The Long Quest to Defeat Alzheimer’s – The State of Dementia Research in 2025

Alzheimer’s disease, the most common form of dementia, poses one of the greatest challenges in modern medicine. Every year, about 10 million people around the world are diagnosed with dementia, and over 55 million are currently living with it. As populations age, those numbers are projected to rise to 78 million by 2030 and 139 million by 2050. Alzheimer’s not only robs individuals of memory and identity, but is also a leading cause of death and disability among the elderly.

More than a century after Alois Alzheimer first described the disease in 1906, there is still no cure – a sobering reality that global leaders acknowledged when they ambitiously set a goal in 2013 to “prevent and effectively treat Alzheimer’s by 2025.” Now that 2025 has arrived, a cure remains elusive, but the landscape of Alzheimer’s research and treatment is finally shifting in meaningful ways (ifpma.org).

Why has it taken so long to make progress against a disease that affects so many? Part of the answer lies in Alzheimer’s complexity. The disease develops insidiously over decades, causing damage in the brain long before obvious memory loss occurs. By the time clinical symptoms emerge, neurons have already been irreversibly lost. Detecting Alzheimer’s in its early, pre-symptomatic stage has been extremely difficult.

Moreover, the biology of Alzheimer’s is extraordinarily intricate, with multiple intertwining processes – from the buildup of misfolded proteins to chronic inflammation – all contributing to the death of brain cells. This complexity means there are many potential culprits to target, but also many opportunities for treatments to fail.

And fail they have: approximately 99% of Alzheimer’s drug candidates tested in clinical trials have failed to show benefit. Between 1998 and 2021, only a handful of new drugs (all for symptom management) were approved out of well over 100 attempts. The field has been littered with expensive disappointments, leading some to dub Alzheimer’s research a “graveyard” for drug development.

Yet 2025 finds the Alzheimer’s community at a hopeful, if complicated, inflection point. After decades of setbacks, the first therapies aiming to slow the disease’s progression have finally reached patients, offering proof that modifying the course of Alzheimer’s is possible. At the same time, a new wave of research is diversifying the fight beyond the old approaches, exploring multiple biological pathways beyond the classic theories.

Huge investments – from pharma companies, governments, and philanthropy – are pouring into Alzheimer’s R&D, reflecting both the urgent medical need and the tantalizing market for a breakthrough. With over $1 trillion in annual global costs attributable to dementia (a figure expected to double by 2030), the stakes could not be higher for patients, health systems, and society at large (brighterstridesaba.com).

In this report, we take an in-depth look at the state of Alzheimer’s and dementia research as of mid-2025. Why has defeating this disease proven so hard? Who are the key players and what are the leading theories guiding current efforts? We examine the enduring debates around the protein hallmarks of Alzheimer’s – amyloid plaques and tau tangles – as well as newer hypotheses like neuroinflammation.

We review which drugs are in development, how much is being invested, and the status of major clinical trials (including when pivotal results are expected). We also consider the economic and policy challenges: the sky-high costs of new Alzheimer’s drugs, “payer pushback” from insurers, and issues of patient access.

This report presents a global overview – from early-phase lab research to late-stage clinical trials, across both public and private sectors – of the long campaign to understand and defeat Alzheimer’s disease.

It has been a long, often frustrating road, marked by scientific controversy and repeated failure. But as we will see, 2025 finds the field cautiously optimistic, armed with new tools, better biological insights, and a pipeline of the most diverse therapeutic strategies yet. The war on Alzheimer’s is far from over, but at last, there are signs that the tide could be starting to turn.

Why Alzheimer’s Is So Hard to Defeat

For decades, Alzheimer’s disease has humbled scientists and drug developers. Few illnesses have seen so many trial failures despite so much effort and money. From 2004 to 2021 alone, at least 98 experimental Alzheimer’s drugs failed in late-stage trials, an astounding attrition rate far higher than in most other disease areas. By 2019, analysts were estimating that over 99% of Alzheimer’s clinical trials had failed to produce an effective treatment (ifpma.org). Why is Alzheimer’s so intractable? Several fundamental challenges have made progress difficult:

Silent onset and late diagnosis: Alzheimer’s pathology begins some 10–20 years before symptoms like memory loss appear (theguardian.com). Abnormal proteins accumulate and neurons die slowly and quietly. By the time a patient is diagnosed with dementia, extensive brain damage has already occurred. This long “silent phase” means that intervening early is critical – yet identifying high-risk individuals or early-stage patients has historically been very difficult. Conventional clinical diagnosis often comes too late, when the disease is advanced and less responsive to therapy.

As Dr. Mike Hutton of Eli Lilly put it, “Amyloid accumulates in the brain for 10 to 15 years before you see clinical symptoms. There is a worry that we’re focusing on populations that are too far advanced.” Early detection is improving (as we’ll explore later), but the lag between pathology and symptoms remains a huge hurdle.

Complex and multifactorial pathology

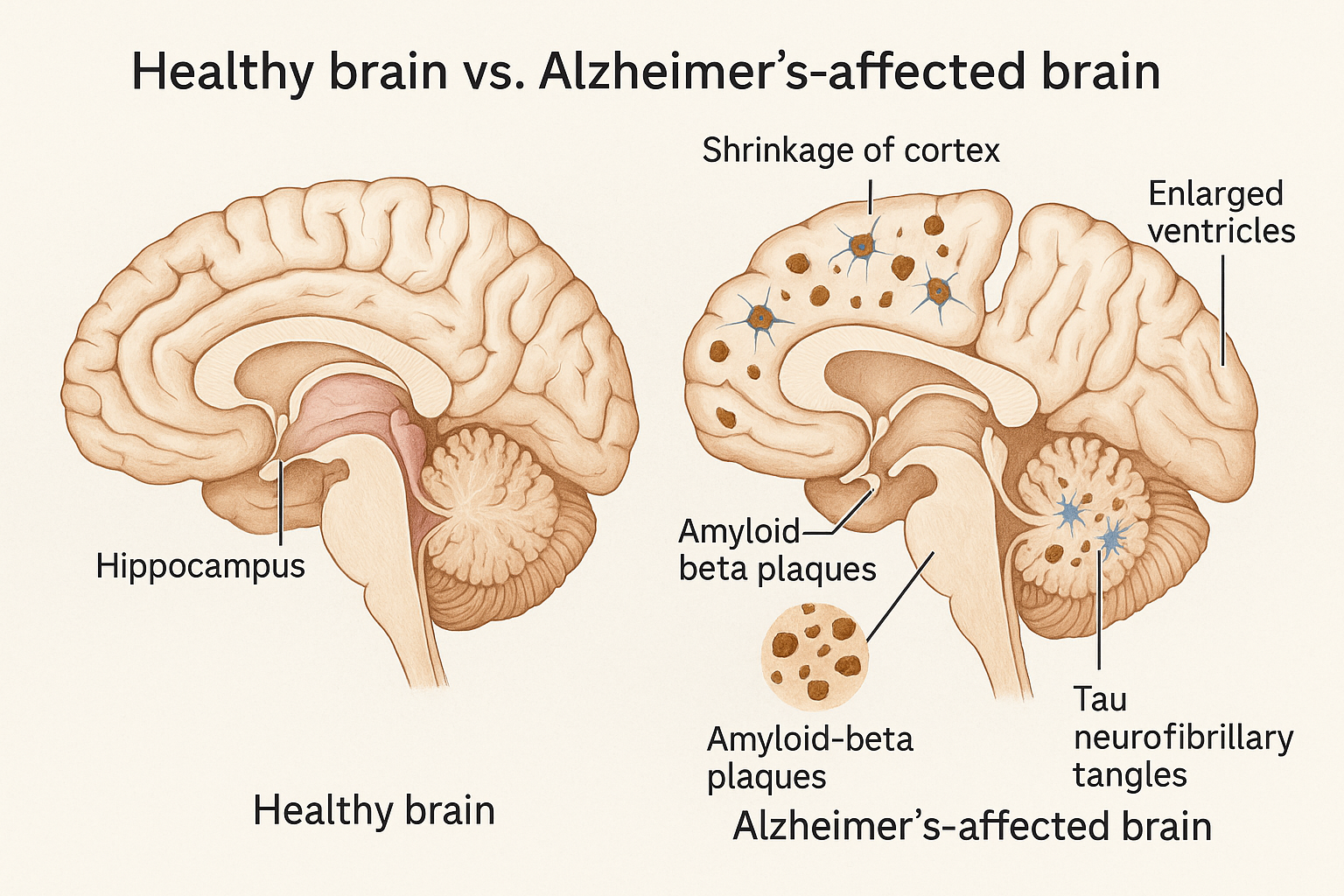

Alzheimer’s is not caused by a single pathogen that can be easily eradicated; it’s a multifactorial degenerative process. The two signature lesions in the brain – beta-amyloid plaques (sticky clumps between neurons) and tau neurofibrillary tangles (twisted protein fibers inside neurons) – are just the most visible features (neurotorium.org).

They interact with a cascade of other changes: chronic inflammation, loss of synaptic connections, vascular damage, metabolic impairments, and more. As one 2025 review noted, Alzheimer’s pathology spans at least 15 different biological processes that are being targeted by drugs.

Alzheimer’s may not be a single disease at all, but a syndrome involving multiple converging pathways. This complexity means a drug that hits only one aspect (say, amyloid build-up) may have limited effect if other processes (tau tangles, inflammation, etc.) continue unabated. It also complicates clinical trials – selecting appropriate endpoints and patient groups when the disease has many manifestations is notoriously tricky.

