The Weekly Term Sheet (29)

For large pharmaceutical firms, the week’s deals underscored a willingness to spend on promising science – especially to hedge against looming patent cliffs. Japan’s Otsuka Pharmaceuticals, for instance, struck a $613 million licensing deal with Sweden’s Cantargia to snag rights to an IL1RAP-targeting antibody for inflammatory diseases. The upfront payment is a modest $33 million, but the biobucks balloon with milestones, signaling Otsuka’s serious bet on autoimmunity.

The therapeutic payoff, if successful, could be substantial: Cantargia’s Phase 1 antibody aims to tame conditions like hidradenitis suppurativa, giving Otsuka a foothold in dermatology and immunology beyond its traditional CNS focus. As Otsuka’s president noted, the deal expands its autoimmune R&D pipeline – a strategic broadening of horizons for a company known more for antipsychotics than skin drugs (fiercebiotech.com).

Meanwhile, Novartis (ever hungry for innovation) went on a radiopharmaceutical foray by partnering with Ratio Therapeutics in a deal worth up to $745 million. Though announced just before our week, it exemplifies the trend: big players shelling out big sums (often heavily backloaded with milestones) to access cutting-edge platforms – in this case, a radioligand therapy for oncology (ratiotx.com).

These headline-grabbing figures are mostly “biobucks” – payments tied to long-term success – but they signal confidence that at least a few of these pipeline prospects will pay off handsomely.

If upfront cash is any indicator of commitment, AbbVie’s exclusive license of Ichnos Sciences’ trispecific antibody for multiple myeloma (signed just ahead of this week): $700 million upfront and up to $1.225 billion in milestones (pharmiweb.com). That pact, although technically inked on July 10, set the tone for the days that followed – highlighting how even in a tighter capital environment, pharma giants remain ready to write large checks for truly novel science. AbbVie’s prize, ISB 2001, is a Phase 1 T-cell engager showing eye-popping early efficacy (84% response in CAR-T naïve patients).

The hefty price tag underscores a strategic theme: big pharma is willing to pay a premium now to secure next-generation therapies that might one day fill the shoes of aging blockbusters.

Bargain hunting and fire sales

At the other end of the deal spectrum, some biotechs found themselves opting for M&A as an exit strategy rather than a victory lap. Concentra Biosciences, an entity backed by biotech investor Kevin Tang, has mastered the art of scooping up distressed “zombie” biotechs for the value of their cash. On July 8 (just before our week), Concentra agreed to acquire CARGO Therapeutics – a CAR-T outfit that hit a wall in clinical trials – for about $4.38 per share plus a CVR, effectively liquidating the company. By July 21, Concentra was launching the tender offer (ainvest.com).

It’s a cautionary tale: after raising nearly $500 million in 2023, CARGO’s ambitions collapsed with a safety setback, and Concentra’s buyout will largely return remaining cash to shareholders.

Pay a premium to net asset value, then return leftover cash – is a polite form of corporate euthanasia for struggling biotechs. It reflects a broader investor impatience: why let a floundering company pivot and burn cash when you can cut losses and salvage what’s left? The chilling effect on management ego is clear, and perhaps welcome. As one analyst quipped, the era of stubbornly pursuing “Plan B” is yielding to a new mantra: “I would prefer not to – unless there’s funding.”

Cross-border courtships and regional ambitions

Consider Acumen Pharmaceuticals, a U.S. biotech with an Alzheimer’s antibody, and JCR Pharmaceuticals from Japan, famed for its blood-brain barrier (BBB) technology. Their partnership, announced July 15, is as strategic as they come: Acumen gets to piggyback on JCR’s “J-Brain Cargo” platform to shuttle its antibody into the brain, potentially overcoming a hurdle that has long stymied neurotherapeutics (fiercebiotech.com).

The deal structure is heavily milestone-weighted – up to $555 million in total biobucks – and gives Acumen an option to license two drugs emerging from the collaboration. It’s a marriage of complementary strengths: JCR’s delivery tech with Acumen’s AβO-selective antibody (sabirnetug) that’s already in Phase 2 trials (fiercebiotech.com). Strategically, each side is hedging its bets. Acumen gains a shot at differentiating its Alzheimer’s therapy in a very crowded field by ensuring the drug actually reaches the brain.

