Insuring Pharmaceutical Royalty Risks: Reinsurance and Case Studies

The pharmaceutical royalty market has grown at a 45% CAGR since 2018, reaching over $6 billion in annual transaction volume—yet sophisticated investors operate almost entirely without the insurance and reinsurance tools that other asset classes take for granted.

This gap creates both significant risk management challenges and potential opportunities for those who understand why traditional risk transfer mechanisms have failed to develop, what emerging products might change the landscape, and how insurance economics would reshape royalty investment returns if products eventually scale.

For royalty investors, understanding this market absence is not merely academic. The structural reasons why reinsurers avoid pharmaceutical pipeline risk illuminate fundamental characteristics of drug development economics. The emerging clinical trial failure insurance products—despite early operational challenges—signal potential market evolution. And the financial modeling of hypothetical insurance structures reveals when such products might make economic sense versus when portfolio diversification remains the superior risk management approach.

This analysis examines the full landscape: historical precedents from monoline-wrapped securitizations, the actuarial impossibility of insuring 80-95% failure rates, lessons from adjacent specialty insurance markets, and detailed financial modeling of how insurance costs would flow through fund economics to affect LP returns and GP carried interest.

The Strategic Case: Why Royalty Investors Should Care About Insurance Markets

The pharmaceutical royalty monetization market represents one of the most attractive alternative asset classes available to sophisticated investors. Deloitte's September 2025 report on the biopharma royalty market confirms sustained institutional interest, while Gibson Dunn's analysis of 2020-2024 transactions shows deal volume more than doubling compared to the prior five-year period. BioSpace reports that royalty financing has become a critical lifeline for biopharma companies navigating uncertain capital markets.

The asset class offers compelling structural advantages: uncorrelated returns (pharmaceutical approval outcomes show near-zero beta to market factors), contractual cash flows from approved products, and potential for mid-teens IRRs on deployed capital. Royalty Pharma, commanding approximately 60% market share, has demonstrated these returns can be achieved at scale through disciplined portfolio construction.

Yet unlike virtually every other asset class of comparable size—corporate credit, real estate, infrastructure, even catastrophe risk—pharmaceutical royalty investors cannot purchase insurance or access reinsurance markets to transfer downside exposure. This is not because no one has tried. The history of pharmaceutical royalty securitization includes notable attempts at credit enhancement, and 2024 saw the first dedicated clinical trial failure insurance product launch at Lloyd's. Understanding why these efforts have struggled reveals fundamental truths about pharmaceutical risk that every royalty investor should internalize.

The question is not whether pharmaceutical insurance "should" exist—economic theory suggests demand exists whenever risk-averse parties face volatile outcomes. The question is whether the structural characteristics of pharmaceutical development permit traditional insurance mathematics to function, and if not, what alternatives might eventually emerge.

Historical Precedents: When Monolines Backed Pharma Royalties

The foundational case studies for insured pharmaceutical royalty transactions date to the early 2000s, when monoline insurance companies provided credit enhancement for pioneering securitizations. These transactions demonstrated both the potential value of insurance wraps and the challenges that ultimately limited their expansion.

The Yale/Zerit Transaction (2000)

The BioPharma Royalty Trust transaction in 2000 represented the first significant pharmaceutical royalty securitization. Yale University, earning approximately $40 million annually in royalties from stavudine (Zerit)—an HIV/AIDS medication licensed to Bristol-Myers Squibb—sought to monetize this income stream while retaining partial economic interest.

The structure was innovative: Yale transferred its royalty interest to a bankruptcy-remote special purpose vehicle via true sale, which then issued $79 million in rated debt. The senior tranche of $57 million received an "A" rating from S&P, while the $22 million mezzanine tranche achieved "AA-" rating—notably higher than achievable without credit enhancement.

ZC Specialty Insurance Co. (a subsidiary of Centre Re, a major reinsurer) provided a financial guaranty on the mezzanine tranche. This insurance wrap enabled higher ratings and broader investor access. The transaction employed debt service coverage ratios of 1.6x for senior notes and 1.3x for mezzanine (the latter achievable only with the insurance wrap). Built-in cash trapping mechanisms activated if coverage ratios deteriorated.

However, the transaction ultimately entered early amortization when Bristol-Myers Squibb faced allegations of inventory manipulation, triggering credit rating downgrades. Zerit sales declined faster than projected as competition intensified. The lesson proved clear: single-asset concentration created vulnerability to both licensee credit events and underlying product performance that even insurance enhancement could not fully mitigate.

The Royalty Pharma/MBIA Transaction (2003)

Learning from the Zerit experience, Royalty Pharma launched a substantially larger and more sophisticated transaction three years later. The $225 million variable funding notes issuance featured royalties from 13 pharmaceutical patents—nine generating royalties at closing, four in late-stage FDA approval. The collateral portfolio represented approximately $4.4 billion in annual underlying drug sales and $49 million in annual royalty receipts.

MBIA, then the dominant monoline insurer, provided a guarantee that enabled AAA/Aaa ratings—the highest possible credit quality. This credit enhancement dramatically reduced funding costs and enabled access to investment-grade institutional investors who could not have purchased unenhanced pharmaceutical royalty exposure.

The structure introduced several innovations now standard in royalty financing: a revolving facility allowing new asset additions (subject to insurer and rating agency approval), executory contract analysis providing comfort that licensees would continue payments through bankruptcy under Section 365(n) of the Bankruptcy Code, and true portfolio diversification reducing single-product exposure.

Table 1: Historical Insured Pharmaceutical Royalty Transactions

| Transaction | Year | Size | Insurance Provider | Rating Achieved | Key Innovation | Outcome |

|---|---|---|---|---|---|---|

| BioPharma Royalty Trust (Yale/Zerit) | 2000 | $79M | ZC Specialty (Centre Re) | AA-/A | First pharma royalty ABS | Early amortization triggered |

| Royalty Pharma Multi-Asset | 2003 | $225M | MBIA | AAA/Aaa | 13-drug diversification | Successful execution |

| BMO Conduit Holdings | Pre-2010 | Undisclosed | MBIA/Ambac | Investment grade | Bank conduit structure | Matured per terms |

The 2008 financial crisis and subsequent collapse of monoline insurers eliminated this credit enhancement pathway. MBIA, Ambac, and other monolines had backed over $200 billion in emerging market and structured finance deals with remarkably low losses—just 7 basis points over 22 years according to industry data. Their withdrawal from exotic asset classes left a significant gap in intellectual property and infrastructure guarantee capacity that remains partially unfilled seventeen years later.

The Emergence of Clinical Trial Failure Insurance

The most significant development in pharmaceutical risk transfer during 2024 was Lloyd's of London's approval of MCI Syndicate 1966, designed specifically to provide clinical trial funding insurance—covering trial costs if a trial fails to meet its primary protocol endpoints. This represents a fundamentally different product than traditional clinical trials liability insurance (which covers participant injuries) and marks the first attempt to insure the binary risk of trial success or failure at meaningful scale.

Program Structure and Capacity

Asta, the Lloyd's managing agent, confirmed MCI received "permission to underwrite" in May 2024, initially forecasting £75 million ($94 million) in gross written premium for the year, later revised to £35 million as the program refined its underwriting criteria. The coverage targets Phase I and Phase II trials with budgets between $3 million and $20 million, lasting less than three years.

