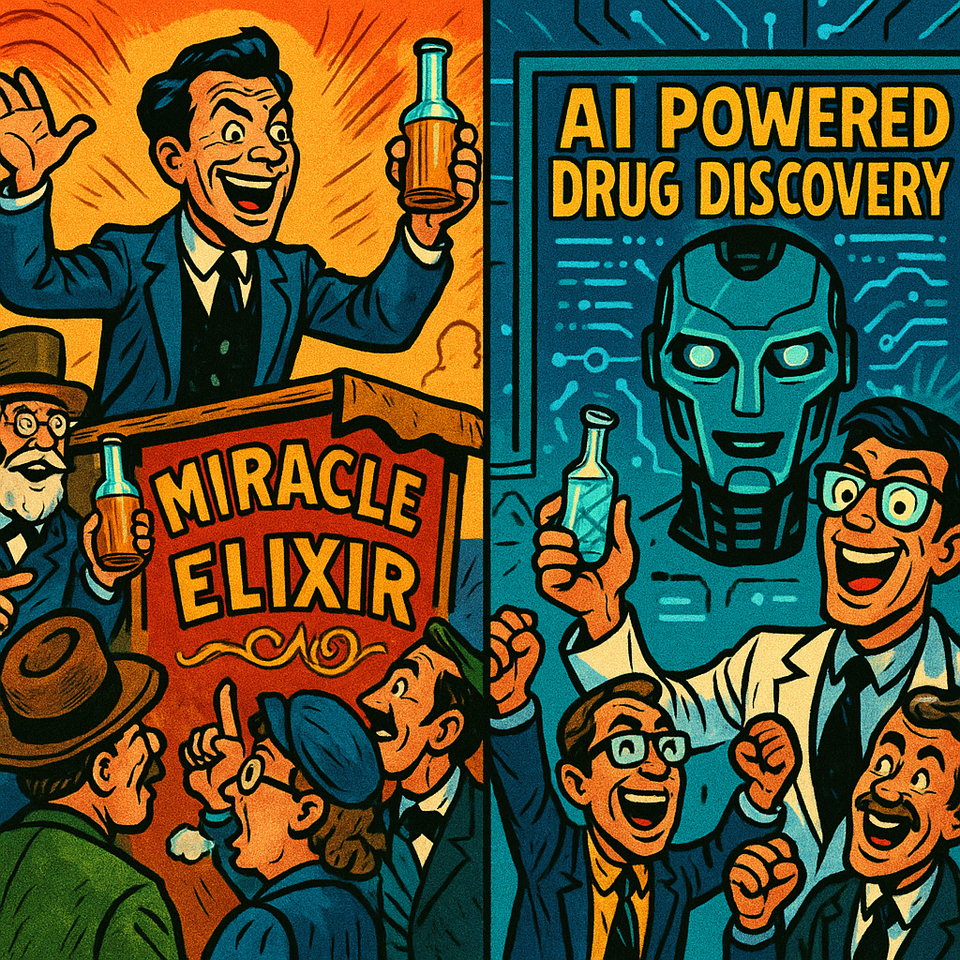

The great AI medicine show

In the late 19th century, traveling medicine shows peddled cure-all elixirs with flamboyant claims. Today’s equivalent in biotech is the “AI-powered” drug discovery platform. Startups boasting deus ex machina algorithms promise to conjure new cures in silico, compressing years of laboratory toil into months of number-crunching. Investors, fearful of missing out on the next big thing, have poured billions into this prospect.

The result is a surge of press releases touting “revolutionary” breakthroughs by artificial intelligence – often with precious little detail to back them up. The biotech industry, ever hungry for an edge in the costly hunt for new drugs, has eagerly embraced the rhetoric. But separating genuine innovation from marketing pixie dust is no mean feat.

AI’s allure – and the ensuing hype – is understandable. Drug development remains a slow, expensive slog: a decade of work and well over a billion dollars on average to bring a single new medicine to market. Any technology that might “radically improve the timely creation of high-quality drug candidates” is bound to grab attention. Already the market for AI in drug discovery is valued around $1.4 billion and projected to reach $3.7 billion by 2027 (cambridgenetwork.co.uk).

Dozens of startups have hung out their shingles as “AI-driven” biotechs. Their pitches often overflow with superlatives – offering “unprecedented levels of efficacy and precision” or “revolutionary drug discovery engines”. The promise is beguiling: algorithms that can sift colossal chemical libraries or pinpoint hidden disease mechanisms, succeeding where human intuition fails. It is a narrative of Silicon Valley magic meeting Big Pharma’s heft, with the potential (so it’s said) to shrink R&D timelines from years to months and save billions in costs. Little wonder that from 2015 to 2021 investor funding in AI-biotechs swelled dramatically, and even pharma giants formed dozens of partnerships with AI upstarts.

Yet as with past tech revolutions in biotech – think combinatorial chemistry in the 1990s or genomics in the 2000s – early exuberance is colliding with reality. In private, pharma old-timers mutter that they’ve “seen this movie before.” Initial results from the first wave of AI-designed drugs, now creeping into clinical trials, have been a mixed bag at best. Not a single new drug fully discovered by AI has reached regulatory approval as of mid-2025.

