Space: the final formulation frontier

These are the voyages of a new class of pharmaceutical pioneers.

Their five-year mission: to explore strange crystallization conditions,

to seek out novel polymorphs and new delivery systems,

to boldly compound where no molecule has compounded before.

In the past two years, the once-theoretical concept of orbiting drug labs has left the launchpad and docked squarely in commercial R&D. Microgravity—a persistent near-weightlessness just 400 kilometers above the planet—acts not as a gimmick but as a differentiator. It reshapes how fluids flow, how molecules bind, and how crystals form, often revealing new structures too unstable for Earth’s gravitational tug. What was once an esoteric curiosity of ISS experiments is now a capital-backed proposition: build capsules, launch them, crystallize drugs, and return with formulations Earth couldn’t otherwise produce.

No warp drive required—just a Falcon 9, a thermal shield, and a regulatory waiver.

In the past two years, the idea of manufacturing medicines in space has rapidly moved from science fiction toward commercial reality. Microgravity – the near-weightless environment in low-Earth orbit – has unique effects on pharmaceutical substances, often yielding drug crystals with more uniform size and structure than those grown on Earth. For decades, astronauts on the Space Shuttle and International Space Station (ISS) have grown protein crystals in orbit to improve drug design; more than 500 such experiments were conducted on the ISS as of 20217.

These studies showed that crystallizing drugs in microgravity can produce higher-quality forms – for example, Merck found that cancer drug Keytruda formed homogeneous, well-ordered crystals in space with lower viscosity, enabling the possibility of switching its administration from time-consuming IV infusions to simple injections (7pc.vc).

Until recently, however, space-based drug research remained a niche endeavor, with one-off experiments reliant on government missions.

Today, a new wave of startups and collaborations is transforming that paradigm into a scalable business. Dedicated space pharma companies have emerged since 2020, developing automated orbital labs and return capsules that make microgravity research a service rather than an occasional experiment (labiotech.eu). The driving idea is straightforward: use space as an R&D and production platform to create improved versions of existing drugs and even novel therapeutics not feasible on Earth. Active pharmaceutical ingredients often behave differently in microgravity, free from the convection and sedimentation that affect crystal growth under gravity.

By leveraging these differences, space manufacturing aims to unlock drug formulations with superior purity, stability, and bioavailability. The past two years have seen major technological milestones and venture investments in this sector, suggesting that “space medicines” could soon become more than a scientific curiosity.

Varda Space Industries: Pioneering Orbital Drug Production

One of the most well-funded pioneers is Varda Space Industries, a California startup founded in late 2020 to build robotic “space factories.” In July 2025, Varda raised $187 million in a Series C round led by Natural Capital and Shrug Capital, bringing its total funding to about $329 million (reuters.com). Backers include prominent venture firms (Lux Capital, Khosla Ventures, Founders Fund) and tech billionaires, reflecting investor confidence in Varda’s vision of microgravity-enabled drug manufacturing.

The company develops small uncrewed capsules that launch to low-Earth orbit (often hitching rides on SpaceX rockets) to perform on-board pharmaceutical processing. Inside these capsules, drug molecules are crystallized under weightless conditions before the capsule re-enters the atmosphere to deliver the products back to Earth.

Varda’s progress in 2023–2025 has been striking. Since its first mission in mid-2023, Varda has launched and safely returned three capsules to Earth, with a fourth currently in orbit and a fifth planned by late 2025. In its inaugural mission (W-1), Varda successfully grew crystals of the HIV antiviral ritonavir in microgravity and recovered them intact upon reentry. Notably, the space-grown crystals represented a novel polymorph (crystal form) of ritonavir that remained stable on Earth, demonstrating that microgravity can unlock new structures without reverting to the Earth-grown form (reuters.com).

Ritonavir is notoriously difficult to formulate on Earth due to such polymorphism issues, so this proof-of-concept was an important validation of Varda’s approach. The second mission in early 2024 carried an active ingredient from an undisclosed pharmaceutical partner, indicating that at least one drug company is already testing Varda’s platform with its compound.

