Geography of the Deal: How Territory Shapes Pharmaceutical Royalty Financing

This analysis catalogues more than 50 major royalty financing transactions from 2019 through early 2026, organising them not by buyer or deal type but by the geography they cover. The goal is to trace how territorial structures have evolved, what SEC filings reveal about actual revenue splits, and what the data tells us about where the market is heading.

The market in numbers

The pharmaceutical royalty financing market reached a record $10 billion in 2025, capping a period of extraordinary growth. Total royalty financings from 2020 through 2024 reached $29.4 billion, more than doubling the $15–19 billion raised during 2015–2019. Royalty Pharma alone deployed $4.7 billion in 2025 — roughly 40% of the total market — while HealthCare Royalty Partners, DRI Healthcare, Blackstone Life Sciences, OMERS, Blue Owl Capital, and OrbiMed collectively accounted for the remainder.

A separate analysis by Gibson Dunn pegged aggregate royalty finance transaction value at approximately $6.5 billion in 2025, up from approximately $5.7 billion in 2024 — growth that underscores the transition from niche alternative to mainstream corporate finance tool. As recently as the early 2000s, annual aggregate royalty finance transaction value was estimated at less than $200 million per year.

The institutional architecture of the market itself shifted in 2025. KKR acquired a majority stake in HealthCare Royalty Partners in July 2025, adding approximately $3 billion in AUM and over 55 products to KKR's healthcare franchise. Royalty Pharma completed the internalization of its external manager in January 2025, generating projected cash savings of over $100 million in 2026 and cumulative savings exceeding $1.6 billion over ten years. DRI Healthcare similarly internalized its manager in mid-2025. And XOMA Royalty pursued an aggressive strategy of acquiring distressed biotechs — including HilleVax, LAVA Therapeutics, Mural Oncology, and Generation Bio — to harvest their royalty and milestone economics from existing licensing partnerships. These institutional shifts reflect a market that is not merely growing but professionalising, with buyers consolidating platforms and lowering cost of capital to compete more effectively for deals.

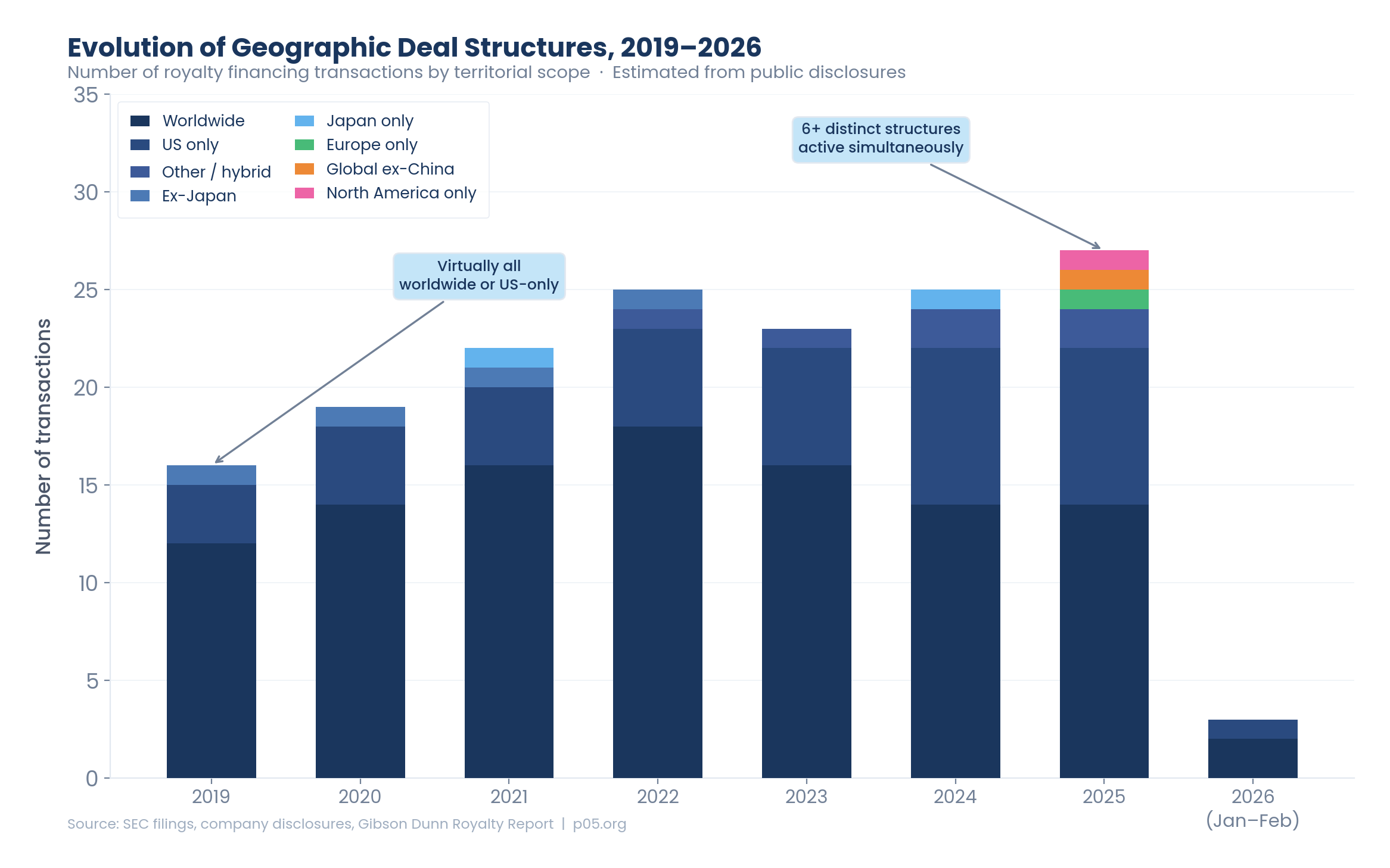

But the more revealing statistic is the geographic one. Through 2022, an estimated 80%+ of deals by value covered worldwide rights. By 2025, that figure had dropped to approximately 48% of deals by count, with US-only structures, Europe-specific transactions, global-ex-China carve-outs, and single-country deals collectively accounting for the other half. The number of distinct geographic structures in active transactions rose from two (worldwide and US-only) in 2019 to six or more in 2025.