The road from flashy algorithm to lifesaving pill remains long and treacherous, and machine learning has not repealed the iron laws of biology. Even so, AI has scored some undeniable wins – enough to keep the dream alive, but not enough to fulfill the most grandiose promises (at least not yet).

To understand how to detect real substance versus hype, consider a few case studies from AI-biotech’s frontlines. Some firms truly leverage AI to speed up discovery; others merely sprinkle the term like magical fairy dust in their investor decks. We will tour a few of each, before drawing out the tell-tale signs that investors and analysts should watch for.

A timeline of hype and reality

Before the case studies, it helps to review the recent history of AI in drug development – a field moving fast, yet not as fast as its boosters predicted:

2012

Atomwise, one of the first startups billing itself as AI-first in drug discovery, is founded in Silicon Valley. It pioneers using neural networks for virtual screening of molecules, setting the template for a wave of imitators.

2014

Recursion Pharmaceuticals, a spin-out from the University of Utah, boldly sets a goal to “develop 100 drugs in 10 years.” The audacious target (ten times the output of a big pharma) exemplifies the early hubris around AI-driven efficiency (healthcare.utah.edu).

2019

Insilico Medicine, a Hong Kong-based upstart, uses a generative adversarial network to design a novel drug candidate for fibrosis in just 46 days – a proof-of-concept feat that garners global headlines. (The compound was preclinical, but the speed dazzled observers and signaled AI’s potential.)

2020

UK-based Exscientia announces that its AI-designed molecule for obsessive-compulsive disorder (created in partnership with Sumitomo Dainippon Pharma) has entered a Phase I trial – the world’s first AI-designed drug to be tested in humans. The drug, for OCD, took under 12 months from project start to clinical candidate, compared to ~5 years typically (labiotech.eu), showcasing a dramatic acceleration.

2021

Insilico’s AI-discovered anti-fibrotic drug ISM001-055 becomes one of the first AI-originated molecules to reach human trials. The company not only identified a novel biological target using AI, but also generated a novel small-molecule drug for it “in less than 18 months” at a cost of only $2.6 million– peanuts by pharma standards.

Venture capital flows into the sector hit a record high: Insilico itself raised $255 million to push its programs toward the clinic (fiercebiotech.com), and other startups like Exscientia and Absci ink mega-deals or IPOs. AI-driven drug discovery is officially “hot.”

2022

The hype peaks. BenevolentAI, another British AI-drug startup, goes public via Europe’s largest-ever biotech SPAC at a valuation of €1.5 billion. Big Pharma firms, from Roche to Pfizer, trumpet AI collaborations.

(Sanofi, for instance, signs a partnership with Exscientia worth up to $5.2 billion, including $100 million upfront, to use AI in designing new pills.)

Alphabet’s DeepMind spins off Isomorphic Labs to apply the AlphaFold breakthrough (predicting protein structures by AI) to drug discovery. Commentators breathlessly talk of AI “reinventing drug discovery from scratch,” predicting that by 2025 “four or five AI-developed treatments” could be in late-stage trials (economist.com).

2023

The mood begins to sober. In early 2025 would later reveal that some much-hyped companies were overstating their AI prowess – for example, startups Absci and Generate Biomedicines claimed to design drugs “from scratch” with AI, but internal data showed they were mostly tweaking known molecules. Investors start asking harder questions.

A global biotech downturn and rising interest rates also take froth out of the market. AI drug startups, many still years from revenue, find that patience is wearing thin.

2024 – Reality bites

In a landmark consolidation, Recursion merges with Exscientia to pool their resources. The combined company – one specializing in high-throughput biology, the other in AI-driven chemistry – cites “synergies” and a robust joint pipeline of 10 clinical programs slated to read out in the next 18 months. Unspoken is the fact that both firms had seen their stock prices sink since initial exuberance; together they have ~$850 million in cash to weather the long haul.

BenevolentAI, meanwhile, suffers a high-profile setback: its leading internal drug candidate (for atopic dermatitis) flops in Phase II, forcing layoffs and a CEO departure. The company announces a strategic “refocusing” to return to its tech-platform roots – effectively conceding that developing drugs in-house is tougher than advertised.

On a brighter note, Insilico reports positive Phase IIa results for its AI-designed fibrosis drug, showing a dose-dependent improvement in lung function (prnewswire.com). It marks the first time a novel AI-discovered molecule demonstrated efficacy signals in patients, a genuine milestone for the field.

2025

As the dust settles, the industry inches forward more modestly. Several AI-designed drugs are now in early and mid clinical trials (roughly two dozen globally), but most are in Phase I or II. The Economist notes that “four or five” could reach Phase III by 2025 (economist.com) – a “small sample” but a start.

No one is expecting miracles overnight. Investors have grown more hard-nosed, insisting on seeing data rather than sci-fi narratives. The AI drug discovery story enters its next chapter, with progress measured in proven results instead of puffery.

This chronology sets the stage. Now, let’s examine a few protagonists of this drama – some who have epitomized the hype, and some who have shown real substance.

Case study 1: Atomwise – When the algorithm leads, but no one follows

Founded in 2012, Atomwise was a trailblazer in applying deep learning to drug discovery. Its technology, based on convolutional neural networks, aims to predict which molecules will bind to a given protein – essentially supercharging the screening process that chemists use to find “hits.”