Eligible drug asset types include small molecules, monoclonal antibodies, and some biologics—but explicitly exclude gene therapies, which remain uninsurable under this framework given their novel risk profiles. Geographic coverage extends to companies domiciled in the USA, UK, and Canada.

The coverage reimburses CRO costs, protocol design fees, and hospital/medical practitioner expenses for design, implementation, monitoring, and review of failed trials. Critically, insurance acts as valid security for lenders, potentially enabling novel debt structures backed by insured development programs.

MCI estimates that 30-50% of risks considered receive terms—dramatically higher than the less than 10% success rate for typical venture capital funding of clinical programs. This selective underwriting is essential; by cherry-picking lower-risk programs, the syndicate attempts to achieve profitable loss ratios despite the high baseline failure rates in pharmaceutical development.

The GATC Health Underwriting Engine

The underwriting engine powering MCI's program comes from GATC Health Corp, whose Multiomics Advanced Technology (MAT) platform claims 87-91% accuracy in predicting clinical trial safety and efficacy outcomes—validated according to the company by University of California, Irvine. GATC describes its technology as a "FICO score for drug development," standardizing risk assessment across biotech assets.

This AI-driven approach represents the only plausible path to profitable underwriting in pharmaceutical development risk. Traditional actuarial methods require large homogeneous exposure pools with stable historical loss distributions—conditions pharmaceutical development does not satisfy. Machine learning approaches that analyze molecular structures, mechanism of action, biomarker profiles, and clinical design characteristics could theoretically identify the subset of trials with genuinely elevated success probabilities.

The challenge lies in validation. GATC has generated seven novel drug candidates in 22 months using the platform and raised $40 million since its 2020 founding, but the ultimate test—actual insurance loss experience over multi-year periods—cannot yet be assessed.

Early Operational Challenges

Signals of early challenges emerged by late 2024. According to industry reports, MCI is reportedly preparing to modify Syndicate 1966's operations, with some clinical trial funding coverage potentially migrating to Syndicate 1902 (MCI's existing Lloyd's syndicate focused on pharmaceutical trials liability). This development underscores the difficulty of pricing and underwriting novel risk categories with limited historical loss data.

Current market capacity reflects this nascent status. Willis Towers Watson's April 2025 assessment indicates maximum indemnity limits of approximately $25 million per trial, with anticipated expansion to $35-40 million. Aon's Clinical Trial Failure Solution offers comparable coverage for Phase I trials of $3-20 million and one-year duration, Phase II trials of $5-20 million and two-year duration, requiring CRO engagement and written clinical trial protocol as prerequisites.

Table 2: Current Clinical Trial Insurance Market Parameters

| Parameter | MCI/Lloyd's Syndicate 1966 | Aon Clinical Trial Failure | WTW Coverage |

|---|---|---|---|

| Maximum Limit per Trial | $25M (expanding to $35-40M) | $20M | $25M |

| Eligible Phases | Phase I, Phase II | Phase I, Phase II | Phase I, Phase II |

| Trial Duration Limit | <3 years | 1-2 years by phase | <48 months |

| Eligible Geographies | USA, UK, Canada | Global (varies) | Global (varies) |

| Excluded Categories | Gene therapy, opioids | High-risk modalities | Gene therapy |

| Acceptance Rate | 30-50% of submissions | Not disclosed | Selective |

| Premium Rates | Confidential | Confidential | Multi-factor pricing |

Why Reinsurers Universally Avoid Pharmaceutical Pipeline Risk

The global reinsurance market manages over $600 billion in annual premiums across mortality, property catastrophe, credit, and specialty lines—yet pharmaceutical development failure remains almost entirely uninsured. This absence is not accidental but reflects fundamental incompatibilities between drug development risk and traditional insurance mechanics. Understanding these barriers explains why the market gap persists and suggests what conditions would need to change for meaningful capacity to develop.

The Four Pillars of Insurability

Traditional insurable risks share four characteristics that enable actuarial pricing and profitable underwriting:

Large homogeneous exposure pools: Property insurers cover millions of similar homes; life insurers underwrite millions of mortality risks with stable statistical distributions. Pharmaceutical development features perhaps 10,000 active clinical programs globally, each with unique characteristics—insufficient scale for law-of-large-numbers diversification.

Independent loss events: Hurricane damage in Florida does not cause hurricane damage in Japan; individual mortality events are largely independent. Pharmaceutical development demonstrates significant correlation within therapeutic areas and mechanism classes. An immunotherapy pathway invalidation affects entire drug classes across multiple companies. Oncology drugs, comprising 33% of all clinical development programs, show particularly severe correlation.

Objective loss triggers: Property damage is photographically documented; death is certified by medical authorities; credit default has contractual definition. Clinical trial "failure" requires subjective interpretation of endpoints, statistical significance thresholds, and regulatory standards. Different observers can reach different conclusions about the same trial data.

Manageable information asymmetry: Insurers can inspect properties, require medical exams, and review credit histories. Pharmaceutical sponsors possess vastly more information about their programs than any external underwriter—interim results, manufacturing challenges, competitive intelligence, and strategic intentions all remain opaque.

Table 3: Insurability Criteria Assessment for Pharmaceutical Development Risk

| Criterion | Property Catastrophe | Life/Mortality | Credit Risk | Pharma R&D | Assessment |

|---|---|---|---|---|---|

| Historical loss data | 150+ years | 200+ years | 40+ years | Limited, highly variable | ❌ Fails |

| Exposure pool size | Millions of properties | Billions of lives | Millions of credits | ~10,000 active programs | ❌ Fails |

| Loss independence | Geographically diversifiable | Largely independent | Manageable correlation | Mechanism-correlated | ❌ Fails |

| Trigger objectivity | Parametric (wind speed, magnitude) | Death certificate | Default event definition | Subjective efficacy judgment | ❌ Fails |

| Information asymmetry | Property inspection | Medical underwriting | Credit bureau data | Severe, sponsor-controlled | ❌ Fails |

| Moral hazard | Cannot cause hurricane | Limited influence on mortality | Some control over default | Significant trial design control | ❌ Fails |

| Loss frequency | Rare tail events | Predictable population rates | Cyclical but manageable | Expected outcome (80-95%) | ❌ Fails |

The Moral Hazard Problem

Moral hazard permeates drug development because sponsors control virtually every aspect of trial execution. A company purchasing development failure insurance faces weakened incentives for rigorous execution—or worse, active incentives to structure trials for failure when insurance payouts exceed alternative value realizations.

Consider the decision tree facing a biotech sponsor with deteriorating interim data:

Without insurance, the sponsor faces maximum incentive to optimize trial design, patient selection, and execution to salvage the program. Failure means losing the entire investment with no recovery.

With failure insurance, the sponsor might rationally choose to let marginal programs fail rather than invest additional resources in rescue attempts. In extreme cases, sponsors could structure trials to fail while collecting insurance proceeds.

The MIT/University of Chicago FDA Hedges research project examined these dynamics and concluded that "adverse selection and moral hazard related to drug development outcomes may cause the market to break down." The paper proposed exchange-traded approval options as an alternative structure, but acknowledged implementation challenges remain unresolved.

Regulatory Capital Treatment

Solvency II capital requirements create additional barriers for European reinsurers. The framework requires Solvency Capital Requirement (SCR) calculations at 99.5% Value-at-Risk—essentially modeling once-in-200-year loss tolerance. Standard risk modules cover non-life underwriting, life, health, market, and counterparty default risks.