Uncertain causative mechanism

For years, the field was dominated by the “amyloid hypothesis” – the idea that accumulation of beta-amyloid protein in the brain is the primary trigger for Alzheimer’s, setting off a cascade including tau tangles and cell death. This led to dozens of trials of anti-amyloid drugs.

But repeated failures of amyloid-targeting therapies to improve cognition caused some to question whether the field had bet on the wrong horse. “Some people in the field would say [the failure rate] has been a disaster… suggesting that the underlying concept, that Alzheimer’s is caused by amyloid plaque, may be wrong,” said Dr. Eric Karran, former research director at Alzheimer’s Research UK (theguardian.com).

Others, like Dr. Karran himself, argued that the problem was not the hypothesis but the execution – trials treating patients too late, or drugs that didn’t adequately clear amyloid. The true relationship between amyloid, tau, and neurodegeneration is still debated.

Recent drug successes (with amyloid-clearing antibodies) somewhat vindicate the amyloid hypothesis – removing amyloid can modestly slow disease (ifpma.org) – but amyloid is clearly not the whole story. The exact causative sequence of events in Alzheimer’s remains only partially understood, which makes targeting the right process at the right time a challenge.

The blood–brain barrier and drug delivery

The brain is a protected organ – a fortress behind the blood–brain barrier (BBB) that keeps many substances (including drugs) out. Treatments for Alzheimer’s must either be small or crafty enough to cross into the brain tissue, or be delivered via methods that bypass the BBB. Large molecule drugs like antibodies only penetrate the brain in small percentages.

This is one reason many Alzheimer’s drugs have to be given at high doses or by direct infusion. It has also prompted innovative solutions – for example, Roche is testing a “brain shuttle” technology to ferry antibodies into the brain more effectively (medscape.com). The BBB is a double-edged sword: it protects the brain, but also limits drug access to the brain, complicating therapy development.

Clinical trial difficulties

Proving that a drug slows Alzheimer’s progression is much harder than, say, showing an antibiotic clears an infection. Cognitive decline is gradual and variable; detecting a drug’s effect amid the noise of normal variation requires large, long trials and sensitive outcome measures. Trials must track subtle changes in memory or function over 18 months or more. Placebo effects and practice effects on cognitive tests can blur outcomes.

Also, enrolling the right patients is crucial – if a trial inadvertently includes people with other types of dementia or very late-stage disease, a potentially effective drug could appear to fail. Only recently have biomarkers (like PET scans or cerebrospinal fluid tests for amyloid and tau) become widely used to ensure that enrolled patients truly have Alzheimer’s pathology and are at an early stage (medscape.com).

These advances improve trial precision, but add cost and complexity (e.g. requiring PET scans for enrollment). All told, Alzheimer’s trials are among the most expensive and complex in medicine, often costing hundreds of millions of dollars and taking 5–10 years from Phase 1 to completion. One analysis estimated the total development time for an Alzheimer’s drug averages 13 years and that assumes it doesn’t fail along the way.

Massive R&D costs and high failure risk

The cumulative cost of failures has been staggering. Large pharmaceutical companies have poured billions into Alzheimer’s research over the past two decades, with little to show until recently. Each late-stage trial failure can mean $100–$500 million (or more) down the drain. Pfizer, for example, exited the Alzheimer’s research space entirely in 2018 after multiple costly failures, deciding to deploy its R&D budget elsewhere.

The high failure rate has at times made investors skittish – Alzheimer’s has been described as a “high-risk graveyard” for drug development. Nonetheless, many companies have persisted, often motivated by the enormous potential reward (a successful drug could help millions and become a mega-blockbuster).

Eli Lilly, for instance, has spent over 30 years in Alzheimer’s research despite failure after failure, and is only now nearing success. As one industry perspective noted, “even when innovation fails, valuable lessons are learned” – each failed trial has taught researchers more about what might or might not work (ifpma.org). These lessons are gradually shaping smarter approaches.

Alzheimer’s is hard to treat because it is biologically complex, starts invisibly early, and has been difficult to even diagnose at the right stage for intervention. Trials are long and expensive, and until recently, they were often testing drugs based on incomplete understanding of the disease. The good news is that the field has learned from these struggles.

There is growing recognition that multiple strategies will be needed – treating Alzheimer’s may require a combination of drugs (as is common in cancer or HIV) to hit different targets. There’s also a push for earlier diagnosis and prevention trials (to catch the disease in the silent phase). As we’ll see next, researchers have broadened their focus beyond the old amyloid mantra. Alzheimer’s research in 2025 is pursuing many hypotheses in parallel – a necessary shift, given the many fronts on which this disease fights us.

Plaques, Tangles and Beyond: Competing Theories of Alzheimer’s

Two microscopic abnormalities in the brain have defined Alzheimer’s disease since Dr. Alois Alzheimer’s 1906 discovery: amyloid plaques and tau tangles (atri.usc.edu). These protein deposits are the classic hallmarks found on autopsy and are required for a definitive diagnosis. For decades, they have been the prime suspects in Alzheimer’s pathology – but the question of which one (if either) is the true trigger of neurodegeneration is akin to a “chicken-and-egg” riddle. In recent years, a third major focus has emerged: neuroinflammation, the brain’s immune response, which may drive or exacerbate the disease. Let’s examine each of these hypotheses – amyloid, tau, and inflammation – and what the latest research says about their roles and the therapeutic strategies targeting them.

The Amyloid Hypothesis: A Sticky Situation

For much of the past 30 years, the dominant theory of Alzheimer’s has been that beta-amyloid (Aβ) is the instigator. Beta-amyloid is a fragment of a larger protein (APP) that, in Alzheimer’s, accumulates into hard, insoluble plaques outside neurons (theguardian.com).

Genetic evidence strongly implicated amyloid early on: rare mutations in the APP gene or in genes that process APP (presenilins) cause aggressive early-onset Alzheimer’s, invariably with massive amyloid buildup. This led researchers to hypothesize that excess amyloid triggers a toxic cascade, including inflammation and tau tangle formation, ultimately killing neurons.

Drug developers accordingly went after amyloid with a vengeance. Over the past two decades, dozens of anti-amyloid therapies entered trials: monoclonal antibodies to tag and clear amyloid, secretase inhibitors to block amyloid production, vaccines to stimulate immunity against amyloid, and so on. The results, until recently, were uniformly dispiriting. Successive late-stage trials failed to slow cognitive decline (delveinsight.com).

High-profile casualties included:

- Bapineuzumab (Pfizer/J&J), an antibody that reduced plaques but showed no clinical benefit (Phase 3 failure in 2012).

- Solanezumab (Eli Lilly), an antibody against soluble amyloid, which missed endpoints in multiple trials from 2014–2017 and again in a 2022 prevention trialdelveinsight.com.

- Crenezumab (Genentech), another antibody, failed in 2019 in both prodromal AD and a trial in genetically predisposed patients.

- Verubecestat (Merck) and atabecestat (J&J), BACE inhibitors (blocking an enzyme that creates amyloid), which were halted when they not only failed to help but unexpectedly worsened cognition or caused side effects. By 2019, virtually all major companies had abandoned BACE inhibitors – an entire class declared a burial ground.

- Semagacestat (Lilly) and tarenflurbil (Myriad), earlier attempts to reduce amyloid, which backfired or lacked brain penetration.

These failures led to growing skepticism about the amyloid hypothesis. Some researchers argued that clearing amyloid so late in the disease (after symptoms) was akin to “removing bullets after the shooter has left” – by then, amyloid had already done its damage by triggering tau and cell death. Others wondered if amyloid was more of a byproduct than a cause. The field was soul-searching: perhaps efforts (and funding) had been misallocated by fixating on amyloid at the expense of other approaches.

However, the amyloid hypothesis has seen a dramatic twist in the past few years. In 2021, Biogen and Eisai’s antibody aducanumab (brand name Aduhelm) made history by becoming the first FDA-approved drug aimed at amyloid reduction. Its approval was contentious – based on a surrogate (plaque clearance) and post-hoc analysis of one positive trial after an earlier futility stop – and many experts questioned if its modest clinical effects justified approval. Nonetheless, the FDA granted aducanumab accelerated approval, citing the unmet need (theguardian.com). Aducanumab did robustly clear amyloid plaques from the brain, though evidence of slowed cognitive decline was murky.

The controversy over this decision highlighted the lingering uncertainty around amyloid: Did removing plaques actually help patients or not? The mixed data and intense pushback from physicians and payers (as we’ll discuss later) resulted in aducanumab’s uptake being extremely low and its eventual withdrawal from the European regulatory process. Aduhelm’s rocky reception cast a shadow, but it didn’t dampen the pursuit of better amyloid-targeting drugs.

By 2022–2023, results emerged for next-generation antibodies that finally demonstrated a clear, if moderate, clinical benefit. In late 2022, Eisai’s lecanemab (now approved as Leqembi) reported a positive Phase 3 trial: an 18-month study showed a 27% slowing of cognitive decline in early Alzheimer’s patients, along with substantial plaque reduction on PET scans (kff.org). This was hailed as the first unequivocal proof that attacking amyloid can alter the disease course (though it’s a slowing, not halting or reversal).

In mid-2023, Eli Lilly announced that donanemab (now Kisunla) also met its Phase 3 goals, slowing decline by about 29–35% (depending on patient subgroup) and clearing amyloid so effectively that many patients could stop dosing early. Donanemab gained regulatory approvals in China in late 2024 and in the U.S. in 2025, making it the third amyloid-directed therapy on the market (after Aduhelm and Leqembi).