Early on, Atomwise garnered accolades and partnerships. The company proudly announced collaborations with big names like Merck and Bayer, and by 2020 it had raised over $170 million in venture funding (including a $123 million Series B round). By all appearances, it was a leader in the AI drug gold rush.

Beneath the glossy press releases, however, Atomwise’s story serves as a cautionary tale. More than a decade since its founding, Atomwise has no drug molecules in clinical trials – not one. Its business model has largely been fee-for-service partnerships: applying its AI to screen compounds for pharma clients, generating predictions of hits that the clients then pursue (or, often, quietly shelve). Insiders note that Atomwise built a strong team of computational chemists but “lacked drug discovery operations” in the traditional sense.

It had plenty of virtual output, but far fewer tangible drug leads that it could call its own. In 2022, Atomwise struck a high-profile deal with Sanofi, which paid $20 million upfront for AI-generated leads against five targets. But producing a few “lead compounds” is a far cry from developing a viable drug. As one industry observer dryly noted, “It is quite an effort to deliver a set of lead compounds. That upfront may be spent by now” (linkedin.com).

Indeed, deal-making can buy time and cash, but it does not guarantee scientific breakthroughs.

By late 2023, murmurs grew that Atomwise was struggling to deliver. The ultimate red flag came when its co-founder and CEO, the charismatic Abe Heifets, quietly departed the company (his profile and name vanishing from the website). The departure, confirmed in October 2024, was a signal that all was not well. Investors had expected Atomwise – one of the earliest AI drug startups – to have at least something in the clinic by now. The fact that it hadn’t suggested that either the technology was overhyped or the company’s execution was lacking (or both).

Atomwise’s story illustrates a key point: AI alone doesn’t make a drug. You can have world-class algorithms, but without the right experimental follow-through and biological insight, you may end up with lots of theoretical predictions and no real medicines. The company remains privately held and has a pipeline chart on its website – but its “Assets” are all preclinical, many only at the “hit to lead” stage.

For all its partnerships, Atomwise “will need to advance their own pipeline” to survive, as one expert observed (linkedin.com). In other words, they eventually must play by the same rules as any biotech: produce drug candidates that actually help patients. Until they do, skepticism is warranted.

Telltale signs

Atomwise’s experience offers a few lessons in spotting hype. The company frequently touted technical achievements (faster screening, lots of compounds analyzed) but provided little concrete data on outcomes. No trials, no peer-reviewed papers showing that its predictions led to potent drugs – just press releases about partnerships.

It’s a red flag when a biotech extols its process but can’t point to any product. Atomwise also set ambitious goals (sometimes hinting it could virtually eliminate the need for lab screening) yet seemed to pivot to a service model when those goals proved hard. Finally, leadership churn – especially the exit of a founder – can be a warning sign in any company claiming a breakthrough; in Atomwise’s case it hinted that the breakthrough hadn’t materialized.

Case study 2: BenevolentAI – Big promises, big setbacks

If one company embodied the AI drug discovery hype cycle, it might be BenevolentAI. Founded in 2013 in London, Benevolent initially portrayed itself as a full-stack AI outfit that could do it all: identify novel targets, design new drugs, even repurpose existing ones, all with its in-house machine learning platform. The company attracted luminary investors and at one point was Britain’s highest-valued private biotech. By 2018 it claimed to have dozens of drug programs underway.

In 2020, BenevolentAI made headlines for using its AI to sift through existing medicines and suggest baricitinib (an arthritis drug) as a potential treatment for COVID-19 – a recommendation that proved prescient, as baricitinib indeed showed benefit in trials and was later approved for COVID (medcitynews.com). This boosted Benevolent’s image as a company whose AI could actually find something useful in the real world.

The crowning moment of hype came in April 2022, when BenevolentAI went public via a SPAC merger that valued it at €1.5 billion. It was Europe’s largest-ever SPAC deal in the biotech sector. The listing documents boasted of 20+ programs in its pipeline and partnerships with heavyweights like AstraZeneca, Novartis, and Eli Lilly.

At least on paper, BenevolentAI looked formidable: hundreds of employees, state-of-the-art labs in Cambridge, and a dual strategy of collaborating with pharma on AI-identified targets while developing its own drugs in-house.

Then reality set in. Over the next two years, Benevolent’s shine faded. One by one, some of those pipeline programs quietly stalled. The most advanced internal drug – a compound for atopic dermatitis – failed to show efficacy in a Phase II trial (it “did not reduce itch and inflammation” in patients). Millions had been spent, but the drug was a dud. In early 2023, facing this disappointment, the company undertook a major restructuring: it laid off staff, shelved some projects, and replaced its CEO (the incoming chief, a pharma veteran, lasted barely 8 months before he too departed).

By late 2024, BenevolentAI announced it would “return to its tech roots” – essentially pivoting back to being a platform provider rather than a drug developer. Tellingly, it also declared intent to take the company private again. As a public company, Benevolent’s stock had plunged over 80% from its debut amid a broader biotech slump and the company’s own lack of tangible progress (app.dealroom.com).

Management argued that escaping the glare of the public markets would allow them to focus on long-term goals. Perhaps so, but from an investor’s standpoint it was a climb-down from the lofty hype of the SPAC merger.

