The biopharma royalty market crosses $14 billion in annual deal flow as competition intensifies

The biopharma royalty financing market has emerged as a critical pillar of life sciences funding, with annual transaction volume reaching $14 billion at a 45% compound annual growth rate through 2025 according to Ernst & Young's 2025 Biotech Beyond Borders Report. This explosive growth reflects fundamental shifts in biotechnology financing, as companies increasingly turn to royalty monetization amid constrained traditional capital markets. The sector now addresses a $150+ billion annual funding gap in global biopharmaceutical R&D, positioning royalty investors at the center of innovation financing.

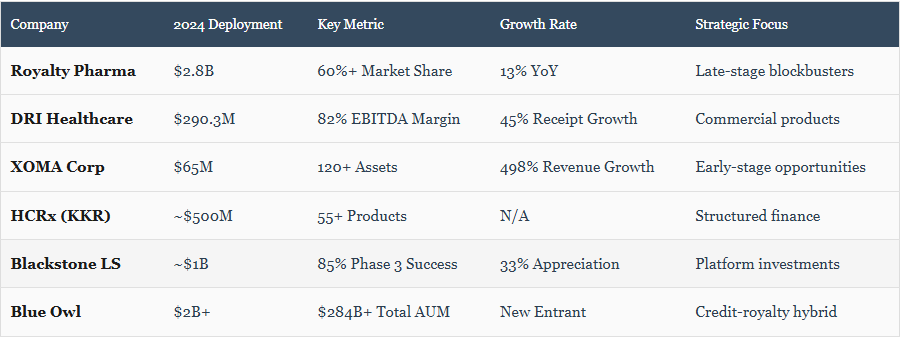

The transformation from niche financing tool to mainstream capital source accelerated dramatically in 2024-2025, driven by persistently challenging equity markets and the maturation of synthetic royalty structures. Major players deployed record capital—Royalty Pharma alone invested $2.8 billion across eight therapies in 2024, while announcing over $2.25 billion in new transactions through mid-2025. This activity surge coincides with a fundamental market restructuring as new entrants challenge established players, creating unprecedented competition for high-quality assets.

Market dynamics reshape as capital deployment surges

The biopharma royalty market demonstrated remarkable resilience and growth through 2024-2025, with total capital deployed expanding significantly beyond historical levels. Royalty transactions averaged $5.42 billion annualized in 2025, compared to $5.07 billion in 2024, marking sustained expansion even as broader biotechnology financing remained constrained. The average deal size grew from $160.6 million in 2024 to $225.9 million annualized for 2025, though upfront payments decreased to $114.9 million as milestone-based structures gained prominence.

Market concentration has evolved substantially from historical patterns. While three firms—Royalty Pharma, Healthcare Royalty Partners, and Blackstone Life Sciences—historically controlled 71% of royalty origination deal value, new entrants have disrupted this oligopoly. New investors drove almost 50% of total market value in recent periods, fundamentally altering competitive dynamics. The entry of major alternative asset managers like Blue Owl Capital, which deployed over $2 billion in healthcare investments within 18 months of serious market entry, exemplifies this transformation.

Deal volumes tell only part of the story. The market has witnessed a fundamental shift in transaction structures, with synthetic royalties growing at 33% annually from 2020-2024, significantly outpacing traditional royalty acquisitions. Royalty Pharma alone announced $925 million in synthetic royalty funding in 2024, marking a record year for this structure. These synthetic arrangements, which involve direct sales of future product revenue percentages rather than existing royalty streams, offer companies greater flexibility while maintaining operational control.

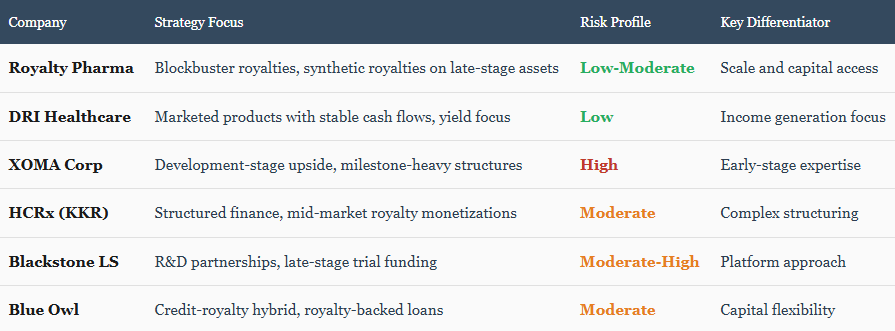

The competitive landscape now features diverse participants across the capital spectrum. Traditional royalty specialists compete with private equity giants, specialized life sciences funds, institutional investors, and even pharmaceutical corporate venture arms. This proliferation of capital sources has begun pressuring pricing, though exact compression metrics remain proprietary. Traditional pharmaceutical royalty rates span from 7-15% for commercial-stage products, with pre-approval assets commanding lower rates due to regulatory and commercial risks.

