Fund of the week: Breakout Ventures

Executive Summary

Breakout Ventures is a San Francisco-based venture capital firm specializing in life sciences and "deep tech" investments. Spun out of a philanthropic seed program in 2016, Breakout Ventures has quickly carved a niche funding early-stage companies where biology, chemistry and technology converge.

This report provides a comprehensive analysis of the firm's strategy, fund economics, performance, and portfolio – balancing a critical red-team view of risks with a blue-team perspective on strengths. We benchmark Breakout's performance against industry standards and peer funds, incorporating quantitative metrics like internal rate of return (IRR), capital deployment models, and venture benchmarks.

Origins and Investment Strategy

Foundation and Leadership

Breakout Ventures emerged from Breakout Labs, a seed-stage program within Peter Thiel's foundation focused on hard-science startups. Lindy Fishburne, the founder of Breakout Labs and now Managing Partner of Breakout Ventures, launched the firm alongside Julia Moore (Co-Founder & Managing Partner) to provide follow-on capital for the most promising science-driven companies. Fishburne's background includes an MBA from UT Austin and leadership of Breakout Labs, while Moore brought experience as a biotech VC (Kearny Venture Partners), Wall Street analyst, and operator in medtech.

This blend of philanthropic origin and venture discipline defines Breakout's investment strategy.

Investment Focus Areas

Early-Stage Bioscience Focus: Breakout Ventures bills itself as "the home for creative bioscience entrepreneurs", targeting companies harnessing the power of cells, computation, and engineering to solve problems in human health and sustainability. In practice, this means seeding startups across:

- Synthetic biology

- Therapeutics (cell and gene therapy)

- Computational drug discovery

- Diagnostics

- Biomanufacturing

- Climate-related biotech

The firm typically enters at Seed or Series A rounds, then continues to support companies through scale-up stages. As Fishburne describes, "Cells are the engine of the next decade as humans can now partner with biology in surprising ways" – a vision reflected in Breakout's portfolio of cutting-edge science ventures.

Network and Differentiation

Having funded 50+ science startups via Breakout Labs, the team spent the last decade building an ecosystem of scientists, founders and co-investors committed to "making science fiction a reality". This network provides proprietary deal flow and diligence capabilities. Breakout often backs companies at a stage when few traditional VCs engage – in Fishburne's words, when "philanthropic capital was necessary" to reach technical milestones.

By the early 2020s, however, deep-tech investing became more mainstream, allowing Breakout Labs to "declare success and transition fully to Breakout Ventures" by 2021. In other words, what began as grant-like funding for moonshots has matured into a conventional VC model now that "investors are embracing deep tech at all stages".

Investment Approach

Breakout's investment approach emphasizes high-conviction bets rather than spray-and-pray. The firm notes that Fund II "integrates our Seed and concentrated A/B strategies" – implying they make initial seed investments and reserve capital to follow on in winners through Series A and B. The team prioritizes quality over quantity, stating their fund size is "well suited to drive returns vs. [merely] AUM building".

In practice, a Breakout fund might back on the order of 10–15 companies, deploying an initial check (often $1–3 million) then doubling down on a subset with larger follow-ons. This focused portfolio construction is designed to yield a high total value to paid-in (TVPI) if a few companies achieve outsized success, rather than indexing the entire market.

Some areas Breakout targets were once viewed as too speculative for traditional VC – e.g. lab-grown biomaterials, programmable biology, or digital biology tools – but now attract significant capital. The firm prides itself on staying at the forefront of such emergent fields: "We challenge the traditional boundaries of science to unlock new possibilities," says Moore.

In summary, Breakout's strategy is to partner early and stay long, providing not just funding but also scientific guidance (their team includes multiple Ph.D.'s) and industry connections through the full life cycle from seed to scale.

Fund Structure and Capital Base

Fund Vehicles

Breakout Ventures operates typical 10-year closed-end venture funds. The firm raised Fund I in 2016 (inception of Breakout Ventures) and an oversubscribed Fund II of $112.5 million in late 2021. While Fund I's exact size wasn't publicly disclosed, it was reportedly much smaller – likely on the order of ~$50–60 million – reflecting Breakout's initial pilot fund to support Breakout Labs graduates.

By contrast, Fund II's $112.5M raised in 2021 more than doubled the capital under management, indicating growing LP appetite for the strategy. Fund II also expanded to include new institutional LPs (e.g. Cortes Capital and AMG National's Cupola funds, university endowments and a bank) beyond the early individual backers.

