Special Purpose Acquisition Companies in Healthcare and Biotech: A Mid-2025 Market Appraisal

The landscape for Special Purpose Acquisition Companies (SPACs) within the healthcare and biotechnology sectors in mid-2025 presents a complex, dual

The weekly term sheet (32)

Global pharmaceutical and biotech deals remain subdued during August week

The week of August 4-9, 2025 marked an unusually quiet

The great AI medicine show

In the late 19th century, traveling medicine shows peddled cure-all elixirs with flamboyant claims. Today’s equivalent in biotech is

Company of the week: BridgeBio Pharma (BBIO)

BridgeBio Pharma stands at a critical inflection point in its evolution from development-stage biotech to commercial pharmaceutical company. With the

Fund of the week: LifeArc

Overview and Financial Model

LifeArc is a UK-based medical research charity with a unique financial model, operating more like an

Intel’s Advances in Biotech: Genomics and Drug Discovery with AI Accelerators (2025)

Habana Gaudi2 and Gaudi3 Accelerators

Intel’s Gaudi2 (2022) and Gaudi3 (2024) AI accelerators target training of large models with

AMD's Expanding Role in AI for Biotechnology: A Comprehensive Analysis

Advanced Micro Devices (AMD) has emerged as a significant challenger to NVIDIA's long-standing dominance, pursuing an aggressive strategy

Nvidia’s Expanding Footprint in Biotech: A Hardware-Centric Analysis

The convergence of artificial intelligence (AI), accelerated computing hardware, and vast biological datasets is transforming healthcare and biotech into a

The weekly term sheet (31)

Global pharmaceutical and biotech deals surge with $15+ billion in transactions

The pharmaceutical and biotechnology sectors witnessed significant deal activity

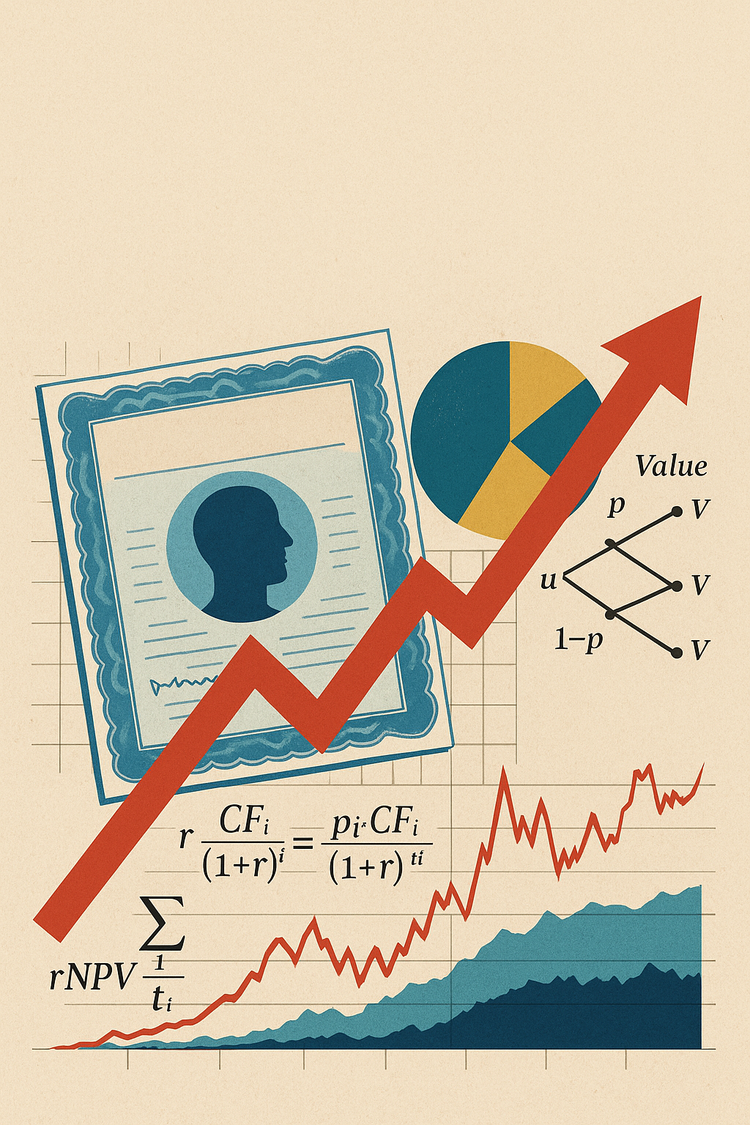

Biotech Equity and Stock Option Valuation – A Deep Dive for Founders

Valuing a biotech venture is a bit like valuing a promising but precarious alchemical experiment – full of potential magic, but