Six major players dominate with distinct strategies

Royalty Pharma maintains market leadership through scale

Royalty Pharma towers over competitors with over 60% global market share and unmatched transaction capacity. The company's 2024 performance showcased this dominance: $2.801 billion in portfolio receipts, $2.8 billion deployed across eight new therapies, and maintenance of $929 million in cash despite aggressive investments. The firm's portfolio spans 15 blockbuster products generating over $1 billion annually, anchored by the Vertex cystic fibrosis franchise contributing $857 million in 2024 royalty receipts.

Strategic execution reached new heights with the $1.1 billion management internalization completed in May 2025, eliminating the 6.5% management fee on portfolio receipts and generating expected savings of $175+ million annually by 2030. Combined with a new $3 billion share repurchase program, these moves position Royalty Pharma for enhanced shareholder returns while maintaining deal flow leadership. The company's stock trades at approximately 19.1x normalized P/E with analysts projecting continued double-digit growth through 2026.

Recent transactions underscore Royalty Pharma's evolution toward larger, more complex structures. The landmark $2 billion Revolution Medicines partnership—combining a $1.25 billion synthetic royalty with $750 million in secured debt—represents the sector's largest and most sophisticated transaction to date. Similarly, the $885 million Imdelltra acquisition from BeOne Medicines demonstrates willingness to pay premium valuations for high-conviction oncology assets with clear commercial trajectories.

DRI Healthcare Trust accelerates growth post-governance reforms

DRI Healthcare Trust emerged from governance challenges with remarkable momentum, deploying $290.3 million across four strategic transactions in 2024 while achieving 45% growth in normalized cash receipts to $190 million. The Trust's portfolio now encompasses 28 royalty streams across 21 products, generating $187.5 million in total income with an impressive 82% adjusted EBITDA margin.

Portfolio composition reflects strategic diversification across therapeutic areas and development stages. Recent acquisitions demonstrate evolving risk appetite: the $115 million Omidria expansion eliminated royalty caps while securing 30% of U.S. net sales through 2031, while the $57 million Casgevy gene therapy investment marks entry into cutting-edge CRISPR technology. The $179 million sebetralstat acquisition for hereditary angioedema, pending FDA approval with a June 2025 PDUFA date, exemplifies late-stage development bets.

Financial performance validates the Trust's strategy. Adjusted EBITDA grew 36.8% to $156.6 million in 2024, supporting a 17.6% distribution increase to $0.10 per unit quarterly in 2025. Management projects 2025 royalty income of $172-182 million excluding milestones and new transactions, suggesting sustainable growth momentum. With CAD $813 million market capitalization and analyst price targets averaging CAD $17.33 (29% upside), DRI Healthcare offers compelling value in the public royalty sector.

XOMA Corporation transforms into specialized aggregator

XOMA's metamorphosis from traditional biotech to royalty aggregator accelerated dramatically in 2024-2025, culminating in the July 2024 corporate rebrand to XOMA Royalty Corporation. The transformation leveraged 35+ years of antibody expertise and $1 billion in historical R&D investments to create a unique early-stage royalty platform. Portfolio expansion was explosive: doubling to 120+ assets through five transactions deploying $65 million in 2024 alone.

The company's differentiated strategy targets pre-commercial opportunities overlooked by larger competitors. XOMA remains the only major aggregator willing to acquire Phase 1/2 assets, exemplified by the $15 million Twist Bioscience transaction securing economic interests in 60+ early-stage programs. This approach yielded 498% revenue growth to $28.5 million in 2024, with cash receipts reaching $46.3 million. The portfolio now includes six commercial products, 11 Phase 3 assets, and over 100 earlier-stage programs.