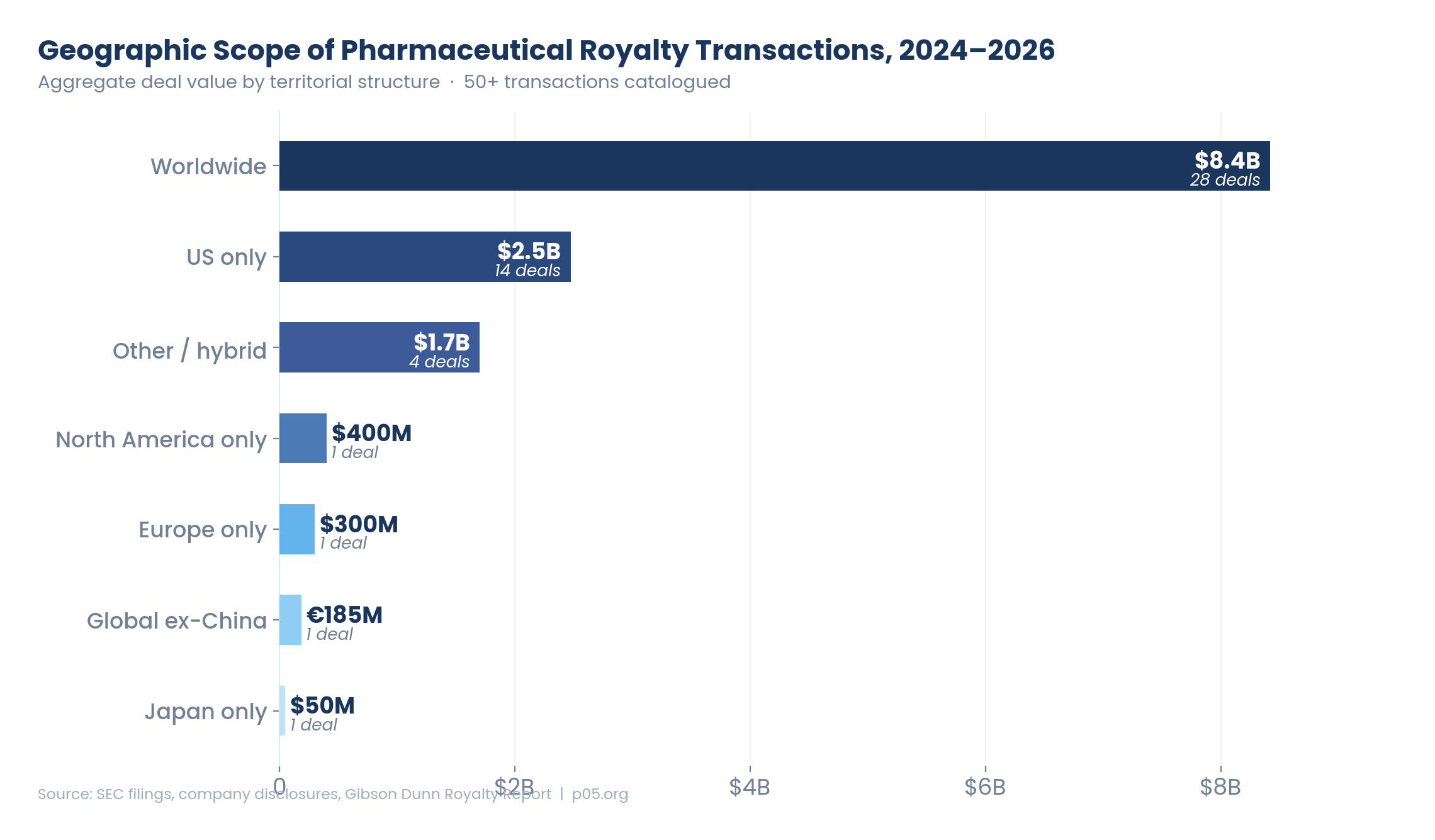

The chart above tells the story in dollar terms: worldwide deals still dominate by aggregate value (~$8.4 billion across roughly 28 transactions in the 2024–2026 period), but US-only deals have emerged as a substantial and fast-growing category (~$2.5 billion across 14 deals). And for the first time, Europe-only, global-ex-China, North America–only, and Japan-only structures each appeared as distinct categories — collectively small by value but significant by precedent.

Part I: The United States — still the centre of gravity

The United States remains the single most important geography in pharmaceutical royalty financing. Higher drug prices, faster regulatory approval, larger insured populations, and the sheer scale of the commercial infrastructure mean that US revenue typically accounts for 50–70% of a drug's global sales in its first years on the market. For royalty buyers, this concentration creates both opportunity and risk.

US-only deals: the commercial-stage sweet spot

The most striking geographic trend of 2024–2025 is the proliferation of US-only royalty transactions. These are not new — synthetic royalties on US net sales have existed for years — but their frequency, scale, and structural sophistication have accelerated markedly. In the 2024–2026 period, at least 14 transactions were explicitly structured around US-only revenue streams, totalling approximately $2.5 billion in committed capital.

| Date | Product | Indication | Buyer | Value | Royalty rate | Structure |

|---|---|---|---|---|---|---|

| Nov 2024 | Niktimvo (axatilimab) | Chronic GVHD | Royalty Pharma | $350M | 13.8% on US net sales | Synthetic; 2.35× cap |

| Nov 2024 | RYTELO (imetelstat) | MDS | Royalty Pharma | $125M | Tiered 7.75%–1% on US net sales | Synthetic |

| Sep 2024 | Yorvipath (palopegteriparatide) | Hypoparathyroidism | Royalty Pharma | $150M | 3% on US net sales | Synthetic |

| Aug 2024 | Voranigo (vorasidenib) | IDH-mutant glioma | Royalty Pharma | $905M | 15%/12% tiered on US net sales | Traditional (Agios) |

| 2024 | OMIDRIA (phenylephrine/ketorolac) | Ophthalmic surgery | DRI Healthcare | $170M | Royalty on US sales through 2031 | Traditional (Omeros) |

| Oct 2025 | Veligrotug/VRDN-003 | Thyroid eye disease | DRI Healthcare | Up to $300M | Tiered on US net sales | Synthetic; milestone-gated |

| 2025 | Ohtuvayre (ensifentrine) | COPD | OMERS/Oaktree | $650M | Revenue interest on US revenue | Revenue interest |

The Niktimvo deal illustrates the logic of US-only structures. Syndax Pharmaceuticals will co-commercialise Niktimvo in the US with Incyte, but Incyte holds exclusive commercialisation rights outside the US. Royalty Pharma's 13.8% royalty applies only to US net sales because that is the revenue stream Syndax controls. The ex-US economics belong to Incyte — a geographic split embedded in the underlying license agreement that determines what the royalty buyer can access.

The Voranigo deal is the largest US-only royalty of the 2024–2025 vintage at $905 million. Agios Pharmaceuticals sold Royalty Pharma a 15% royalty (stepping down to 12% above certain thresholds) on US net sales of vorasidenib, a first-in-class brain cancer therapy acquired by Servier. Servier holds global commercialisation rights, but the royalty — which Agios retained from its 2023 oncology asset sale — applies specifically to US revenue.