None of this is to say BenevolentAI is a fraud – far from it. The company has serious scientists and did break new ground with some of its AI tools. It delivered genuine contributions, like the COVID drug repurposing and identifying novel biological targets for collaborators (AstraZeneca has publicly taken forward a couple of AI-suggested targets for chronic kidney disease and fibrosis). But the gap between promise and performance was glaring.

Benevolent exemplified a firm that talked as if AI would fundamentally upend drug R&D, yet ultimately learned that drug R&D still involves a lot of old-fashioned trial and error. In its SPAC heyday, the company’s language was decidedly optimistic: it would “radically transform” how medicines are discovered. After some bruising lessons, its tone now is more circumspect: focusing on providing tools to others and partnering its internal assets earlier.

Telltale signs

What can an observer glean from the BenevolentAI saga?

First, watch those pipelines. At the time of its SPAC, Benevolent listed many programs, but closer inspection showed most were in very early stages (discovery or preclinical). The few that had reached clinical trials were small Phase I safety studies, not efficacy trials. An investor would be wise to discount lofty valuations when no program had yet proven itself in patients.

Second, be wary of companies that claim to do everything in-house – target discovery, chemistry, clinical development – especially if they haven’t proven any part of it yet. Benevolent spread itself wide, which arguably diluted focus.

Third, track record matters: lots of partnerships can indicate validation, but one should ask, what came out of those partnerships? In Benevolent’s case, partnerships generated some identified targets and gave the company cash, but by 2024 none had yielded a drug. A savvy analyst will look for outcomes, not just deals.

Finally, structural shifts (e.g. layoffs, strategic pivots, delisting plans) speak volumes. When a self-proclaimed AI leader has to retrench so starkly, it suggests their approach wasn’t delivering as advertised.

The tone of communications changed as well – from exuberant to defensive – a shift any careful reader of press releases or earnings calls could detect.

Case study 3: Exscientia – Hitting the target (within reason)

On the more optimistic side of the ledger is Exscientia, a UK-based company founded in 2012 by scientist Andrew Hopkins. Exscientia has positioned itself as a pioneer of “AI-designed medicines.” Unlike many peers, it has chalked up concrete achievements to justify that label.

As noted, Exscientia was first to put an AI-designed small-molecule drug into clinical trials: the compound DSP-1181 for OCD, created in a collaboration with Japan’s Sumitomo Pharma. The design cycle was astonishingly fast – about 12 months from project start to a candidate ready for trials (labiotech.eu), whereas traditionally it can take 4–5 years to discover and optimize a new drug candidate.

How did they do it? Exscientia’s AI platform (cheekily named “Centaur Chemist,” alluding to a human-machine hybrid approach) was used to generate and evaluate thousands of potential molecules. Importantly, the AI didn’t work in isolation – it operated in tandem with human medicinal chemists, learning from their decisions and vice versa (labiotech.eu).

The result was a novel molecule that hit the desired target (a brain receptor) and had a good drug-like profile, achieved with far fewer iterations than usual. This success in accelerated design was hailed by experts as “hard evidence that AI really will deliver on its transformative potential” (labiotech.eu).

Exscientia didn’t stop at one. By 2022, it had another AI-designed drug in Phase I (an immuno-oncology molecule) and several more in preclinical stages. The company also leveraged AI in target selection – an area often overlooked amid the focus on molecule design. For instance, Exscientia formed a partnership with Bayer to use AI to identify novel targets in cardiovascular disease, and with Bristol Myers Squibb in oncology. Its business model blended proprietary drug development with partnerships, giving it multiple shots on goal.

In October 2021, Exscientia went public on Nasdaq, raising around $300 million, one of the first pure-play AI drug companies to IPO. It earned credibility by speaking the language of pharma: instead of just bragging about algorithms, Exscientia consistently talked about advancing a pipeline of drug candidates. By 2023 it had molecules in Phase I for cancer, inflammation and viral diseases, many co-developed with larger pharma firms.

That is not to say Exscientia hasn’t faced challenges. The company’s share price, like many biotechs, slid after its IPO as investor enthusiasm cooled. And despite faster design, an AI-created drug must still prove itself in trials – something that simply takes time and cannot be shortcut by computation. Notably, even the OCD drug (DSP-1181) that entered trials in 2020 has yet to report Phase II results or reach the market (drug development is a marathon, not a sprint, AI or not).

In 2024, as mentioned, Exscientia agreed to merge with Recursion – a move born partly of opportunity (combining complementary strengths) and partly of necessity. Exscientia’s CEO said the merged entity would have “first-in-class” pipelines across multiple disease areas and “bring treatments to patients faster.” That remains to be seen, but it signals that even the leaders saw value in consolidation, bulking up to survive for the long term.

Telltale signs: Exscientia illustrates what a more substantive AI-drug company looks like. First, it set measurable goals and hit them – e.g., “AI will cut design time from 5 years to 1 year” – and then demonstrated it in practice (labiotech.eu). Rather than just saying “we have a revolutionary platform,” Exscientia could point to a real drug candidate derived using its platform in record time. That sort of concrete outcome is a green flag. Second, Exscientia has been relatively transparent about its methods. Its CEO often emphasized that AI was used to augment human chemists, not replace them. This honesty about what the AI actually does (learning design rules, suggesting molecules, etc.) lends credibility – it’s not portrayed as a magic box, but a tool.