JCR, fresh off a separate $825 million AAV capsid pact with AstraZeneca’s Alexion unit days earlier, now tacks on an Alzheimer’s venture, spreading its technology across rare diseases and common neurodegeneration alike. In the punctilious tone of Bartleby: one might say JCR is ensuring it has “preferably more” shots on goal rather than fewer.

The week also illustrated China’s growing role as both a source of innovation and acquirer of it. Hong Kong–listed Sino Biopharmaceutical made waves on July 15 by announcing the purchase of the remaining stake of LaNova Medicines, a Shanghai-based cancer biotech, for up to $951 million (reuters.com).

LaNova had turned heads just months before when Merck & Co. licensed its PD-1/VEGF bispecific antibody (LM-299) in a deal worth up to $3.3 billion (fiercebiotech.com).

Now Sino Biopharm is bringing LaNova fully in-house, effectively betting that ownership of cutting-edge Chinese science will pay off more than partnership. The move “will enhance Sino’s competitiveness and influence in oncology innovation” and poise it for more international partnerships by leveraging LaNova’s R&D, the company said (reuters.com).

The deal also speaks to a trend identified in a Jefferies report released July 14: Chinese biotechs are increasingly out-licensing assets to Western pharma, reshaping global deal flow (fiercebiotech.com). Sino’s acquisition flips the script – a Chinese pharma consolidating Chinese innovation – potentially to out-license it right back to the West on its own terms. It’s a shrewd high-level strategy wrapped in a $951 million package.