Encouraged by results, Varda has expanded from small-molecule drugs (like pills) into biologics, such as therapeutic antibodies. These larger protein drugs present even bigger formulation challenges on Earth – many antibodies can only be given via IV infusion because they don’t dissolve well in injectable solutions. In microgravity, however, fluids mix without settling and crystals can grow slowly without convection, often yielding uniformly sized protein crystals.

Varda’s CEO Will Bruey notes that space-grown biologic crystals could enable new formulations – for example, turning an IV-only antibody therapy into a high-concentration injectable for subcutaneous administration (touchmedicalmedia.com). “We’re able to open up a whole new world of drug formulations that otherwise wouldn’t exist,” Bruey said of the company’s work on antibody crystallization. The potential benefits range from improved patient convenience (at-home injections instead of hospital infusions) to significant healthcare cost savings.

On the ground, Varda has built extensive infrastructure to support this mission. The startup opened a dedicated pharmaceutical laboratory in El Segundo, CA, and even constructed a room-sized centrifuge (its “hypergravity” machine) to test drug formulations under varied gravity levels before committing them to space (phys.org). This in-house screening, essentially subjecting candidate compounds to higher-than-Earth gravity, helps identify which drugs are most sensitive to gravity’s effects and thus likeliest to benefit from microgravity processing. Only those that show improvement under these tests are selected for the precious capsule slots bound for orbit.

According to Varda, this rigorous screening is crucial because spaceflight is still costly and time-consuming, so one must choose targets wisely to find “gravity-sensitive” formulations worth the investment. Varda’s long-term goal is to make launches routine – eventually daily – but in 2025 the cadence is on the order of a few missions per year (payloadspace.com).

Importantly, Varda is not just developing technology in a vacuum; it is also navigating uncharted regulatory and logistical terrain. In 2023, the company faced a hurdle when its first capsule spent months orbiting Earth awaiting a reentry clearance – U.S. authorities initially hesitated to permit the capsule’s return over land due to safety and policy concerns (spectrum.ieee.org). Varda eventually secured an FAA reentry license in early 2024, clearing the way for regular operations (spacenews.com).

This episode underscored that policy and infrastructure for private reentry missions are still catching up with the technology. Nonetheless, by mid-2025 Varda has proven it can fly to orbit and back repeatedly, making it one of the first movers in practical space biomanufacturing.

Bruey expects to have the first space-formulated drug in human trials by the late 2020s, and he emphasizes that Varda’s competitive moat will lie not in monopoly access to microgravity (“anyone can go to space and float around”) but in the proprietary drug formulations and intellectual property the company develops. In other words, Varda aims to be a pharmaceutical company enabled by space, rather than just a space company carrying drugs.

Beyond Varda: An Emerging Ecosystem of Space Pharma Players

Varda may be among the highest-profile startups in this arena, but it is far from alone. Multiple companies across the US and Europe have entered the space-based pharma and biotech market in the last two years, each with a slightly different focus.

What they share is the belief that microgravity and the space environment can unlock biomedical innovations—and a race is on to commercialize those innovations. Below is a summary of major players and their recent activities, as well as notable 2025 investment deals in the space-biotech sector:

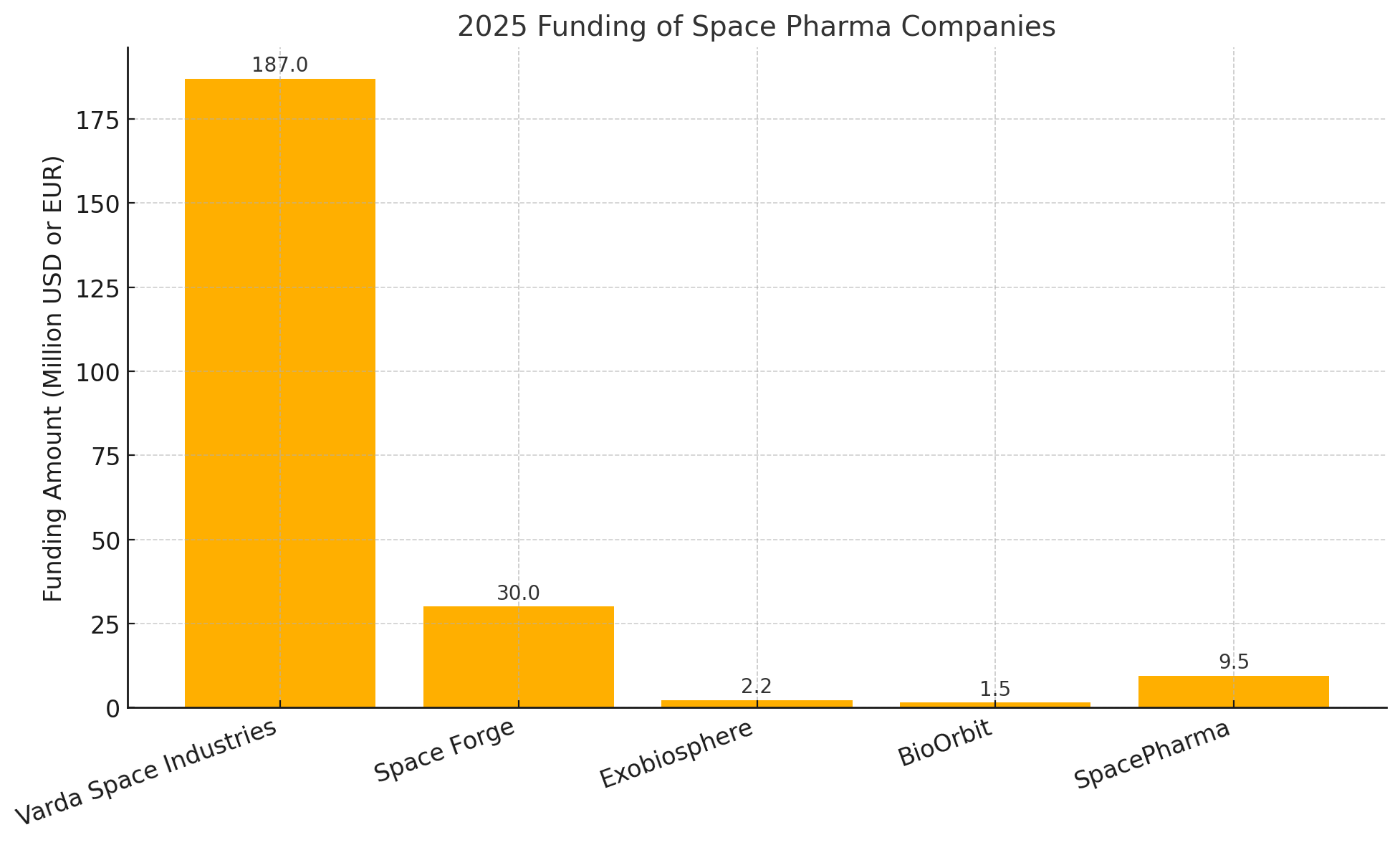

| Company | Focus | 2025 Funding Deals | Key Investors/Backers |

|---|---|---|---|

| Varda Space Industries (U.S.) | Orbital capsules for microgravity drug formulation and manufacturing. | Series C – $187 M (Jul 2025) | Natural Capital, Shrug Capital, Lux Capital, Khosla Ventures, Founders Fund, Peter Thiel. |

| Space Forge (U.K.) | Reusable small satellites for in-orbit manufacturing (materials & pharma). | Series A – $30 M (May 2025) | NATO Innovation Fund (lead), with European deep-tech investors. |

| Exobiosphere (Luxembourg) | Space-based drug discovery platform (CRO model for microgravity experiments). | Seed – €2 M (Apr 2025) | Luxembourg Space Agency (public seed backing). |