Pharmaceutical pipeline risk fits none of these categories, requiring costly internal model development and supervisory approval. Without standardized capital charges, insurers face regulatory uncertainty and potentially punitive capital requirements. Basel III/IV similarly lacks specific risk-weight categories for R&D investment risk.

For a reinsurer considering pharmaceutical development coverage, the capital allocation decision becomes circular: without historical loss data, they cannot model expected losses; without modeled losses, they cannot determine capital requirements; without capital requirements, they cannot price coverage; without priced coverage, they cannot accumulate loss data.

The Catastrophe Bond Comparison

FINRA notes that insurance-linked securities, particularly catastrophe bonds, have grown into a $100+ billion market by successfully transferring natural disaster risk to capital markets investors. These instruments work because of parametric triggers—payments activate based on objective measurements (earthquake magnitude, wind speed, rainfall totals) rather than subjective loss assessments.

Pharmaceutical development lacks equivalent parametric measures. FDA approval is binary but subjective in its determination; clinical trial success depends on statistical interpretations that can be contested; commercial performance varies continuously rather than triggering discrete events.

Research reveals no evidence of catastrophe bond-like structures for pharmaceutical pipeline risk, no dedicated insurance-linked securities for clinical trial failure, no sidecar arrangements specifically for clinical trial capacity, and no industry loss warranties for specialty pharma lines. This complete absence—despite theoretical demand from both sponsors seeking hedges and investors seeking uncorrelated returns—demonstrates the structural impossibility of traditional risk transfer mechanisms.

Clinical Trial Success Rates: The Actuarial Impossibility

Understanding why insurance markets cannot form requires examining the underlying loss distributions. Clinical trial success data from BIO/Informa covering 9,704 programs and 12,728 phase transitions demonstrates failure rates too high and variable for traditional actuarial modeling.

Phase Transition Probabilities

The comprehensive BIO study covering 2011-2020 reveals the fundamental challenge: pharmaceutical development failure is not a tail risk but an expected outcome.

Table 4: Clinical Trial Phase Transition Success Rates (2011-2020)

| Phase Transition | Success Rate | Failure Rate | Sample Size | Actuarial Implication |

|---|---|---|---|---|

| Phase I → Phase II | 52.0% | 48.0% | 4,414 | Near coin-flip odds |

| Phase II → Phase III | 28.9% | 71.1% | 4,933 | Expected failure |

| Phase III → NDA/BLA | 57.8% | 42.2% | 1,928 | Substantial risk persists |

| NDA/BLA → Approval | 90.6% | 9.4% | 1,453 | Only stage with high success |

| Overall LOA (Phase I → Approval) | 7.9% | 92.1% | 12,728 | Catastrophic baseline loss |

The Phase II bottleneck represents the critical pricing challenge for any hypothetical insurer. With only 28.9% of drugs advancing from Phase II to Phase III, this stage represents expected failure—the opposite of insurable tail risk. For context, the catastrophe bond market targets events with 1-2% annual probability; Phase II failure occurs 71% of the time.

Reinsurers price coverage assuming profitable average years with occasional catastrophic losses. In pharmaceutical development, the average outcome is catastrophic loss. A reinsurer expecting 70% of covered trials to fail cannot generate sustainable profits at any premium rate sponsors would accept.

Therapeutic Area Variation

Pharmaphorum analysis highlights that therapeutic area variation adds complexity insurers cannot easily model. The range of outcomes creates adverse selection opportunities: sponsors with hematology programs (23.9% LOA) would avoid insurance they could price themselves, while sponsors with cardiovascular programs (4.8% LOA) would disproportionately seek coverage.

Table 5: Success Rates and Implied Premium Rates by Therapeutic Area

| Therapeutic Area | LOA from Phase I | Phase II Success | Implied Fair Premium | With 50% Loading |

|---|---|---|---|---|

| Hematology | 23.9% | 48.1% | 76.1% | 114.2% |

| Infectious Disease | 13.2% | 38.4% | 86.8% | 130.2% |

| Rare Disease (non-oncology) | 17.0% | 44.6% | 83.0% | 124.5% |

| All Indications | 7.9% | 28.9% | 92.1% | 138.2% |

| Neurology | 5.9% | 26.8% | 94.1% | 141.2% |

| Oncology | 5.3% | 24.6% | 94.7% | 142.1% |

| Cardiovascular | 4.8% | 21.0% | 95.2% | 142.8% |

| Urology | 3.6% | 18.5% | 96.4% | 144.6% |

An insurer pricing "pharmaceutical development risk" as a uniform category would face immediate adverse selection. Sophisticated sponsors would bring their worst programs—those with below-average success expectations—to the insurance market while retaining their best programs uninsured. This adversely selected pool would experience even higher failure rates than the population average, generating losses that exceed premium income.

Deteriorating Historical Trends

Historical trends show worsening success rates, complicating any actuarial extrapolation based on past experience. Overall LOA declined from 10.4% (2003-2011) to 9.6% (2006-2015) to 7.9% (2011-2020) to approximately 6.7% in the most recent data (2014-2023). Phase I success rates collapsed from approximately 75% in 2006-2008 to below 40% by 2021-2023 according to Frontiers analysis.

Any insurer pricing based on historical data faces systematic underpricing risk as the underlying distribution continues to worsen. Unlike mortality tables that improve over time (people live longer, enabling lower life insurance premiums), pharmaceutical development success rates deteriorate as easier targets get addressed and remaining disease areas prove more challenging.

Biomarker Stratification

Biomarker-driven programs offer the brightest spot for potential insurability. Programs with biomarker selection achieve 15.9% LOA versus 7.6% without biomarkers—a 2.1x improvement. This suggests any future insurance market would likely focus on biomarker-selected programs with measurable intermediate endpoints.

However, this creates natural adverse selection: sponsors would bring their non-biomarker programs (with worse success expectations) to the insurance market while retaining biomarker-selected programs uninsured. The insured pool would systematically underperform the broader market, generating adverse loss experience.

Financial Impact Modeling: How Insurance Would Affect Returns

Even if pharmaceutical development insurance existed at scale, premium rates would likely render it economically irrational for most royalty investors. Modeling insurance costs through fund economics reveals the sensitivity of returns to premium drag and identifies the narrow conditions under which insurance might provide value.

The Fundamental IRR Relationship

For investment funds, recurring costs compound against returns over the holding period. The relationship between annual cost drag and IRR impact follows a roughly linear pattern for typical fund structures:

Each 1% of NAV in annual costs reduces 10-year IRR by approximately 80-100 basis points.

With typical royalty fund gross IRRs ranging from 12-18% according to industry benchmarks, insurance premiums consuming 5-25% of invested capital would substantially erode returns. The impact depends critically on premium payment timing—upfront payments create maximum IRR drag due to time-value effects.

