The weekly term sheet (32)

Global pharmaceutical and biotech deals remain subdued during August week

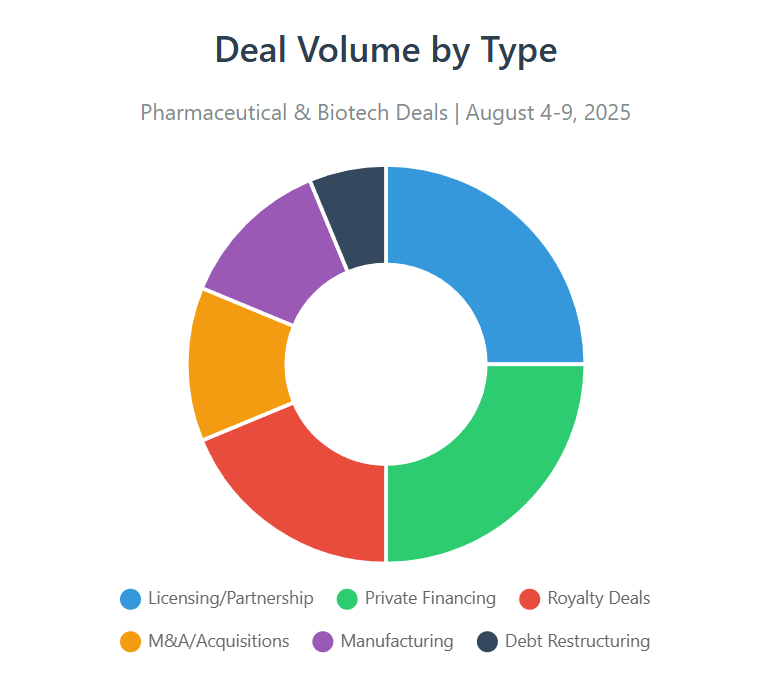

The week of August 4-9, 2025 marked an unusually quiet period for pharmaceutical and biotech dealmaking globally, with only 16 confirmed transactions totaling approximately $2.3 billion in disclosed values across all markets.

The Asia-Pacific region dominated with 8 of the 16 deals (50%), while North America contributed 5 deals and Europe saw 3 transactions. This geographic concentration reflects the continuing shift of biotech innovation and dealmaking momentum toward Asian markets, which now account for 40% of global pharmaceutical licensing agreements compared to just 3% in 2020.

Asia-Pacific drives limited deal flow with billion-dollar partnerships

The most significant transaction of the week emerged from the continuing China-West licensing. GSK's partnership with Jiangsu Hengrui Pharmaceuticals, announced during the week of August 3, commanded a $500 million upfront payment with potential total value reaching $12 billion.

The deal grants GSK global rights (excluding Greater China) to HRS-9821, a PDE3/4 inhibitor for chronic obstructive pulmonary disease currently in clinical development. This partnership exemplifies the "NewCo model" trend where Chinese innovations are licensed for Western development, with Hengrui leading through Phase I before GSK takes over global development.

Novatim Immune Therapeutics sealed a CAR-T partnership with US-based ERIGEN worth up to $2.12 billion in total potential value, including $15 million in near-term milestones, up to $1.32 billion in development and regulatory milestones, and up to $800 million in sales-based royalties.

The deal centers on KQ-2003, a BCMA/CD19 dual-target CAR-T therapy currently in Phase Ib trials in China for hematologic malignancies. ERIGEN gains global rights excluding Greater China, India, Turkey, and Russia.

Pfizer completed its previously announced $1.25 billion acquisition of rights to 3SBio's SSGJ-707, a PD-1/VEGF bispecific antibody. The deal, which grants Pfizer worldwide rights except China, recently received Chinese regulatory clearance for Phase III lung cancer studies. Pfizer retains a $150 million option to extend rights into China.

On the manufacturing front, Samsung Biologics announced two contracts worth $319.6 million with Asian and European partners on August 9, extending through 2030-2033. The Korean CDMO giant reported record H1 2025 sales of $1.88 billion, up 21.3% year-over-year, having signed $2.4 billion in new contracts during the first half—exceeding 60% of its entire 2024 volume.

Royalty deals emerge as alternative financing pathway

Royalty financing activity proved surprisingly concentrated on August 4, 2025, with XOMA Royalty Corporation executing two acquisitions in a single day. The company acquired LAVA Therapeutics N.V. for $1.16-1.24 per share plus a contingent value right (CVR) providing 75% of net proceeds from LAVA's partnered programs with Pfizer (PF-08046052 for EGFR-positive solid tumors) and Johnson & Johnson (JNJ-89853413 for CD33-positive hematologic cancers). Simultaneously, XOMA acquired HilleVax, Inc. for $1.95 per share plus a CVR structure capturing 90% of future norovirus vaccine proceeds.