These developments have to an extent reinvigorated the amyloid hypothesis. We now know that removing amyloid can provide clinical benefit, confirming amyloid is not an innocent bystander. However, the benefits are modest – a few months’ slowing of decline over 18 months – and come with risks. All amyloid antibodies can cause ARIA (amyloid-related imaging abnormalities), which are brain edema or microhemorrhages seen on MRI. In trials, about 20–40% of treated patients experienced ARIA side-effects (mostly asymptomatic brain swelling, but some cases of serious bleeding occurred).

This highlights another challenge: amyloid is often deposited in cerebral blood vessels as well (CAA, cerebral amyloid angiopathy), so clearing it can weaken vessels and cause leaks. The new drugs thus require careful monitoring with periodic MRI scans.

Researchers are now looking to refine amyloid-targeting therapy: for example, Roche’s experimental antibody trontinemab attaches to a “brain shuttle” molecule to increase delivery across the BBB, aiming to get more antibody into the brain with potentially lower systemic doses. Others are exploring subcutaneous injections of antibodies instead of IV infusions to ease administration – in fact, a Leqembi auto-injector for weekly use is under FDA review to make maintenance therapy more convenient. The hope is to reduce treatment burden and side effects.

It’s worth noting that amyloid might be most relevant early in the disease – a trigger for pathology – whereas later on, tangles and inflammation might drive neurodegeneration more. This has shifted some focus to preventive trials: for example, the ongoing AHEAD 3-45 study is testing lecanemab in people with no symptoms but elevated brain amyloid, to see if removing plaques before cognitive impairment can delay onset (globalrph.com).

Other prevention efforts include trials in people with high-risk genes (like the API trial in Colombian families with presenilin mutations, which unfortunately reported no benefit for crenezumab in 2022), and the DIAN initiative (Dominantly Inherited Alzheimer Network) which is now testing combinations including an anti-tau drug after anti-amyloid alone wasn’t enough. The amyloid hypothesis, once in crisis, is now tempered but intact: amyloid is one key piece of the Alzheimer’s puzzle, and finally we have tools to target it. The quest now is how to integrate those tools with other approaches for greater effect.

The Tau Hypothesis: Untangling the Neurons

If amyloid is the spark, many believe that tau is the flame that actually consumes the brain in Alzheimer’s. Tau protein is a structural protein that stabilizes microtubules in neurons. In Alzheimer’s, tau molecules undergo chemical changes (phosphorylation and other modifications) that cause them to misfold and aggregate into insoluble tangles inside neurons (neurotorium.org).

These neurofibrillary tangles choke the neurons from within, disrupting transport systems and synapses, and are strongly associated with neuron death. Crucially, the spread of tau tangles through the brain correlates closely with disease progression and symptoms – much more so than amyloid plaque burden.

Early in Alzheimer’s, tangles are limited to the memory center (transentorhinal cortex/hippocampus); as the disease advances, tangles march through the neocortex, paralleling cognitive decline. This has made tau a compelling target: stop tau, and you might stop the neurodegenerative fire at its core.

Tau-focused therapeutic strategies lagged amyloid ones by many years, but they are now a major frontier of research. Approaches include anti-tau antibodies, tau aggregation inhibitors, tau vaccines, and gene therapies (antisense oligonucleotides) to reduce tau production. So far, no tau-targeting therapy has been proven to slow Alzheimer’s in a definitive trial, but there are intriguing clues and ongoing trials that keep the tau hypothesis very much alive.

One reason tau has been tricky is its location: inside cells. Unlike amyloid plaques floating between neurons, tangles reside within neurons, making it harder for antibodies (which circulate outside cells) to directly clear them. Antibodies might neutralize tau spreading between cells – there is evidence tau pathology propagates in a prion-like manner via extracellular tau seeds. Several big trials of passive immunotherapy against tau have read out in recent years, mostly without the hoped-for clinical benefit.

For instance, semorinemab (by Genentech/AC Immune) failed to slow cognitive decline in a Phase 2 trial in 2021, despite some reduction in tau accumulation on scans. Gosuranemab (Biogen) and tilavonemab (AbbVie) were other anti-tau antibodies that fizzled in mid-stage trials, leading to their discontinuation. More recently, UCB’s bepranemab (an antibody targeting a mid-region of tau) had a disappointing Phase 2 result in 2023: it slowed the accumulation of tau in the brain (on PET scans) but did not slow clinical decline compared to placebo (nature.com).

This suggests that while the antibody hit its biological target, that alone wasn’t enough to help patients over the 18-month study – perhaps because tangles that had already formed were unaffected or because other damage was ongoing. It was a setback for tau immunotherapy, but not the end of the story.

New tau antibodies are being designed to target specific pathological forms of tau. Posdinemab (JNJ-63733657) from J&J is one such next-gen antibody – it targets tau phosphorylated at a particular site (pTau217) that is closely linked to Alzheimer’s pathology (pubmed.ncbi.nlm.nih.gov). Posdinemab showed good safety in Phase 1 and is now in a Phase 2b trial (called AuTonomy) in early Alzheimer’s.

The FDA even granted it Fast Track designation in 2023, reflecting its potential novelty. Another, Eisai’s E2814, targets the microtubule-binding region of tau and is being tested in a unique prevention trial in people with familial Alzheimer’s (in the DIAN study, in combination with lecanemab). There is cautious optimism that by aiming at the right tau species and perhaps using them alongside amyloid therapies, tau antibodies might show benefits in the next few years.

Active tau vaccines are also under development. A vaccine introduces a tau fragment or mimetic to stimulate one’s own immune system to produce anti-tau antibodies. One of the furthest along is AADvac1 (by Axon Neuroscience), which targets an abnormal truncated form of tau. In Phase 2, AADvac1 was safe and generated antibodies, and there were hints of slower cognitive decline in treated patients over 2 years.

While not conclusive, it was encouraging enough that larger studies are being planned. Another vaccine, ACI-35 (AC Immune/Johnson & Johnson), targets tau phosphorylated at specific sites. The first version ACI-35.030 had some issues with low immune responsenews-medical.net, so it’s being optimized. Vaccines could offer long-term, lower-cost therapy if effective – a single course might induce sustained immunity against tau.

Beyond immunotherapy, there are small-molecule approaches to tau. Researchers are testing drugs to prevent tau from clumping or to enhance its clearance. For example, tau aggregation inhibitors like hydromethylthionine (LMTX, related to methylene blue) were tried by TauRx in trials – results were largely negative, though the company controversially claimed a benefit in patients who weren’t on other medications.

Other compounds aim to alter tau’s pathological modifications: sodium selenate was tested to activate an enzyme that de-phosphorylates tau (only modest effects seen)t, and lithium (a GSK-3β inhibitor) has long been eyed to reduce tau phosphorylation, though trials have been inconclusive so far (news-medical.net).

O-GlcNAcase inhibitors are an intriguing new class – by blocking an enzyme that removes a protective sugar modification on tau, they hope to keep tau in a less toxic state. Several of these OGA inhibitors have reached Phase 2 with a good safety profile. Meanwhile, antisense oligonucleotides (ASOs), which reduce production of specific proteins, have entered the ring: BIIB080 (developed by Ionis and Biogen) is an ASO that tells neurons to produce less tau protein. In an early trial, BIIB080 dramatically reduced tau levels in the cerebrospinal fluid and even hinted at some slowing of cognitive decline over a year.

It received FDA Fast Track status in 2023 and is now moving to larger trials, with new data expected in 2026. If it pans out, lowering the production of tau protein could tackle the problem at its source.

Overall, the tau hypothesis maintains that tangles are the proximate killers of neurons, and thus taming tau is essential for a meaningful impact on the disease. The evidence for tau’s central role is strong – you can find people with a high amyloid load but no dementia (so-called “amyloid-positive cognitively normal” individuals), but high tau in the brain almost invariably tracks with cognitive impairment.

Moreover, a class of neurodegenerative diseases called “tauopathies” (like frontotemporal dementia and chronic traumatic encephalopathy) feature tangles without amyloid, and they too cause severe dementia. All this suggests that even if amyloid initiates Alzheimer’s, tau is the executioner.

The challenge is that tau is a harder target to hit – intracellular, and its toxic spread is not fully understood. But 2025 finds an unprecedented array of tau-focused trials underway, from J&J’s antibody to Biogen’s antisense to Axon’s vaccine. The coming 1–3 years will be pivotal in seeing if any of these can slow disease progression.

If an anti-tau therapy succeeds, it could be combined with amyloid removal for a one-two punch: remove the initial trigger and block the downstream damage. Many experts suspect this combination (and possibly others) will be needed for truly effective disease modification.

The Inflammation Hypothesis: Fire in the Brain

Beyond plaques and tangles, Alzheimer’s can be viewed as a story of chronic neuroinflammation – a smoldering brain immune response that causes collateral damage. Brains of Alzheimer’s patients show activated microglia (the brain’s resident immune cells) clustering around plaques, as well as elevated inflammatory cytokines. Whether this inflammation is a cause or consequence of the disease (or both) is an area of intense study.

There’s evidence that microglial dysfunction contributes to Alzheimer’s: mutations in certain microglial genes (like TREM2) significantly increase Alzheimer’s risk, implying that in some people, an impaired immune response to amyloid might accelerate pathology. The “inflammation hypothesis” posits that reducing harmful inflammation or correcting microglial function could slow Alzheimer’s progression – especially since inflammation might drive a vicious cycle of tissue damage once triggered by initial amyloid or tau pathology.