Table 6: Insurance Premium Impact on 10-Year Fund IRR

| Scenario | Gross IRR | Premium (% of Investment) | Equivalent Annual Drag | Net IRR | IRR Points Lost | % of Gross Return Lost |

|---|---|---|---|---|---|---|

| Baseline (No Insurance) | 15.0% | 0% | 0.0% | 15.0% | — | — |

| Light Coverage | 15.0% | 5% | 0.5% | 14.5% | 50 bps | 3.3% |

| Moderate Coverage | 15.0% | 10% | 1.0% | 13.9% | 110 bps | 7.3% |

| Substantial Coverage | 15.0% | 15% | 1.5% | 13.3% | 170 bps | 11.3% |

| Heavy Coverage | 15.0% | 20% | 2.0% | 12.7% | 230 bps | 15.3% |

| Maximum Coverage | 15.0% | 25% | 2.5% | 12.1% | 290 bps | 19.3% |

| Actuarially Fair Phase III | 15.0% | 42% | 4.2% | 10.4% | 460 bps | 30.7% |

| Actuarially Fair All Phases | 15.0% | 92% | 9.2% | 4.8% | 1,020 bps | 68.0% |

The final two rows illustrate the impossibility of actuarially fair pricing. At 42% premium (reflecting Phase III failure rates) or 92% premium (reflecting overall development failure rates), insurance would consume the majority of potential returns—economically irrational for any profit-seeking investor.

Fund-Level Waterfall Analysis

For fund economics, insurance costs cascade through the distribution waterfall structure. Standard royalty fund terms include 1.5-2.0% management fees on committed capital during the investment period plus 20% carried interest above an 8% preferred return hurdle, as detailed by Carta and industry guides.

Insurance creates triple drag on fund performance:

- Premiums reduce invested capital available for returns

- Lower gross returns reduce carried interest potential for GPs

- Extended holding periods (if insurance enables riskier investments) increase cumulative management fee burden

Table 7: Fund-Level Economics Comparison (10-Year, $100M Fund)

| Component | Without Insurance | With 15% Premium | Difference |

|---|---|---|---|

| Committed Capital | $100M | $100M | — |

| Invested Capital (net of fees/expenses) | $90M | $90M | — |

| Insurance Premium Paid | $0 | $13.5M | ($13.5M) |

| Capital Deployed to Investments | $90M | $76.5M | ($13.5M) |

| Gross Investment Return (2.0x MOIC) | $180M | $153M | ($27M) |

| Total Management Fees (10yr @ 1.75%) | $17.5M | $17.5M | — |

| Available for Distribution | $162.5M | $135.5M | ($27M) |

| Preferred Return (8% hurdle on $100M) | $80M | $80M | — |

| Distributable Above Hurdle | $82.5M | $55.5M | ($27M) |

| GP Carried Interest (20% of above-hurdle) | $16.5M | $11.1M | ($5.4M) |

| LP Net Distributions | $146.0M | $124.4M | ($21.6M) |

| LP Net MOIC | 1.46x | 1.24x | (0.22x) |

| GP Carry as % of Invested | 18.3% | 14.5% | (3.8%) |

Limited partners absorb the majority of insurance costs through reduced distributions, while general partners face meaningfully lower carried interest pools. The 22 basis point MOIC reduction (1.46x to 1.24x) represents value destruction rather than risk transfer—the insurance premium exceeds the expected value of downside protection.

Break-Even Analysis Framework

The decision framework for insurance purchases compares expected loss mitigation to premium cost plus any risk aversion value:

Insurance Economic Value = (Probability × Avoided Loss) + (Risk Aversion Premium) − (Insurance Premium)

Decision Rule: Purchase insurance when Economic Value > 0

For development-stage programs with 92.1% failure probability, the calculation becomes:

Expected Loss Without Insurance: 92.1% × $10M investment = $9.21M expected loss

Actuarially Fair Premium: $9.21M (equals expected payout)

Loaded Premium (50% loading): $9.21M × 1.5 = $13.82M

Premium as % of Investment: 138.2%

No rational investor purchases insurance costing 138% of investment value. The premium exceeds the maximum possible loss, guaranteeing negative expected value from the insurance transaction regardless of outcome.

Even for later-stage programs with lower failure rates, the economics remain challenging:

Table 8: Break-Even Premium Analysis by Development Stage

| Stage | Failure Rate | Max Recoverable Loss | Fair Premium | 50% Loaded Premium | Break-Even Feasibility |

|---|---|---|---|---|---|

| Phase I | 48.0% | 100% of investment | 48.0% | 72.0% | Economically irrational |

| Phase II | 71.1% | 100% of investment | 71.1% | 106.7% | Exceeds investment value |

| Phase III | 42.2% | 100% of investment | 42.2% | 63.3% | Marginally possible for strategic use |

| NDA/BLA | 9.4% | 100% of investment | 9.4% | 14.1% | Potentially viable |

| Approved Products | ~5% (commercial risk) | Variable | ~5% | ~7.5% | Comparable to other specialty lines |

Only NDA/BLA-stage coverage and approved-product commercial risk insurance approach premium levels comparable to other specialty insurance markets. This explains why the emerging clinical trial insurance products focus on Phase I/II trials with modest budgets and strict selection criteria—they cannot profitably cover the full development spectrum at any price sponsors would accept.

Risk-Adjusted Return Considerations

Risk-adjusted return metrics reveal nuanced trade-offs that simple IRR comparisons miss. Insurance reduces return variance by eliminating tail losses, potentially improving Sharpe-equivalent ratios despite lower absolute returns.

However, pharmaceutical development risk demonstrates near-zero beta to market factors. The FDA Hedges research found "betas are insignificantly different from zero for CAPM and Fama-French factors." This idiosyncratic, uncorrelated risk is precisely what portfolio theory suggests investors should hold unhedged, capturing risk premium without systematic market exposure.

For institutional investors with diversified portfolios, pharmaceutical royalty risk provides diversification benefits that would be eliminated by insurance. Hedging away the idiosyncratic risk removes the very characteristic that makes the asset class attractive from a portfolio construction perspective.

Table 9: Risk-Adjusted Return Impact of Insurance

| Metric | Without Insurance | With 15% Insurance | Interpretation |

|---|---|---|---|

| Expected Return | 15.0% | 12.7% | Lower absolute performance |

| Return Volatility (σ) | 25.0% | 12.0% | Substantially reduced variance |

| Sharpe Ratio (rf=4%) | 0.44 | 0.73 | Improved risk-adjusted return |

| Maximum Drawdown | -100% (total loss) | -15% (premium only) | Dramatically reduced tail risk |

| Beta to S&P 500 | ~0.0 | ~0.0 | Unchanged non-correlation |

| Diversification Value | High | Eliminated | Loss of portfolio benefit |

The Sharpe ratio improvement is real but misleading. Institutional investors seeking uncorrelated returns specifically value pharmaceutical exposure for its zero-beta characteristics—eliminating the variance through insurance removes the diversification benefit while still consuming returns through premium costs.

Lessons from Adjacent Specialty Insurance Markets

Examining insurance markets that successfully developed for comparable risks illuminates potential pathways for pharmaceutical coverage evolution—and underscores fundamental differences that explain why pharma remains uninsured.