DRI Healthcare's Viridian transaction (up to $300 million for veligrotug and VRDN-003) is structured explicitly on US net sales for an ophthalmic biologic targeting thyroid eye disease. The deal includes aggressive declining tiers that reflect buyer caution about long-term US pricing exposure — a structural innovation increasingly common in US-only deals. Notably, this was DRI's third synthetic royalty transaction and second pre-approval deal, marking the company's increasing comfort with US-only pre-commercial risk. With veligrotug's BLA submission expected in early 2026 and VRDN-003 Phase 3 topline data from the REVEAL-1 and REVEAL-2 trials expected in the first half of 2026, the deal exemplifies how US-only structures can be used to fund commercial launch activities while keeping ex-US optionality intact.

The Ohtuvayre deal — $650 million from OMERS Life Sciences and Oaktree Capital — deserves particular attention. Structured as a revenue interest on US ensifentrine-related revenue rather than a traditional percentage royalty on net sales, the transaction gives the buyers exposure to Verona Pharma's entire US product economics, not just net sales after deductions. Ensifentrine, a first-in-class PDE3/PDE4 dual inhibitor for COPD, launched in the US in mid-2025. Verona self-commercialises in the US but has not yet partnered the product outside the US — meaning the US-only scope reflects both the current commercial reality and a deliberate decision to preserve ex-US optionality for future monetisation or partnership.

Why US-only? Licence structures and pricing clarity

The prevalence of US-only deals reflects a structural reality rather than a geographic preference. In many cases, the selling biotech simply does not own the ex-US commercial rights. Syndax licensed Incyte for ex-US Niktimvo. Agios sold its entire oncology portfolio to Servier but retained a US-linked royalty. Omeros retained its own ex-US royalties on OMIDRIA while monetising the US stream through DRI. The geographic scope of the royalty follows the contours of the underlying licence.

But there is a second, more strategic factor at play. US-only deals offer buyers two advantages: pricing transparency (US net price is typically higher and more predictable than ex-US) and regulatory clarity (a single FDA approval versus the multi-agency complexity of worldwide rights). For sellers, US-only monetisation preserves optionality — the company retains the ability to monetise ex-US rights separately, or to benefit from the often slower but eventually substantial ramp-up of European and Asian sales.

SEC filings reveal the US revenue concentration

Royalty Pharma's 2024 10-K and underlying marketer filings provide the most granular view of actual regional revenue splits across royalty-bearing products:

| Product | 2024 global revenue | US share | Ex-US share | Royalty geographic scope |

|---|---|---|---|---|

| Trikafta/Kaftrio (Vertex) | $11.02B | 61% ($6.68B) | 39% ($4.34B) | Worldwide |

| Imbruvica (AbbVie/J&J) | ~$3.6B annualised | 73% | 27% | Worldwide profit share |

| ELEVIDYS (Sarepta) | $1.79B | ~95% (US direct) | ~5% (Roche ex-US) | US + ex-US royalty |

| Evrysdi (Roche) | CHF 1.6B (~$1.9B) | ~45% | ~55% | Worldwide |

| Spinraza (Biogen) | ~$1.0B | ~40% | ~60% | Worldwide |

Two patterns stand out. First, the US share varies dramatically by product — from 95% for ELEVIDYS (a gene therapy with limited ex-US rollout) to just 40% for Spinraza (a mature product with broad global reimbursement). Second, the ex-US share tends to grow over time as products launch in additional markets. Evrysdi's ex-US share has risen from roughly 20% at its 2020 US launch to approximately 55% by 2024, driven by Roche's rollout across Japan, Europe, and emerging markets. Spinraza followed a similar trajectory — its ex-US sales actually exceeded US sales by 2022.

This time-dependent geographic shift is critical for royalty valuation. A US-only royalty captures the high-priced early cash flows but misses the long tail of ex-US revenue growth. A worldwide royalty starts with a lower effective yield (diluted by territories still in the pre-launch phase) but benefits from a compounding geographic expansion.

Part II: Worldwide — the default structure and its evolution

Worldwide royalties remain the most common structure by both count and value, accounting for approximately 28 deals and $8.4 billion in the 2024–2026 period. The logic is straightforward: a royalty covering 100% of global sales captures the full commercial potential of the underlying product, eliminates geographic concentration risk, and simplifies administration.

The 2025 mega-deals: all worldwide

The three largest royalty transactions of 2025 were all structured on worldwide net sales:

Revolution Medicines / daraxonrasib — $2 billion (June 2025). Royalty Pharma's largest-ever synthetic royalty comprises a $1.25 billion synthetic royalty plus a $750 million senior secured loan, all tied to global sales of daraxonrasib, a first-in-class RAS(ON) inhibitor for KRAS G12D–mutated cancers. Revolution Medicines will self-commercialise globally. The worldwide structure reflects the fact that Revolution owns 100% of commercial rights everywhere — no geographic carve-out is possible because no licensing partner exists.

Imdelltra / BeOne Medicines — up to $950 million (August 2025). Royalty Pharma acquired an approximately 7% royalty on worldwide sales of Amgen's Imdelltra (tarlatamab), a DLL3-targeting BiTE for small cell lung cancer, from BeOne Medicines for $885 million upfront. Amgen commercialises Imdelltra globally, and the royalty covers all territories without exception.

Aficamten / Cytokinetics — up to $575 million (May 2024, expanded). Royalty Pharma's tiered royalty (4.5% stepping to 1% above thresholds) on the hypertrophic cardiomyopathy therapy covers worldwide net sales. The worldwide scope is essential here because aficamten's peak sales potential — estimated at $3–5 billion by sell-side analysts — depends critically on both US and EU/Japan launches.

Worldwide deals: the full catalogue, 2024–2026

| Date | Product | Buyer | Value | Royalty rate | Notes |

|---|---|---|---|---|---|

| Jun 2025 | Daraxonrasib (Revolution) | Royalty Pharma | Up to $2B | Synthetic + loan | Largest synthetic royalty ever |

| Aug 2025 | Imdelltra/tarlatamab (Amgen) | Royalty Pharma | $885M+ | ~7% | From BeOne Medicines |

| Dec 2025 | Neladalkib/zidesamtinib (Nuvalent) | Royalty Pharma | Up to $315M | Pre-existing royalty | ALK/ROS1 oncology |

| Dec 2025 | Tividenofusp alfa (Denali) | Royalty Pharma | $275M | 9.25% | Hunter syndrome enzyme replacement |

| Dec 2025 | Evrysdi final tranche (PTC) | Royalty Pharma | $240M + milestones | Tiered 7.2%–14.5% | Consolidation of worldwide royalty |

| Nov 2025 | AMVUTTRA (Alnylam via Blackstone) | Royalty Pharma | $310M | 1% through 2035 | ATTR amyloidosis siRNA |

| Sep 2025 | Obexelimab (Zenas BioPharma) | Royalty Pharma | Up to $300M | 5.5% | IgG4-RD and lupus; global biotech |

| Feb 2025 | Litifilimab (Biogen) | Royalty Pharma | Up to $250M | TBD | Lupus; Biogen retains worldwide rights |