In 2025, neuroinflammation is one of the hottest areas in Alzheimer’s research, accounting for roughly 17% of drugs in the pipeline (medscape.com). This is a big change from a decade ago, when almost all trials were targeting amyloid or tau. Now, scientists are testing a variety of anti-inflammatory or immunomodulatory strategies:

Microglial activation modulators

One approach is to adjust the activity of microglia – neither over-activate them (which can cause friendly fire on neurons) nor let them be too sluggish (failing to clear debris). An example is Alector’s AL002, an antibody intended to agonize TREM2 (a receptor on microglia that helps them respond to plaques). By boosting TREM2 signaling, AL002 aims to make microglia more efficient “housekeepers” of amyloid and dead cells. It’s in Phase 2 trials, though results are not yet public. Another, ABBV-8E12 (tilavonemab) was actually an anti-tau antibody thought to work partly via microglial engagement; its failure suggests these mechanisms are tricky.

Cytokine blockers

Drugs that target specific inflammatory cytokines in the brain are being tested. For instance, XPro1595 by INmune Bio is a novel inhibitor of soluble Tumor Necrosis Factor (TNF), a pro-inflammatory molecule. In early Phase 2 results, XPro reduced neuroinflammation markers and seemed to improve certain cognitive measures in patients with mild AD and high inflammation biomarkers (inmunebio.com). This drug is essentially trying to dampen the “fire” without dousing beneficial immune functions. It’s an example of repurposing an approach used in systemic inflammatory diseases (like anti-TNF drugs for rheumatoid arthritis) for Alzheimer’s.

Complement system inhibitors

The brain’s complement cascade, part of the innate immune system, can drive synapse loss in Alzheimer’s by tagging synapses for destruction. Trials are underway with drugs like ANX005 (Annexon Biosciences), an antibody against C1q (the initiating component of complement). The hypothesis is that blocking complement will prevent excessive pruning of synapses in early Alzheimer’s. Results are pending; it’s a delicate balance, as complement also helps clear pathogens.

Inflammasome inhibitors

Some experimental work suggests the NLRP3 inflammasome inside microglia is overactive in Alzheimer’s, amplifying inflammation. Drugs to inhibit NLRP3 (being developed for various diseases) could potentially be applied to Alzheimer’s, though none have reached advanced trials for AD yet.

Repurposed anti-inflammatories

There have been long-running epidemiological hints that chronic use of NSAIDs (like ibuprofen) might reduce Alzheimer’s risk (observational studies of arthritis patients, etc.). However, trials of NSAIDs for prevention largely failed to show benefit, possibly because they were given too late or not targeting the right inflammatory pathways. Other repurposed ideas include colchicine (an old anti-inflammatory gout drug) which is in trials for Alzheimer’s and related dementias.

Targeting glial energy metabolism

Some efforts focus on supporting the health of microglia and astrocytes (the support cells in brain). For example, AL001 (latozinemab) aims to increase progranulin (a protein important for microglial function) and is in trials primarily for frontotemporal dementia, but the concept overlaps with Alzheimer’s inflammation issues.

Gut-brain axis and infections

A somewhat separate angle is that chronic infections or gut microbiome changes induce inflammation that affects the brain. The controversial example was Cortexyme’s atuzaginstat, a drug targeting P. gingivalis (a gum disease bacterium) and its toxins, under the theory that this bacteria infects the brain and triggers Alzheimer’s inflammation.

In a Phase 2/3 trial (2021), atuzaginstat failed to meet endpoints in mild-to-moderate AD, though a subgroup with high bacterial DNA load in saliva showed slight improvement. This has not yet led to a viable therapy, but it keeps alive questions about infectious triggers of neuroinflammation (e.g. herpes virus, which some studies implicate). So far, no antimicrobial or antiviral approach has made a dent in clinical trials, but research continues.

Genetically, the role of inflammation is supported by the fact that many Alzheimer’s risk genes (besides the big one, APOE) relate to microglial function (e.g., TREM2, CD33, CR1). This has cemented the idea that inflammation is not just a side-effect but a driver of disease in at least some patients (medscape.com).

The tricky part is modulating the immune system appropriately. Too little immune activity and the brain can’t clean up toxic proteins; too much and the friendly fire damages neurons. The current crop of trials will teach us a lot about whether tweaking the brain’s immune response can slow the disease. As of now, none of these inflammation-based therapies have emerged as proven disease modifiers, but many are in Phase 2, so we anticipate important readouts by 2025–2026.

Other Emerging Angles: Vascular Health, Metabolism, and Synapses

In addition to amyloid, tau, and inflammation, Alzheimer’s research in 2025 is exploring a panoply of other hypotheses. The disease is so complex that nearly every aspect of brain health is being investigated for a link. Here are a few notable avenues:

Vascular contribution

It’s increasingly recognized that cerebrovascular disease (strokes, microinfarcts, poor blood flow) worsens dementia and interacts with Alzheimer’s pathology. Many patients have mixed Alzheimer’s and vascular dementia pathology. Trials have examined if improving vascular health could help cognition – for example, drugs like nilvadipine (a calcium-channel blocker antihypertensive) were tested to see if better brain perfusion slows decline (results were negative).

Nonetheless, controlling cardiovascular risk factors (blood pressure, cholesterol, diabetes) is strongly recommended for brain health, and ongoing studies like ATRI’s U.S. Pointer are testing multi-domain interventions (diet, exercise, vascular risk control) to prevent cognitive decline.

Metabolic and insulin signaling

Alzheimer’s is sometimes dubbed “type 3 diabetes” because of evidence of insulin resistance in the brain. GLP-1 agonists (diabetes drugs like liraglutide and semaglutide) have shown neuroprotective effects in animal models. This led to major trials: Novo Nordisk’s semaglutide (famous as an anti-diabetes and anti-obesity drug) is in Phase 3 trials (EVOKE and EVOKE+) for early Alzheimer’s (medscape.com). Results due in 2025 will reveal if this repurposed pill can slow cognitive decline. If positive, a cheap oral drug could dramatically change the treatment landscape.

So far, smaller trials (e.g., with liraglutide) hinted at improved brain glucose metabolism, but were too small to show cognitive effects. Additionally, metformin (another diabetes drug) and intranasal insulin have been explored, though evidence is mixed. Metabolic enhancers like T3D-959 (a PPAR delta agonist) are in early trials aiming to boost neuron energy use.

Cholinergic and neurotransmitter strategies

the only approved drugs for Alzheimer’s until 2021 were cholinesterase inhibitors (donepezil, rivastigmine, galantamine) and memantine – these treat symptoms by boosting neurotransmitters, not disease progression. Some new symptomatic approaches are emerging: KarXT (xanomeline + trospium), which targets muscarinic acetylcholine receptors, is being tested for Alzheimer’s-related psychosis with Phase 3 results expected in 2025. AXS-05 (dextromethorphan + bupropion) is seeking approval to treat Alzheimer’s agitation (delveinsight.com).

These don’t cure dementia but address behavioral symptoms. Another area is synaptic plasticity enhancers – compounds to boost the formation or function of synapses. Levetiracetam (an anti-epileptic) at low doses showed some cognitive benefit in amnestic mild cognitive impairment, possibly via stabilizing neural activity. Neuromodulators like serotonergic or noradrenergic drugs (e.g., antidepressants) are being tested for whether long-term use can slow decline by improving sleep or reducing neuropsychiatric symptoms that exacerbate dementia.

Senolytics

A novel approach is tackling cellular senescence – the accumulation of “zombie” cells that secrete inflammatory factors. The rationale is that in aging (including the aging brain), senescent cells might promote degeneration. A trial is combining dasatinib (a cancer drug) + quercetin (a flavonoid), both of which can selectively eliminate senescent cells, to see if this senolytic combo improves outcomes in Alzheimer’s (medscape.com). Early-stage studies are ongoing; it’s an example of thinking outside the traditional amyloid/tau box.

Epigenetic and circadian factors

researchers are also looking at how gene expression changes (epigenetics) and circadian rhythm disruptions contribute. Some experimental drugs aim to enhance clearance of toxic proteins by leveraging the brain’s glymphatic system (which works during sleep). Sleep drugs and circadian regulators are being examined for potential long-term benefits on dementia risk.

The overarching trend is diversification of targets. In fact, as of 2025, 70% of Alzheimer’s drugs in trials target non-amyloid, non-tau mechanisms – reflecting all the approaches mentioned above and more. “Research is revealing even more complexities in how Alzheimer’s starts and progresses, and this goes beyond amyloid,” noted Dr. Sheona Scales of Alzheimer’s Research UK (medscape.com).

This diversity hedges bets: even if one hypothesis fails, others might pay off. It also opens the door to combination therapy, which many expect will be necessary. Just as combination therapy is standard in treating HIV or cancer (diseases with complex resistance mechanisms), Alzheimer’s might ultimately be treated with a “cocktail” addressing multiple pathways. Indeed, there are already 20 trials testing combination therapies – some combining an anti-amyloid with an anti-inflammatory, others pairing drugs like dasatinib + quercetin (senolytic) or dextromethorphan + a CYP inhibitor (for agitation). The idea is to attack the disease on several fronts at once.