The firm also published results: for example, they co-authored papers and presented at conferences about their AI-designed molecules, which outside experts could scrutinize. Third, Exscientia focused on the right metrics: instead of boasting about how many compounds its AI could generate (a vanity metric), it highlighted meaningful metrics like speed to candidate, or the improvement in potency/side-effect profile achieved by AI iterations. These are things investors can latch onto and compare to industry norms.

Finally, Exscientia balanced hype with humility. It never claimed AI would make drug discovery easy, only faster in certain stages. The fact that it embraced partnerships (acknowledging it needed Big Pharma’s might for expensive clinical trials) showed a grounded strategy. In short, look for AI biotechs that talk about drugs and patients, not just about AI. If their narrative is “we discovered compound X for disease Y, and here’s how it performs,” that’s far more convincing than abstract claims of changing the world.

Case study 4: Insilico Medicine – From generative models to genuine molecules

No discussion of AI in biotech is complete without Insilico Medicine, a company that straddles East and West (with operations in Hong Kong, Shanghai, and New York) and has been one of the most flamboyant proponents of AI for drug design.

What sets Insilico apart is that it has consistently aimed to do end-to-end AI drug discovery: using AI to find new targets (via its ‘PandaOmics’ system) and to design new molecules (via ‘Chemistry42’), then testing them in the lab and clinic. It essentially tries to invent new biology and new chemistry with AI – an ambitious mandate. Skeptics wondered if this was realistic; Insilico’s CEO, Alex Zhavoronkov, insisted it was, and he set out to prove it.

In 2021, Insilico announced a breakthrough: its AI had identified a novel target (a protein called TNIK) implicated in idiopathic pulmonary fibrosis (IPF, a deadly lung disease), and designed a novel small-molecule inhibitor for it. This drug, ISM001-055, went from initial concept to a preclinical candidate in under 18 months, with an out-of-pocket cost around $2.6 million.

In a world where big pharma often spends 4–5 years and ~$50–100 million to get to the same point, those numbers turned heads. By late 2021, Insilico had entered Phase I trials with ISM001-055 – a milestone heralded as “the first AI-discovered novel target and AI-designed novel molecule” to be tested in humans (fiercebiotech.com). The achievement even made some hardened pharma veterans grudgingly applaud. Insilico did not stop at Phase I. In 2024, it reported preliminary Phase IIa results for the drug, showing a favorable safety profile and a hint of efficacy (patients on ISM001-055 showed dose-dependent improvement in lung function over 12 weeks, compared to placebo).

In late 2022, Insilico released a detailed report sharing how many molecules it typically synthesizes per project (~70) and its success rates at various steps. It claimed a 100% success rate in moving AI-designed candidates from preclinical testing into IND-enabling studies (admittedly in a small sample so far). While such self-reported numbers should be taken with a grain of salt, the fact the company openly discussed them is a positive sign. It suggests a willingness to be measured by outcomes, not just hype.

Today, Insilico has multiple other programs in the pipeline (from ALS to cancer), some discovered via AI and moving toward the clinic. It also faced a funding challenge: being partly based in China during a biotech downturn meant it had to get creative in financing.

Despite that, it secured partnerships – for instance, with Fosun Pharma and Teva – and even obtained grant funding for certain projects. Insilico’s resilience and real progress have made it something of a standard-bearer for the field. In industry forums, when someone asks “has AI actually ever discovered a drug?”, proponents can now point to Insilico’s IPF program as a concrete example. It’s not a cured disease yet, but it’s a start.

Telltale signs

Insilico demonstrates a few markers of a genuinely AI-driven yet scientifically rigorous company. One is transparency and data sharing – Insilico published its methods in top journals (e.g. detailing the TNIK target discovery) and even shared benchmarks publicly. Companies that are confident in their tech will often seek peer validation; those that hide behind proprietary secrecy might be obfuscating a lack of substance. Another sign is leadership with domain expertise. Insilico’s team includes veteran pharmaceutical chemists and biologists alongside AI experts, ensuring a balance. When evaluating an AI biotech, checking the team composition is crucial: if it’s all coders and no one who has ever brought a drug to trial, be cautious.

Additionally, Insilico’s willingness to talk about failures or roadblocks (for example, it acknowledged when certain AI-generated molecules turned out toxic, prompting them to refine their models) gives credibility – it shows they’re doing real science, where negative results happen. In contrast, a hype-driven firm often paints everything as rosy and rarely mentions any experiment that didn’t work (an unlikely scenario in drug research!).

Finally, Insilico aligned its business strategy with its claims: it actually invested in internal R&D to create drugs, putting its money where its mouth was. This is in contrast to a company that only sells AI software or signs superficial collaborations while never taking on the risk of drug development. If AI is so great, one might ask, why isn’t the company using it to develop its own drugs? In Insilico’s case, they did – and that speaks volumes.

These case studies illustrate a spectrum from hype to hope. Now, how can an outside observer – especially an investor or analyst – distinguish the two in practice? Below we distill some tell-tale signs and signals that can help identify when a biotech is genuinely harnessing AI versus merely riding the buzzword bandwagon.

Checklist: Is that “AI-powered” biotech the real deal or just hype?