Recent corporate acquisitions demonstrate aggressive expansion tactics. The completed Turnstone Biologics acquisition and pending deals for HilleVax ($1.95/share), LAVA Therapeutics ($1.16-1.24/share), and Mural Oncology ($2.035/share) add significant pipeline depth. With over $100 million in cash and multiple near-term catalysts including December 2025 Phase 3 data for ersodetug in congenital hyperinsulinism, XOMA offers high-risk, high-reward exposure to royalty sector growth.

HCRx gains strategic backing through KKR acquisition

Healthcare Royalty Partners' July 2025 acquisition by KKR marks a pivotal strategic evolution for the 19-year-old firm. While financial terms remained undisclosed, the transaction provides HCRx access to KKR's vast capital resources and global network while maintaining operational independence under CEO Clarke Futch's continued leadership. The combined platform manages approximately $3 billion in assets with over $7 billion in cumulative commitments since inception.

HCRx's portfolio spans 55+ products across 10+ therapeutic areas, demonstrating exceptional diversification. Recent transactions highlight continued market leadership in structured financings: up to €185 million for IQIRVO (elafibranor) across multiple tranches, $250 million for BRIUMVI debt financing, and $150 million senior debt for NEXLETOL/NEXLIZET. The firm's expertise in complex, multi-tranche structures positions it uniquely for sophisticated counterparties seeking flexible capital solutions.

Integration with KKR's broader healthcare portfolio—including BridgeBio Pharma, Dawn Bio, and Immedica Pharma—creates significant synergies. Enhanced capital deployment capabilities enable larger transactions while maintaining HCRx's specialized royalty monetization focus. With offices across Stamford, San Francisco, Boston, London, and Miami, the platform possesses global reach to source and execute increasingly complex international transactions.

Blackstone Life Sciences deploys record capital

Blackstone Life Sciences emerged as the sector's most aggressive capital deployer, leveraging its $4.6 billion BXLS V fund—the largest life sciences private fund ever raised—alongside the $1.6 billion inaugural BXLS Yield royalty and structured credit vehicle. Total platform assets exceed $10 billion, with a new $5+ billion fund targeting 2025 launch. The platform's 33% appreciation rate in 2024 and 85% Phase III success rate (versus 48% industry average) validate its late-stage, de-risked investment approach.

Landmark transactions define Blackstone's market presence. The $2 billion Alnylam collaboration including 50% royalty interest in inclisiran/Leqvio remains the largest pre-profitability biotech financing, while the $750 million Moderna partnership for influenza mRNA vaccines demonstrates continued appetite for platform technologies. The April 2025 sale of Anthos Therapeutics to Novartis for $3.1 billion exemplifies successful ownership strategy execution, generating exceptional returns for limited partners.

Strategic differentiation comes through Blackstone's three-pronged approach: collaboration funding for established companies, ownership positions in emerging biotechs, and non-dilutive royalty/credit structures. Recent additions like former Pfizer Chief Scientific Officer Mikael Dolsten as Senior Adviser strengthen scientific expertise. Focus areas span oncology, infectious diseases, metabolic conditions, and rare diseases, with emphasis on late-stage, commercially validated opportunities.

Blue Owl Capital rapidly builds healthcare platform

Blue Owl Capital's healthcare royalty expansion represents the most dramatic new entrant success story. Following the Q4 2023 acquisition of Cowen Healthcare Investments' ~$1 billion in assets, Blue Owl deployed over $2 billion in healthcare investments within 18 months3. The firm's $284+ billion total AUM provides unmatched capital access for large-scale transactions, exemplified by the $1.25 billion BridgeBio partnership combining $450 million in term loans with $300 million in royalty financing.

Strategic positioning leverages Blue Owl's multi-platform capabilities across credit, equity, and royalty structures. The $250 million co-investment with Healthcare Royalty for TG Therapeutics' BRIUMVI demonstrates collaborative approach with established specialists. Recent transactions like the $262.5 million ITM Isotope facility for radiopharmaceutical development and $500 million Madrigal term loan showcase expanding therapeutic reach.

Leadership under Sandip Agarwala (formerly of Longitude Capital) and Kevin Raidy (ex-Cowen) brings deep sector expertise to Blue Owl's vast capital base. The integrated "Blue Owl Healthcare Opportunities" platform focuses on mid-to-late-stage equity investments complementing credit and royalty strategies. This comprehensive approach positions Blue Owl to capture opportunities across the entire biopharma capital structure, from early-stage venture to commercial-stage royalties.