| Jan 2026 | TEV-'408 (Teva) | Royalty Pharma | Up to $500M | TBD | Autoimmune; vitiligo |

| May 2024 | Aficamten (Cytokinetics) | Royalty Pharma | Up to $575M | 4.5%/1% tiered | HCM |

| May 2024 | Frexalimab (ImmuNext/Sanofi) | Royalty Pharma | ~$525M | TBD | Multiple sclerosis |

| Nov 2024 | Ekterly/sebetralstat (KalVista) | DRI Healthcare | Up to $184M | 5–6% / 1.1% / 0.25% tiered | HAE; worldwide net sales |

| 2024 | CASGEVY (Editas via CRISPR/Vertex) | DRI Healthcare | $57M | Payment rights | Gene editing; worldwide |

| 2024 | Xenpozyme (Sanofi/HLS) | DRI Healthcare | $45.75M | ~1% capped | Lysosomal storage; worldwide |

| 2025 | NGENLA (OPKO/Pfizer) | HCRx | $250M | Profit share | Growth hormone; worldwide |

| 2025 | NEXLETOL/NEXLIZET (Esperion) | HCRx | $150M | Via Daiichi Sankyo licence | Cholesterol; global |

| 2025 | ZOLGENSMA + pipeline (REGENXBIO) | HCRx | $250M | Gene therapy royalty portfolio | Worldwide AAV vector royalties |

| 2025 | Moderna influenza vaccine | Blackstone | $750M | Development funding | Global mRNA vaccine platform |

| 2025 | Sacituzumab tirumotecan (Merck) | Blackstone | $700M | Development funding | Global ADC programme |

Several of these transactions merit closer examination for what they reveal about how worldwide structures are evolving.

The REGENXBIO/HCRx deal (May 2025) introduced a novel royalty bond structure to the market. Rather than purchasing a percentage royalty on a single product, HCRx provided a $250 million bond (principal amount) in exchange for rights to anticipated royalty payments from ZOLGENSMA sales for SMA, milestone payments from REGENXBIO's partnerships with Nippon Shinyaku (RGX-121 for Hunter syndrome and RGX-111 for Hurler syndrome), and licensing fees from NAV Technology Platform licensees Rocket Pharmaceuticals and Ultragenyx. The worldwide scope is inherent in the underlying technology platform — REGENXBIO's AAV vectors are used by licensees commercialising globally — but the bond structure means HCRx receives quarterly interest payments derived from a portfolio of worldwide royalty streams rather than a single product's sales. This represents a structural innovation: the buyer is financing a technology platform's global royalty economics, not a single drug.

The Blackstone/Merck sacituzumab tirumotecan transaction (November 2025) illustrates how worldwide development funding deals intersect with geographic licensing structures. Blackstone paid Merck $700 million to fund a portion of sac-TMT's development costs through 2026 — the ADC is in 15 global Phase 3 trials across six tumour types. In return, Blackstone is eligible to receive low- to mid-single-digit royalties on net sales of sac-TMT across all approved indications in Merck's marketing territories. Critically, Merck holds only ex-China rights to sac-TMT, having in-licensed it from Sichuan Kelun-Biotech in 2022 for $47 million upfront and up to $1.4 billion in milestones. Blackstone's "worldwide" royalty thus covers Merck's marketing territories — effectively global-ex-China — because that is the commercial geography Merck controls. The deal demonstrates how China out-licensing structures create new geographic boundaries even within ostensibly global transactions.

On the same day, Blackstone sold its 1% royalty interest in Alnylam's AMVUTTRA to Royalty Pharma for $310 million — a secondary transaction that illustrates the increasing liquidity of worldwide royalty positions. Blackstone had originally acquired the AMVUTTRA royalty through a 2020 $2 billion collaboration with Alnylam. The sale to Royalty Pharma represents a clean exit for Blackstone at an attractive multiple, while Royalty Pharma adds another worldwide commercial-stage royalty to its portfolio.

The worldwide structure works best when a single company controls global commercialisation (Revolution Medicines, Zenas BioPharma), when the royalty derives from an academic or upstream licence (REGENXBIO's AAV technology platform covers all downstream products globally), or when the product is mature enough that revenues are already flowing from multiple territories (Evrysdi, AMVUTTRA).

The tiered worldwide royalty: pricing geography implicitly

Even within worldwide deals, geographic considerations are embedded in the economics. Royalty Pharma's tiered structure on Evrysdi illustrates the point: the royalty rate escalates from 7.2% on the first $500 million of annual global sales to 14.5% above $2 billion. Since Evrysdi's US sales alone are approaching $900 million, the tier breakpoints effectively give the buyer a lower rate on the first tranche (which is predominantly US revenue) and a higher rate on the upper tiers (which increasingly reflect ex-US growth). The geography is not carved out, but it is priced into the tier structure.

Similarly, DRI Healthcare's Ekterly (sebetralstat) deal features extreme tier compression: 5–6% on the first $500 million, dropping to just 1.1% on sales between $500–750 million and 0.25% above $750 million. Since the first $500 million will be almost entirely US-driven (Ekterly launched in the US in July 2025; EU and Japan approvals are pending), the buyer is effectively paying a meaningful royalty on US cash flows and a nominal rate on the eventual ex-US expansion. The worldwide structure provides upside optionality without concentrating risk on uncertain international launches.

Part III: Europe steps into the spotlight

For decades, Europe was the silent partner in pharmaceutical royalty financing — always included in worldwide deals, occasionally referenced in ex-US structures, but never the explicit subject of a standalone transaction. That changed in June 2025.

BridgeBio/BEYONTTRA: the first major Europe-only royalty

BridgeBio's sale of European acoramidis royalties to HealthCare Royalty and Blue Owl Capital for $300 million represents a genuine structural innovation. The transaction monetises 60% of BridgeBio's royalties on the first $500 million of annual BEYONTTRA net sales in Europe only, with total payments capped at 1.45× the purchase price.

The deal exists because of a specific licensing structure. In March 2024, BridgeBio entered into an exclusive licensing agreement with Bayer Consumer Care AG to commercialise acoramidis in Europe under the BEYONTTRA brand. Under that licence, BridgeBio receives tiered royalties starting in the low-30% range on European net sales. The US product (marketed as Attruby) is commercialised directly by BridgeBio with no licensing partner and no royalty obligation.

By monetising the European royalty stream separately, BridgeBio achieved several things simultaneously: it raised $300 million in non-dilutive capital to fund the US Attruby launch; it preserved 100% of US economics; and it retained 40% of European royalties above the $500 million threshold plus the uncapped upside above $500 million in annual European sales. For HCRx and Blue Owl, the transaction offers exposure to a blockbuster cardiovascular franchise (ATTR-CM is projected to be a multi-billion-dollar global market) through a well-defined, geographically ring-fenced cash flow backed by a large pharma marketer (Bayer).