| BioOrbit (U.K.) | Microgravity protein crystallization for biologics (space “pharma factory”). | Seed – (Late 2024, undisclosed) | 7percent Ventures, Seraphim Space, Type One Ventures, Airbus Accelerator (non-dilutive support). |

| SpacePharma (Israel/CH) | Miniaturized automated labs (“SPACETORY”) for microgravity pharma R&D. | Grant/Equity – €9.5 M (Mar 2024) (EIC Accelerator) | European Innovation Council (blended finance: grant + equity). |

| Redwire (U.S.) – public | ISS-based biomanufacturing services (protein crystal growth via “PIL-BOX” platform). | Partnerships: New collaborations (2024) with Eli Lilly, Bristol Myers Squibb for ISS experiments. | ISS National Lab (CASIS) support; Redwire is a public company (NYSE: RDW) investing in biotech payloads. |

| Space Tango (U.S.) | Automated microgravity research modules (CubeLab) for biotech and materials. | Gov’t Contracts: DARPA B-SURE program (2023) for off-Earth biomanufacturing; multiple NASA SBIR/STTR awards. | NASA, ISS National Lab (as a commercial services provider); partnerships with biotech firms (e.g. LambdaVision retinal implant manufacturing). |

Table: Notable space-biotech companies and their recent funding or partnership deals. 2025 deals in bold.

Several observations emerge from this landscape. First, the field is global – while the U.S. has Varda, Redwire, and Space Tango, Europe is not far behind with ventures like the U.K.’s BioOrbit and Luxembourg’s Exobiosphere. Both European startups were founded in 2023–2024 and secured initial funding by 2025 to build out microgravity R&D platforms. Exobiosphere, for instance, is developing a high-throughput drug screening service in orbit and plans its first mission under the backing of the Luxembourg Space Agency.

BioOrbit, led by a former International Space University team, envisions large-scale protein drug crystallization in space as a contract manufacturing service for pharma companies.

Its goal aligns with that of Varda: to enable subcutaneous injection formulations for blockbuster antibody therapies like cancer drugs, thereby “bringing treatment from hospital to home via space” (touchmedicalmedia.com). BioOrbit’s early funding came from space-specialist venture funds and it has partnered with Europe’s new commercial capsule provider The Exploration Company for its first launch in 2025 (7pc.vc).

Second, we see a blend of business models. Some companies focus on drug discovery and preclinical research (e.g. using microgravity to find new drug targets or optimize compounds), essentially as a service for other biotech firms. This is the CRO-like approach of Exobiosphere, which aims to screen many drug candidates in orbit for novel properties. Other players target drug manufacturing and formulation – producing improved drug forms (crystals, tissues, etc.) that can be directly used in therapies. Varda and BioOrbit fit this category, positioning themselves as future contract manufacturers for pharmaceuticals, or even developers of proprietary space-derived drugs.

Redwire and Space Tango occupy a slightly different niche as technology and service providers that enable microgravity experiments (largely on the ISS to date) for partners like universities, biotech startups, and big pharma. Notably, Redwire – a larger aerospace firm – has leveraged the ISS National Lab to conduct multiple protein crystallization investigations in 2023–2024: its PIL-BOX lab-on-a-chip system has now flown at least four batches of drug crystallization experiments in orbit.

In late 2024, Redwire reported that insulin crystals grown in microgravity were significantly larger and more well-ordered than those grown on Earth, confirming past ISS research with a real commercial partner (Eli Lilly). Redwire’s latest missions also included projects with Bristol Myers Squibb and a startup (Exesa Libero Pharma), targeting treatments for diabetes, cardiovascular disease, and obesity (redwirespace.com).

This indicates that major pharmaceutical companies are starting to actively explore microgravity R&D, at least in partnership or as early pilots. While pharma giants have not yet invested equity in these space companies, they are providing paid payloads or research funding – a positive sign for market validation.