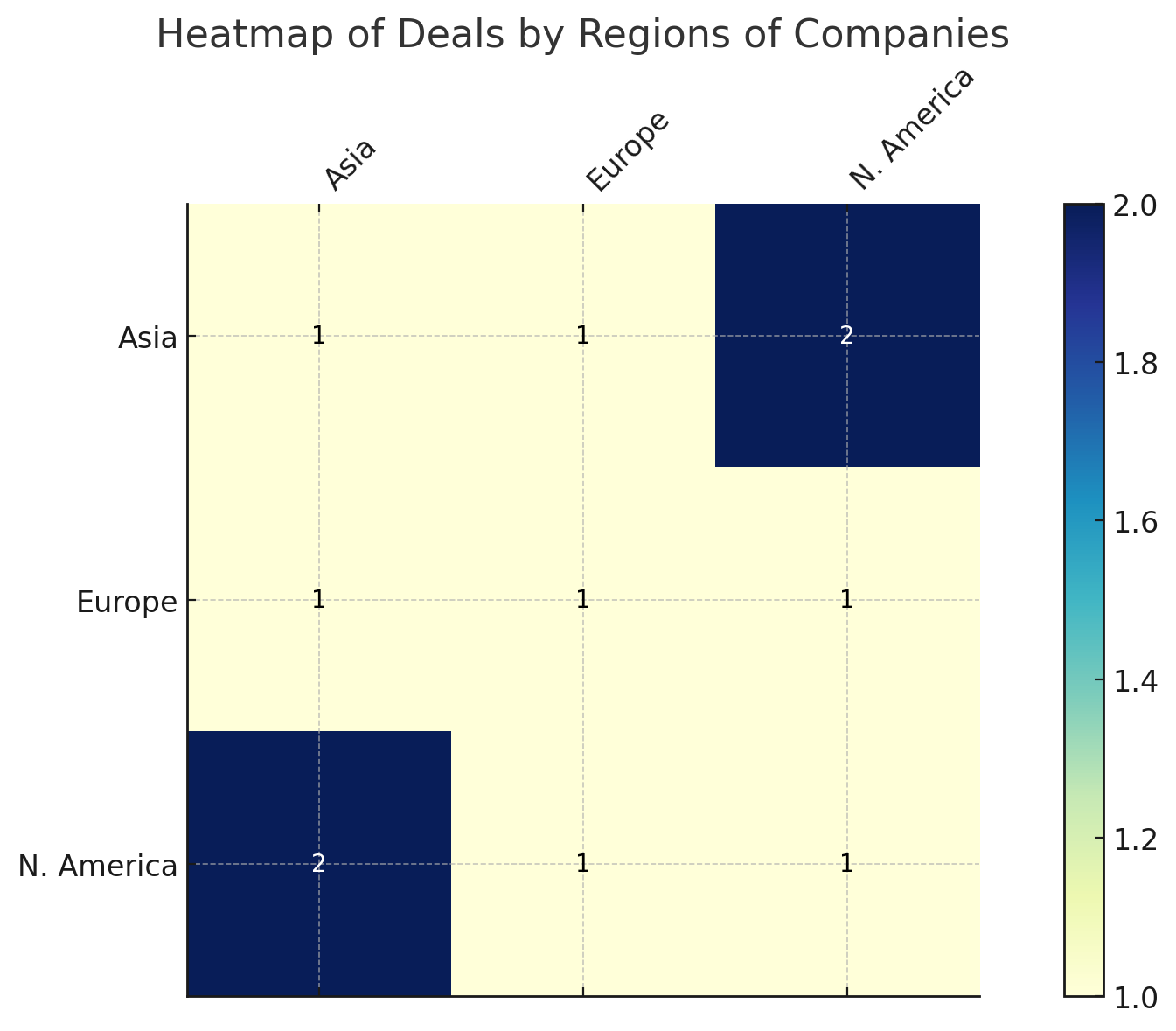

Geography, in fact, was no barrier at all in this week’s bargaining. A quick look at the patterns shows a truly international marketplace: deals linked Asia and Europe, North America and Asia, North America and Europe, as well as purely domestic tie-ups in each region.

Japan’s Otsuka tapping a Swedish biotech, a U.S.-Japan Alzheimer’s alliance, and a China-U.S. bispecific antibody tie-up (I-Mab/ABL Bio’s program) all contributed to this East-West flurry. Europe and North America also maintained their long-standing transatlantic link, exemplified by Switzerland’s Debiopharm licensing a drug from Canada’s Repare Therapeutics.

Figure 1: Heatmap of deal activity by geography (July 14–21, 2025). Each cell shows the number of deals involving companies from the corresponding regions. Cross-border deals dominated, with particularly active links between Asia and North America.

Even purely domestic deals stood out for their strategic significance. SandboxAQ, a California-based Alphabet spinoff blending AI and quantum tech, teamed up with iOncologi, a small biotech in Florida, to develop a vaccine against glioblastoma (a notoriously aggressive brain cancer).

No dollar figures were disclosed – perhaps an implicit admission that this is more of a moonshot R&D collaboration than a traditional licensing deal. But qualitatively, it’s intriguing: SandboxAQ will apply its simulation-driven AI drug discovery tools, while iOncologi contributes expertise in immunotherapy and a target indication where “limited treatment options” is an understatement. The partners ambitiously aim to have an mRNA vaccine ready for trials in 18 months.

Strategically, this collaboration is a bet that combining the most comprehensive oncology datasets with advanced quantitative AI can dramatically accelerate cancer vaccine development (fiercebiotech.com).

Likewise, in Europe, LEO Pharma of Denmark and Germany’s Boehringer Ingelheim chose collaboration over competition. On July 14, they revealed an exclusive global license agreement that hands LEO the commercial reins to Spevigo (spesolimab) – Boehringer’s breakthrough monoclonal antibody for generalized pustular psoriasis (GPP). With Spevigo already approved and launched in more than 40 countries as the first therapy for this rare, severe skin disease (leo-pharma.com), one might wonder why Boehringer would part with its “flagship dermatology product.”

The answer lies in strategic focus. Boehringer’s strengths and interests lie in broader immunology and cardiometabolic arenas; Spevigo, while innovative, serves a niche dermatological market. LEO, on the other hand, has six decades of dermatology expertise and a global dermatology sales infrastructure. By transferring Spevigo to LEO for $105 million upfront plus milestones and royalties, Boehringer ensures the drug will get the focused attention (and marketing muscle) needed to reach more patients worldwide.

LEO gains a marketed product that slots perfectly into its portfolio, reinforcing its commitment to “transformational medicines in dermatology.” For LEO’s CEO, Christophe Bourdon, the deal means the opportunity to help more patients with a devastating disease – and not incidentally, to immediately boost LEO’s revenue with a commercial-stage asset.

Boehringer’s perspective, delivered with a touch of gracious humility, is that Spevigo’s full potential “requires continued focus… and LEO is exceptionally well-positioned to build on the strong foundation we’ve laid”.