The BEYONTTRA deal's significance extends beyond its $300 million size. It demonstrates that European pharmaceutical revenue — historically viewed as supplementary to US sales — can serve as standalone collateral for institutional-scale royalty financing. If Bayer achieves even modest penetration of the European ATTR-CM market, the royalty stream could be substantial: with tiered royalties starting in the low-30% range on European net sales projected to reach $1 billion+ at peak, HCRx and Blue Owl's 60% share of royalties on the first $500 million alone represents a highly attractive cash flow.

Europe in worldwide deals: the growing secondary market

Outside of the landmark BEYONTTRA transaction, Europe features prominently as a revenue contributor across virtually all worldwide royalty structures. In mature products, European sales often approach or exceed US levels:

The Vertex cystic fibrosis franchise (Trikafta/Kaftrio) generated $4.34 billion in ex-US revenue in 2024 — 39% of the $11.02 billion total — with Europe as the dominant ex-US market. Importantly, ex-US revenue grew faster than US revenue (13% vs 11%), reflecting ongoing country-by-country reimbursement expansions. Royalty Pharma's 86.5% ownership of a blended ~9% royalty on these worldwide sales means European revenue is already contributing approximately $340 million annually to Royalty Pharma's top line through this single asset.

Spinraza (nusinersen) provides the most dramatic example of European revenue growth in a royalty context. At launch, Spinraza was overwhelmingly a US product. By 2022, ex-US sales (primarily Europe) had overtaken US sales, with the split roughly 40% US / 60% rest-of-world. Royalty Pharma's worldwide royalty on Spinraza thus shifted from a US-dominated cash flow to one where European and other international markets generate the majority of revenue — a transformation that played out over approximately five years.

Esperion: the quiet European royalty

A less publicised but structurally important European royalty exists within the Esperion/NEXLETOL franchise. Esperion receives royalties from Daiichi Sankyo on European sales of bempedoic acid (marketed as NILEMDO and NUSTENDI in Europe), while retaining direct US commercialisation. HealthCare Royalty's $150 million investment (January 2025, structured as senior debt) effectively captures this European royalty stream — a structure that separates the geographies even within a globally-available product. The Esperion deal is notable because it demonstrates that European pharmaceutical royalties can underpin institutional financing even when the marketer is a Japanese pharmaceutical company (Daiichi Sankyo) and the originator is a US biotech — a three-way geographic complexity that the royalty structure simplifies into a single, well-defined cash flow.

The pipeline of potential Europe-only deals

The BEYONTTRA precedent opens a door that several other products could walk through. Any product with a European licensing partner and tiered royalties payable to the originator is a candidate for a similar monetisation. Candidates visible in the current market include products where a US biotech has licensed European rights to Bayer, Roche, Novartis, Sanofi, or Ipsen — creating exactly the kind of geographically ring-fenced royalty stream that HCRx and Blue Owl purchased from BridgeBio. The HCRx/BRIUMVI transaction (December 2024, $250 million in debt financing for TG Therapeutics' multiple sclerosis therapy commercialised in Europe by Sandoz) represents another variation on the theme — while structured as debt rather than a royalty purchase, it is economically backed by European sales of a product with a separate US commercial strategy.

The growing precedent set for European standalone financing also reflects a maturing European pricing and reimbursement environment. While European drug prices remain lower than US prices, they are increasingly predictable — and predictability is what royalty buyers value most. The European Medicines Agency's centralised procedure, combined with relatively transparent national reimbursement negotiations in Germany (AMNOG), France (CEPS), and the UK (NICE), creates a pricing trajectory that can be modelled with reasonable confidence. For a royalty buyer constructing a discounted cash flow, a European revenue stream with a 35% probability-weighted lower price but 50% lower pricing variance may be as attractive as a US-only stream on a risk-adjusted basis.

Part IV: Asia — from afterthought to deal-shaping force

Asia's role in pharmaceutical royalty financing has historically been marginal. Japan and China together account for roughly 15–20% of global pharmaceutical sales, but their contribution to royalty-eligible revenue has been constrained by complex regulatory pathways, government pricing pressure, and the prevalence of territory-specific licensing that fragments ownership.

That picture is changing rapidly — but not in a uniform direction.

Japan: the shrinking but still relevant market

Japan's share of the global pharmaceutical market has collapsed from over 25% in the early 1980s to just 4.4% in 2023, now comparable to Germany. Annual government pricing revisions (implemented since FY2021), the "drug loss–drug lag" phenomenon — 49% of US-approved drugs from 2014–2022 were never approved in Japan — and yen depreciation have all eroded Japan's attractiveness as a royalty revenue source.

Yet Japan continues to appear in royalty transactions in two distinct ways:

Japan-only deals. OrbiMed's September 2024 acquisition of $50 million in Poxel's TWYMEEG (imeglimin) royalties represents one of the rare pure Japan-only royalty transactions in recent years. TWYMEEG is approved exclusively in Japan (where it was the first new diabetes mechanism in over 20 years) and is commercialised by Sumitomo Pharma under a licence that generates 8–18% tiered royalties for Poxel. The deal is structurally analogous to the Akebia/Vafseo transaction from 2021, where HealthCare Royalty purchased royalties on a product (vadadustat) approved only in Japan. Both transactions treat a single country's revenue as a standalone asset — viable when the local market is sufficiently large and the approval is in hand.

Ex-Japan carve-outs. The opposite structure — monetising global rights excluding Japan — has been a feature of the market since 2019. Royalty Pharma's $330 million acquisition of Eisai's tazemetostat royalty explicitly covered global ex-Japan rights, because Eisai retained Japanese commercialisation. The ex-Japan scope reflected both the licence structure and a valuation reality: the ex-Japan portion was estimated to represent 85–90% of tazemetostat's global value, given Japan's relatively small oncology market share for that indication.

Japan is increasingly included in worldwide deals (Evrysdi's worldwide royalty captures Japanese sales, which launched in 2021 via Roche), but it rarely drives deal economics. The Japanese contribution to a worldwide royalty is typically 5–10% of total revenue, meaningful but not determinative.

China: the licensing explosion reshapes deal geography

China's impact on royalty deal geography is less about China as a revenue source and more about China as a source of innovation that creates new geographic structures.

In 2025, Chinese biotechs signed 157 out-licensing deals worth $135.7 billion — a staggering increase from 94 deals/$51.9 billion in 2024. China-originated assets now comprise 28–31% of global pharmaceutical pipelines, up from just 3% in 2013. By October 2024, China biotech licence-out upfront payments (~$3.1 billion) exceeded primary market financing (~$2.71 billion) for the first time, signalling a structural shift in how Chinese innovation reaches capital markets.

