He Who Controls the Term Sheet Controls the Deal

Dear reader,

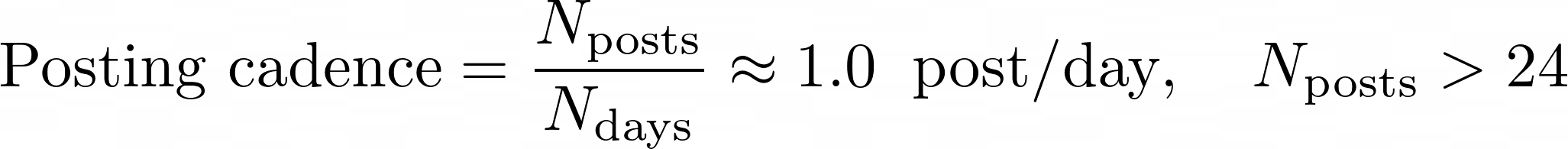

A brief desk note from your resident author Sebastian. The kettle is still on, the models still overfit, and—miracle of small compounding—the blog still ships daily.

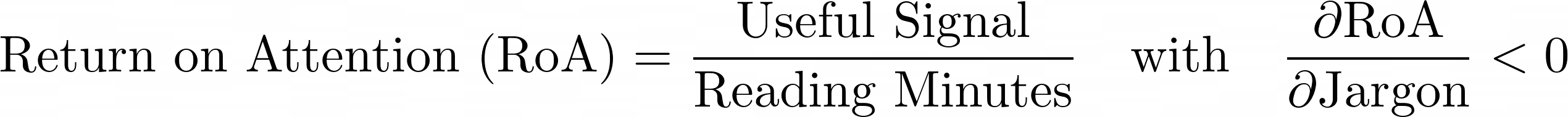

First, thank you. There are now comfortably 100+ of you reading the newsletter every day. You are the scarce resource in an economy of attention, and I’m grateful you spend some of it here. If you want more deep dives (or fewer), more charts (or fewer), do say—editorial policy is gloriously non‑binding.

Second, company & fund spotlights are now a recurring feature. If you want your fund or company dissected send a deck. I’ll bring the spreadsheet and an unreasonable number of footnotes.

Third, if you’d like to meet fellow readers, we have a WhatsApp lobby—civil, useful, lightly moderated:

Join us → https://chat.whatsapp.com/Jz2rS5OAvmB7BeLRvN8IML

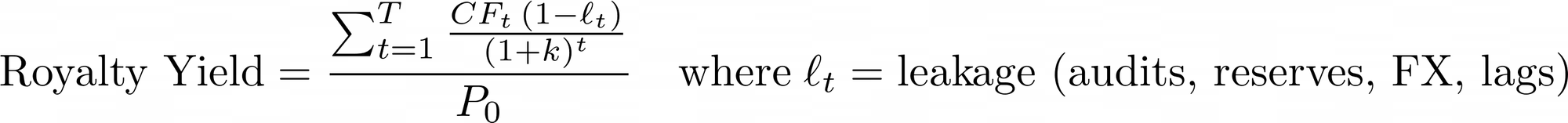

Fourth, a call for royalty specialists: if you have recent experience buying, selling, or managing royalties, I’d love to compare notes on diligence, audit traps, and tail‑risk hygiene.

What we’ve covered so far (a brisk recap)

House style: finance for builders—companies, funds, royalties, hardware for AI‑biotech—and the behavioural foibles that make spreadsheets cry.

1) Royalty finance & credit (reader favourites)

- Anatomy of Biopharma Royalty Deals; Royalty Financing Rescues Biopharma (176 uniques); Royalty Strategies in Biotech; Private equity moves deeper into biotech royalties (268 uniques); BioPharma Credit PLC; and scheduled: The biopharma royalty market crosses $14B in annual deal flow.

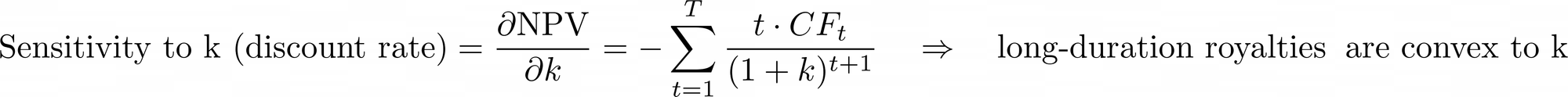

Through‑line: royalties as duration‑matched cashflows with governance hair.

2) AI, compute & the return of the mainframe

- Nvidia’s Expanding Footprint in Biotech; AMD’s Expanding Role; Intel’s Advances; AI in Pharma 2025; AI Models in Biotechnology: 2025 Market Analysis; Using Generative AI to Create Synthetic Data; The AI Infrastructure Shift and The silicon valley time machine.