Market share analysis reveals shifting competitive dynamics

Capital deployment patterns illuminate dramatic market evolution. Royalty Pharma maintains dominance with $2.8 billion deployed in 2024 and over $2.25 billion announced in 2025 through August, representing approximately 35-40% of total market activity. However, this marks a decline from historical 60%+ market share as competition intensifies. The emergence of Blue Owl Capital as a major force—deploying comparable capital to established players within months of serious market entry—exemplifies rapid competitive shifts.

Transaction count analysis reveals further fragmentation. Gibson Dunn tracked 102 publicly announced transactions from 2020-2024 among major players, with deal frequency accelerating substantially in 2024-2025. While Royalty Pharma participates in the highest-value transactions, mid-market deals increasingly go to specialized players like HCRx or newer entrants. The average deal size bifurcation—mega-deals exceeding $500 million versus numerous sub-$100 million transactions—creates distinct competitive segments.

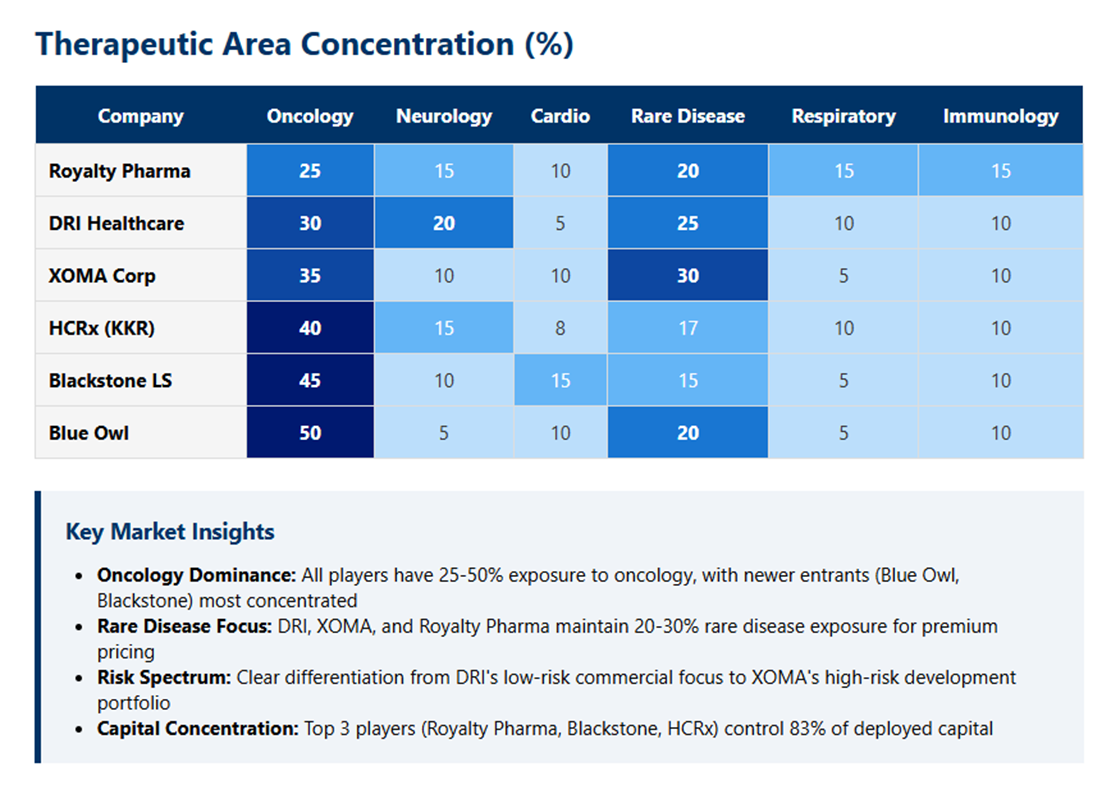

Market share by therapeutic area demonstrates strategic differentiation. Royalty Pharma dominates oncology with recent blockbuster acquisitions, while DRI Healthcare shows strength in ophthalmology and rare diseases. Blackstone Life Sciences leverages platform company relationships for cardiovascular and metabolic opportunities. XOMA's early-stage focus creates minimal overlap with commercial-stage competitors, carving out a unique market niche.