The standard China out-licensing structure works as follows: a Chinese biotech grants global or ex-Greater China rights (typically defined as China, Hong Kong, Taiwan, and Macau) to a Western pharmaceutical company, retaining Greater China commercialisation. The Western partner pays upfronts, milestones, and royalties on ex-China sales; the Chinese biotech commercialises domestically.

This structure creates a new class of royalty-eligible assets: global-ex-China royalty streams. When a Western pharma in-licenses a China-originated molecule and eventually commercialises it in the US, Europe, and Japan, the resulting royalty obligation can be monetised — but it covers global-ex-China sales only. The Chinese biotech's domestic revenue is excluded.

GENFIT/IQIRVO: the first explicit global-ex-China royalty deal

The clearest example of this emerging structure is GENFIT's January 2025 royalty financing for IQIRVO (elafibranor), a treatment for primary biliary cholangitis. The €185 million deal with Pharmakon Advisors/NovaQuest Capital Management is structured on worldwide sales excluding Greater China. GENFIT licensed Greater China rights to Terns Pharmaceuticals separately; Ipsen holds worldwide commercialisation rights for all other territories.

The deal includes specific caps: royalties on net sales up to €600 million annually, with a cumulative cap at 155% of the subscription price (~€277.5 million maximum return to investors). The Greater China exclusion reduces both the revenue base and the regulatory complexity — Terns' Chinese development pathway is independent of Ipsen's global programme, and Chinese pricing is notoriously unpredictable.

Notable China mega-deals creating future royalty assets

The wave of China out-licensing in 2024–2025 has created dozens of new assets that will eventually become candidates for royalty financing:

| Date | Licensor (China) | Licensee (West) | Total deal value | Structure |

|---|---|---|---|---|

| Jul 2025 | Hengrui Medicine | GSK | ~$12B | ~12 oncology programmes; ex-China |

| Jun 2025 | CSPC Pharma | AstraZeneca | $5B+ | AI drug discovery platform; ex-China |

| 2025 | 3SBio | Pfizer | Up to $6B | Oncology programmes; ex-China |

| Jan 2024 | Shanghai Argo | Novartis | $4.35B | Cardiovascular siRNA; ex-China |

Each of these deals generates royalty obligations that flow from the Western licensee to the Chinese licensor on ex-China sales. If any of these programmes reach commercialisation and the Chinese biotech chooses to monetise its royalty stream, the resulting transaction will be inherently global-ex-China in scope. This is not a hypothetical scenario — it is the inevitable downstream consequence of the licensing structures already in place.

The first concrete proof of this thesis arrived in November 2025, when Blackstone's $700 million development funding deal with Merck for sacituzumab tirumotecan created a royalty on a China-originated asset's ex-China sales. Merck had in-licensed sac-TMT from Sichuan Kelun-Biotech in 2022, retaining commercialisation rights only outside Greater China. Blackstone's royalty therefore applies to Merck's marketing territories — an implicit global-ex-China structure arising directly from the underlying China out-licensing deal. While the Blackstone transaction was structured as development funding rather than a traditional royalty acquisition, it demonstrates the mechanism by which China out-licensing deals are already generating investable ex-China royalty assets, years before the underlying products reach peak commercial sales.

The velocity of new China out-licensing deals in 2025 also raises questions about royalty rate stacking. When a Chinese biotech out-licenses to a Western pharma, the royalty typically ranges from high-single-digit to low-double-digit percentages of ex-China net sales. If the Western pharma subsequently monetises part of its own economics through a synthetic royalty (as Blackstone did with Merck), the total royalty burden on the product increases. At some point, the cumulative royalties — original licensor royalty plus synthetic royalty plus any upstream technology platform royalties — may compress margins sufficiently to affect launch decisions, particularly in lower-priced European markets. This geographic tension between royalty stacking and market-specific pricing will become a defining issue as China-originated assets reach commercial maturity in 2027–2030.

Part V: Territorial carve-outs and hybrid structures

Beyond the major geographic categories, a growing number of transactions employ bespoke territorial structures that reflect the specific commercial realities of the underlying products.

North America only

OMERS Life Sciences' November 2025 acquisition of 25% of Ultragenyx's Crysvita (burosumab) royalty for $400 million is structured as North America only, with royalty payments beginning January 2028 and capped at 1.55× the purchase price. Crysvita, a treatment for X-linked hypophosphatemia, generates substantial sales globally (Kyowa Kirin commercialises in Japan and other territories), but the OMERS transaction specifically covers the North American royalty that Ultragenyx receives from Kyowa Kirin's US and Canadian commercialisation efforts.

The North America–only structure is relatively unusual but reflects the specific licence geography: Kyowa Kirin pays Ultragenyx royalties on North American sales under a territory-specific agreement. The deal effectively isolates the highest-revenue, most price-stable portion of the global Crysvita franchise.

Global ex-Japan: the traditional carve-out

The ex-Japan structure has been a fixture of pharmaceutical royalty financing since well before the period covered in this analysis. Japan's pharmaceutical industry has historically retained domestic rights to compounds developed by Japanese companies, creating a natural boundary that royalty buyers must navigate.

Royalty Pharma's 2019 acquisition of Eisai's tazemetostat royalty ($330 million) covered global ex-Japan rights — Eisai retained Japanese commercialisation while selling the royalty on US, European, and rest-of-world sales. The ex-Japan portion was valued at approximately 85–90% of global tazemetostat value, reflecting Japan's relatively small share of global oncology revenue for that specific indication.

Similarly, Blackstone Life Sciences' 2020 investment in Reata Pharmaceuticals' bardoxolone ($350 million) was structured as global ex-Asia, excluding Kyowa Kirin's Japanese/Asian territory. The monetised stream covered US, European, and rest-of-world sales only — a structure dictated by Reata's pre-existing licensing agreement with Kyowa Kirin.

Revenue interest structures

Not all geographic carve-outs are royalties. OMERS Life Sciences and Oaktree's $650 million financing for Verona Pharma's Ohtuvayre (ensifentrine) is structured as a revenue interest on US ensifentrine-related revenue — a broader claim than a percentage royalty on net sales, but still geographically limited to the United States. Revenue interest structures give the buyer exposure to total product economics (not just net sales after deductions) but are inherently more sensitive to US-specific commercial risks.

Part VI: The IRA effect — geography as hedge

The Inflation Reduction Act's Drug Price Negotiation Programme (DPNP) is reshaping the geographic calculus of royalty financing in ways that are no longer theoretical. On January 1, 2026, the first negotiated prices for ten Medicare Part D drugs took effect — the first time the US federal government has actively set drug prices by negotiating directly with manufacturers. The discounts ranged from 38% (Imbruvica) to 79% (Januvia) off 2023 list prices, representing an estimated $6 billion in annual savings for the Medicare programme and $1.5 billion in out-of-pocket cost reductions for beneficiaries.