In other words: we invented this thing, but you might sell it better. It’s a partnership model that Bartleby might praise as sensible and self-aware – each company sticking to its knitting, to the benefit of patients and shareholders alike.

Pivots, priorities and “strategic relevance”

One striking feature of this week’s deals is how they reflect strategic pivots by biotech companies under pressure. When the funding environment gets tough (and recent years have certainly tested biotech’s fortitude), even promising science can end up on the chopping block unless a partner steps in. Several deals illustrate how smaller biotechs are reshuffling assets to survive and focus.

Repare Therapeutics, a precision oncology player, exemplified this survival instinct. After spending time and treasure developing lunresertib, a novel PKMYT1 inhibitor, Repare hit pause on the program earlier in the year when a combo trial plan was shelved (fiercebiotech.com). Rather than let lunresertib die on the vine, Repare found it a new home with its existing collaborator Debiopharm. Announced July 16, the licensing deal is modest in biotech terms: $10 million upfront, $5 million soon after, and up to $257 million in milestones (should the drug ever go the distance).

Debiopharm will also take over the ongoing Phase 1b study of lunresertib combined with Debio 0123 (Debiopharm’s own WEE1 inhibitor). For Repare, this was a strategic retreat to focus on its core synthetic-lethality programs. The company had already abandoned plans for a Phase 3 with lunresertib in ovarian cancer, and CEO Lloyd Segal made clear that only a willing partner would keep it alive (fiercebiotech.com).

Now that partner has appeared, effectively relieving Repare of further expenses while preserving a sliver of upside via milestones and royalties. Debiopharm’s CEO, in true optimistic fashion, hailed the “very promising phase 1/1b data” and the synergy of the combination, expressing belief that this duo could “drive rapid and deep tumor regressions” (fiercebiotech.com). Strategic relevance here is two-fold: Repare gets to reallocate resources to its priority programs (PLK4 and Polθ inhibitors in early trials), and Debiopharm bolsters its pipeline with a complementary asset that might enhance the value of its WEE1 inhibitor.

It’s a neat example of creative deal-making in lean times – akin to two dance partners finding each other when the music slows. As Bartleby might note, sometimes second-hand assets can find a second life, provided the price is right and the new owner sees hidden value.

Another small biotech, I-Mab, demonstrated a different kind of pivot: one driven by bold specialization. After a rough start to 2025 – including mass layoffs and a pipeline cull – the China-based (and Maryland-incorporated) company declared it would pivot entirely to one lead program, a bispecific antibody dubbed givastomig (fiercebiotech.com).

Givastomig targets Claudin 18.2 (CLDN18.2) on tumor cells and 4-1BB on T cells, an immunotherapy approach for gastric cancer. To fortify this pivot, I-Mab decided to buy out the source of one key component: the CLDN18.2 monoclonal antibody on which givastomig is based. So on July 17, I-Mab announced the acquisition of Bridge Health, the little-known owner of that antibody, for a grand total of $3 million upfront (in installments) plus up to $3.9 million in milestones (fiercebiotech.com).

In an era of billion-dollar mega-deals, these sums are rounding errors – indeed, I-Mab’s press release couched it as $1.8M now and $1.2M laterfiercebiotech.com, probably less than what some companies spend on a corporate retreat. But strategically, it’s hugely significant for I-Mab. By owning Bridge’s antibody outright, I-Mab secures full control of givastomig’s IP and eliminates any dependence on outsiders. The company touted that Bridge’s antibody is “the secret sauce” to givastomig’s potential, citing its superior binding affinity even to tumors with low CLDN18.2 levels. In other words, I-Mab believes this bispecific could be best-in-class because of that antibody’s unique properties – so why leave the fate of your crown jewel in someone else’s hands?

The timing is apt: givastomig has shown an 83% objective response rate in Phase 1b testing for gastric cancers, and a Phase 2 trial is underway with brisk enrollment. Owning the antibody also simplifies I-Mab’s partnership with South Korea’s ABL Bio, with whom it shares global rights to givastomig. I-Mab’s move is like a company buying the factory that makes its secret ingredient – a prudent vertical integration, albeit on a small scale. The strategic relevance is clear: for a mere few million dollars, I-Mab has “solidified its pivot” and de-risked the core of its future strategy.