Competitive intensity manifests in evolving deal structures and pricing. Bidding processes have become increasingly structured, with multiple parties competing for attractive assets. Synthetic royalty adoption accelerated as companies recognized enhanced flexibility versus traditional structures. Pricing compression remains difficult to quantify precisely, but market participants report increased competition affecting returns, particularly for lower-risk commercial assets.

New market entrants transformed competitive dynamics fundamentally. Private equity giants like KKR (acquiring Healthcare Royalty), alternative asset managers like Blue Owl Capital, specialized funds like Bain Capital Life Sciences, and corporate venture arms all entered aggressively. These new participants drove almost 50% of total market value in recent periods, breaking the historical oligopoly of three firms controlling 71% of origination value.

Recent mega-deals redefine transaction sophistication

Revolution Medicines secures largest royalty financing in industry history

The $2 billion Revolution Medicines-Royalty Pharma partnership announced June 24, 2025, establishes new benchmarks for scale and structure. The transaction's $1.25 billion synthetic royalty component involves five $250 million tranches tied to development milestones, with the first two tranches mandatory upon positive Phase 3 data. Royalty rates on daraxonrasib range from 7.80% on initial sales to 0.75% on $6-8 billion, creating aligned incentives while preserving Revolution's upside.

The $750 million secured debt facility at SOFR + 5.75% provides additional flexibility, with initial funding contingent on FDA approval for metastatic pancreatic cancer. This hybrid structure enables Revolution Medicines to pursue independent global commercialization of daraxonrasib—potentially the first therapy to inhibit all major RAS forms affecting ~116,000 patients annually in pancreatic and non-small cell lung cancers.

BridgeBio's strategic royalty monetizations preserve upside

BridgeBio's sequential royalty transactions demonstrate sophisticated portfolio management. The June 2025 $300 million European royalty monetization with Healthcare Royalty and Blue Owl Capital involves selling 60% of royalties on first $500 million in annual European BEYONTTRA sales, capped at 1.45x the initial payment. This structure preserves unlimited upside beyond the cap while providing immediate capital for U.S. commercialization.

Combined with Bayer's $210 million upfront payment plus potential $75 million in near-term milestones for European rights, BridgeBio accessed nearly $600 million in non-dilutive financing while retaining majority economics. BEYONTTRA's U.S. approval in November 2024 triggered $500 million in milestone payments, validating the asset's value. With 1,028 unique prescriptions by February 2025 and demonstrated 42% reduction in cardiovascular events, commercial trajectory supports aggressive monetization strategy.

TG Therapeutics leverages BRIUMVI success for growth capital

TG Therapeutics' $250 million credit facility from Healthcare Royalty and Blue Owl Capital exemplifies commercial-stage royalty financing. Secured by BRIUMVI revenues—$365 million in 2024 growing to projected $570-575 million in 2025—the five-year facility enabled debt refinancing and a $100 million share buyback program. Q2 2025 revenues of $138.8 million (+91% year-over-year) demonstrate robust commercial execution supporting the financing.

The earlier Neuraxpharm partnership providing up to $645 million for ex-U.S. rights validates BRIUMVI's global potential. With $140 million upfront plus potential $492.5 million in milestones and tiered royalties up to 30%, TG Therapeutics maximized value while focusing on U.S. commercialization. This dual-track monetization strategy—U.S. debt financing plus international partnership—optimizes capital efficiency while preserving upside.

Portfolio composition trends toward risk diversification

Therapeutic area allocation across major players reveals strategic portfolio construction evolution. Oncology maintains the largest allocation at 25-30% of portfolio value for most firms, reflecting the therapeutic area's 31% share of the global biopharma market and $82 billion in annual R&D investment. However, concentration risk management prevents any single therapeutic area from exceeding 30% of portfolio value, driving diversification into rare diseases, neuroscience, and immunology.

Clinical stage distribution shifted markedly toward later-stage assets. Royalty Pharma maintains approximately 62% commercial products versus 38% development-stage assets, while newer entrants like XOMA deliberately target earlier opportunities with 100+ pre-clinical to Phase 2 programs complementing 6 commercial and 11 Phase 3 assets. This barbell approach—either fully de-risked commercial or high-reward early-stage—reflects market bifurcation as mid-stage development becomes less attractive.

