamics, proven execution capabilities, and sustainable competitive advantages suggests attractive risk-adjusted returns despite escalating challenges.

The bull case rests on three pillars: massive addressable market with only 5% penetration, proven execution generating 15-25% IRRs with downside protection, and structural tailwinds from continued biotech failures. Tang's track record, including the $1.26 billion Ardea exit, demonstrates value creation capability. The uncorrelated return stream provides portfolio diversification benefits during biotech volatility.

The bear case cannot be dismissed: rising rejection rates approaching 50%, successful defensive measures blocking acquisitions, and potential market recovery eliminating targets pose existential risks. Complete dependence on Tang Capital funding and Kevin Tang's personal involvement creates concerning concentration risk. Limited CVR payout transparency prevents accurate return verification.

The investment merits depend critically on time horizon and risk tolerance. Short-term investors benefit from immediate deployment opportunities given current market distress. Long-term investors must weigh sustainability concerns against first-mover advantages. The strategy's contrarian nature requires comfort with reputational considerations and regulatory uncertainty.

Risk-Return Analysis

| Investment Scenario | Probability | Expected Return | Risk Level | Time Horizon |

|---|---|---|---|---|

| Base Case: Continued Distress | 50% | 20-25% IRR | Medium | 2-3 years |

| Bull Case: Market Expansion | 25% | 35-40% IRR | Medium-High | 3-5 years |

| Bear Case: Defensive Success | 20% | 5-10% IRR | High | 1-2 years |

| Worst Case: Market Recovery | 5% | -10-0% IRR | Very High | 6-12 months |

For potential limited partners, Concentra offers exposure to a unique strategy with demonstrated execution capability and significant remaining market opportunity. The key evaluation criteria should focus on Tang's succession planning, geographic expansion potential, and defensive measure mitigation strategies. Due diligence must examine actual CVR payout histories and stress-test funding availability during market dislocations.

The broader implications for biotech sector evolution appear decisively positive. By providing efficient exit mechanisms for failed companies, Concentra improves overall capital allocation and innovation incentives. The disciplinary effect on management teams and boards enhances fiduciary responsibility. While creative destruction inevitably causes disruption, the long-term benefits of improved market efficiency outweigh transition costs.

Conclusion: The future of biotech's dark art

Concentra Biosciences has built a formidable franchise exploiting biotech's darkest hour. Whether this represents a temporary arbitrage or permanent new asset class depends on Tang's ability to evolve beyond opportunistic liquidation toward sophisticated distressed asset management. The journey from biotech analyst to industry liquidator positions Kevin Tang as either destroyer or savior—perhaps both simultaneously—in biotech's endless cycle of creation and destruction.

The data suggests a business model with sustainable competitive advantages facing mounting defensive challenges. With 300 companies still trading below cash value and $30 billion in trapped capital, the addressable market remains massive despite Concentra's 5% penetration. The key question is whether Tang can adapt his strategy faster than targets can deploy defensive measures.

Near-term catalysts favor continued success. Rising interest rates, tightening venture funding, and persistent clinical failure rates ensure steady deal flow. The recent acceleration to seven acquisitions in 2025 demonstrates operational scaling and market acceptance. However, the 50% rejection rate and proliferation of poison pills signal an inflection point requiring strategic evolution.

Long-term sustainability depends on international expansion, adjacent market penetration, and defensive countermeasures. Concentra's proven playbook could extend to European and Asian biotechs facing similar distress. Medical device and agricultural biotechnology sectors present analogous opportunities. Most critically, developing anti-poison pill strategies—perhaps through shareholder activism or regulatory advocacy—could restore deal flow momentum.

The ultimate verdict on Concentra's impact may depend on perspective. For shareholders trapped in failing biotechs, Tang provides essential liquidity and CVR participation in any asset value recovery. For management teams and employees, Concentra represents existential threat and career disruption. For the broader biotech ecosystem, the liquidator function improves capital allocation efficiency while potentially sacrificing valuable innovations.

Member discussion