Table 1: Breakout Ventures Funds Overview

| Fund | Launch | Size (Commitments) | LP Base | Investment Focus | Notable Investments |

|---|---|---|---|---|---|

| Breakout Fund I | 2016 | ~$50M (est.) | Thiel Foundation (anchor), Dolby F.V., S Cubed, etc. | Seed-stage deep science | Immusoft, Ecovative |

| Breakout Fund II | 2021 | $112.5M (actual) | Above + new endowments, family offices, bank | Seed to Series A "creative bioscience" | CellChorus, ZymoChem |

| Investment Model | - | 10-year closed LP fund | ~10–15 portfolio companies per fund; GP commit ~2% | Initial check ~$1–3M; follow-ons through Series B (reserve ~50% of fund) | - |

Sources: Breakout Ventures press release, Big Path Capital showcase, and industry estimates.

Limited Partners

Notably, Fund II's investor list blends tech luminaries and family offices interested in deep science. Existing LPs in Fund II included Dolby Family Ventures, Thiel Foundation, and S Cubed Capital (the family office of Mark Stevens), all of whom had backed Fund I. High-profile tech figures Chris Sacca (Lowercase/Lowercarbon), Crystal Sacca, Tony Fadell (of iPod and Nest fame), Zack Bogue and Matt Ocko (co-founders of DCVC) also personally committed. Their participation signals confidence – these are investors who themselves operate venture funds in climate-tech and deep-tech.

The presence of such LPs likely benefited Breakout in both capital and network: for example, DCVC's partners investing might open co-investment opportunities, and Thiel's foundation anchor gave credibility. New LPs in Fund II extended the base, with Cortes Family Office (Love's) and other institutional capital joining. This mix of mission-aligned family offices, foundations, and tech veterans suggests Breakout positioned itself as an impact-oriented yet return-driven fund, attracting those who seek both financial and "intellectual returns" (exposure to cutting-edge science).

General Partner Team & Economics

Breakout Ventures is led by Managing Partners Lindy Fishburne and Julia Moore, who likely contribute the standard GP commitment (often 1–2% of fund capital) to align incentives. The firm's core team has grown modestly, now including Ph.D.-level investors Dr. Dana Watt (partner) and Dr. Nima Ronaghi (principal), who were hired in 2021 to deepen scientific expertise. A CFO (James Chan) and General Counsel (Ziv Yoash) joined in 2023 as operations scaled.

This suggests a lean firm structure, with <10 professionals managing ~$170M across funds – a size typical for a boutique venture fund. We can infer Breakout applies a conventional "2 and 20" fee model (2% annual management fee, 20% carried interest on profits), though their one-pager hints at a focus on returns over fees, as they explicitly distance themselves from "AUM building". The small fund sizes relative to many VC firms means management fees are modest – reinforcing that the GPs' payout will come predominantly from carry earned if the funds perform well.

In terms of capital structure and vehicles, Breakout Ventures uses standard limited partnership funds (the legal entity for Fund II is listed as "Breakout Ventures II, L.P." in filings). A Bloomberg profile cites "Breakout Ventures Associates LLC" as an advisor, which likely refers to the GP/management company. There is no indication of using unconventional structures like evergreen funds or SPACs – Breakout sticks to the classic venture model of draw down capital commitments over ~5 years, then harvest returns by year ~10.

Notably, their Breakout Labs predecessor was philanthropic (grant-based with warrants), but Breakout Ventures' funds are for-profit, returning gains to LPs. The firm's evolution thus exemplifies a "catalytic philanthropy" approach seeding an area until market investors take over.

Portfolio Construction and Deployment

Portfolio Composition

Breakout Ventures constructs relatively concentrated portfolios aimed at delivering high multiples on invested capital. With Fund I (2016 vintage), the firm invested in roughly a dozen startups – several of which were spin-outs of Breakout Labs. As of 2021, Fund I's investments included: Immusoft (B-cell gene therapy), Checkerspot (synbio materials), Strateos (robotic labs), Cytovale (sepsis diagnostics), Ecovative (mycelium materials), and Twelve (CO₂-to-chemicals).

These six named examples suggest a broad mix across biotech therapeutics, tools, and sustainability-oriented tech. Fund II, which held a first close of $30M in early 2021 and a final close at $112.5M by year-end, has started with a similar cadence. By the end of 2022, Fund II had deployed capital into CellChorus (single-cell analytics), ZymoChem (green chemistry via microbes), Parthenon Therapeutics (cancer microenvironment therapy), and others in stealth.