Risk profiles evolved with market maturation. Historical industry-wide clinical development success rates of ~14.3% from Phase I to approval improve dramatically for Phase 3 assets at 60-70% success probability. Blackstone Life Sciences' 85% Phase 3 success rate demonstrates superior asset selection, while Royalty Pharma's 77% success rate for development-stage acquisitions validates diligence processes. Portfolio construction increasingly emphasizes quantifiable risk metrics over qualitative assessments.

Product concentration management became paramount as portfolios scaled. Royalty Pharma's Vertex CF franchise, contributing ~30% of 2022 portfolio receipts, is expected to decline to mid-teens percentage by 2030 through portfolio expansion. DRI Healthcare maintains no single asset above 15% concentration across 28 royalty streams. This active concentration management protects against single-product risks while maintaining exposure to blockbuster upside.

Emerging trends reshape industry structure and competition

Synthetic royalty adoption accelerated dramatically, growing 33% annually from 2020-2024 versus traditional royalty purchases. These structures, involving direct sales of future revenue percentages on products companies continue to own and commercialize, offer superior flexibility. Companies retain operational control while accessing significant capital, explaining why Royalty Pharma's $925 million in 2024 synthetic royalty funding marked a record year for the structure.

Hybrid financing structures gained prominence as companies sought optimal capital solutions. Revolution Medicines' combination of synthetic royalty and secured debt, BridgeBio's partial royalty sales preserving upside, and milestone-heavy transactions reducing upfront capital requirements exemplify structural innovation. Royalty-backed loans emerged as another variant, using future royalty streams as collateral for immediate liquidity while retaining long-term economics.

Competitive bidding dynamics intensified with new entrant proliferation. Multiple parties now compete for attractive assets through structured auction processes, contrasting with historical bilateral negotiations. This competition pressures pricing, particularly for lower-risk commercial assets where return expectations compressed. Geographic expansion into Europe and Asia-Pacific markets provides some relief from U.S. market competition.

Pricing evolution reflects market maturation and competition. Traditional pharmaceutical royalty rates spanning 7-15% for commercial products face downward pressure from capital abundance. Pre-approval assets command lower rates given regulatory risks, while synthetic royalties often price below traditional structures due to retained upside. Milestone-based payments reduce effective rates by deferring capital deployment until value inflection points.

New market entrants transformed competitive dynamics fundamentally. Private equity giants like KKR (acquiring Healthcare Royalty), alternative asset managers like Blue Owl Capital, specialized funds like Bain Capital Life Sciences, and corporate venture arms all entered aggressively. These new participants drove almost 50% of total market value in recent periods, breaking the historical oligopoly of three firms controlling 71% of origination value.

Financial performance validates sector attractiveness

Public company metrics demonstrate robust financial health across the sector. Royalty Pharma's $2.801 billion in 2024 portfolio receipts grew 13% year-over-year excluding one-time items, generating $2.565 billion in adjusted EBITDA. The company guides for $2.9-3.05 billion in 2025 portfolio receipts, representing 4-9% growth despite tough comparisons. With $929 million in cash against $7.8 billion in debt, leverage remains manageable at approximately 3x net debt to EBITDA.

DRI Healthcare's transformation is even more dramatic: 45% growth in normalized cash receipts to $190 million drove adjusted EBITDA up 36.8% to $156.6 million. The 82% EBITDA margin highlights the model's operational efficiency. Management projects $172-182 million in 2025 royalty income excluding new transactions, suggesting sustainable organic growth. Trading at CAD $13.40-14.49 against CAD $17.33 average analyst targets implies 29% upside potential.

XOMA's early-stage focus yields different metrics but equally impressive growth. Revenue exploded 498% to $28.5 million in 2024 with total cash receipts of $46.3 million. The company maintains over $100 million in cash while aggressively expanding through corporate acquisitions. Preferred stockholders receive 8.625% (Series A) and 8.375% (Series B) dividends, providing attractive yield in the current rate environment.

Private company performance, while less transparent, appears equally robust. Healthcare Royalty's $3.47 billion AUM and $5+ billion historical deployment demonstrate sustained growth. Blackstone Life Sciences' 33% appreciation rate in 2024 and successful exits like the $3.1 billion Anthos sale validate the strategy. Blue Owl's ability to deploy $2+ billion within 18 months of serious market entry3 confirms abundant attractive opportunities.