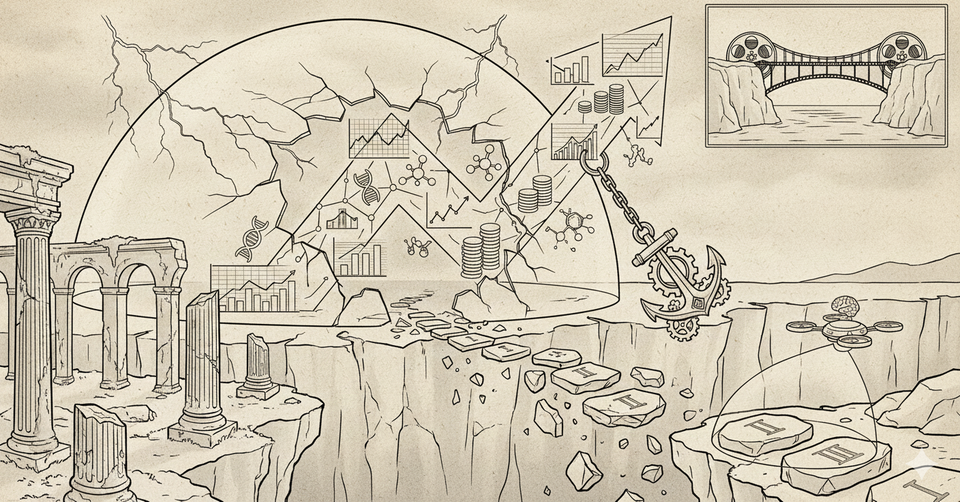

Film Completion Bonds: The Closest Analogue

Film completion bonds represent the closest operational analogue to hypothetical pharmaceutical development insurance: concentrated risk on complex creative projects with binary outcomes. The market emerged in the 1950s when Film Finances recognized that traditional insurance couldn't address production completion risk.

Today, completion bonds cost 2-6% of production budgets (higher-risk projects can reach 8%), with industry reports suggesting bonded productions achieve 98%+ completion rates versus roughly 85% for unbonded productions. The premium structure includes the bond fee itself plus a 7.5-10% contingency requirement that functions as a deductible.

Table 10: Film Completion Bond Structure

| Component | Typical Terms | Pharmaceutical Equivalent |

|---|---|---|

| Premium Rate | 2-6% of budget | Would need 70%+ for Phase II |

| Contingency Requirement | 7.5-10% of budget | No equivalent deductible structure |

| Completion Rate | 98%+ for bonded productions | 7.9% approval rate |

| Takeover Rights | Full production control | No equivalent mechanism |

| Recovery on Claims | Significant (completed films have value) | Near-zero (failed drugs have no value) |

| Moral Hazard | Limited (producers want completion) | Significant (sponsors may prefer failure) |

Critical differences explain why this model hasn't transferred to pharma. Completion guarantors can take over troubled productions—seizing control of cast, crew, and footage to force completion. Industry guides note that guarantors maintain the right to replace directors, revise scripts, and make creative decisions necessary to deliver a completed film. No equivalent mechanism exists for failing clinical trials; insurers cannot take over development programs and "force" efficacy.

The moral hazard structure differs fundamentally: film producers want completion because unfinished films generate zero revenue. Pharmaceutical sponsors might rationally prefer failure with insurance recovery over marginal success without it—creating adverse incentives that completion bond structures don't face.

Trade Credit Insurance: Successful Business Risk Coverage

The global trade credit insurance market demonstrates successful coverage of commercial (business) risk at scale. The market exceeds $12-15 billion in annual premiums while maintaining gross loss ratios around 33-38%—indicating profitable underwriting despite covering counterparty default risk.

Three providers (Allianz Trade, Coface, Atradius) control approximately 75% of the global market, achieving scale through portfolio diversification across millions of commercial relationships. Key success factors include:

Continuous monitoring: Credit insurers maintain real-time intelligence on counterparty creditworthiness, adjusting coverage limits dynamically as conditions change.

Cancellable limits: Unlike traditional insurance with fixed policy terms, credit insurance allows insurers to withdraw or reduce coverage when risk deteriorates—preventing adverse accumulation.

Objective triggers: Payment default has clear contractual definition; there's no subjective interpretation of whether a counterparty "should have" paid.

Pharmaceutical development lacks equivalent characteristics. Clinical trial outcomes cannot be monitored in real-time with adjustable coverage; "failure" requires subjective clinical interpretation rather than objective trigger activation; and moral hazard concerns prevent the continuous relationship model that makes credit insurance function.

Weather Derivatives: Solving Trigger Objectivity

The weather derivatives market evolved from zero to approximately $17-25 billion in notional value over 25 years (1997-2024) by solving the trigger objectivity problem through parametric indices. Rather than insuring against subjective "weather damage," these instruments pay based on objective measurements from official weather stations.

Heating Degree Day (HDD) and Cooling Degree Day (CDD) contracts pay based on temperature readings—objective, third-party verified triggers immune to moral hazard. CME exchange-traded contracts cover 47 cities worldwide, with market research projecting continued growth as climate volatility increases corporate demand for weather risk management.

The pharmaceutical equivalent would require objective, third-party verified efficacy measures independent of sponsor control—currently impossible given clinical trial structure. FDA approval decisions, while binary, involve subjective regulatory judgment; clinical endpoints require statistical interpretation; and interim results remain sponsor-controlled.

Table 11: Specialty Insurance Market Development Comparison

| Market | Premium Volume | Loss Ratio | Development Period | Key Success Factor | Pharma Applicability |

|---|---|---|---|---|---|

| Film Completion Bonds | ~$500M-1B | Very low (<2%) | 1950s-present | Takeover rights | ❌ No takeover mechanism |

| Trade Credit Insurance | $12-15B | 33-38% | Post-WWII | Continuous monitoring, cancellable limits | ❌ Binary outcomes, no monitoring |

| Political Risk (MIGA) | Multi-billion | Very low | 1988-present | Government leverage | ❌ No government guarantee |

| Weather Derivatives | $17-25B | N/A (derivatives) | 1997-present | Parametric triggers | ❌ Subjective endpoints |

| Residual Value Insurance | Niche | Limited data | Established | Asset reversion | ❌ Zero recovery value |

| Clinical Trial Insurance | ~$50M (nascent) | Unknown | 2024-present | AI underwriting | ⚠️ Unproven |

Munich Re and Swiss Re: Major Reinsurer Positioning

The world's largest reinsurers have developed pharmaceutical-adjacent products without addressing core development risk:

Munich Re offers EQuIP (Earnings Quality Insurance Protection), covering non-damage business interruption from regulatory non-compliance and manufacturing suspensions. Coverage limits range from $10 million to $150 million with 24-month indemnity periods. Munich Re notes that biopharma has experienced over $12 billion in losses from manufacturing suspensions and quality issues since 2001. However, this addresses operational risk—not R&D outcome risk.

Swiss Re Corporate Solutions provides alternative risk transfer solutions including captive fronting and structured multi-year programs for pharmaceutical clients. Their pharmaceutical expertise focuses on product liability and clinical trial liability—not development failure coverage.

Gen Re (Berkshire Hathaway) offers reinsurance capacity for clinical trials liability insurance, noting that Phase I trials carry the highest participant injury risk despite smaller enrollment. This liability coverage protects against lawsuits from trial participants—an entirely different risk from development failure.

The absence of major reinsurer engagement with pharmaceutical development failure risk, despite clear theoretical demand, confirms the structural barriers identified in actuarial analysis.

Credit Enhancement: The Actionable Near-Term Opportunity

While development failure insurance remains practically unavailable, credit enhancement for approved-product royalty streams represents an actionable near-term opportunity. Understanding how insurance wraps affect credit spreads reveals potential value creation pathways for royalty investors and originators.

Historical Spread Compression from Monoline Wraps

The municipal bond insurance market, though diminished from its pre-2008 peak, demonstrates spread compression mechanics that could apply to pharmaceutical royalty securitizations. According to municipal bond analysis, current AA-rated wraps from Assured Guaranty (the largest remaining provider) reduce spreads by approximately 10-17 basis points for A-rated underlying credits.