In summary, amyloid and tau remain crucial targets (they define the disease), but they are now part of a larger constellation of therapeutic strategies. Alzheimer’s is a tangled web of pathology, and 2025’s researchers are unravelling each thread: amyloid plaques, tau tangles, microglial activation, vascular health, metabolic function, protein homeostasis, and beyond. The hope is that through a multipronged approach, the next generation of treatments will have synergistic effects to truly alter the course of this devastating illness.

Trials and Tribulations: The Alzheimer’s Drug Pipeline in 2025

Given the myriad hypotheses and targets described, it is no surprise that the Alzheimer’s drug development pipeline in 2025 is more crowded – and more diverse – than ever before. After years of despair, there is new momentum: researchers around the world have launched scores of trials, buoyed by recent successes and better tools (like biomarkers and genetic insights). Let’s take stock of the current pipeline, the key drugs in development, and what major trial readouts are on the horizon.

According to a comprehensive January 2025 survey of ClinicalTrials.gov, there are 182 active clinical trials testing 138 unique therapies for Alzheimer’s disease. This includes drugs in Phase 1 (safety testing), Phase 2 (mid-stage efficacy), and Phase 3 (large pivotal trials).

Dr. Jeffrey Cummings, who leads this annual pipeline report, notes that the 2025 pipeline has more trials and more drugs than the 2024 pipeline, reflecting the ramp-up in investment. Crucially, the pipeline has expanded not just in size but in scope: agents are directed at a broad array of 15 biological targets/processes identified in Alzheimer’s, from proteostasis and inflammation to epigenetics.

Some headline numbers illustrate this new diversity (medscape.com):

- Only 18% of drugs in trials now target amyloid-related pathways (a major shift from a decade ago when half or more did).

- About 11% target tau-related processes.

- Approximately 17% are aimed at neuroinflammation or immune mechanisms.

- 22% target various neurotransmitter or synaptic targets (symptomatic treatments, cognitive enhancers, or behavioral symptom drugs).

- Another 6% focus on synaptic plasticity/neuroprotection specifically.

- The rest are scattered across metabolism/mitochondria, vascular, growth factors, hormonal pathways, APOE4-related strategies, etc.

Importantly, repurposed medications comprise about one-third of the pipeline. These are drugs originally developed for other conditions (diabetes, depression, hypertension, etc.) now being tested against dementia. Repurposing is attractive because these drugs often have known safety profiles and can move to Phase 2/3 faster. The example of semaglutide for AD is one; others include atorvastatin (cholesterol drug), sildenafil (yes, Viagra – there was an observational study hinting at lower Alzheimer’s incidence among users, now being tested prospectively), and intranasal insulin.

To put the pipeline in perspective, as of early 2025 there are 48 trials in Phase 3, 86 trials in Phase 2, and 48 in Phase 1 for Alzheimer’smedscape.com. This is a healthy funnel (if a bit bottom-heavy in mid-stage). Since the start of 2024 alone, 56 new trials were added, including 10 new Phase 3 programs. Perhaps most striking: 12 Phase 3 trials are slated to report results in 2025 (medscape.com). This means the coming months could bring a flurry of news – positive or negative – that will shape treatment options. Let’s highlight some key players and trials to watch in each phase:

Phase 3 Readouts in 2025

One eagerly awaited result is from the EVOKE/EVOKE+ trials of semaglutide (the GLP-1 agonist pill). If semaglutide shows cognitive benefit, it would validate the metabolic approach and could quickly become a widely used therapy given its oral convenience. Another is Karuna’s trial of KarXT (xanomeline/trospium) for treating psychosis and agitation in Alzheimer’s (medscape.com). Managing behavioral symptoms is a big part of care, and if KarXT (already successful in schizophrenia trials) works for dementia psychosis, it would fill a major gap (currently, off-label antipsychotics are used, which have risks).

Donanemab’s TRAILBLAZER-ALZ 2 trial results were already positive in 2023; in 2025 the focus will be on regulatory approvals and real-world roll-out for donanemab (the FDA in the US, EMA in Europe, etc., are evaluating it – China and some others have approved it as noted). Gantenerumab’s second act: Roche is not giving up on its antibody that failed in 2022; they have modified it as “trontinemab” with a brain shuttle to increase uptake (medscape.com). A Phase 1 showed it dramatically increased brain antibody levels; a Phase 2 is upcoming to see if that translates to efficacy.

Lecanemab (Leqembi), already approved, will also yield more data as ongoing extension studies (like the AHEAD prevention trial) progress, and it could get approvals in more regions (Europe’s EMA, for instance, recommended approval in early 2025 after some delay (pharmaceutical-technology.com).

On the tau front, JNJ-63733657 (posdinemab) won’t have Phase 2 results until perhaps 2026, but we might see interim data or news if the AuTonomy trial meets any early milestones. UCB’s bepranemab might present full published results of its recent Phase 2 – to understand why it failed clinically but succeeded biomarker-wise, informing future tau mAb design.

Phase 2 trials (potential future Phase 3 entrants)

A number of mid-stage trials could graduate to Phase 3 if results are good. BIIB080 (tau antisense) will have Phase 2 data by 2026 (medscape.com), but any strong signal might prompt a larger trial sooner. ALZ-801 (valiltramiprosate) by Alzheon is an interesting one in Phase 3 already: it’s an oral agent targeting amyloid oligomers. It is essentially a prodrug of tramiprosate, aiming at APOE4/4 homozygous patients. Results might come in 2024–25; if positive, it could be the first easy-to-take anti-amyloid (though mechanism differs from antibodies).

Anavex 2-73 (blarcamesine), a small molecule that modulates sigma-1 and muscarinic receptors, had a controversial Phase 2/3 in 2022 that the company claimed was successful, but many experts were skeptical of the analysis. It’s nonetheless moving to larger trials.

Cassava Sciences’ simufilam, another controversial candidate (targeting an altered filament protein to restore synaptic function), is in Phase 3 with results maybe by late 2025 – but there are outstanding questions about the integrity of some of Cassava’s preclinical data. These two illustrate the high-risk, high-reward nature of some smaller companies in the pipeline – while big pharmas focus on antibodies and well-validated targets, smaller biotechs sometimes pursue idiosyncratic approaches that generate hype yet need rigorous confirmation.

Another Phase 2 to watch: NE3107 (a small molecule anti-inflammatory/insulin-sensitizer) that reportedly had a positive Phase 2 (cognitive improvement in mild AD) in 2022; a larger trial is planned. Lomecel-B, a cell therapy (MSC stem cells) for Alzheimer’s, showed hints of slowing cognitive decline in a small Phase 1; a Phase 2 trial is underway to see if stem cell infusions could modulate inflammation and trophic support in the brain.

Phase 1 and exploratory

In early trials, entirely new modalities are being explored. Gene therapies delivered via AAV vectors, for example, are being tested to deliver nerve growth factors or anti-tau genes to the brain. CRISPR-based therapies are still in preclinical stages for Alzheimer’s but not yet in human trials. Focused ultrasound to open the blood–brain barrier transiently (to help clear amyloid or deliver drugs) is another innovative approach: a 2023 pilot showed safety and some cognitive hints in a small group (fusfoundation.org). If this non-pharmacological method can be optimized, it could synergize with antibody therapy by improving their brain entry.

Amid this bustling pipeline, it’s worth remembering that failures continue to happen – that’s the nature of the field. The DelveInsight report in early 2025 pointed out several notable failures in 2023-2024: Lilly’s LY3372689 (an O-GlcNAcase inhibitor for tau) was halted, Athira’s fosgonimeton (aimed at a growth factor pathway) produced mixed Phase 2 results and lost investor confidence, Roche’s gantenerumab was a major Phase 3 failure in late 2022, and even Lilly’s old stalwart solanezumab finally died for good as a prevention trial in asymptomatic patients showed no benefit in 2023 (delveinsight.com).

Verubecestat, lanabecestat, umibecestat – all the BACE inhibitors – were terminated by 2018-2019. It reads like a graveyard of once-promising names. But these failures are now viewed less as “the end” and more as lessons or redirections. Each failed approach has often led to a new and better approach (e.g., failing with solanezumab targeting monomeric amyloid led to focusing on protofibrils with lecanemab, which succeeded). The pipeline today is wiser from past failures – targeting earlier disease stages, using biomarkers to select the right patients, and designing drugs that more potently engage their targets.

One trend is the rise of combination and prevention trials. Combination therapy trials already account for 11% of the total (medscape.com), a proportion likely to grow. Meanwhile, prevention trials (testing interventions in cognitively normal but at-risk people) are proliferating.

These include not only drug trials like AHEAD (lecanemab in preclinical AD) and API (anti-amyloid in genetic AD), but also multidomain lifestyle trials (e.g., the European FINGER study showed (globalrph.com)a combo of exercise, diet, and cognitive training slowed cognitive decline in at-risk seniors – inspiring similar studies worldwide).

The idea is shifting from playing catch-up with established dementia to getting ahead of the disease process – akin to controlling cholesterol before heart attacks happen. By 2025, prevention is no longer a fringe idea (medscape.com) but an increasingly mainstream goal in research. As Cambridge’s Dr. James Rowe noted, “the notable increase in late-phase trials focused on prevention… is very exciting. The aspiration to prevent, not just treat, is starting to be seen in the figures.”