Distribution and shareholder returns remain strong across public companies. Royalty Pharma's $3 billion share repurchase authorization plus consistent dividends, DRI Healthcare's 17.6% distribution increase, and XOMA's high preferred dividends demonstrate cash generation strength. These returns, combined with equity appreciation potential, create compelling total return profiles in a sector benefiting from powerful secular trends.

Future catalysts position sector for continued expansion

The biopharma royalty market faces extraordinary growth catalysts through 2026. A $300+ billion patent cliff threatening major pharmaceutical revenues from 2026-2030 will drive aggressive business development and create royalty acquisition opportunities. Simultaneously, the $150+ billion annual funding gap1 between R&D requirements and available capital ensures sustained demand for alternative financing. With traditional IPO markets delivering only 30 offerings raising $4 billion in 2024 versus historical norms, royalty financing's relative attractiveness continues increasing.

Artificial intelligence promises to revolutionize drug discovery economics. With 30% of new drugs by 2025 expected to utilize AI development tools, potentially reducing costs 25-50%, the volume of developable assets requiring funding will expand dramatically. This pipeline expansion benefits royalty investors through increased deal flow and improved success rates. Early AI-discovered drugs entering late-stage development create near-term investment opportunities.

New product launches provide immediate growth drivers. Royalty Pharma's portfolio includes five major 2025 launches: Servier's Voranigo for brain cancer, Bristol Myers Squibb's Cobenfy for schizophrenia, Ascendis' Yorvipath for hypoparathyroidism, Syndax/Incyte's Niktimvo for chronic GVHD, and Geron's Rytelo for myelodysplastic syndromes. These launches, combined with 11 Phase 3 readouts expected across portfolios, create multiple value inflection points.

Market structure evolution continues favoring sophisticated royalty investors. The shift from bilateral negotiations to competitive auctions, adoption of complex hybrid structures, and expansion into new therapeutic areas and geographies creates opportunities for differentiated strategies. Firms with specialized expertise, flexible capital structures, and global reach position best for this evolving landscape.

Industry consolidation appears inevitable given over 20 active participants competing for limited high-quality assets. The KKR-Healthcare Royalty transaction may catalyze further M&A as subscale players seek enhanced capital access. Alternatively, pharmaceutical companies might acquire royalty portfolios to augment pipelines, as precedented by Roche's acquisition of Flatiron Health. These structural changes could fundamentally reshape competitive dynamics.

The royalty revolution transforms biopharma financing permanently

The biopharma royalty financing market's evolution from niche tool to essential funding mechanism represents a fundamental shift in life sciences capital formation. With $14 billion in annual deal flow growing at 45% CAGR, the sector now provides critical funding for innovation while offering investors attractive risk-adjusted returns uncorrelated with broader markets. The entry of major alternative asset managers, proliferation of synthetic royalty structures, and sustained demand from capital-constrained biotechnology companies ensure continued expansion through 2026 and beyond.

Market leadership remains concentrated but increasingly contested. Royalty Pharma's 60% market share and $2.8 billion annual deployment capacity provide unmatched scale, yet aggressive new entrants like Blue Owl Capital demonstrate that established positions face genuine competition. The diversity of strategies—from XOMA's early-stage focus to Blackstone's late-stage concentration—creates a rich ecosystem serving varied company needs across development stages.

Financial performance validates the model's sustainability. Public companies generate robust cash flows with EBITDA margins exceeding 80%, while private players report strong returns justifying continued fundraising. The sector's ability to thrive despite challenging broader market conditions demonstrates resilience that attracts both companies seeking capital and investors seeking returns. With multiple growth catalysts including AI-driven discovery, patent cliff opportunities, and expanding global markets, biopharma royalty financing has permanently transformed from alternative option to mainstream solution.

The implications extend beyond immediate market participants. As royalty financing matures into an essential component of biopharma capital structure, it enables continued innovation despite traditional funding constraints. Companies retain operational flexibility while accessing growth capital, investors achieve portfolio diversification with attractive yields, and ultimately, patients benefit from sustained therapeutic development. The biopharma royalty market hasn't just grown—it has fundamentally reshaped how life sciences innovation gets funded in the 21st century.

Member discussion