The weekly term sheet (30)

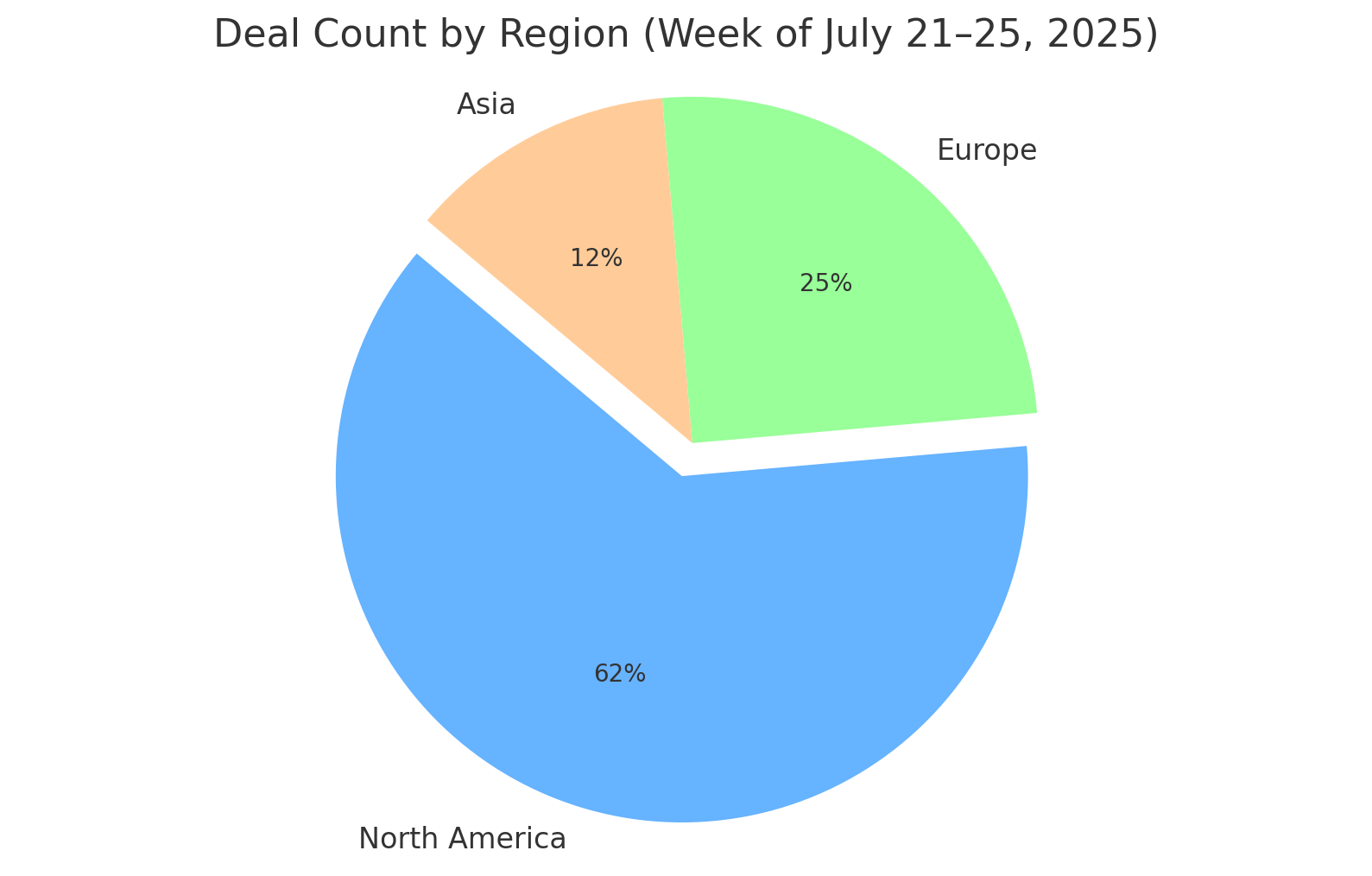

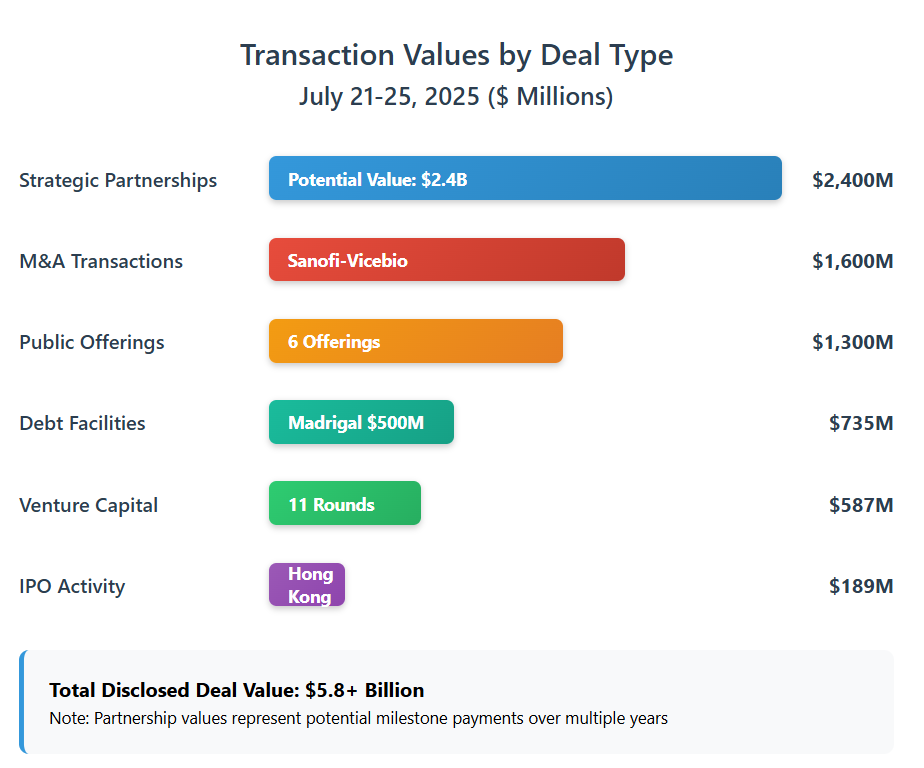

During the week of July 21–25, 2025, the biopharmaceutical industry saw a flurry of deal-making worldwide. This included major M&A acquisitions, high-value licensing and co-development partnerships, venture capital financings, and even an IPO listing. North America accounted for the majority of deal activity, with European and Asian firms also contributing notable transactions.

Figure 1: Regional distribution of publicly announced biopharma deals during the week of July 21–25, 2025. North America-based companies were involved in the majority of deals (approx. 62%), followed by Europe (25%) and Asia (12%).

Mergers & Acquisitions (M&A)

Acquisition deals announced this week spanned both large pharma and smaller biotech targets, across North America and Europe. The table below summarizes the week’s notable M&A, including the parties, deal value, therapeutic focus, asset stage, and strategic rationale:

| Acquirer (Country) | Target (Country) | Therapeutic Focus | Deal Value | Lead Asset Stage | Strategic Rationale / Comments |

|---|---|---|---|---|---|

| Sanofi (France) | Vicebio Ltd. (UK, private) | Respiratory virus vaccines (RSV, hMPV) | $1.15 B upfront + $450 M milestones (total ~$1.6 B) | Phase 1 (combo RSV/hMPV vaccine) | Expands Sanofi’s protein-based vaccine pipeline beyond mRNA platforms. Expected to close Q4 2025. |

| Perceptive Advisors (USA) | Synthego (USA, private) | CRISPR gene editing tools | Undisclosed (asset purchase) | N/A (Platform/Services) | Financial sponsor buyout to stabilize operations; Synthego continues gene editing services under new ownership. |