In summary, the current Alzheimer’s drug pipeline is large, diverse, and dynamic. It spans everything from cutting-edge biologics to repurposed pills, from high-tech gene therapies to holistic lifestyle interventions. Global participation is also evident – trials are taking place across North America, Europe, Asia, and beyond, and regulatory agencies around the world are weighing new drugs (for instance, Japan, China, and others approved lecanemab in 2023-2024 even as Europe deliberated). There is a palpable sense in the field that after decades of frustration, momentum is finally on the side of progress – but it will require navigating the upcoming trial results, which are sure to have some disappointments alongside victories (statnews.com).

The Key Players: Who’s Leading the Effort?

The fight against Alzheimer’s is a global, multidisciplinary enterprise, involving pharmaceutical giants, biotech startups, academic institutions, government agencies, and advocacy organizations. Here we profile some of the key players and how they shape the trajectory of Alzheimer’s research and development:

Big Pharma and Biotech Companies

Large pharmaceutical companies have been and remain central. Eli Lilly, Biogen, Eisai, Roche/Genentech, Johnson & Johnson, Merck, and Novartis are among those who invested heavily over the years. Lilly, for example, has been in the game for three decades – its long quest (including the failed semagacestat, solanezumab, etc.) is finally paying off with donanemab (ifpma.org).

Biogen bet big on aducanumab and, despite the controversies, followed through with Eisai on lecanemab. Eisai, a Japanese firm, has emerged as a major leader, co-developing the first successful antibody (lecanemab) and pioneering its own diagnostics. Roche sank enormous resources into amyloid antibodies (crenezumab, gantenerumab) without success so far, but is innovating with brain shuttles and also has a pipeline of tau therapies.

Johnson & Johnson and its subsidiary Janssen have fingers in many pies: they partnered on BACE inhibitors, have a tau antibody (posdinemab) in trials, and are investing in vaccines (through a collaboration with AC Immune).

Merck and Pfizer, after big failures (Merck’s verubecestat, Pfizer’s bapineuzumab and a general R&D re-org), pulled back around 2018 – though Merck still markets the successful BACE-derived diagnostic tool (florbetapir amyloid PET tracer).

Interestingly, Novo Nordisk, not previously a neurology player, might become one if semaglutide works, leveraging its success in diabetes/obesity into neurology.

AstraZeneca too had partnered on lanabecestat (failed) and has some early programs.Importantly, many big firms have partnerships with smaller biotechs or academic spin-offs. For instance, TauRx (a Singapore/UK company) pursued the tau aggregation inhibitor LMTX; AC Immune (Switzerland) has collaborations on multiple fronts (Genentech for anti-tau, J&J for vaccines); Ionis (RNA therapeutics firm) worked with Biogen on the tau antisense.

Alector (California biotech) teamed with AbbVie on immunotherapy approaches. The list of biotech players is long: e.g., Anavex, Cassava Sciences, Alzheon, Athira, Cortexyme (now Quince), INmune Bio, Annexon, Vaccinex, Cerecin, AgeneBio, T3D Therapeutics, BioVie, NeuroImmune, AC Immune, ImmunoBrain Checkpoint, and more – each targeting different mechanisms from sigma receptors to lipids to inflammatory checkpoints. Many of these are mentioned in the DelveInsight analysis as late-stage hopefuls (delveinsight.com).

While big pharma often handles the expensive Phase 3 trials and global approvals, small innovators often do the early high-risk science that larger companies later license or acquire if promising.

Public Research Institutions and Collaboratives

On the public side, the U.S. National Institutes of Health (NIH) – particularly the National Institute on Aging (NIA) – has massively ramped up funding for Alzheimer’s research in the past decade. U.S. federal funding for Alzheimer’s and related dementias reached about $3.8 billion per year by 2023 (alz.org), a more than 5-fold increase since 2013. This infusion has supported big programs like the Accelerating Medicines Partnership (AMP-AD), which fosters public–private data sharing to find new targets, and the Alzheimer’s Disease Neuroimaging Initiative (ADNI) for biomarker development (atri.usc.eduatri.usc.edu).

The European Union has its own Joint Programme – Neurodegenerative Disease (JPND) and huge consortium projects (like EPAD for Alzheimer’s prevention trial readiness). China is investing as well – China’s approval of drugs like Oligomannate (a seaweed sugar-based drug purported to modulate gut flora) in 2019 and donanemab (Kisunla) in 2024 shows their eagerness to implement new therapies, and Chinese academia contributes a growing share of AD research publications. Japan has been at the forefront via companies like Eisai and through government-backed programs focusing on dementia as a national priority in their aging society.Academic medical centers worldwide run many of the trials, often in collaboration.

Networks like the Alzheimer’s Clinical Trials Consortium (ACTC), based in the U.S., coordinate multi-center trials for investigator-initiated studies. The Dominantly Inherited Alzheimer Network (DIAN), based at Washington University in St. Louis with international sites, leads trials in familial AD. Such collaborations ensure that knowledge and resources are pooled, which is crucial given the complexity of the trials.

Philanthropy and Non-Profits

Philanthropic organizations play a significant role in funding high-risk, novel research and raising public awareness. The Alzheimer’s Association (US), the largest dementia charity, not only provides support services but also funds research (over $250 million in active grants) and convenes the annual AAIC conference, the biggest AD research meeting. They have also been active in policy, lobbying for increased NIH funding and better Medicare coverage for new treatmentsalz.org. In 2022, the Alzheimer’s Association helped push CMS to ease its stance on covering monoclonal antibodies upon full FDA approval (which happened in 2023 for lecanemab).

The Alzheimer’s Drug Discovery Foundation (ADDF), co-founded by Leonard Lauder and led scientifically by Dr. Howard Fillit, specifically focuses on funding early-stage drug discovery and diverse targets beyond amyloid. Dr. Fillit noted how the drug portfolio has dramatically diversified compared to five years ago (medscape.com) – a change ADDF has helped bring about by seeding research into inflammation, mitochondria, neuroprotection, etc. Cure Alzheimer’s Fund is another philanthropy that supports basic research on novel targets (they helped fund the discovery of the importance of microglial gene TREM2, for example).

Tech philanthropists have also joined in: the late Paul Allen’s Allen Institute did foundational work on brain aging; Bill Gates has invested in Alzheimer’s diagnostics and data initiatives, co-founding the Dementia Discovery Fund and Davos Alzheimer’s Collaborative (focused on global research infrastructure).

Healthcare Systems and Payer

Interestingly, as new therapies come to market, payers (insurance systems) become key players too – effectively gatekeepers to patient access. In the US, Medicare (CMS) had an outsized influence on aducanumab’s fate: after Aduhelm’s approval, CMS said it would only cover it (and similar drugs) for patients in clinical trials (biopharmadive.com). This unprecedented decision in April 2022 severely limited Aduhelm’s use. By mid-2023, CMS updated its stance: with full FDA approval of Leqembi, Medicare agreed to cover it for all eligible patients (those with mild Alzheimer’s and confirmed amyloid pathology), but with a catch – providers must submit data to a patient registry to track outcomes (kff.org).

This was the first time Medicare tied coverage of a drug to ongoing data collection (a form of Coverage with Evidence Development). While not as restrictive as trial-only coverage, the registry requirement reflects continued caution and desire for real-world evidence on safety and effectiveness. Outside the US, national health systems and health technology assessment bodies (like NICE in the UK or IQWiG in Germany) are evaluating these drugs’ cost-effectiveness. For example, Japan and some European countries have approved Leqembi with likely conditions on pricing or usage, whereas as of early 2025, NICE had not yet recommended any of the new mAbs pending further review of efficacy vs cost.

In short, it takes a village to tackle Alzheimer’s: big pharma provides muscle and experience in drug development, biotechs bring innovation and agility, academia contributes deep scientific insight and trial infrastructure, governments supply funding and coordination, nonprofits keep the focus on patient needs and seed high-risk ideas, and payers and regulators ultimately determine which breakthroughs reach patients and under what conditions. Collaboration among these stakeholders has grown – for instance, public-private partnerships like the AMP-AD bring NIH, pharma, and nonprofits together to share data, and the Global Alzheimer’s Platform network accelerates recruitment for trials.

The competitive landscape is also notable: companies that were once rivals in the amyloid antibody race (Biogen vs Lilly vs Roche) are now in some ways racing against the disease rather than each other. Each successful drug potentially benefits the others by proving the viability of the pathway. And with combination therapies likely needed, former competitors might end up partnering (for example, one can imagine a future trial combining Lilly’s donanemab with a Roche/Genentech tau antibody, if science suggests it).

The Cost of Progress: Investments, Pricing, and Payer Pushback

Alzheimer’s not only tests science and medicine – it also tests our healthcare systems and economics. With new treatments emerging, questions of cost, value, and access have come to the fore. This is exemplified by the saga of aducanumab and its successors, which sparked intense debate about drug pricing and insurance coverage. Here, we examine how much is being invested in Alzheimer’s R&D and what the potential return on that investment looks like, as well as the payer pushback and policy responses to very expensive therapies that offer incremental (though important) benefits.

First, the investment: After decades of failure, one might assume investments would dry up – but the opposite happened. The sheer scale of the Alzheimer’s crisis (and market) has attracted increasing funding. On the public side, as noted, the U.S. is now spending nearly $4 billion per year on Alzheimer’s researchalz.org – a dramatic rise that lawmakers justified by pointing to the even greater cost of care for dementia (over $300 billion annually in the U.S. in direct and unpaid care costs). Europe similarly has dedicated hundreds of millions of euros through programs like the EU Joint Programme on Neurodegenerative Disease.