Investors and industry watchers should approach any “AI in drug discovery” claim with healthy skepticism. Here is a checklist of questions and indicators to critically evaluate such companies.

What has the company actually delivered?

Look for tangible outputs: drug candidates discovered, patents filed, clinical trials initiated. If a startup has existed for 5+ years with no molecules in preclinical or clinical development, its AI hasn’t yielded much more than conventional methods (despite whatever they tout). By contrast, companies that have moved compounds into animal studies or human trials, or licensed drug candidates to partners, demonstrate real progress. Check pipelines: are there compounds with compound codes and indications listed, or just vague promises? If they do have candidates, are those novel (new chemistry, new targets) or just me-too molecules and repurposed drugs?

Does the company provide data and case studies?

Credible firms will share at least some metrics or examples. Do they have any peer-reviewed publications showing how their AI discovered a molecule or predicted a target? Do they present at conferences with actual results? Transparency is key. Beware of those that only speak in buzzwords (“our proprietary deep learning algorithm revolutionizes X”) but never show specifics. Even if certain details are secret, a genuine company finds ways to validate its technology through third-party scrutiny (publications, collaborations, etc.).

As a test, see if they mention success rates, time savings, or other quantifiable outcomes; absence of any numbers can be a red flag.

How does the company describe its AI’s role?

Is it grounded and clear, or vague and grandiose? For instance, a substantive player might say, “Our AI model screened 10 million compounds and suggested 5 leads, of which 2 showed activity in vivo – 40% hit rate, higher than traditional methods.” A hype-y firm might say, “We use cutting-edge AI to completely transform drug discovery,” without explaining how. Look for technical substance: do they discuss the kind of models (e.g. generative models, reinforcement learning), the validation performed, or the integration with laboratory experiments?

If press releases read like a string of fashionable jargon (AI, blockchain, metaverse – why not throw in everything!) with no scientific content, run. One tell: companies that anthropomorphize AI (“our AI ‘brain’ has figured out how to cure cancer”) or claim “no one has ever done this before” in absolute terms are usually more style than substance (statnews.com).

Who is on the team and advisory board?

This is often revealing. A credible AI-driven biotech will have a balanced team: top-notch AI scientists and seasoned drug discovery experts (people who have worked at pharma companies or led compounds through clinical trials). They will also likely have domain experts in the disease areas they target. A hype-oriented company might be heavy on data scientists and MBAs but light on pharmaceutical chemists, biologists, or clinicians. If the CEO and founders have deep tech backgrounds but no pharma experience, one should ask how they plan to navigate the myriad experimental and regulatory pitfalls of drug development.

Conversely, involvement of respected figures from big pharma or academia (with meaningful roles, not just token advisors) can indicate the company is taken seriously and its approach has scientific merit. Check if the scientific advisory board includes leaders in chemistry or medicine who are actively engaged – their presence (or absence) speaks volumes.

Are there reputable partners or investors – and what do they say?

Partnerships with major pharma companies can be a positive sign, but scrutinize the details. Big Pharma does lots of penny ante deals for scouting purposes. If a partnership is announced, does it come with significant funding upfront or milestones (indicating the pharma partner’s strong interest), or is it a small pilot project? For example, Exscientia’s multi-target deal with Celgene (in 2019) and later with Bristol Myers Squibb had substantial dollar values attached, suggesting the partner saw real promise.

Also, consider the trajectory: have partners expanded the relationship over time? If a company announced a collaboration two years ago and nothing has been heard since, maybe the results disappointed. The words of investors can be telling too: seasoned biotech VCs will often temper their public enthusiasm with caution. If all you hear are platitudes and none of the hard questions, be wary – it might be a bubble inflating. On the other hand, if an investor in the company writes or speaks about why they believe the AI approach will give an edge (with specifics), that’s more credible.

How does the company handle setbacks or limitations?

In drug R&D, things will go wrong. A mature company is upfront about challenges – e.g. acknowledging when a model didn’t predict toxicity, or when an AI-suggested drug failed an experiment and how they learned from it. An all-hype outfit rarely, if ever, mentions any failure.

If every press release is relentlessly optimistic and never is there a discussion of scientific hurdles, consider it a warning sign. Reality is messy; an honest company’s narrative will admit to some messiness. The tone in investor communications is thus a clue: is it all sizzle, or is there steak (with some gristle too)?

Do they measure success in business terms or just tech terms?

Ultimately, a biotech lives or dies by drug outcomes, not by having the fanciest algorithm. Listen for mentions of clinical milestones (IND filings, trial results, patient outcomes) as measures of progress. If instead the company dwells on being “the first to use AI technique X” or brags about “our GPU cluster has Y petaflops of power,” it may be focusing on the wrong benchmarks.

Technological prowess is great, but in biotech it must translate into biological results. As one industry veteran commented, “the first wave of clinical data from AI-discovered compounds is coming to light and, so far, it’s not a slam dunk”linkedin.com – meaning even the best tech needs to prove itself in the clinic. A grounded company will acknowledge that “the game hasn’t played out and there are many reasons to remain optimistic, but cautious” (linkedin.com). A hype company will claim the game is already won.