According to Breakout's website, the active portfolio now spans 24 companies (as of 2025) across Funds I and II:

Table 2: Portfolio Company Categorization

| Category | Companies | Focus Areas |

|---|---|---|

| Therapeutics & Health | Immusoft, Appia Bio, Incendia Tx, Parallel Bio, Passkey Tx, Phantom Neuro, Shiratronics, TFC Therapeutics | B-cell therapy, allogeneic cell therapy, tumor reprogramming, immune-system-on-a-chip, computational drug discovery, neuroprosthetics, neuromodulation, cancer stem cells |

| Synthetic Biology & Biotech Platforms | Checkerspot, Ecovative Design, EnPlusOne Bio, ZymoChem | Bio-based polymers, mycelium materials, enzymatic RNA production, microbial biomanufacturing |

| Computational & Data-Driven Science | Noetik, Canaery, Copernic Catalysts, STRM.BIO | AI for immunotherapy discovery, machine olfaction, physics-based catalyst design, gene therapy delivery |

| Diagnostics & Tools | Cytovale, CellChorus, Epana Bio, Surf Bio | Rapid sepsis diagnostics, high-throughput cell analysis, genomics-driven autoimmune therapy, drug delivery stabilization |

| Climate & Sustainability Deep Tech | Twelve, Modern Meadow, A-Alpha Bio | Carbon recycling to fuels/materials, biofabricated leather/collagen, protein interaction mapping |

This portfolio reveals Breakout's thematic clustering in areas where "biology, chemistry and technology are converging". Roughly half the companies are therapeutics/healthcare plays (with heavy R&D and regulatory risk), while others are platform technologies or materials science ventures addressing sustainability.

The inclusion of companies like Modern Meadow – known for lab-grown leather – reflects Breakout's willingness to fund "out-there" science ventures before they become hot sectors. Modern Meadow initially got Breakout Labs support and later closed a $130M Series C round in 2021, an indication that such bets can attract substantial follow-on capital if successful.

Capital Deployment Pattern

Breakout typically deploys capital over a 3–4 year investment period for each fund. For example, Fund I (2016–2020) likely made initial investments through 2019, with reserves used for follow-ons in 2019–2022. Fund II (2021–present) is probably mid-way through deployment as of 2025. A 2021 LP update noted Fund II had "just completed our first close ($30M) and [we] are capping the fund at $100M" (later increased to $112M).

By late 2021, Breakout had "already begun deploying capital from Fund II" into new deals. This suggests an active pace – possibly 3–5 new investments per year – while keeping dry powder for follow-ons.

We can infer from the concentrated approach that Breakout aims to invest roughly $5–10M per company over the life of a fund. For instance, if Fund I was ~$50M and backed ~12 companies, the average allocation per company would be ~$4M (including follow-ons).

In practice, some will receive more (the "big winners" in Series B rounds) and some less. Indeed, the firm explicitly mentions "concentrated A/B strategies" in Fund II, meaning they plan to double down on the most promising seeds through Series A and B rounds – an approach that can increase ownership stakes in winners, but also means fewer total shots on goal.

Follow-On and Syndication

As a seed-stage lead, Breakout often syndicates with larger VCs for later rounds. For example, Twelve (Opus 12), which Breakout seeded, went on to raise a $57M Series A led by Capricorn and Carbon Direct and a $130M Series B (2021) including prominent climate-tech investors.

Breakout likely contributed pro-rata in those rounds (to maintain stake) but would rely on bigger funds to bankroll the bulk. Similarly, Strateos raised $56M from strategics and VCs to build out its remote lab platform, indicating Breakout's seed was followed by outside capital.

The ability to attract follow-ons is crucial: Breakout's portfolio has collectively raised over $1B in follow-on funding after Breakout's initial investments – a strong validation of the companies' quality and the firm's network.

However, syndication is a double-edged sword: while it brings more resources, it can dilute Breakout's ownership unless Breakout can maintain pro-rata. With modest fund sizes, Breakout must be selective in which follow-ons to join. The firm's solution is to "connect core LPs with direct investment opportunities" for later stages.

In other words, Breakout sometimes taps its LP network (several of whom are VCs or have family offices) to co-invest in later rounds of portfolio companies. This extends Breakout's influence and provides companies additional capital without needing a larger dedicated opportunity fund. It's an interesting aspect of their capital structure: LPs not only commit to the funds but may invest side-by-side in breakout successes.