Thesis: capex gravity is pulling serious workloads on‑prem, changing the P&L shape of modern biotechs.

3) Deals, structures & capital markets

- Breakout: Basics of Pharma Deal Structuring (a runaway hit at 719 uniques).

- Collateralized Fund Obligations: The $7T Question; Private equity biotech investment landscape in Q3 2025 (90 uniques); Bristol Myers Squibb’s $300M Autoimmune Spinout; Global M&A (Mar–Jun 2025).

Moral: structure eats valuation for breakfast.

4) Weekly series & recurring features

- The Weekly Term Sheet (#29→#36) keeps your Sunday honest.

- Company of the Week: OpenAI, Palantir, BridgeBio, Arrakis, Avalyn, Repare.

- Fund of the Week: RTW, ARCH, Concentra (143 uniques), LifeArc, DRI Healthcare, Clinique La Prairie Longevity Fund.

5) Policy, HTA & the economist’s toolbox (used responsibly)

- Europe’s grand HTA experiment; Comparative Regulatory Approaches to AI; Regulatory Sandboxes for AI; and a tour of metrics under cross‑examination: DCF, NPV, IRR, VaR, WACC, CAPM, POS/POPT/LOA/PTRS/PTRS and friends.

Position: finance in biopharma needs fat‑tailed thinking and humility about uncertainty.

6) Science, pipelines & clinical method

- Yamanaka factors; ADCs—Magic Bullets Reloaded; Longevity trials; Space: the final formulation frontier; Biosimilar patent cases; and scheduled: two radiopharma dispatches—Global Radiopharmaceutical Patent Wars and The Billion‑Dollar Gold Rush.

7) Culture, satire & the industrial theatre of progress

- The Definitive Guide to Biotech Conference Darwinism (85 uniques); THE PANEL DISCUSSION FROM HELL; The Biotech Deck Drinking Game; Middle‑aged, Male, and Mildly Annoyed….

Observation: networking is a contact sport, but elbows are optional.

By the numbers (select snapshots)

- Top 5 most‑read (by unique visitors):

- Basics of Pharma Deal Structuring — 719

- Private equity moves deeper into biotech royalties… — 268

- Royalty Financing Rescues Biopharma — 176

- Fund of the Week: Concentra — 143

- Private equity biotech investment landscape (Q3 2025) — 90

(Honourable mention: Conference Darwinism — 85.)

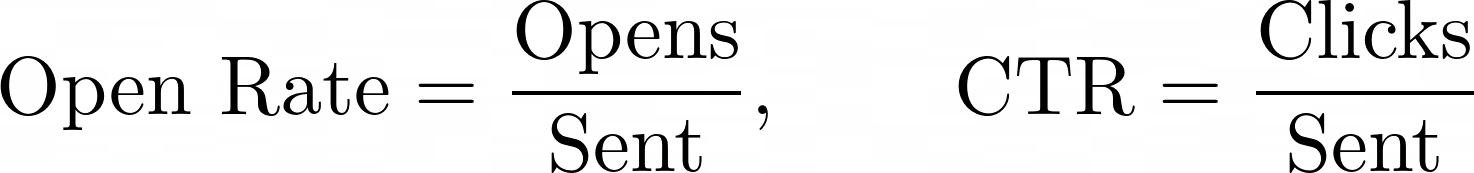

- Open‑rate band: most recent sends sit roughly ~55–70%. Harder content ≠ lower engagement; it just pressures me to cut adjectives.

What’s next (and how you can shape it)

- Reader requests: What would you like to see next—deep dives on radiopharma unit economics, a running leaderboard of royalty buyers, or a quarterly hardware buyer’s guide for AI‑biotech labs? Hit reply and be unshy.

- Feature your org: If your fund or company belongs in the spotlight, send materials (deck, model, latest MD&A). I’ll produce a balanced piece: clear assumptions, explicit sensitivities, and a short “bear case” paragraph you’ll secretly thank me for.

- Join the conversation: The WhatsApp group is where term sheets and job leads quietly circulate:

https://chat.whatsapp.com/Jz2rS5OAvmB7BeLRvN8IML - Royalty experts: If you’ve closed deals in the last 24 months, let’s talk about audit frequency, co‑sale clauses, step‑down schedules, and how to price the “grey goo” of measurement error.

In sum: this is a shop floor for practical finance—less theatre, more throughput. The brief remains simple: make capital a little smarter each day, one post at a time. You keep reading; I’ll keep doing the literary equivalent of cleaning the data room at 2 a.m.

Yours in accruals,

Sebastian

PS: If you’ve read this far, you’ve already outperformed the market.

Member discussion