A third trend is the development of supporting infrastructure: namely, affordable launch and safe reentry capabilities. The dramatic drop in launch costs over the past decade (thanks to reusable rockets like SpaceX’s Falcon 9) is a key enabler that reduces the barrier to entry by orders of magnitude. But equally important is the rise of dedicated reentry vehicles that can bring payloads back routinely, beyond relying on the ISS and its limited return capacity. Varda was the first to fly a private return capsule, but by 2025 several others are in the mix. For example, Space Forge in the UK has tested its small ForgeStar reentry satellite (though a full recovery success is still pending), and raised significant capital to pursue in-orbit manufacturing of semiconductors and pharmaceuticals.

In Europe, the German startup ATMOS Space Cargo launched a test reentry mission (Phoenix capsule) in 2024 and is developing an inflatable heat-shield reentry craft for recovering materials. A French startup, The Exploration Company, is building the Nyx capsule for cargo (its first demonstrator flew in early 2023). Even established station companies like Nanoracks/Voyager are planning small reentry pods (e.g. the “Outpost” concept) to return experiments.

Varda’s CEO has acknowledged at least a dozen reentry vehicle efforts underway globally, and he welcomes the competition – seeing microgravity itself as a commodity and Varda’s edge in the application and pharma know-how. For the space medicine sector as a whole, these developments are critical: the easier and cheaper it is to access orbit and return payloads, the more feasible it becomes to integrate space-based steps into the pharmaceutical R&D pipeline.

By the late 2020s, the logistics of doing routine work in LEO (low-Earth orbit) may be far more streamlined than today, with private space stations (from Axiom Space, Sierra Space, and others) coming online to supplement the ISS. This burgeoning infrastructure underpins many startups’ projections that what sounds fantastical now – mass production of drug crystals in orbit – could be standard practice within a decade (touchmedicalmedia.com).

Market Potential vs. Hurdles: A Critical Outlook

For investors, the allure of space-based pharma is the combination of a huge addressable market with a unique value proposition. The global pharmaceutical market exceeds $1.5 trillion annually, and even niche improvements to blockbuster drugs can translate into major revenue. If a new crystal form extends a drug’s patent or market share (for instance, by enabling a superior formulation), it can be worth billions. Additionally, drugs are high value-to-mass products, meaning a few kilograms of a pharmaceutical compound can be worth tens or hundreds of millions of dollars. This high value density is ideal for the economics of space transport.

Unlike bulk commodities, shipping a small vial of life-saving medicine from orbit could be cost-effective if that medicine is uniquely better. The microgravity environment essentially offers a novel “R&D dimension” – revealing phenomena like protein folding, aggregation, or cell growth in ways Earth laboratories cannot. We have already seen cases where space experiments yielded drug insights (e.g. a new tuberculosis drug target via crystal grown on the ISS (nasa.gov), or a Duchenne muscular dystrophy therapy advanced by JAXA’s space crystal work).

The hope of companies like LinkGevity (a U.K. startup) is that space can also act as an accelerated disease model – for example, mimicking aspects of aging or organ deterioration – to discover drugs for both astronauts and Earth patients. With national space agencies and programs like NASA’s Space Biology/Space Health supporting such dual-use biotech (LinkGevity joined a NASA Space Health accelerator in 2024), there is a tailwind of public funding alongside private capital.

That said, it’s important to approach this sector with measured expectations. Significant technical and commercial challenges remain before “space medicine” becomes a profitable reality. One challenge is scientific validation: a crystal that looks better in space is not automatically a better drug on Earth. Rigorous analysis must confirm that any new polymorph or formulation actually improves efficacy, stability, or bioavailability in patients. Then there is the hurdle of regulatory approval.

A drug made partially in orbit will have to satisfy FDA and EMA requirements for quality control, reproducibility, and safety. Regulatory pathways for space-manufactured pharmaceuticals are uncharted – agencies may require extensive bridging studies to ensure that “space-grown” is equivalent (or superior) to Earth-grown in every relevant aspect. This could slow down time-to-market for these novel formulations.