An integrated view of the week’s deals

For a comprehensive snapshot, Table 1 catalogs the week’s major biotech deals, categorizing each by type, financial terms, therapeutic area, stage of development, and strategic rationale. From mega-mergers to minute milestone payments, from preclinical platforms to marketed medicines, the table highlights just how varied – and yet purposeful – these deals have been.

Table 1: Key biotechnology deals (July 14–21, 2025)

| Companies (Buyer – Seller) | Deal Type | Terms / Value | Therapeutic Area | Asset Stage | Strategic Rationale / Relevance |

|---|---|---|---|---|---|

| Sino Biopharm – LaNova Medicines (China) | M&A (Acquisition) | Up to $951M (cash & milestones) | Oncology (bispecifics, ADCs) | Phase 1–3 pipeline | Builds Sino’s oncology portfolio and leverages Merck-partnered PD-1×VEGF bispecifics to strengthen global R&D |

| Otsuka Pharma – Cantargia (Japan–Sweden) | Licensing Deal | $33M upfront + up to $580M milestones; royalties on sales | Autoimmune & Inflammation (IL-1) | Phase 1 (CAN10 antibody) | Diversifies into immunology with IL1-RAP antibody for hidradenitis suppurativa and other inflammatory conditions |

| Acumen Pharma – JCR Pharma (USA–Japan) | R&D Collaboration + Option License | Up to $555M milestones; tiered royalties | Neurology (Alzheimer’s) | Phase 2 (sabirnetug) | Combines JCR’s BBB-penetrating J-Brain Cargo with Acumen’s Aβ oligomer antibody to improve CNS delivery |

| Repare – Debiopharm (Canada–Switzerland) | Licensing Deal | $10M upfront + $5M near-term; up to $257M; royalties | Oncology (PKMYT1 inhibitor) | Phase 1b (combo); Phase 3 aborted | Repare exits paused program; Debiopharm adds to WEE1 pipeline via PKMYT1 synthetic lethality strategy |

| SandboxAQ – iOncologi (USA) | Strategic Partnership (Co-dev) | Not disclosed | Oncology (glioblastoma mRNA vaccine) | Preclinical | AI/quantum platform + immunotherapy to co-develop glioblastoma vaccine; aims to enter trials in ~18 months |

| I-Mab – Bridge Health (China–USA) | M&A (Asset Acquisition) | $3M upfront + $3.9M in milestones | Oncology (CLDN18.2 × 4-1BB bispecific) | Phase 1b (83% ORR); Phase 2 enrolling | I-Mab secures antibody IP for givastomig; eliminates dependency; accelerates lead bispecific for gastric cancer |

| LEO Pharma – Boehringer Ingelheim (DK–DE) | License + Transfer of Rights | $105M upfront; milestones & royalties (undisclosed) | Dermatology (GPP; Spevigo®) | Marketed product | LEO adds first-in-class IL-36R therapy; expands portfolio and access in specialty dermatology |