For the royalty market, the most consequential of the first ten negotiated drugs is Imbruvica (ibrutinib), on which Royalty Pharma holds a worldwide profit share royalty. Imbruvica's negotiated price represents a 38% discount to its 2023 list price — the smallest discount among the ten drugs, but still a material reduction in the revenue base from which Royalty Pharma's payments are calculated. Importantly, this price reduction applies only to US Medicare Part D sales. Imbruvica's ex-US revenue — approximately 27% of global sales — is entirely unaffected by the DPNP, creating exactly the kind of geographic divergence that this analysis has tracked.

CMS will select 15 additional drugs for negotiation in 2026 (prices effective 2028), including both Part D and Part B drugs for the first time. The estimated impact — 5–6% of lifetime revenue for the average small molecule, with NPV impact potentially twice that given later-stage timing — applies only to US Medicare pricing. Ex-US revenue is unaffected.

The policy environment surrounding the DPNP is itself evolving in ways that affect geographic calculations. In April 2025, President Trump issued Executive Order 14273, directing HHS to propose revised guidance for the DPNP and to work with Congress to equalise the treatment of small molecule drugs and biologics — addressing the so-called "pill penalty" under which small molecules are eligible for DPNP selection after just 9 years versus 13 years for biologics. This asymmetry has significant geographic implications: small molecules tend to have broader global distribution earlier (faster ex-US launches), while biologics tend to be more US-concentrated in their early years. Equalising the timelines would reduce the pressure on small molecule royalties and potentially make US-only small molecule royalties more attractive to buyers who currently face earlier DPNP exposure.

Separately, in December 2025, President Trump announced that 14 of the 17 largest pharmaceutical companies had signed voluntary "most favoured nation" (MFN) pricing agreements committing to offer pricing matching the lowest prices they charge in other developed countries for Medicaid and cash-paying customers. Unlike the IRA's statutory price negotiations, these MFN deals are voluntary and their enforcement mechanisms remain unclear — within days of signing, manufacturers announced price increases on over 350 branded medications. For royalty structuring, the MFN agreements introduce a new layer of uncertainty: if enforced, they would compress US prices toward European levels, reducing the premium that makes US-only royalties attractive. If not enforced, they represent noise rather than signal. Either way, the directional trend — downward pressure on US pricing from multiple policy vectors — reinforces the geographic diversification thesis.

The Trump administration's One Big Beautiful Bill Act (signed July 2025) also carved out an important exemption: drugs treating only orphan conditions are now completely exempt from Medicare price negotiations. This has material geographic implications for the royalty market, since many rare disease drugs — including several in the Royalty Pharma and HCRx portfolios — are disproportionately US-concentrated. The orphan exemption effectively de-risks US-only royalties on rare disease products, making this specific combination of geography and therapeutic area more attractive to buyers. Analysis by West Health and Verdant Research suggests the exemption could delay DPNP negotiation for blockbuster drugs like Keytruda and Opdivo by up to 10 years, given their orphan indication approvals.

This creates a structural incentive to diversify geographic exposure in royalty portfolios. 87% of surveyed institutional investors reported that the IRA has influenced their small molecule investing decisions, and 77% of pharmaceutical executives have already altered launch plans for specific therapeutic areas in response.

IRA-specific deal provisions now standard

The most immediate geographic impact of the IRA is the standardisation of adjustment clauses in royalty agreements:

Economic adjustment clauses. Many recent royalty agreements include provisions that reduce the royalty rate if the underlying product is selected for DPNP. The logic is straightforward: if US net revenue falls due to government price negotiation, the seller's royalty obligation should adjust proportionally. These clauses effectively build US pricing risk into the deal structure.

Royalty floors with IRA exemptions. Some transactions specify minimum royalty payments but exempt IRA-related revenue declines from triggering floor violations. This protects the buyer's downside while acknowledging that DPNP selection is an exogenous risk neither party can control.

Milestone acceleration. Deals are increasingly structured to front-load value capture before potential DPNP selection. The 9-year small molecule window and 13-year biologic window create predictable timelines that royalty structurers can work around — ensuring that the bulk of the return is earned before the government price reduction takes effect.

The geographic hedge thesis

The longer-term IRA impact on geography is more subtle. If US net prices decline for products selected for DPNP, the relative contribution of ex-US revenue to total royalty cash flows will increase mechanically. A product generating 60% of revenue from the US and 40% from ex-US markets might shift to 55%/45% after DPNP price reductions — making the ex-US portion more valuable on a relative basis.

This dynamic may partly explain the emergence of Europe-only deals like BEYONTTRA and the increasing willingness of buyers to accept global-ex-China structures. If US revenue carries DPNP optionality risk, European revenue — subject to its own pricing pressures but immune to DPNP — becomes a more attractive standalone asset.

The BridgeBio/BEYONTTRA transaction can be read through this lens. HCRx and Blue Owl are acquiring a European royalty stream on a cardiovascular blockbuster that will never be subject to IRA price negotiation. BridgeBio retains 100% of US Attruby economics, which carry both the upside of higher US pricing and the downside of eventual DPNP exposure. The geographic separation creates a natural hedge for both parties.

Part VII: What the data shows — 2024–2026 patterns

The chart above illustrates the proliferation of geographic structures over time. In 2019, virtually all deals fell into two categories: worldwide or US-only, with occasional ex-Japan or Japan-only outliers. By 2025, the market had fragmented into six or more distinct structures operating simultaneously.

Summary statistics

| Geographic structure | Deal count (2024–26) | Total value | Average deal size | Key examples |

|---|---|---|---|---|

| Worldwide | ~30 | ~$9,500M | ~$317M | Revolution Medicines, Imdelltra, TEV-'408, Denali, Evrysdi, Ekterly, REGENXBIO |

| US only | ~15 | ~$2,775M | ~$185M | Niktimvo, Voranigo, RYTELO, Yorvipath, Viridian, OMIDRIA, Ohtuvayre |

| Europe only | 1 | $300M | $300M | BridgeBio/BEYONTTRA |

| Global ex-China | 1+ | €185M+ | €185M+ | GENFIT/IQIRVO; Blackstone/Merck sac-TMT (implicit) |

| North America only | 1 | $400M | $400M | OMERS/Crysvita |

| Japan only | 1 | $50M | $50M | OrbiMed/TWYMEEG |

| Other/hybrid | ~5 | ~$2,100M | ~$420M | Blackstone development funding, revenue interests, royalty bonds |

Note: Counts updated through January 2026; "Global ex-China" includes the Blackstone/Merck sac-TMT transaction, which is structured as development funding with royalties on Merck's marketing territories (ex-China). The TEV-'408 transaction (January 2026) is included in the worldwide count as the first major deal of 2026.