Performance Metrics and Benchmarks

Key Venture Fund Metrics

Assessing Breakout Ventures' performance requires examining interim metrics, since the firm's funds are young and largely unrealized (i.e. few exits to cash so far). Key venture fund metrics include:

Table 3: Venture Capital Performance Metrics

| Metric | Definition | Benchmark Targets | Breakout Status (Est.) |

|---|---|---|---|

| TVPI (Total Value to Paid-In) | Combines realized and unrealized value; multiple on invested capital | • 1.5x = Mediocre<br>• 3.0x = Strong<br>• 5.0x+ = Elite | Fund I likely >1.5x (on paper)<br>Fund II too early |

| DPI (Distributions to Paid-In) | Cash actually returned to LPs | • <0.2x = Young fund<br>• 1.0x = Full payback<br>• >2.0x = Strong returns | Fund I likely <0.2x<br>(minimal exits) |

| IRR (Internal Rate of Return) | Annualized return accounting for time and cash flow timing | • 18.7% = VC industry avg<br>• 20-30% = Target<br>• >25% = Top quartile | Target: 20-25% net |

Current Performance Status

For Breakout Ventures, Fund I (2016) is around year 9 of its lifecycle (as of 2025). No known large exits have occurred, so DPI is minimal – perhaps Cortexyme's IPO provided some liquidity (if they sold shares post-lockup). Cortexyme (NASDAQ: CRTX), an Alzheimer's drug startup in the Breakout Labs portfolio, went public in 2019 reaching a multi-billion valuation, but later cratered ~90% after its Phase 2/3 trial failed, and pivoted to a new indication.

If Breakout Labs (or Breakout Ventures if it had any stake) realized gains pre-crash, that could have produced a small distribution. Otherwise, most of Fund I's value remains marked-up on paper (RVPI). Several Fund I companies have raised up-rounds, boosting carrying value: e.g. Twelve's valuation presumably soared in its $130M Series B, and others like Ecovative and Checkerspot raised substantial follow-ons. As a result, Fund I's TVPI is likely >1.5× (on paper) but DPI <<1×. The true test will be converting RVPI to DPI via exits in coming years.

Comparative Market Performance

To illustrate Breakout's performance in context, consider how a $100 investment might fare in different asset classes over the 2016–2025 period:

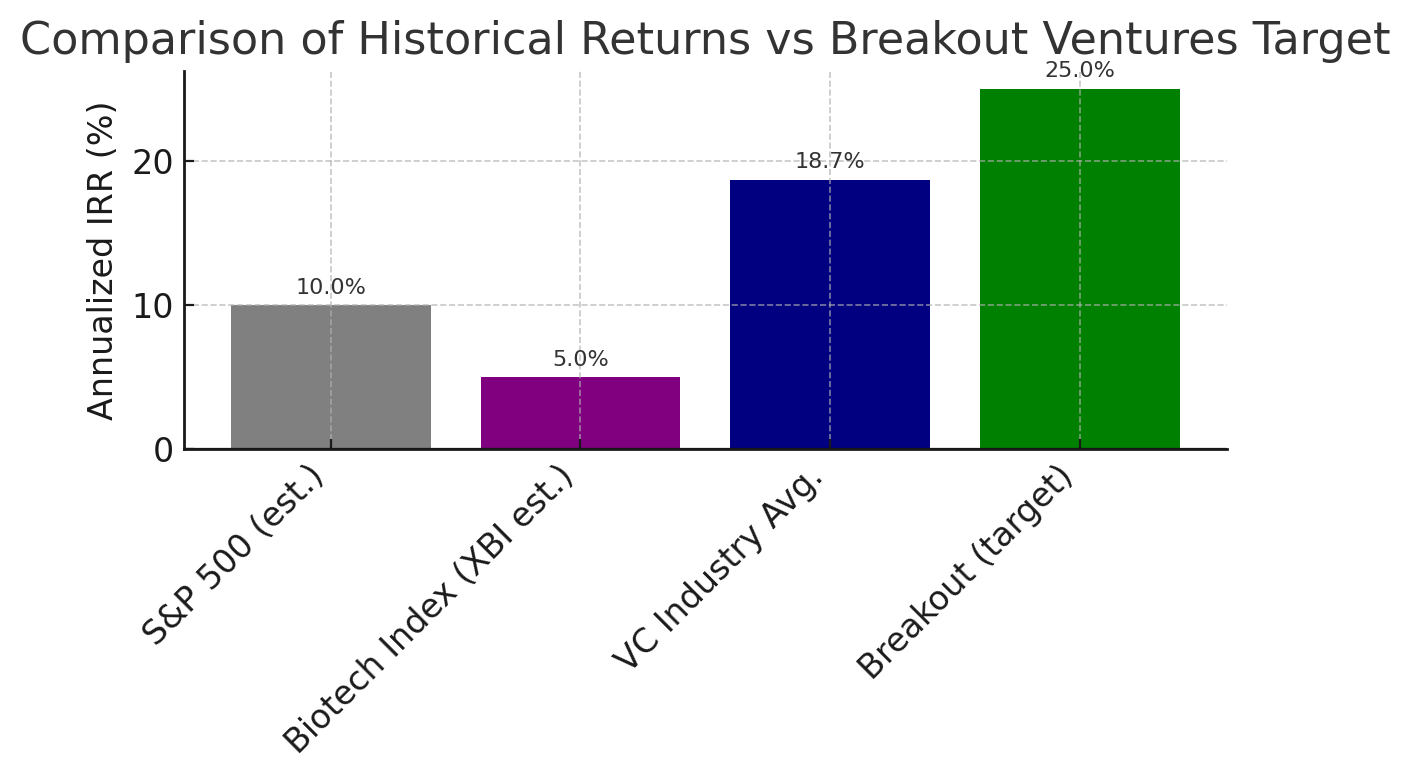

Figure 1: Comparison of Historical Returns vs Breakout Ventures Target

The comparison shows:

- S&P 500 (est.): ~10% annual returns

- Biotech Index (XBI est.): ~5% annual returns

- VC Industry Avg: ~18.7% annual returns

- Breakout (target): ~25% annual returns

As Figure 1 shows, public biotech markets have been volatile and underperformed relative to venture capital. The S&P 500 (broad stock market) delivered roughly ~10% annual returns over the past decade (for ~2.5× in 10 years), while a biotech sector index (e.g. S&P Biotech ETF) has struggled – the leading biotech index plunged ~60% from its early-2021 peak amid a sector downturn, translating to low single-digit or negative IRRs for the 2016–2025 period.

By contrast, venture capital as an asset class returned ~18–19% annually in the 2010s, handily beating public equities. Breakout's own target would be to exceed the VC average – perhaps aiming for ~20–25% IRR (net).

Table 4: Simulated Outcome Scenarios

| Scenario | Total Value (TVPI) | Net IRR (≈) | Description |

|---|---|---|---|

| Blue Sky (Top-Decile) | 5.0× | ~25% | One or two "moonshots" exit at billion-dollar valuations, yielding 10–20× on those investments. Multiple smaller wins. (E.g. Twelve IPOs at $5B+.) LPs earn ~5× their money. |

| Base Case (Target) | 3.0× | ~15% | A few solid exits (3–5× returns each) and others break even or moderate. Portfolio leader perhaps 10×. Achieves a typical VC target of ~3× gross, ~2.5× net after fees. Meets mid-to-upper quartile performance. |

| Downside (Subpar) | 1.5× | ~5% | Few exits, many write-offs. Follow-on valuations don't hold or IPO market stays cold. Fund returns only 1.5× after a decade – barely above capital + inflation. This would lag venture benchmarks and disappoint LPs. |

These scenarios underscore the high variance in venture outcomes. Breakout's concentrated approach accentuates this variance – the fund's fate may rest on one or two big winners. For Fund I, candidates for such winners include Twelve (if its carbon technology reaches commercial scale) or perhaps Cytovale (if its sepsis test becomes standard in ERs).

For Fund II, it might be too early, but one could imagine a biotech like Appia Bio or a platform like EnPlusOne making a breakthrough. The red-team view must consider the risk that none of the portfolio companies achieve massive scale (e.g. due to scientific failure or market hurdles), yielding a mediocre outcome.

Portfolio Company Spotlights: Successes and Challenges

A closer look at specific portfolio companies provides insight into Breakout's track record and value-add:

Success Stories

Twelve (CO₂ Transformation) – Flagship success in progress Twelve (formerly Opus 12) uses proprietary electrochemical reactors to convert carbon dioxide into useful chemicals and fuels. Breakout Labs supported Opus 12 early, and Breakout Ventures invested in its seed round. Twelve has since secured major partnerships (Mercedes-Benz, Procter & Gamble, NASA) and raised $57M Series A and $130M Series B funding.

The company is pioneering a new market ("carbon-to-value") and could see an exit via IPO or acquisition if it continues on this trajectory. On paper, Breakout's stake in Twelve has likely appreciated significantly (with the Series B valuing the company in the hundreds of millions). This is a blue-team example of Breakout's model working: a high-risk idea (carbon recycling) that gained traction and attracted late-stage capital, validating Breakout's early conviction.

Cytovale (Sepsis Diagnostic) – Steady progress, awaiting outcome Cytovale is developing the IntelliSep test – a 10-minute blood test to detect sepsis risk in emergency rooms. Breakout Ventures backed Cytovale's vision of using single-cell biomechanical markers for rapid diagnostics. The company has since published successful study results and is navigating FDA pathways. It also raised funding from other VCs (Blackhorn, Dolby Ventures, etc.).