Finally, one of the simplest sanity-checks: ask the question, “If you took the AI out of the equation, what has this company really done?” If the answer is “not much,” then all the value hinges on the AI working miracles. And miracles are rare. If the answer is “they have, say, a novel molecule in Phase I for cancer even aside from how it was found,” that’s more reassuring. In other words, focus on outputs, not inputs. AI is an input. New drugs (or at least promising leads) are the output that matters.

Reading between the lines of “AI-powered” press releases

Corporate communications can be notoriously euphemistic, but with a critical eye, one can discern a lot. Here are a few common phrases in “AI drug discovery” press releases and how to interpret them:

We have a powerful AI platform (or engine) that can revolutionize drug discovery” – 🚩 Red flag until proven otherwise.

Nearly everyone says this. Look for mention of a specific achievement alongside the claim. If none is given, it’s fluff. Genuine companies will usually tie the platform claim to a concrete example (e.g. “our platform, which earlier identified compound X for disease Y, is now being applied to…”). Without that, assume it’s aspirational talk.

“In silico” – Latin for “in silicon (computer)”, meaning computer-simulated. A press release might say “identified in silico candidates”. This means the AI spat out some molecules. Nice, but ask what happened next. Were they synthesized and tested in a lab assay? Many “AI-found” hits evaporate upon experimental validation. A good release will mention something like “validated in vitro” or “tested in cell models” – indicating the compounds weren’t just digital fantasies. If it stops at in silico, then nothing tangible exists yet.

“First AI-designed drug to enter clinical trials” – This phrasing has been used a few times (each company loves to claim a “first” of some sort). Check the fine print: sometimes it’s the first in a specific country or the first for a specific disease. And crucially, remember that entering clinical trials is just the beginning. Many drugs (AI-designed or not) enter Phase I and never get to Phase II or III because of safety or lack of efficacy.

So while it is a positive sign, it’s not evidence of ultimate success. Treat such “firsts” as modest milestones, not endpoints.

“Our AI found a novel target/compound” – Novel is the key word. If true, that’s interesting. But how novel and by what measure? Sometimes “novel compound” might mean novel to that company but in reality similar to known drugs. Or “novel target” might mean a gene that was in literature already but the company hadn’t considered it before.

Ideally the press release or associated publication will clarify, e.g. “a previously unreported biological target in disease Z”. If you can’t find any mention of the target or compound outside the company’s own materials, it could indeed be new – or the company could be keeping it secret (understandable to a degree). In investor communications, however, they should at least communicate why they think it’s novel and important. If they don’t, probe further.

“We shortened the discovery time from years to months”

This is a favorite claim (and sometimes true as Exscientia and Insilico demonstrated). It’s compelling, but as an investor, ask: does a shorter discovery time materially de-risk or improve the program? Saving time is great – it can save money and get to patients faster – but if the drug ultimately fails in Phase II, a speedy discovery only gets you to failure faster.

The question is whether AI is not just accelerating the process but also improving the quality of the candidates (higher success probability). A careful company might claim time savings along with something like “and our AI-designed candidates have 2x higher success rate in preclinical tests” Time will tell if that holds industry-wide. When you see timeline claims, also consider how much of that time saving is due to AI vs. simply more aggressive project management.

Buzzword overload

If you see a release jam-packed with jargon like “knowledge graph,” “blockchain-enabled,” “omics-powered,” “Web3,” etc., the company is possibly overcompensating. Real drug hunters usually speak at least somewhat plainly about the problem being solved (e.g. “we’re targeting a protein that’s hard to drug by conventional methods, and our AI helped find a starting point”). Marketing-heavy language could indicate they are selling an idea rather than reporting a result.

In essence, press releases should be the starting point, not the final word. They are designed to attract interest, so treat them as one would a sugar-coated résumé. It’s the due diligence afterward that uncovers the true fitness of the candidate.

Investment guidance: How to perform AI-biotech due diligence

For those looking to invest in or partner with companies in this space, a more traditional due diligence approach is needed – albeit with a few tweaks to account for the AI element:

Scientific peer review

Get an independent (human!) drug discovery expert to evaluate the company’s claims. If they say “our AI predicts protein-ligand binding better than anyone,” have a computational chemist vet that claim by examining any benchmarks or even testing a sample prediction. If they claim “30% hit rate in novel targets,” verify how they define a hit and whether the assays were robust.

Essentially, treat the AI like any other drug discovery tool – demand evidence that it works better than the status quo. Academic literature can help here; see if the methods the company uses have been published or if others have reported similar results.

Pipeline and IP audit

Look at every program in the pipeline. Where did it originate? Was it really AI-derived or did the company in-license a compound and now just say they optimized it with AI? (This happens – not everything labeled AI is from AI.) Check patent filings; a truly novel AI-designed molecule should show up in recent patent applications by the company.

If all patents are years old or filed by someone else, the “AI-designed” part may be more window dressing. Evaluate the novelty of the compounds and targets through patent searches or scientific databases. If the AI just regurgitated known chemical scaffolds, that’s less impressive (unless it’s targeting something new with them).

Reproducibility

If the company has published data, have others been able to reproduce or at least support their findings? One strong indicator is external validation – e.g. a partner company continuing a program because their labs also got good results, or a joint publication with a respected institute. In absence of publications, even anecdotal evidence from industry peers can be useful (sometimes pharma collaborators will speak at conferences about how an AI partnership went – positive or negative).