Key observations

Worldwide deals still dominate by value but are losing share by count. Worldwide structures account for approximately 70% of deal value but only about 55% of deal count. The gap reflects the fact that the largest deals (Revolution Medicines at $2 billion, Imdelltra at $950 million) are invariably worldwide, while the proliferating US-only and regional deals tend to be smaller. The January 2026 Teva/Royalty Pharma TEV-'408 deal — up to $500 million for a worldwide royalty on an early-stage autoimmune asset — confirms that worldwide remains the default for development-stage funding, where the ultimate commercial geography is uncertain and the buyer wants maximum optionality.

US-only is the fastest-growing category. US-only deals represented approximately 18% of transactions by count in 2019–2022 but rose to approximately 31% in 2024–2026. The growth reflects both structural factors (more companies splitting US and ex-US rights through licensing) and strategic factors (buyers seeking commercial-stage clarity over global development-stage uncertainty). Critically, the US-only category is also diversifying beyond traditional royalties: the Ohtuvayre revenue interest, the Viridian pre-approval synthetic royalty, and the OMIDRIA time-limited royalty represent three distinct structural approaches to US-only monetisation, each calibrated to different risk profiles and cash flow characteristics.

Regional deals are no longer anomalies. The emergence of Europe-only, North America–only, and Japan-only transactions as distinct categories — even if each currently contains only one or two deals — represents a structural shift. These transactions demonstrate that specific territories can support institutional-scale financing on a standalone basis. Moreover, the implied global-ex-China scope in the Blackstone/Merck sac-TMT deal suggests that this geographic structure will become increasingly common as China-originated assets advance through Western clinical development.

Structural innovation is accelerating across all geographies. The 2024–2026 vintage introduced several structural firsts: the royalty bond (REGENXBIO/HCRx), the Europe-only capped royalty (BridgeBio/BEYONTTRA), the pre-approval US-only synthetic royalty with milestone gating (DRI/Viridian), and the development funding agreement with implicit geographic boundaries (Blackstone/Merck). These innovations reflect a market where deal structurers are increasingly sophisticated about pricing geographic risk and where geography itself has become a design parameter rather than a given.

The average deal size varies dramatically by geography. North America–only and Europe-only deals are sized comparably to mid-range worldwide deals ($300–400 million), suggesting that buyers are willing to pay worldwide-comparable valuations for geographically concentrated but high-conviction cash flows. Japan-only deals remain small ($50 million), reflecting Japan's diminished market share.

The buyer landscape is broadening. The 2024–2026 period saw meaningful participation from buyers outside the traditional royalty buyer universe. OMERS Life Sciences (a Canadian pension fund), Oaktree Capital (a credit-focused alternative asset manager), Blue Owl Capital, Pharmakon Advisors/NovaQuest, and KKR (through its newly acquired HCRx platform) all completed significant transactions. This institutional broadening increases competitive pressure for deals and may push buyers toward geographic niches — European royalties, US-only pre-commercial structures, or global-ex-China assets — where specialised knowledge creates a sourcing or underwriting advantage.

Conclusion: the map as alpha

The 2019–2026 period has seen pharmaceutical royalty financing evolve from a geographically monolithic market to one where territorial thesis drives deal structuring, valuation, and risk allocation. The first weeks of 2026 have already demonstrated the durability of these trends: Royalty Pharma's up-to-$500 million TEV-'408 deal with Teva (worldwide, development-stage) and the implementation of the first DPNP negotiated prices (US-specific, affecting Imbruvica among the royalty-relevant products) are proceeding simultaneously — one deal expanding global scope, one policy compressing US economics.

Five developments will define the next phase:

The IRA's real-world impact will crystallise. With the first ten negotiated prices now in effect as of January 2026 and 15 additional drugs selected for 2027 pricing, the DPNP is no longer a theoretical risk — it is a quantifiable one. Royalty buyers can now observe the actual revenue impact of negotiated pricing on Imbruvica and calibrate their models accordingly. The key variable to watch is whether the orphan drug exemption from the One Big Beautiful Bill Act and the potential equalisation of small molecule/biologic timelines under Executive Order 14273 will materially alter which products are most exposed. For royalty structurers, the answer will determine whether US-only royalties need standard DPNP adjustment clauses or product-specific carve-outs.

The BridgeBio/BEYONTTRA precedent will be replicated. The $300 million Europe-only royalty opens the door to a new category of geographically ring-fenced transactions. If acoramidis achieves even a fraction of its projected European peak sales, the HCRx/Blue Owl transaction will validate European royalty streams as a distinct asset class. Other candidates are already visible: any product with a European licensing structure (Bayer, Roche, Novartis, Sanofi as marketers) and tiered royalties to the originator could support a similar monetisation. The maturing European pricing environment — more predictable, if lower, than the US — may make European royalties particularly attractive to institutional buyers seeking lower-volatility cash flows.

China's licensing explosion will reach the royalty market. The 157 out-licensing deals signed by Chinese biotechs in 2025 alone will generate dozens of Western-commercialised products with royalty obligations payable on ex-China sales. The Blackstone/Merck sac-TMT deal is the first concrete example of a China-originated asset generating its own royalty transaction — and it will not be the last. Royalty buyers who develop frameworks for valuing these geographically bifurcated assets will have a structural advantage. The key analytical challenge is modelling ex-China revenue trajectories for assets where the Chinese biotech retains domestic rights and may launch ahead of the Western partner, generating clinical and commercial data that affects global expectations.

The institutional landscape will consolidate around geographic specialisation. KKR's acquisition of HCRx, combined with Royalty Pharma's internalization and DRI's platform strengthening, suggests a market where scale matters — but where geographic expertise may matter more. Mid-market buyers may find the most attractive opportunities in the geographic niches that larger players overlook: European standalone royalties below $200 million, Japan-only positions on products with strong domestic reimbursement, or pre-commercial US-only structures on orphan drugs exempt from DPNP. XOMA Royalty's strategy of acquiring distressed biotechs to harvest their licensing economics represents yet another geographic angle — acquiring the worldwide royalty rights of companies that lack the resources to monetise them.

Hybrid structures will proliferate. The 2025 vintage introduced royalty bonds (REGENXBIO/HCRx), development funding with implicit geographic boundaries (Blackstone/Merck), revenue interests on US-only economics (OMERS/Ohtuvayre), and capped European-only royalties (BridgeBio/BEYONTTRA). These are not variations on a single theme — they are distinct financial instruments designed to price specific geographic risks. As the market matures, the number of possible geography-structure combinations will increase, creating a more complex but ultimately more efficient market for matching capital to pharmaceutical cash flows.

The common thread is that geography is no longer a footnote in pharmaceutical royalty financing. It is the framework within which risk is assessed, structures are designed, and returns are generated. The investors who map the territory most precisely will capture the most value.

Disclaimer: All information in this report was accurate as of the research date and is derived from publicly available sources including company press releases, SEC filings, regulatory announcements, and financial news reporting. Information may have changed since publication. This content is for informational purposes only and does not constitute investment, legal, or financial advice.

Member discussion