Private industry’s investment is harder to quantify but undoubtedly runs into the tens of billions over the past two decades. It’s been said that Alzheimer’s drug research has seen “more than $30 billion in R&D for nothing to show” before 2021 – a hyperbolic way to highlight the huge sunk costs. Companies like Lilly likely spent well over $1–2 billion on solanezumab and other failures. Biogen spent massive sums on aducanumab’s trials, including restarting the program after initial failure. Yet these companies persist because a successful Alzheimer’s drug is also a massive business opportunity: the global Alzheimer’s drug market, virtually stagnant for years at ~$3-4 billion (just from symptomatic drugs), could explode tenfold or more if disease-modifying drugs become standard for millions of patients.

However, those future revenues raise the issue of who will pay. Aducanumab launched in 2021 with a list price of $56,000 per year in the U.S. for a patient of average weight. This sticker shock prompted immediate backlash from insurers, physicians, patient groups, and even Congress (biopharmadive.com). Biogen was accused of pricing unrealistically high given the tenuous evidence of efficacy. Major hospital systems (like Cleveland Clinic and Mass General) announced they wouldn’t administer it. Private insurers indicated they might not cover it widely.

Medicare, facing the prospect of millions of potential patients, warned that covering Aduhelm could alone raise Medicare Part B spending astronomically, and even preemptively hiked premiums for 2022 in anticipation (kff.org). Facing this “intense pushback,” Biogen in late 2021 slashed the price by ~50% to $28,200 per year. Even that did not rescue the drug – once Medicare’s restrictive coverage decision came in 2022, Aduhelm was effectively dead in the water. Biogen’s case became a cautionary tale: if a drug’s perceived value is not aligned with its price, payers will balk. And in single-payer or centralized systems (like NHS in UK or CMS in US for Medicare), that can make or break a drug’s adoption.

Now, with Leqembi (lecanemab) and Kisunla (donanemab), companies have tried to avoid Aduhelm’s missteps. Eisai set Leqembi’s annual price at $26,500 – lower than Aduhelm’s original price, but still very high for a drug needed potentially for years (biopharmadive.com). Is $26.5k/year “worth it” for ~27% slowing of decline? Analyses by groups like the Institute for Clinical and Economic Review (ICER) suggest that to be cost-effective (in terms of quality-adjusted life years), the price might need to be lower, perhaps in the $10-20k range given the modest efficacy.

Eisai likely chose $26.5k to thread the needle – it’s high but they argue Alzheimer’s imposes such huge costs that even a small delay in institutionalization or caregiving burden is worth that price. They also pointed out that severe Alzheimer’s can cost $50-100k/year per patient in care, so a drug that delays those costs has societal valuekff.orgkff.org.

Medicare’s decision to cover Leqembi after full approval was monumental, because Medicare is the primary payer for the over-65 population that Alzheimer’s affects. However, Medicare’s coverage comes with a requirement: providers must collect data on each patient in a registry. The idea is to monitor real-world outcomes and safety, effectively continuing Phase 4 research. This was a compromise between outright restriction and open-ended coverage. It means patients can get the drug (which is critical), but doctors and hospitals have to navigate paperwork to submit data. It remains to be seen if this dampens uptake due to administrative burden.

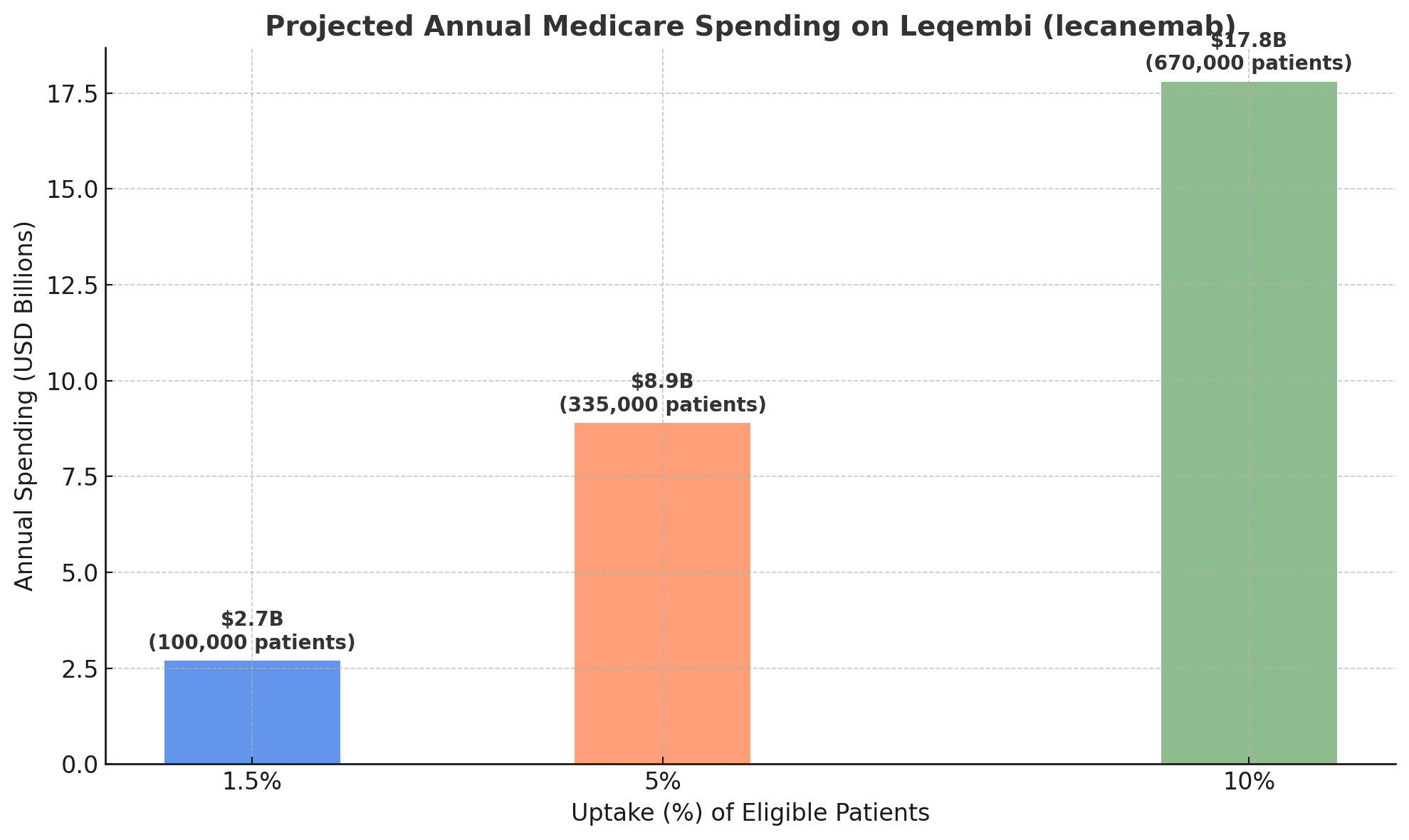

Even with coverage, a significant issue is patient out-of-pocket cost. In Medicare Part B (which covers physician-administered drugs like infusions), patients typically pay 20% coinsurance. For a $26,500 drug, that’s $5,300 a year out-of-pocket – a huge sum considering the median income of Medicare beneficiaries is around $30,000 (kff.org).

Many retirees simply won’t be able to afford that, unless they have supplemental Medigap insurance or qualify for Medicaid. This raises equity concerns: wealthier, often white, patients might have better access than lower-income or minority patients, exacerbating disparitieskff.org. Policymakers and insurers will have to consider if special accommodations (like waiving cost-sharing) should be made for these drugs, given their unique nature as the first disease-modifying treatments for a devastating illness.

From the macro perspective, if these drugs are widely adopted, the spending is eye-popping. Kaiser Family Foundation (KFF) estimated that if just 100,000 Medicare patients (a small fraction, ~1.5% of those with Alzheimer’s) take Leqembi, it would cost Medicare about $2.7 billion per year. That would place it among the top 3 costliest Part B drugs. If uptake grew to 500,000 patients (still under 10% of eligible), annual spending would approach $17–18 billion– roughly half of the entire current Medicare Part B drug budge.

This doesn’t even count ancillary costs: each patient needs amyloid PET scans or spinal taps to confirm diagnosis, plus periodic MRIs to monitor for ARIA side effects, plus infusion center costs. Those could add tens of thousands more per patient. Some analyses project the total cost per patient per year could be $82,500 when including all related care (cbsnews.com).

Such spending would inevitably reflect back in higher insurance premiums and taxes. In fact, Medicare Part B premiums jumped by 15% for 2022 largely due to Aduhelm’s anticipated costg; when Aduhelm’s use was curbed, premiums actually saw a rare small decrease in 2023 (kff.org).

If Leqembi and others see broad use, seniors may face higher Part B premiums again. For private insurers (covering <65 early-onset Alzheimer’s patients, or those in Medicare Advantage), covering these drugs will also be a major expense that could raise overall healthcare costs and premiums for employers and individuals.

Payer pushback thus far has been manifested in the restrictive coverage, calls for more data, and public discussion of value. But we might also see negotiations on price. In many countries with single-payer healthcare, the government negotiates or dictates drug prices.

The U.S. historically has not for Medicare Part B, but a recent law (the Inflation Reduction Act of 2022) gives Medicare the power to negotiate prices for certain high-cost drugs starting in the late 2020s. If Leqembi or donanemab remain high-expenditure, they could be candidates for negotiation down the line. Additionally, there’s pressure on companies to implement value-based pricing – for instance, tying payment to patient outcomes (though in Alzheimer’s that’s tricky to measure on individual basis).