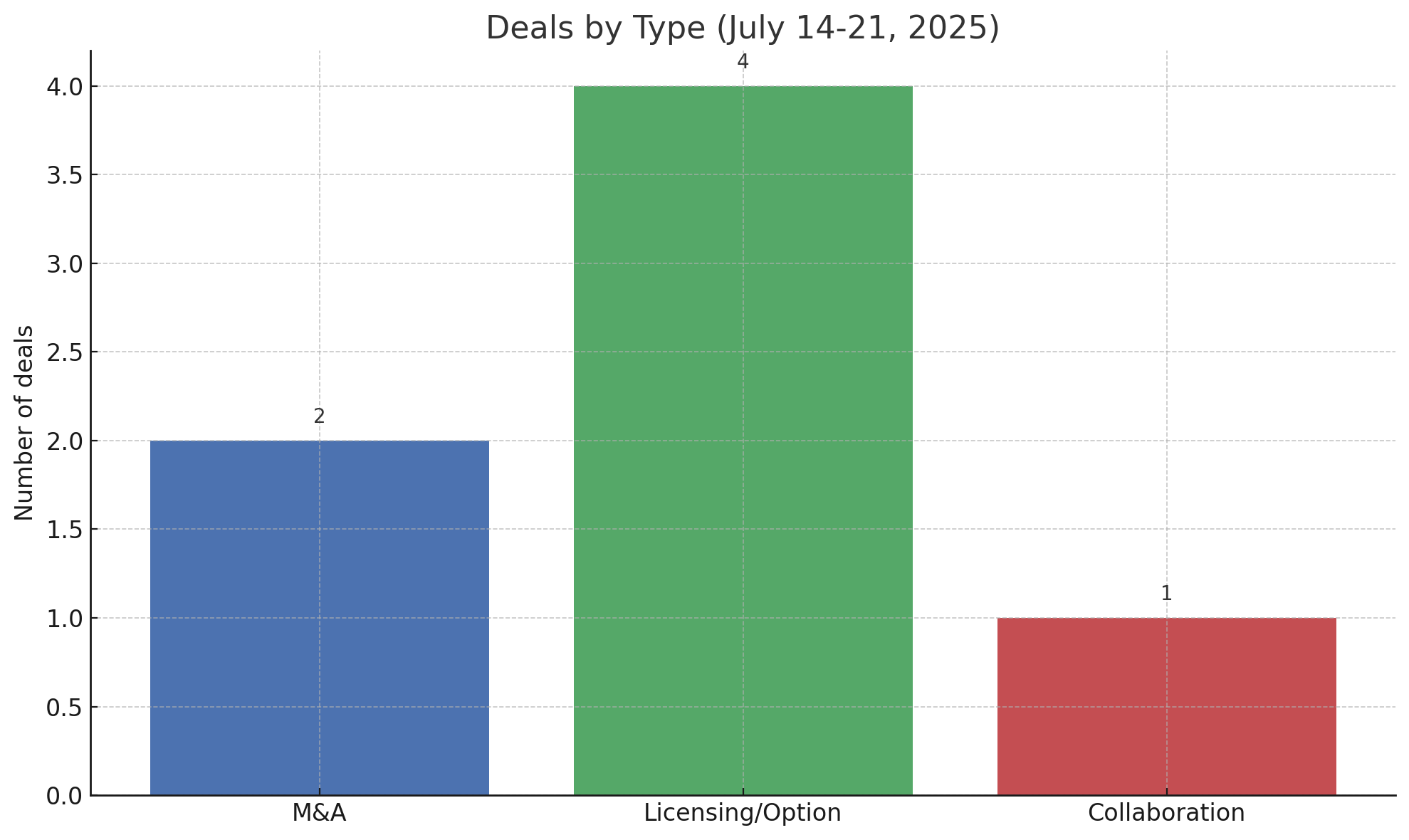

This integrated view reveals how diverse deal types – from hefty M&A to nuanced option-based alliances – served different strategic ends. Figure 2 summarizes the count of deals by type during the week. Notably, licensing and option deals were the most common, suggesting that companies favored sharing rights and risks over outright acquisitions during this period.

Indeed, four significant licensing/collaboration agreements were announced, compared to two full acquisitions. This tilt toward partnerships aligns with a high-level strategic trend: in a market that’s still recovering from a funding drought, biotechs and pharmas alike prefer to “try before they buy,” locking in future options without betting the farm upfront.

Figure 2: Number of deals by type (week of July 14–21, 2025). Licensing/option agreements dominated the week’s deal activity, outnumbering outright M&A transactions, with a smaller portion of pure R&D collaborations. This indicates a strategic preference for risk-sharing partnerships during the period.