Key highlights: Sanofi’s $1.6 billion acquisition of London-based Vicebio gives it a next-generation respiratory vaccine platform, including a Phase 1 combo vaccine for RSV and hMPV (biopharmadive.com). This furthers Sanofi’s strategy to broaden its vaccine portfolio with non-mRNA technologies, complementing its existing RSV franchise (e.g. Beyfortus antibody). In North America, Synthego – a prominent CRISPR tools provider – was acquired by Perceptive Advisors’ funds (a life-sciences investment firm) in a private deal. The buyout is expected to strengthen Synthego’s financial position and support continued innovation in CRISPR research products. Notably, Synthego will maintain operations and staff post-deal, ensuring continuity for its global customer base (biospace.com).

Licensing & Co-Development Partnerships

This week featured multiple partnership and licensing agreements between large pharmaceutical companies and biotech innovators. These deals span oncology, immunology, and vaccine/antiviral research, often involving significant milestone potential (“bio‐bucks”) and global rights. The table below outlines the key partnerships announced:

| Partners (Countries) | Focus Area / Modality | Deal Terms | Stage of Assets | Notes / Strategic Rationale |

|---|---|---|---|---|

| Eli Lilly (USA) & Gate Bioscience (USA) | Molecular gate small molecules for extracellular protein degradation | Upfront (undisclosed) + equity; up to $856 M (milestones + royalties) | Preclinical (platform stage) | Lilly gains global rights to a first-in-class approach targeting undruggable proteins. |

| Novartis (Switzerland) & Matchpoint Tx (USA) | Covalent drug discovery for inflammatory diseases | $60 M upfront and research funding + up to $1 B in milestones | Preclinical | Access to platform for targeting transcription factors with oral drugs. |

| Sanofi (France) & Kling Bio (Netherlands) | B-cell platform for antiviral antibody discovery | Collaboration with option to license; terms undisclosed | Discovery research | Sanofi taps patient-derived B-cell platform for neutralizing antibodies targeting conserved viral epitopes. |

Insights: The Lilly–Gate “molecular gate” deal (worth up to $856 million) exemplifies big pharma’s appetite for early-stage platform technologies with broad applicability. Gate’s approach to selectively eliminate disease-causing extracellular proteins could open new therapeutic classes, and Lilly’s involvement (including an equity stake) provides validation and resources to accelerate this work (fiercebiotech.com).

Similarly, Novartis’ partnership with Matchpoint (Boston-area biotech) involves a relatively modest upfront ($60 M) but significant downstream milestones (up to $1 B), reflecting confidence in Matchpoint’s covalent chemistry platform to deliver new anti-inflammatory drug candidates. Notably, Matchpoint’s focus on “hard-to-drug” targets with covalently binding compounds dovetails with Novartis’ strategy to pursue innovative chemistry for immunology (globenewswire.com). In Europe, Sanofi’s collaboration with Amsterdam-based Kling Bio highlights the continued interest in next-generation antibody discovery methods.

Sanofi will apply Kling’s B-cell platform to potentially develop novel antiviral antibodies, complementing Sanofi’s vaccine R&D by focusing on human-derived antibody responses for difficult pathogens (pharmaceuticalmanufacturer.media).

This follows Sanofi’s broader efforts to expand its toolkit beyond mRNA – in this case by harnessing patients’ immune repertoires for vaccine and therapy design.

Venture Funding Rounds

Venture capital financing in biotech remained active, with at least two major rounds (>$50M) disclosed during the week. Both were U.S.-based companies raising growth capital to advance clinical-stage programs:

| Company (Location) | Round | Amount Raised | Therapeutic Focus | Lead Asset Stage | Notable Investors / Comments |

|---|---|---|---|---|---|

| Dispatch Bio (Philadelphia, PA, USA) | Seed + Series A (Launch) | $216 M (combined) | Universal solid tumor immunotherapy platform | Preclinical (first-in-human expected 2026) | Co-founded by Carl June; combines viral targeting with cell therapy. Strong VC and pharma syndicate. |

| Avalyn Pharma (Cambridge, MA, USA) | Series D | $100 M | Inhaled therapies for pulmonary fibrosis | Phase 2b | Funding two inhaled IPF drugs: pirfenidone (AP01) and nintedanib (AP02). Oversubscribed round. |

Both financings illustrate investors’ continued willingness to back clinical-stage innovations despite market challenges. Dispatch Bio’s remarkable $216 million debut out of stealth provides it a runway to test its novel two-pronged immunotherapy in solid tumors (fiercebiotech.com).