Cytovale's CEO praised Breakout for helping "see around corners at critical moments", indicating Breakout's hands-on support. The exit path here might be acquisition by a diagnostics or device company if the test gains regulatory approval – a positive outcome could return multiples on Breakout's investment, whereas a setback (regulatory or adoption challenges) could stall the company.

Long-Term Plays

Modern Meadow (Biofabrication) – Promising tech, long road Modern Meadow set out to "grow" leather from cultured cells to avoid animal hides. Breakout Labs funded it early, and Breakout Ventures remained involved as it evolved. The startup took almost a decade to refine its science and pivoted to collagen-based textile coatings.

In 2021 it closed a $130M Series C and brought in a new CEO, suggesting commercial scaling is in sight. Modern Meadow's journey shows the long timelines for deep tech to mature – a challenge for venture horizons. Breakout's willingness to stick with it (the Medium update touted this funding round) implies they provided patient capital.

Checkerspot (Performance Materials) – Small win potential Checkerspot engineers microalgae to produce novel oils for high-performance polyurethanes and materials. Breakout invested early. The company has launched consumer products (skis, outdoor gear) using its materials and raised follow-on rounds. While not a unicorn, Checkerspot could provide a moderate exit (perhaps via acquisition by a specialty chemicals or consumer products firm). Such mid-level successes (say a 3–5× return) are important to bolster the fund's overall return in case the moonshots take longer or fail.

Cautionary Tales

Cortexyme (Alzheimer's) – High-profile failure As noted, Cortexyme was funded under Breakout Labs (pre-fund) and targeted Alzheimer's disease via a novel pathogen hypothesis. It IPO'd in 2019, giving early backers a chance at liquidity, but its trial failure in 2021 caused the stock to crash ~80%. This serves as a cautionary tale: even a paper profit can vanish if the science doesn't pan out. It underscores clinical risk in the biotech part of Breakout's portfolio. Red-team analysts would point to Cortexyme as evidence that Breakout's bets can be as volatile as any biotech VC's, and that deep science ventures carry a high failure rate.

Across the portfolio, the success rate so far appears encouraging: Most Breakout companies have secured next-stage financing (a proxy for progress), and none (publicly known) have gone bankrupt. A few have had down-rounds or pivots (e.g. Cortexyme's pivot, Modern Meadow's strategy change), but this is expected given the technical complexity.

Crucially, Breakout's ability to attract follow-on capital (over $1B in aggregate) indicates that independent investors see value in these startups. That validation is a strong positive indicator for ultimate outcomes, even though the exits may not come until 5–10+ years post initial investment.

Comparative Analysis: Breakout vs. Peer Funds

How does Breakout Ventures stack up against other investment firms in the life sciences and deep-tech arena? Here we compare it on several dimensions to peer funds:

Table 5: Breakout Ventures vs. Selected Peers

| Metric/Fund | Breakout Ventures (SF) | The Engine (MIT, Boston) | DCVC (Data Collective, SF) |

|---|---|---|---|

| Founded | 2016 (spun out of Breakout Labs) | 2016–17 (MIT initiative) | 2012 (deep-tech focused VC) |

| AUM (approx.) | ~$170M (Fund I ~$60M, II $112M) | ~$1B (Fund I $150M, II $230M, III $398M) | >$2B (multiple funds; latest ~$350M) |

| Focus Sectors | Early-stage bioscience (health, biotech, sustainability) | "Tough Tech" – broad (biotech, energy, materials, robotics, etc.) | Broad deep tech (IT, AI, biology, aerospace, climate) |

| Portfolio Size (co's) | ~24 active (Funds I–II) | 56 (across Fund I–III) | 100+ (across ~8 funds, incl. seed) |

| Notable Investments | Twelve (carbon tech), Cytovale (diagnostics), Ecovative (mycelium), Immusoft (gene therapy) | Commonwealth Fusion (fusion energy), Form Energy (grid storage), E25Bio (rapid tests) | Zymergen (biofacturing), Planet Labs (satellites), Pivot Bio (agriculture) |

| Exits to Date | Cortexyme IPO (2019; post-IPO collapse); others pending | None major yet (as of 2025) | ~6 IPOs (e.g. Recursion, AbCellera); several M&As (e.g. Zymergen → Ginkgo) |

| Team & Edge | Small team (2 GPs, PhD investors) with science network from Breakout Labs; very hands-on | Affiliated with MIT, access to labs/researchers; has its own incubator space in Cambridge | Larger team; deep domain experts and broad reach; known for data-driven approach and early bets |

Key Comparisons

1. Fund Size & Stage Breakout's ~$170M across two funds is relatively small. For context, The Engine (MIT's tough-tech fund launched 2017) raised $150M Fund I, $230M Fund II (2020), and $398M Fund III (2022) – now over $1B AUM to deploy into similar hard-science startups. Data Collective (DCVC), a Silicon Valley deep-tech VC co-founded by Breakout LPs Zack Bogue and Matt Ocko, manages multiple funds (their 2018 fund was ~$300M; a 2021 "DCVC IV" raised $350M) and even a dedicated DCVC Bio fund.