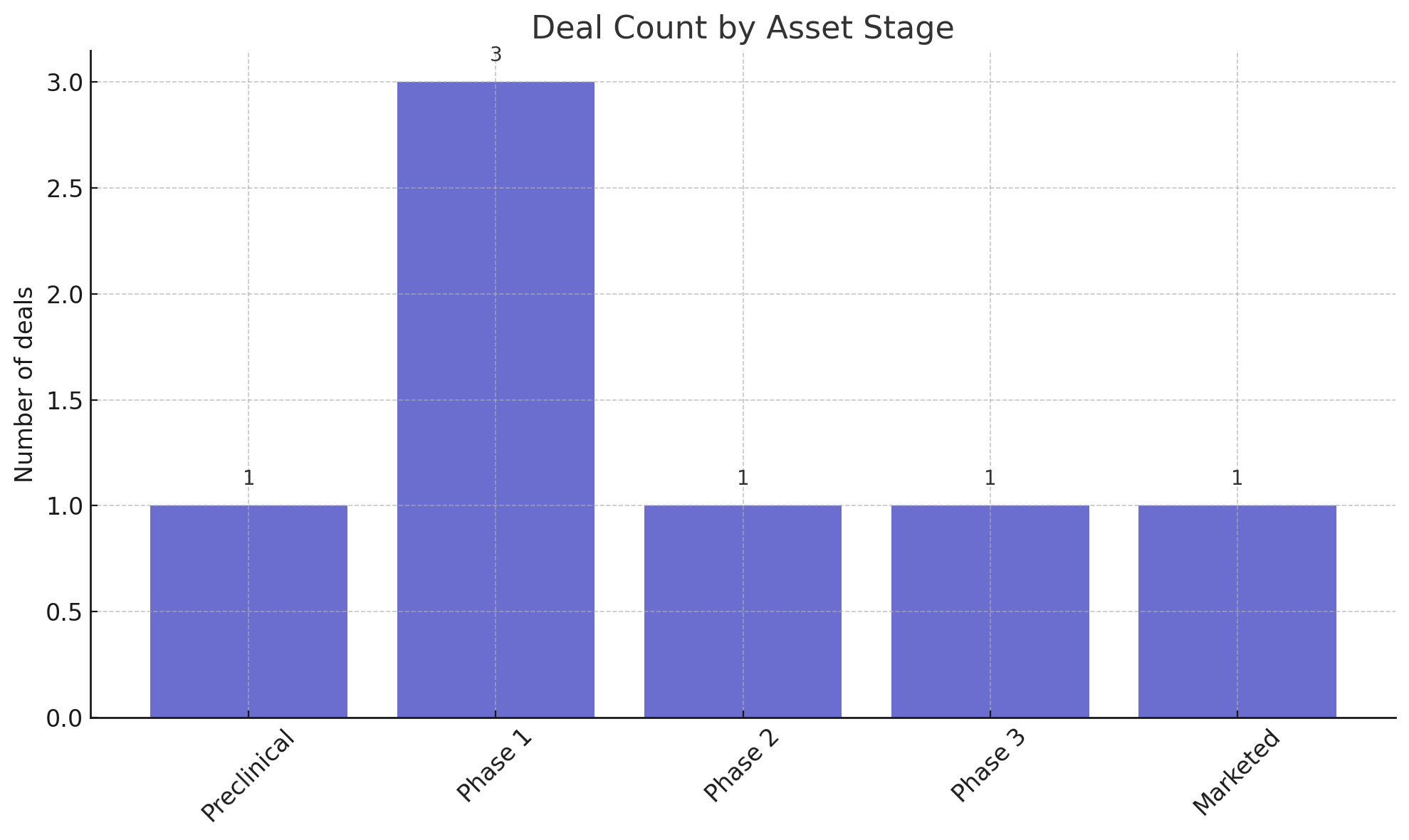

Similarly, Figure 3 illustrates the distribution of deals by the stage of development of the assets involved. The deals spanned every stage – from preclinical research partnerships to late-stage and marketed assets

The plurality of deals (3 out of 7) centered on Phase 1 programs, reflecting how many biotechs seek partners once a first-in-human signal is obtained. There was one deal each in Phase 2 (Acumen’s Alzheimer’s antibody), Phase 3 (LaNova’s pipeline included a Phase 3 ADC), and for a marketed product (Spevigo). Even a preclinical collaboration (SandboxAQ’s AI-driven vaccine project) made the roster, underlining that innovation and strategic value aren’t confined to clinical-stage assets. For big pharma, early-stage deals provide a foothold in emerging modalities (AI-designed vaccines, novel protein degraders, etc.) without paying Phase 3 prices.

Figure 3: Deal count by asset stage. Transactions during the week involved assets across development stages, with Phase 1 programs constituting the largest share. This reflects robust deal activity even at early stages of R&D, as companies position themselves for long-term payoffs. Later-stage and commercial assets, while fewer in number, commanded significant attention and value.

Member discussion