The company’s strategy – “spray-painting” tumor cells with a viral vector and then attacking them with cell therapy – is ambitious, and the syndicate’s makeup (blue-chip VCs, an academic cancer institute, and a pharma corporate investor) signals high enthusiasm.

Meanwhile, Avalyn Pharma’s $100 million Series D will fund late-phase trials of inhalable treatments for idiopathic pulmonary fibrosis (fiercepharma.com). By delivering existing anti-fibrotic drugs directly to the lungs, Avalyn aims to boost efficacy and reduce systemic side effects. The round’s size – following a $175M Series C in 2023 – suggests that Avalyn is viewed as a leading contender in pulmonary fibrosis, potentially accelerating time to market if Phase 2b results are positive.

Aside: In the venture ecosystem, it’s worth noting that venture creation platforms also raised funds this week. For example, TCG Labs Soleil, a biotech venture builder, announced an additional $400 M raise (now $800 M total) to launch single-asset startups (biopharmadive.com). This underscores a trend of investors not only funding companies, but also funding the formation of new biotechs to fill pipeline gaps.

IPOs and Public Offerings

Public market activity in biotech remained limited, but one significant international IPO took place:

| Company | Exchange | Proceeds | Focus | Stage | Use of Proceeds / Notes |

|---|---|---|---|---|---|

| Leads Biolabs (China) | HKEX (Hong Kong) | ~$189 M | Oncology and autoimmune (ADCs, bispecifics) | 6 clinical-stage assets | Funds to support Phase 1–3 pipeline trials. Focus on IO 2.0 platforms. |

Leads Biolabs (Nanjing, China)

This clinical-stage oncology biotech listed on the Hong Kong Stock Exchange (HKEX) on July 25, 2025, raising approximately $189 M in gross proceeds (biospace.com). The IPO was priced at HK$35/share, and the company offered ~36.86 million shares (split between Hong Kong public and international tranches).

Leads Biolabs plans to use ~65% of the funds for ongoing and planned Phase 1–3 trials of its pipeline, which includes 14 drug candidates (six in clinical stages) targeting cancer and autoimmune diseases. The company specializes in immuno-oncology 2.0, T-cell engagers (TCEs), and antibody-drug conjugates (ADCs), and its HKEX debut provides capital to advance several globally competitive programs (e.g. bispecific antibodies and a trispecific antibody for oncology).

Notably, no traditional biotech IPOs were recorded on Nasdaq or NYSE during the week, reflecting the cautious U.S. IPO environment in mid-2025.

Instead, alternative routes like reverse mergers and SPACs have been a path for some—earlier in the summer, for instance, Israel’s Minovia Therapeutics agreed to go public via a SPAC at a $180 M valuation. The Leads Biolabs offering in Hong Kong highlights that Asian capital markets remain accessible for biotech fundraises, especially for companies with strong pipelines aiming to broaden their global reach.

Conclusion

In summary, the week of July 21–25, 2025 demonstrated a robust pace of deal-making across the biopharma industry. Large pharmaceutical companies pursued acquisitions and partnerships to fill strategic gaps – from Sanofi bolstering its vaccine arsenal, to Lilly and Novartis investing in cutting-edge drug discovery platforms. Venture investors supplied hefty funding to promising biotech players in oncology and rare diseases, ensuring these companies can advance critical clinical programs.

Geographically, North America led in deal activity (particularly venture financings and partnerships), while Europe contributed significant M&A and collaborations, and Asia delivered a major IPO (and continues to be a source of licensing opportunities).

Member discussion