Business model and incentives

Consider how the company makes money now and plans to in future. Is it selling software, providing services, or developing drugs to sell/license? If it’s software-based (like Schrödinger, a notable computational chemistry firm that IPO’d in 2020), then the rigor of its tech and user feedback matter more. If it’s developing drugs, then it should be measured against biotech metrics (e.g. drug trial success, FDA approvals eventually).

Some AI biotechs try to straddle both (platform + pipeline). Ensure they are not caught in a no man’s land of neither generating software revenue nor advancing drugs far enough to create value. The risk is they spend too much on R&D without a clear payoff timeline. An investor should insist on seeing a roadmap: what are the key milestones (e.g. “By 2024, IND filing for compound X; by 2025, Phase II data for program Y”)? And are these realistic?

Ask the hard questions directly

When speaking to management, some pointed questions can be illuminating. For example:

"How do you decide which predictions from the AI to actually pursue in the lab? Give a recent example.” A substantive team will eagerly walk you through a case study. A flimsy one will hand-wave.

“What’s a failure or limitation of your platform that you’ve identified and how did you address it?” If they claim there are none, that’s not credible. You want to see self-awareness.

“How do you measure the productivity gains from your approach? Can you show metrics A versus industry standard B?” The answer reveals whether they even gather such data. A serious company should.

"Why did Big Pharma partner with you? What convinced them?” The answer might highlight specific capabilities or results (e.g. “they saw we could generate diverse lead series in 1/3 the time”). If the answer is essentially “AI is hot and they didn’t want to miss out,” well, that says it all.

Regulatory and ethical angle

One emerging due diligence area is how regulators view AI-derived products. It’s worth asking if the company has engaged with the FDA or EMA regarding any aspect of using AI (for instance, how they justify a novel molecule’s design rationale). Currently regulators don’t treat AI-designed drugs differently – they care about safety and efficacy like any other. But companies boasting AI might have to answer questions about data provenance (for targets coming from AI analysis of human data, e.g. genomics, are there privacy issues? biases in training data?).

An investor should ensure the company isn’t neglecting these considerations. If a company’s IND filing to FDA casually says “our AI picked this target,” expect the FDA to ask, “Great, now show us the biological evidence that target is relevant.” The AI per se won’t impress regulators – hard data will.

Financial runway

Because AI-biotechs often start with a tech mindset, some have been overly optimistic on timelines (recall Recursion’s 100 drugs by 2024 dream). Check the cash balance and burn rate, then map it against the realistic timeline for their next value-inflection point (e.g. Phase I result). Many such companies raised big rounds in the boom; if that money is due to run out before they achieve proof of concept in humans, there is risk of a down-round or worse.

Ideally, a company should have cash to get through a couple of clinical readouts, especially given that AI won’t magically make trials cheaper – those costs are the same as for any biotech.

In summary, approach AI drug development companies with the same rigorous analysis as any biotech, plus an extra layer of technical scrutiny on their AI claims. The key is to translate AI-speak into drug-speak: how much faster, cheaper, or better is this company at finding drugs, and what evidence is there for that? If they can’t answer in concrete terms, you might be looking at hype.

A dose of realism (and optimism)

It’s easy to be cynical when faced with bombastic claims, and the past few years certainly saw overhype in AI for drug discovery. Some companies will undoubtedly fade away after burning through cash without results. We may look back on certain press releases with the same amusement reserved for dot-com era brochures. However, dismissing the field entirely would be a mistake. Beneath the hype, a genuine technological shift is underway.

The challenge is separating innovation from marketing spin.

The next few years will likely bring a healthy shake-out. The “AI-biotech” companies that survive will be those that pair clever algorithms with real-world drug development savvy – the ones that treat AI as an enabling tool, not a magical wand. They will have demonstrated successes (even if small at first) that earn them the trust of larger partners and regulators.

We’re already seeing a hint of this natural selection: consolidation (like Recursion-Exscientia) and more cautious investment, as analysts “exercise a little more caution” and demand to see results.

For investors, the opportunity is still there. AI won’t cure cancer at the click of a button, but it may well incrementally improve R&D productivity – and even incremental gains in such a costly industry can be worth billions. The trick is to back the doers, not the talkers.

This means cutting through the buzzwords and focusing on fundamentals: good science, validated platforms, smart management, and achievable milestones. As The Economist’s Bartleby might quip, it pays to remember that in pharmaceuticals, as in life, if something sounds too good to be true, it usually is. Expect miracles, by all means, but verify them first.

In the end, AI in drug development is likely to follow the classic Gartner hype cycle: a peak of inflated expectations, a trough of disillusionment, and then a gradual slope of enlightenment. We are now exiting the peak and perhaps entering the trough. The next stage – enlightenment – will be characterized by more quiet, steady progress.

Drugs discovered with substantial help from AI will reach late-stage trials; a few may earn approval in the coming years (though they won’t carry a special “AI-approved” label – they’ll just be drugs that work). When those successes arrive, they might not make as much splash as the headlines of the hype phase, but they will be far more important.

For those evaluating the field today, the imperative is clear: be as data-driven and critical as the AI platforms claim to be. That is the surest way to tell if a biotech claiming to use AI is on the cusp of the future – or merely selling snake oil with silicon branding.

Member discussion