The June 2017 St. Louis Lambert Airport transaction illustrated this precisely: A-rated underlying bonds wrapped to AA rating achieved 17 basis point spread reduction, from 2.43% to 2.26% yield on 10-year bonds. For $100 million in bonds over 10 years, this spread compression generates approximately $1.7 million in interest savings—meaningful value creation if insurance premiums remain below this threshold.

Table 12: Credit Enhancement Spread Impact by Rating Category

| Underlying Rating | With AA/AAA Wrap | Estimated Spread Savings | 10-Year Value per $100M | Break-Even Annual Premium |

|---|---|---|---|---|

| A | AA | 10-17 bps | $1.0-1.7M | 0.10-0.17%/year |

| BBB | AA | 30-50 bps | $3.0-5.0M | 0.30-0.50%/year |

| BB | AA | 80-120 bps | $8.0-12.0M | 0.80-1.20%/year |

| B | (Typically unwrappable) | — | — | — |

For sub-investment-grade pharmaceutical royalty issuers, the potential spread compression of 80-120 basis points through insurance wraps could meaningfully reduce financing costs if such wraps were available.

Current Life Sciences Debt Pricing Benchmarks

Understanding current market pricing for life sciences debt provides context for potential insurance value creation:

Biotech venture debt typically costs 7-15% annual interest with 5-20% warrant coverage, reflecting substantial risk premiums for pre-revenue companies. This pricing represents lender compensation for binary development outcomes.

The Revolution Medicines transaction demonstrates royalty-adjacent pricing structures. Royalty Pharma's $2 billion funding agreement with Revolution Medicines included synthetic royalty components, while the company's debt facilities price at substantial spreads over risk-free rates given development-stage assets.

BioPharma Credit PLC, a London-listed investment company focused on life sciences secured lending, achieves 8-12% portfolio yields on approved-product-backed debt. The company's 11.31% dividend yield reflects realized returns from this strategy.

Table 13: Current Life Sciences Debt Market Pricing

| Instrument Type | Typical Rate/Spread | Equity Component | Collateral | Rating |

|---|---|---|---|---|

| Pre-clinical Venture Debt | 12-15% + warrants | 15-20% warrant coverage | None/IP | Unrated |

| Clinical-Stage Venture Debt | 10-14% + warrants | 10-15% warrant coverage | IP/equipment | Unrated |

| Approved Product Secured Debt | SOFR + 450-700 bps | 0-5% warrant coverage | Royalty streams | BB-BBB |

| Royalty Monetization (senior) | SOFR + 300-500 bps | None | Senior royalty interest | BBB-A |

| Royalty Pharma Senior Notes | Treasury + 100-150 bps | None | Corporate guarantee | Baa2/BBB |

CLO and Structured Credit Parallels

CLO credit enhancement structures offer a template for pharmaceutical royalty securitization without requiring third-party insurance. AAA CLO tranches achieve their rating through 34-39% subordination—junior tranches absorbing losses before senior tranches. No realized loss has ever occurred in any senior AAA, junior AAA, or AA-rated CLO tranche according to industry data.

Applying similar tranching principles to diversified pharmaceutical royalty portfolios could create investment-grade senior securities backed by sub-investment-grade underlying assets. The key requirements include:

Portfolio diversification: Sufficient drug/sponsor diversity to achieve independence assumptions Structural subordination: Junior tranches absorbing first losses Cash flow waterfalls: Priority payment structures protecting senior tranches Revolving provisions: Ability to substitute assets while maintaining credit quality

The European Investment Bank's Project Bond Credit Enhancement (PBCE) model suggests a potential public-sector role. PBCE provides subordinated credit enhancement up to 20% of senior bond nominal or EUR 200 million, lifting credit ratings without extending EIB's own AAA rating to projects. A similar structure for pharmaceutical royalties—perhaps through NIH, BARDA, or development finance institution mechanisms—could enable broader capital access for drug development financing.

Hypothetical Insured Royalty Structures

Imagining functional insurance structures for pharmaceutical royalties reveals specific design requirements and remaining obstacles. Several theoretical approaches merit consideration despite current market absence.

Structure 1: Approved Product Revenue Floor Guarantee

Concept: Insurance guaranteeing minimum annual royalty revenues for already-approved products, protecting against commercial underperformance rather than development failure.

Mechanics: Coverage activates if actual royalty receipts fall below a guaranteed floor (e.g., 70% of projected revenues). Insurer pays the difference between actual and guaranteed amounts up to policy limits.

Pricing Estimate: 1-2% of guaranteed revenue annually, comparable to trade credit insurance rates. Commercial underperformance for approved products occurs at 10-20% frequency—manageable loss rates for traditional insurance.

Trigger Mechanism: Objective (actual revenues versus guaranteed floor), eliminating subjective interpretation.

Key Challenge: Adverse selection. Sponsors would purchase coverage precisely when they anticipate revenue shortfalls from competitive threats, generic entry, or safety signals. Underwriters would need sophisticated commercial forecasting to identify deteriorating prospects.

Table 14: Hypothetical Revenue Floor Guarantee Structure

| Parameter | Illustrative Terms |

|---|---|

| Coverage Trigger | Actual royalties < 70% of projected |

| Maximum Payout | 30% of guaranteed annual revenue |

| Policy Term | 3-5 years |

| Premium Rate | 1.5-2.5% of guaranteed revenue annually |

| Deductible | First 10% shortfall retained |

| Eligible Products | Approved, commercial-stage only |

| Exclusions | Generic entry, voluntary withdrawal |

Structure 2: Milestone Achievement Insurance for Late-Stage Assets

Concept: Insurance paying fixed amounts upon failure to achieve specified development milestones (Phase III completion, NDA filing, FDA approval).

Mechanics: Sponsor purchases coverage at trial initiation. If specified milestone is not achieved within defined timeframe, insurer pays agreed benefit. Similar to credit default swap structure but for regulatory milestones.

Pricing Estimate: 40-70% of insured amount for Phase III milestones (reflecting 42% failure rates plus loading). Premium rates would vary dramatically by therapeutic area, biomarker status, and prior clinical data.

Trigger Mechanism: Binary milestone achievement/non-achievement within specified timeframe. Some subjectivity remains (what constitutes "milestone achievement" may be contested).

Key Challenge: Moral hazard and adverse pricing. Sponsors with deteriorating interim data would seek coverage; sponsors with positive signals would avoid it. Premium rates reflecting true risk would exceed 50% of insured value for most programs.

Structure 3: Portfolio Insurance for Diversified Royalty Funds

Concept: Coverage guaranteeing minimum fund-level returns rather than individual asset outcomes, leveraging portfolio diversification.

Mechanics: Insurer guarantees that diversified royalty portfolio achieves minimum return threshold (e.g., 1.0x MOIC). If portfolio underperforms, insurer pays difference between actual and guaranteed returns.

Pricing Estimate: 3-5% of NAV annually for portfolios of 30+ assets. Diversification reduces expected loss frequency compared to single-asset coverage.

Trigger Mechanism: Portfolio-level mark-to-market or realized return calculation at specified dates.

Key Challenge: Limited historical fund data prevents actuarial pricing. Correlation during sector-wide events (regulatory standard shifts, pandemic disruption) could cause simultaneous portfolio underperformance exceeding modeled expectations.