All these economic considerations underscore that demonstrating clinical value is crucial. If lecanemab and donanemab truly help patients maintain independence longer (delay nursing home placement, for example), payers may see downstream cost offsets that justify the expense. But if benefits are marginal or difficult to quantify, payers will remain reluctant.

So far, the new antibodies have shown statistically significant slowing of decline – an important first step, but patients and families often ask, “Will it make a noticeable difference in my daily life?” Some experts characterise the current benefit as “meaningful but not huge”. The hope is that next-generation therapies or combinations will further improve efficacy, which could then improve the cost/benefit calculus as well.

Finally, we must consider the investment in care infrastructure that goes hand-in-hand with new drugs. Having a therapy means little if patients can’t get diagnosed or treated in a timely way. Right now, diagnosing Alzheimer’s definitively often requires specialized PET scans or lumbar punctures, which are not universally available or reimbursed (Medicare, for example, still limits amyloid PET scan coverage, though that may change with new policies).

There’s a push to approve and reimburse blood tests for AD biomarkers, which are emerging as accurate screening tools for amyloid and taut. Wider use of such blood tests could identify eligible patients more easily and cheaply, thus improving access to treatment (and also potentially expanding the market for the drugs – something payers are eyeing). At the treatment end, infusion centers need to accommodate potentially hundreds of thousands of new patients receiving regular infusions – a logistical challenge. In some rural or underserved areas, there may be a shortage of memory specialists or infusion clinics, creating geographic disparities in access.

The global picture on pricing is still evolving. Japan’s system approved Leqembi and will negotiate a price (likely somewhat lower than US price). In Europe, after some initial hesitation, the EMA’s approval in 2025 of lecanemab will lead to country-by-country pricing talks.

Countries with single-payer systems might drive harder bargains; for instance, if a country concludes the drug’s benefit doesn’t justify $25k/year, they might only pay $15k/year or restrict it to certain subgroups. We have already seen high unmet need sometimes leading to premium pricing (as with rare disease drugs), but Alzheimer’s is not rare – broad usage makes cost containment a bigger issue for national budgets.

In conclusion, the economics of Alzheimer’s treatments are as challenging as the science. Massive R&D investments are now yielding products, but those products come with high price tags that healthcare systems struggle to absorb given modest efficacy. Payers are responding with caution – demanding evidence through coverage with evidence development, and foreshadowing tough price negotiations.

For patients and families, these drugs represent newfound hope, but also anxiety: hope that the relentless decline might be slowed; anxiety about whether they can access and afford the treatments, and whether insurers will support them. In the coming years, as more therapies (hopefully with greater effect) emerge, pressure will grow to devise innovative payment models – perhaps government subsidies, value-based arrangements, or insurance redesign – to ensure that scientific progress actually translates into public health progress.

Future Outlook: Hope on the Horizon

As we stand in mid-2025, the campaign against Alzheimer’s disease is entering a new phase. There is at last tangible progress to point to: disease-modifying treatments on the market (albeit with limitations), a pipeline bursting with novel ideas, and significantly improved tools for early detection. The mood in the research community is one of guarded optimism – a welcome change after years of frustration. Yet, no one is declaring victory; Alzheimer’s remains an exceptionally formidable foe. What can we expect in the coming years, and what are the key challenges that remain?

Short-term milestones (2025–2026)

In the next 18 months, we will see results from the many Phase 3 trials reporting out. By end of 2025, we’ll likely know if an oral drug like semaglutide can replicate in Alzheimer’s the success it’s had in other diseases – a positive result would be a game-changer, providing an easy alternative or adjunct to antibodies (medscape.com).

We’ll learn whether tackling neuropsychiatric symptoms yields new therapies (KarXT, AXS-05) that can improve patients’ quality of life even if they don’t slow the disease. We will also get clarity on tau therapies in development: for example, if J&J’s posdinemab shows clear target engagement and even a hint of cognitive benefit in Phase 2, it will validate tau as the next big target to aggressively pursue.

By 2026, Biogen’s tau antisense (BIIB080) data will come – potentially the first proof that gene silencing can slow a neurodegenerative disease (medscape.com).

We also anticipate regulatory decisions across the world. Europe, which had been cautious, is likely to approve lecanemab (Leqembi) and donanemab in 2025, meaning patients in EU countries may finally access what US and Japanese patients already can. This will raise similar debates about cost-effectiveness in those healthcare systems.

In parallel, blood-based diagnostics may gain regulatory green lights, enabling wider screening and earlier diagnosis – a critical component if therapies work best early. By 2025, at least one plasma biomarker test (for example, Quest’s AD-Detect or C2N’s Precivity) might get FDA clearance for clinical use, and global adoption could follow.

Medium-term (2027–2030): If the current trajectory holds, by the end of the decade we could have a catalog of therapies addressing different facets of Alzheimer’s. Perhaps an anti-amyloid antibody (or even a cheaper small molecule amyloid agent) will be combined with an anti-tau treatment – trials of such combos could start once tau drugs reach Phase 3. We might also see an anti-inflammatory or microglial modulator prove itself and join the arsenal.

The first generation of preventive therapies might show efficacy: imagine a scenario where someone in their 50s with high Alzheimer’s risk (say, an APOE4 carrier with elevated amyloid on a blood test) could take a drug or vaccine to postpone or avert dementia. Ongoing prevention trials like AHEAD and API will inform this – even if they don’t succeed with current drugs, they’ll tell us how to design better prevention studies.

In terms of societal impact, if we can routinely slow Alzheimer’s by, say, 30–50% with combinations, that could translate to patients living several extra years independently. That would be a profound change. It’s possible that by 2030, Alzheimer’s could become a manageable chronic condition for those with access to treatments, rather than an inevitably terminal, rapid descent. This is speculative but not out of reach if current progress continues.

However, there are cautionary notes. Many unknowns remain: Will patients continue to respond over the long term to these therapies? (Some might plateau or decline after initial slowing.)

Will tackling amyloid and tau together yield additive benefits, or will we encounter diminishing returns? How do we tailor treatments to individuals? – for example, an APOE4/4 patient might benefit more from certain approaches (like Alzheon’s ALZ-801 targeting APOE-related amyloid oligomers) than an APOE3 patient, etc. The field of precision medicine in Alzheimer’s is just beginning – eventually, genetic and biomarker profiles might guide personalized combinations (much as oncology does with tumor markers).

Indeed, one Neurotorium piece was titled “From One-Size-Fits-All to Precision Medicine” (neurotorium.org), underlining that the heterogeneity of Alzheimer’s (or Alzheimer’s diseases, plural, as some call it) may require custom strategies per patient.

Drug development challenges will persist. Many mechanism-based approaches will still fail – perhaps we’ll find out that clearing tau is even harder than hoped, or that an anti-inflammatory drug helps biomarkers but not clinical outcomes. We must also contend with safety: as therapies get more aggressive (e.g., combination of multiple immunotherapies), risks could compound. Vigilant monitoring in trials and real-world is essential to ensure we aren’t causing more harm than benefit.

Then there’s the health system readiness: millions of people have early Alzheimer’s or MCI that is currently undiagnosed. Will primary care doctors be prepared to screen and refer these patients earlier? The healthcare workforce (neurologists, geriatricians) may need expansion and training for the new era of Alzheimer’s care. Caregiver support will remain crucial too – drugs are not a panacea, and patients will still need supportive care, memory interventions, and social support.

Economically, a hopeful vision is that as more competitors (drugs) enter the field, prices will moderate. Perhaps biosimilars or alternative modalities (like a small molecule that reduces amyloid or tau) could undercut the pricey antibodies, saving costs. Or if evidence of long-term benefit becomes robust (say a drug clearly delays nursing home placement by 2 years), insurers may be more comfortable with broad coverage and even eliminate co-pays, knowing it saves money in the big picture. The value proposition should improve if second-generation drugs can double the efficacy we see today.

One cannot ignore the global equity issue either: most innovation is happening in wealthy countries, but the majority of dementia sufferers by 2050 will be in low- and middle-income countries. Efforts like the Davos Alzheimer’s Collaborative (a project of the World Economic Forum and stakeholders including Gates and WHO) are starting to think about global access – investing in research cohorts in diverse populations, helping build diagnostic capacity worldwide (davosalzheimerscollaborative.org).

We can be optimistic that by 2030, emerging economies will also benefit from blood tests and generic forms of current drugs, ensuring Alzheimer’s advances don’t widen health disparities further.

Alzheimer’s research has taught us humility, but also persistence. Progress came more slowly than predicted – the lofty goal of 2013 (a cure or effective therapy by 2025) was not fully met, though we got partway there with “effective therapy” emerging just at the deadline. The new goal might be something like effective prevention or highly effective combination therapy by 2030. Given the trajectory, this seems achievable. Each incremental victory – clearing plaques, slowing decline by a few months – adds up, and researchers are building on those gains.

We now appreciate that Alzheimer’s won’t likely be vanquished by a single silver bullet, but by a sustained, multi-front campaign. In a sense, we’ve opened a new front in that war with the advent of disease-modifying drugs; the battle now is to refine and deploy them in a way that truly bends the curve of this illness for society.

To conclude on a note of cautious hope: Not long ago, it was common to hear that “nothing can be done” for Alzheimer’s patients except symptomatic care. In 2025, we can finally say that is no longer true – we can intervene in the disease process itself, however imperfectly for now. The quest now is to turn these early breakthroughs into robust, widespread solutions.