Flagship Pioneering, a Boston firm that incubates biotech companies (e.g. Moderna), operates with billions in AUM. Compared to these, Breakout is a boutique – which can be a double-edged sword.

2. Focus and Deal Flow Unlike generalist VCs, Breakout sticks to deep science. Peers in this space include SOSV's IndieBio accelerator (which seeds biotech startups in batches), Arch Venture Partners (life sciences VC known for early-stage biotech), Lux Capital (deep-tech VC, though more broad including space, AI, etc.), and university-linked funds like The Engine.

Breakout's differentiator is its origin and network from Breakout Labs – a decade of relationships with research institutions, scientists, and even government programs. This likely gives Breakout a proprietary pipeline of "first look" at certain wild ideas.

3. Performance to Date Most peer funds of similar vintage are also in early stages of returns, but we can glean some comparisons. The Engine's portfolio (56 companies) has had no major exits yet but many companies progressing (fusion energy startup Commonwealth Fusion, etc.) – Engine's IRR is unclear but likely still mostly unrealized. DCVC, having started earlier, had some wins and some losses: for example, DCVC backed Zymergen, a synbio company that IPO'd in 2021 at ~$3B but then flamed out and was acquired for just $300M in 2022.

That echoes the volatility seen in Breakout's Cortexyme case. On the other hand, DCVC also invested in Recursion Pharma and AbCellera, both of which went public successfully. For a sense of scale, DCVC's sixth portfolio company IPO'ed by 2021 – Breakout Ventures, by virtue of starting later and with fewer companies, hasn't seen an IPO yet (Cortexyme aside).

4. Risk Profile Breakout's portfolio skews a bit more toward health/biotech than some peer "tough tech" funds that invest in, say, aerospace or quantum computing. This means Breakout faces biotechnology-specific risks: clinical trial failures, regulatory hurdles, and dependence on big pharma exits. The downturn of 2022–2023 saw a historic slump in biotech IPOs – in fact, only 9 biotech companies went public in the first half of 2023, the slowest pace in 6+ years.

This affects all life science VCs: they must either hold companies longer or accept smaller M&A exits. Breakout's timing was such that Fund I companies hoping to IPO around 2022 hit a near-closed IPO window. This pushes liquidity out. A positive sign is that by late 2023 and 2024, biotech markets showed some recovery and M&A picked up.

Red Team vs. Blue Team: Risks and Opportunities

Finally, we synthesize a risk/reward assessment of Breakout Ventures, weighing the red-team (critical) perspective against the blue-team (supportive) perspective on key aspects:

Investment Thesis Validity

Red Team Perspective: Breakout's focus on unproven science bets is inherently risky. Many projects (e.g. novel therapeutics, synthetic biology platforms) may fail to ever reach market, leading to a high loss ratio. The firm is effectively trying to pick needles in a haystack of lab experiments. If the scientific paradigm shifts (e.g. a promising approach like gene therapy hits setbacks), an entire swath of their portfolio could devalue.

The long gestation of deep-tech means some investments might require 10+ years to exit – testing LP patience and IRR, especially if the IPO market stays weak. Additionally, competition from well-capitalized funds could squeeze Breakout: hot science startups might bypass a $100M fund for a bigger lead investor who can fund them through IPO.

Blue Team Perspective: Breakout's focus is also its strength – the firm has developed specialized expertise in creative bioscience that generalist investors lack. By getting in early, Breakout has valuation arbitrage on its side; even one or two hits can return the fund many times over.

The deep relationships with the scientific community create a proprietary deal flow of breakthroughs that peers might miss. Moreover, Breakout's success stories (raising $1B+ follow-on capital for portfolio companies) show its thesis was ahead of the curve. Now that "investors are embracing deep tech at all stages", Breakout is sitting on a trove of equity in companies that could become the next generation of biotech disruptors, acquired or IPO'ed for large sums.

Fund Economics & Structure

Red Team Perspective: A small fund size can limit the ability to support companies through later stages – Breakout could be diluted in later rounds or even washed out if unable to follow on. The firm may also face key-person risk: as a boutique operation heavily identified with Lindy Fishburne and Julia Moore, any change in their availability or health could impact performance.