Table 15: Comparison of Hypothetical Insurance Structures

| Structure | Risk Covered | Premium Estimate | Trigger Type | Feasibility |

|---|---|---|---|---|

| Revenue Floor Guarantee | Commercial underperformance | 1-2.5%/year | Objective revenue measurement | Moderate - similar to trade credit |

| Milestone Insurance | Development milestone failure | 40-70% upfront | Binary milestone achievement | Low - pricing prohibitive |

| Portfolio Insurance | Fund underperformance | 3-5%/year | Portfolio return calculation | Low - insufficient data |

| Captive Structure | Self-insured development risk | Cost of capital | Internal allocation | Moderate - no true risk transfer |

| Synthetic Put Options | Mark-to-market downside | Black-Scholes pricing | NAV calculation | Low - illiquidity, no market |

Structure 4: Captive Insurance for Large Pharmaceutical Companies

Concept: Major pharmaceutical companies establish subsidiary insurers to formalize internal risk management without external transfer.

Mechanics: Pharma company capitalizes a captive insurer that "covers" development programs. Premiums paid to captive create explicit capital allocation and pricing discipline. Captive may access reinsurance markets for specific risk layers.

Benefits:

- Improved internal capital allocation discipline

- Tax-efficient reserve accumulation in favorable jurisdictions

- Potential reinsurance access for catastrophic layers

- Formalized risk quantification for investor communication

Limitations: No actual risk transfer occurs—the parent company bears ultimate losses. Captive structures work best for companies with diversified pipelines achieving meaningful internal diversification.

Feasibility: Moderate. Several major pharmaceutical companies operate captive insurers for traditional liability coverage; extending to development risk would require regulatory approval and actuarial justification.

Premium Pricing Models: Frameworks from Comparable Markets

Specialty insurance pricing methodologies provide frameworks for estimating hypothetical pharmaceutical coverage costs despite absence of actual market data. Understanding these models illuminates why current pricing remains prohibitive and what conditions might enable future market development.

The Fundamental Premium Formula

The basic insurance pricing equation applies across all lines:

Premium = Expected Loss × (1 + Loading Factor)

Where:

Expected Loss = Probability of Loss × Loss Severity

Loading Factor = (Expenses + Profit + Risk Charge) / Expected Loss

For pharmaceutical development insurance:

Expected Loss = Failure Probability × Insured Amount

Loading Factors in specialty lines typically range 40-100% of expected loss, covering:

- Administrative expenses: 5-15% of premium

- Underwriting costs: 5-10% of premium

- Broker commissions: 10-20% of premium

- Profit targets: 3-8% of premium

- Risk/capital charge: 15-45% of premium

Table 16: Hypothetical Premium Calculation by Development Stage

| Stage | Failure Rate | Expected Loss per $100 | 75% Loading | Total Premium | Premium as % of Investment |

|---|---|---|---|---|---|

| Phase I | 48.0% | $48.00 | $36.00 | $84.00 | 84% |

| Phase II | 71.1% | $71.10 | $53.33 | $124.43 | 124% |

| Phase III | 42.2% | $42.20 | $31.65 | $73.85 | 74% |

| NDA/BLA | 9.4% | $9.40 | $7.05 | $16.45 | 16% |

| All Phases Combined | 92.1% | $92.10 | $69.08 | $161.18 | 161% |

| Approved (Commercial) | ~5% | $5.00 | $3.75 | $8.75 | 9% |

These calculations reveal why traditional insurance fails for development-stage programs: premiums exceeding 100% of insured value are economically irrational. Even NDA/BLA-stage coverage at 16% of investment value creates substantial drag on returns. Only approved-product coverage approaches premiums comparable to other specialty lines.

Loss Ratio Targeting

Specialty insurers target loss ratios of 55-75% for sustainable underwriting. Working backward from target loss ratios reveals required premium rates:

Required Premium = Expected Loss / Target Loss Ratio

For 65% Target Loss Ratio:

Phase III Premium = 42.2% / 0.65 = 64.9% of investment

Phase II Premium = 71.1% / 0.65 = 109.4% of investment

Even at aggressive 75% loss ratio targets (minimal profit margin), Phase II coverage would require 95% premium rates—still economically destructive.

Risk-Based Capital Considerations

Risk-based capital allocation methods suggest pharmaceutical risk would face punitive capital requirements. Casualty Actuarial Society frameworks assign beta coefficients of 2.0-3.0 for commercial liability lines. Pharmaceutical development risk—with undefined loss distributions and correlation concerns—would likely command higher coefficients of 3.0-5.0.

Required return on allocated capital compounds premium requirements:

Capital Charge = Allocated Capital × Required Return × Policy Term

Premium Addition = Capital Charge / Premium Volume

For a reinsurer requiring 15% return on capital with 3x capital allocation relative to premium, the capital charge alone adds 45% to premium requirements—before expected losses.

Accounting and Tax Treatment Considerations

For royalty funds considering insurance structures, accounting treatment influences reported returns through premium timing and recognition methodology. Understanding these effects enables accurate performance comparison across insured and uninsured strategies.

US GAAP Premium Accounting

Under ASC 720-20 (Insurance Costs), non-insurance entities expense premiums over the coverage period in proportion to protection received. PwC guidance on insurance arrangements clarifies that prepaid premiums appear as assets until coverage begins, then amortize to expense ratably.

Table 17: Premium Accounting Treatment Impact

| Premium Structure | Cash Flow Timing | Expense Recognition | IRR Impact | MOIC Impact |

|---|---|---|---|---|

| Upfront (Year 0) | Immediate outflow | Amortized over term | Maximum negative | Reduces numerator |

| Annual (Each Year) | Spread over term | As incurred | Moderate negative | Reduces numerator |

| Contingent (On Claim) | Deferred | When payable | Minimal if no claim | Reduces on failure only |

| Embedded (In Returns) | Part of deal terms | Reduces gross return | Reflected in gross IRR | Lower reported gross |

Premium payment timing significantly affects reported IRR. Upfront payments create maximum IRR drag because earlier cash outflows receive highest present value weighting in IRR calculations.

Fund Reporting Implications

Fund accounting presents flexibility in whether insurance premiums constitute "invested capital" or "fund expenses":

Classification as Invested Capital: Premium included in denominator for MOIC/DPI/TVPI calculations. Results in higher multiple denominators but cleaner expense ratios.

Classification as Fund Expenses: Premium excluded from invested capital denominator. Improves MOIC calculation (smaller denominator) but increases expense ratios and may raise LP concerns about fee drag.

Table 18: Classification Impact on Reported Metrics

| Metric | Premium as Investment | Premium as Expense | Difference |

|---|---|---|---|

| Invested Capital (Denominator) | $100M + $15M premium = $115M | $100M | $15M |

| Gross Return | $180M | $180M | — |

| Gross MOIC | 1.57x | 1.80x | 0.23x higher |

| Expense Ratio | Normal | Elevated by premium | Worse optics |

| LP Perception | Conservative accounting | May raise questions | Context-dependent |

Most fund managers would likely classify premiums as part of invested capital for conservative, consistent reporting—accepting lower MOIC calculations rather than explaining elevated expense ratios.

Tax Considerations

Insurance premium deductibility and timing affect after-tax returns for taxable investors:

Premium Deductibility: Insurance premiums are generally deductible as ordinary business expenses when paid or accrued, depending on taxpayer's accounting method.