Logistics and scalability pose another challenge. While launch costs have dropped, orbit is still not easily accessible on demand. Missions must be scheduled months in advance, and things can go wrong (launch failures, reentry weather issues, etc.). For example, Varda’s ambitious goal of daily flights is aspirational; achieving even monthly cadence will require many vehicles, rapid refurbishment, and enough paying payloads to justify the frequency.

The current reality (as of 2025) is that only a handful of flights have been carried out by any one company. Production volume is very low – on the order of grams to a few kilograms of crystals per mission. Scaling to industrial quantities will demand orders-of-magnitude more flights or much larger spacecraft, as well as cost breakthroughs in reentry and recovery operations. Varda’s cofounder Delian Asparouhov has noted that their existing capsule can bring back about 50 kg of API per trip, which for certain high-value drugs could be an entire batch (several months’ supply).

However, not all drugs are so potent that 50 kg goes a long way. If a therapy needed tons per year, orbital manufacturing would struggle unless many capsules flew routinely.

There is also the question of market willingness. Pharmaceutical companies are known to be conservative with their supply chains and manufacturing processes – for good reason, given the high stakes of drug quality. Will big pharma widely adopt space-based processes? So far, their approach is cautious: experiment in orbit to gather data, but no one is betting their core production on it yet. We may need to see a clear “success story” – e.g., one drug that, thanks to space, gains FDA approval in a new form that helps patients and makes money – to truly open the floodgates.

Investors like Natural Capital (lead in Varda’s round) acknowledge this, saying that a single high-profile win could rapidly change perceptions in the pharma industry, turning space from a novelty into a credible tool.

Until then, startups must sustain themselves on venture funding, government grants/contracts (from NASA, ESA, DARPA, etc.), and early revenue from pilot projects or related services (for instance, Varda has been using its reentry capsules for hypersonic testing for defense clients as a revenue stream).

In summary, the market potential for space-enabled pharmaceuticals is large but will unfold gradually. The period of 2023–2025 has been about laying groundwork – proving technology, raising capital, and convincing stakeholders of the concept’s validity. This groundwork has been largely successful: we now have multiple private capsules that have flown and returned drug samples, compelling data on microgravity benefits, and increasing involvement from established pharma companies in experiments.

Looking forward, the next few years will be critical in translating these early wins into sustainable business. Key milestones to watch for include: the first commercial contract between a space manufacturing startup and a pharma company to develop a specific drug; regulatory submissions for a “space-made” drug formulation; the ramp-up of flight frequency with multiple capsules per launch (Varda plans to fly two capsules on one rocket in 2024 as a test of doubling capacity); and the entrance of new facilities like Axiom Station or Starlab that can host biotech payloads in orbit continuously.

Investors are advised to remain clear-eyed. There is plenty of hype around “industrializing low-Earth orbit,” but in pharma, the timelines are long and the proof is in the clinical outcomes. The next 2–3 years will likely focus on R&D and partnerships, not massive revenue – essentially a continuation of de-risking the science and engineering.

By the late 2020s, if one or two drugs enabled by microgravity show tangible patient benefits or cost savings, we can expect rapid scaling of space pharma ventures (and possibly M&A, as larger pharma or aerospace players acquire the most successful startups). On the other hand, if results disappoint – for example, if the improvements seen in orbit don’t justify the added complexity – some ventures may pivot or fold, and the market could remain a specialized niche.

At its core, medicine from space remains an experiment – a bold and exciting one grounded in real scientific phenomena, but an experiment nonetheless. 2025 finds us at an inflection point: the technology is finally catching up with decades of research hints, and capital is flowing to seize the opportunity. Now comes the hard part of execution in both space and on Earth.

If the pioneers succeed, the payoff could be transformative – drugs manufactured in orbit that improve life on Earth, and a new high-tech sector bridging aerospace and biotech. If they fail, it will serve as a reality check on the limits of the “new space” economy in the near term. For now, cautious optimism prevails among investors and researchers: the petri dish has left the planet, and all eyes are on what grows from it next.

Member discussion