Another concern is that having a diverse LP base (some potentially with their own agendas, e.g. family offices wanting co-investment) could create alignment issues or pressure to deviate from strategy. Also, Breakout's management fee on $112M is only ~$2M/year – covering a small team – thus they must rely on generating carry (profits) for meaningful compensation, which they only earn if returns exceed hurdles. This can be motivation but also stress, potentially pushing risk-taking.

Blue Team Perspective: Breakout's lean structure means low overhead and agility. They aren't burdened by managing billion-dollar funds, so they can give very personalized attention to each portfolio company.

This aligns with successful early-stage investing, where mentorship and network are as valuable as money. The GPs have "skin in the game" and are clearly focused on performance (with target IRRs ~20%+). The LP roster's composition – tech founders, families, foundations – likely represents patient capital that understands the long timelines and won't force short-term moves. Having mission-driven LPs (e.g. Thiel Foundation, Dolby family) also means they share Breakout's vision of fostering breakthrough innovations, not just chasing quick flips.

This philosophical alignment can be a stabilizer during tough cycles. The GP team has expanded thoughtfully (adding a CFO, GC, etc. as needed), showing prudent management of growth. Importantly, Breakout's ability to attract new institutional LPs in Fund II (including a "leading bank" and endowments) suggests confidence in their model from sophisticated investors.

Portfolio Quality and Support

Red Team Perspective: The true quality of Breakout's portfolio will only be known at exit – it's easy for companies to raise follow-on funding in boom times (2020–21 saw abundant capital), but harder to create real value. Some Breakout companies might be over-valued after hype rounds and could face down-rounds (reducing fund TVPI).

There's also cluster risk: many portfolio companies are in the biotech/health sector, so common headwinds (e.g. FDA regulatory crackdowns, biotech bear markets) could negatively impact many investments simultaneously. Breakout may also spread itself thin if multiple startups encounter challenges at once, given the small team – they can't be everywhere.

Blue Team Perspective: By most measures, Breakout's portfolio is performing well: nearly all companies have advanced technically and secured top-tier co-investors. For example, in Breakout's Fund II: Appia Bio raised a Series A with 8VC and Northrup Grumman, Parallel Bio is backed by ARCH, etc. This syndication with reputable firms serves as external validation of quality. Breakout also adds value beyond money: their founders often credit the firm for pivotal help.

The Cytovale CEO's quote about Breakout helping the company succeed exemplifies this hands-on support. Breakout fosters a community among portfolio founders, hosting retreats and knowledge-sharing (the website emphasizes gathering "brilliant humans together" to collaborate). This can accelerate learning and prevent common pitfalls, effectively de-risking execution.

The fact that Breakout Labs companies cumulatively raised over $1B and counting shows that once these startups meet technical milestones, the market recognizes their value – implying Breakout is selecting companies with real merit, not just sci-fi dreams.

External Environment

Red Team Perspective: Macroeconomic and industry conditions pose risks. High interest rates and recession fears in 2022–2023 led to a VC funding pullback, especially in speculative sectors like biotech. As noted, the biotech index dropped ~60% from its peak, and IPO windows shut – a scenario where venture valuations were marked down and fundraising for funds got tougher.

If such conditions persist or recur, Breakout's portfolio could stagnate (no exits, tougher to raise Series C/D rounds) and Breakout might struggle to raise a Fund III. Also, deep-tech is now a crowded buzzword – there is greater competition for LP dollars from new climate-tech funds, university funds, etc. Breakout will need to demonstrate results to secure its next fund in such an environment.

Blue Team Perspective: Conversely, global trends favor Breakout's domains: Pandemic and climate concerns have heightened interest in biotech and sustainability tech. Governments and corporates are pouring money into bio-manufacturing, vaccines, renewable materials – exactly the areas Breakout invests in. This tailwind increases the chances of non-dilutive funding (grants, ARPA-E awards like ZymoChem's $4.2M grant) supplementing their startups, extending runways. Big Pharma's need for innovation can lead to lucrative M&A exits (as seen by rising biotech acquisitions in 2023–25).

Also, the venture market's pullback has a silver lining: less frothy valuations mean Breakout can invest in 2023–24 at reasonable entry prices, boosting potential returns. Breakout's focus on real science (as opposed to fad apps) could also yield more resilient value. Even during the downturn, many Breakout companies kept advancing – e.g. some pivoted to contribute in COVID (LogicInk working on CRISPR diagnostics, Inhalon Bio developing inhaled antibodies). This adaptability and relevance to critical problems indicate long-term value that can outlast market cycles.

Member discussion