Claim Proceeds: Insurance payouts for loss recovery are generally taxable as ordinary income to the extent they exceed adjusted basis in the covered asset.

Timing Mismatch: Premiums paid upfront generate current-year deductions, while losses may occur (and claims be received) in future years—creating timing benefits for deferred taxation.

For tax-exempt investors (foundations, endowments, pension funds), these considerations are neutral, making pre-tax economics the primary decision factor.

The Market Gap: Strategic Implications for Royalty Investors

The absence of pharmaceutical development insurance creates both challenges and opportunities for sophisticated royalty investors. Understanding structural barriers enables better risk management, while monitoring market evolution may identify future tradeable instruments.

Portfolio Construction as Primary Risk Management

Without insurance availability, portfolio diversification becomes the essential risk management tool. Academic research on pharmaceutical portfolio theory demonstrates Sharpe ratio improvements from N=10 to N=50 independent assets before diminishing returns—suggesting minimum portfolio sizes for well-diversified royalty exposure.

Royalty Pharma's portfolio construction demonstrates this principle: 35+ commercial products with diverse therapeutic area exposure achieves meaningful diversification. The company's development-stage assets have achieved 76% approval rates—far exceeding industry averages—through rigorous selection rather than insurance protection.

Table 19: Portfolio Diversification Impact on Risk Metrics

| Portfolio Size | Expected Failures | Variance Reduction | Sharpe Ratio Improvement | Minimum Recommended |

|---|---|---|---|---|

| 1 asset | Binary (0 or 100%) | Baseline | Baseline | Unacceptable concentration |

| 5 assets | 3-4 failures expected | ~50% reduction | Moderate improvement | Still concentrated |

| 10 assets | 7-9 failures expected | ~70% reduction | Significant improvement | Minimum viable |

| 25 assets | 18-23 failures expected | ~85% reduction | Substantial improvement | Comfortable diversification |

| 50+ assets | 40-46 failures expected | ~92% reduction | Near-maximum improvement | Fully diversified |

Correlation Management Within Portfolios

Diversification benefits depend critically on asset independence. Correlation within therapeutic areas—particularly oncology—limits diversification gains from naive portfolio construction:

High Correlation Risk: Multiple oncology programs targeting similar mechanisms or pathways may fail simultaneously if the scientific hypothesis proves invalid.

Moderate Correlation: Programs from the same sponsor may face correlated risks from manufacturing, regulatory relationships, or organizational capability.

Low Correlation: Programs across different therapeutic areas, modalities, and sponsors approach independence assumptions.

Royalty investors should consciously construct portfolios to minimize correlation, even at the cost of passing on individually attractive opportunities that increase concentration.

Structuring Innovation as Partial Risk Transfer

Modern royalty financing structures increasingly embed insurance-like features without formal insurance mechanisms:

Tiered Royalty Rates: Labiotech reports that royalty structures with rates declining at higher revenue levels (like Revolution Medicines' 4.55% on first $2 billion, declining to zero above $8 billion) embed partial downside protection for sponsors—they keep more upside if products significantly exceed expectations.

Return Caps: Synthetic royalty deals often include return caps (1.5x-4.0x) that limit investor upside in exchange for higher probability of achieving base returns. This risk-sharing resembles insurance economics without insurance mechanics.

Milestone-Contingent Payments: Structuring investments as milestone-triggered tranches reduces capital at risk at each stage, effectively self-insuring through staged deployment.

Convertible Features: Deals with equity conversion rights upon certain triggers provide alternative value realization paths if primary monetization underperforms.

Monitoring Market Evolution

Market evolution may eventually enable pharmaceutical risk transfer instruments. Several indicators warrant monitoring:

Clinical Trial Insurance Performance: MCI Syndicate 1966's loss experience over the next 2-3 years will demonstrate whether AI-driven underwriting can achieve sustainable profitability. Positive results could attract additional capacity.

Regulatory Clarity: SEC, CFTC, and state insurance regulator guidance on classification of pharma risk instruments (securities, derivatives, or insurance) would reduce structural uncertainty for product developers.

Exchange Infrastructure: FDA Hedges-style exchange-traded approval options would require trading platform development, market maker commitment, and sufficient liquidity—prerequisites that remain absent.

Public Sector Engagement: Government-backed credit enhancement (through NIH, BARDA, or development finance institutions) could bootstrap market development by providing initial risk capacity that private markets cannot.

Conclusion: Accepting Risk While Understanding the Insurance Gap

Pharmaceutical royalty investors face a structural reality that distinguishes their asset class from virtually all other institutional investment categories: the risks they bear cannot be conventionally insured. Clinical trial failure rates of 80-95% transform insurance from risk management into certain loss, while information asymmetry, moral hazard, and correlated scientific risks eliminate traditional underwriting approaches.

The financial modeling presented reveals that insurance premiums would likely exceed investment value for most development-stage programs, rendering coverage economically irrational even if available. Only post-approval commercial risk approaches pricing comparable to other specialty lines—and even there, credit enhancement structures remain underdeveloped compared to other asset classes.

For sophisticated royalty investors, this analysis suggests several strategic conclusions:

Portfolio diversification remains the primary risk management tool. With insurance unavailable, constructing portfolios of 30-50+ assets across diverse therapeutic areas, development stages, sponsors, and geographies achieves the variance reduction that insurance would otherwise provide. Correlation management—avoiding mechanism concentration even when individual opportunities appear attractive—matters as much as asset count.

Structuring innovation can transfer partial risk without formal insurance. Tiered royalty rates, return caps, milestone-contingent payments, and convertible features embed insurance-like economics in deal structures. Sophisticated investors can negotiate these features to match their risk preferences.

Credit enhancement for approved products represents the most actionable near-term opportunity. While development failure insurance remains unavailable, credit wraps for royalty-backed debt could compress spreads by 80-120 basis points for sub-investment-grade issuers. Investors and originators should explore available credit enhancement mechanisms from remaining monolines, development finance institutions, or structural subordination.

Market evolution warrants monitoring but not reliance. Clinical trial insurance products at Lloyd's represent genuine innovation, but early operational challenges confirm the difficulty of profitably underwriting R&D outcomes. The structural barriers identified in this analysis—high failure rates, moral hazard, adverse selection, correlation, and trigger subjectivity—remain unresolved. Investors should plan portfolios assuming insurance remains unavailable for the foreseeable future.

The fundamental insight is that pharmaceutical development risk's near-zero market beta and high idiosyncratic nature make it precisely the risk that portfolio theory suggests sophisticated investors should hold unhedged, capturing risk premium without systematic market exposure. The absence of insurance is not a market failure requiring correction but an appropriate response to the underlying risk characteristics that define this asset class.

For royalty investors with sufficient scale and diversification to weather individual program failures while capturing portfolio-level returns, the insurance gap creates competitive advantage rather than disadvantage. Understanding why insurance markets have failed—and why they are unlikely to develop at scale in the near term—enables better risk acceptance and more informed portfolio construction than waiting for risk transfer mechanisms that may never materialize.

Disclaimer: I am not a lawyer or financial adviser. This article does not constitute investment advice, legal advice, or financial advice of any kind. All information presented here is derived from publicly available sources including SEC filings, press releases, and industry reports. Details of specific transactions may have changed since publication. Readers should conduct their own due diligence and consult with qualified legal and financial professionals before making any investment or business decisions.

Member discussion