Ligand Pharmaceuticals announced a $40 million strategic investment in Orchestra BioMed on August 4, structured as $20 million at closing, $15 million deferred, and $5 million in equity. Ligand receives low double-digit royalties on the first $100 million in revenues from Orchestra's cardiovascular programs. The deal formed part of Orchestra's larger $111.2 million financing round including Medtronic participation.

Notably absent were new transactions from major royalty players including Royalty Pharma, DRI Healthcare Trust, HealthCare Royalty Partners, and BioPharma Credit during the target week, despite Royalty Pharma reporting strong Q2 results with 20% year-over-year portfolio growth.

European activity centers on AI drug discovery and regulatory milestones

European deal activity remained subdued with only three notable transactions beyond the royalty deals. The week's most innovative deal saw Chai Discovery raise $70 million in Series A funding on August 6, led by Menlo Ventures through its Anthology Fund with Anthropic. While technically a US company, the AI drug discovery platform attracted significant European investor interest and has implications for global pharmaceutical R&D. Chai's antibody design platform achieves a 20% hit rate compared to traditional methods' 0.1%, representing a 200-fold improvement.

Minghui Pharmaceutical's $131 million pre-IPO round on August 7, co-led by OrbiMed and Qiming Venture Partners, will support commercial launch of its lead dermatology asset MH004 in China. The pan-JAK inhibitor topical cream for atopic dermatitis is currently in Phase 3 trials, with the company also advancing oncology programs including a PD-1/VEGF bispecific and a TROP-2 antibody-drug conjugate.

The Danish-US collaboration between Genmab and AbbVie achieved regulatory momentum August 7-8 with their EPKINLY (epcoritamab) CD3×CD20 bispecific antibody meeting dual primary endpoints in the Phase 3 EPCORE FL-1 trial for follicular lymphoma. The FDA accepted the supplemental biologics license application for priority review with a November 30, 2025 PDUFA date.

North American public markets see minimal activity amid rate uncertainty

North American dealmaking proved remarkably quiet during the target week beyond the royalty transactions. Heron Therapeutics executed a $177.7 million capital restructuring on August 8, including $35 million in new 5.0% senior convertible notes due 2031. The complex transaction, advised by Leerink Partners, eliminates near-term debt maturities by retiring $125 million in existing convertibles through cash and converting another $25 million to equity.

NervGen Pharma utilized its at-the-market program to raise $1.13 million through sales of 385,200 shares at an average price of $2.95. The clinical-stage company developing spinal cord injury treatments represents the week's only other North American public market activity beyond the royalty deals.

Notably absent were any initial public offerings, follow-on offerings, or PIPE transactions—continuing the 2025 trend of only 7 biotech IPOs exceeding $50 million in the first half, the lowest level since 2018. The biotech indices showed flat performance despite Federal Reserve rate cut optimism, with the Nasdaq Biotechnology Index closing the week at 4,523.62, down 0.63%.

Emerging markets report negligible activity

Latin America, Middle East, and Africa collectively produced no major deal announcements during August 4-9. Hikma Pharmaceuticals released H1 2025 financial results on August 7, reaffirming expectations for strong second-half growth but announcing no specific transactions.

The absence of deals from these regions during the narrow timeframe doesn't reflect broader trends. The Latin American pharmaceutical market continues growing at 5.4% CAGR with Brazil representing a $37.3 billion market. The Middle East biotech sector reached $32 billion in 2020 with Saudi Arabia's National Biotechnology Strategy targeting regional leadership by 2030. Africa's $27.65 billion pharmaceutical market projects 3.4% CAGR growth despite 70-90% import dependency.

Deal structure evolution reflects risk management priorities

The week's transactions revealed important structural trends shaping 2025 dealmaking. Milestone-heavy structures dominated, with the GSK-Hengrui deal featuring $500 million upfront against $12 billion total potential value—a 4% upfront ratio. Similarly, Novatim-ERIGEN structured just $15 million near-term against $2.12 billion total potential, representing less than 1% upfront commitment.

Contingent value rights emerged prominently in the royalty sector, with both XOMA acquisitions featuring CVR structures capturing future program value. These instruments allow acquirers to minimize upfront payments while providing shareholders participation in future success—critical for "zombie biotech" transactions where companies trade below cash value.

Geographic rights carve-outs became increasingly complex. The Pfizer-3SBio deal excludes China with an option to expand, while Novatim-ERIGEN excludes Greater China, India, Turkey, and Russia. These territorial strategies reflect both regulatory complexities and local market access considerations.

Alternative financing instruments dominated over traditional equity, with convertible debt (Heron), royalty financing (Ligand-Orchestra), and at-the-market programs (NervGen) preferred over dilutive offerings. This mirrors broader 2025 trends where companies avoid traditional IPOs amid the "two-tier" market separating AI/tech valuations from traditional biotech.

Market indicators suggest temporary pause rather than structural slowdown

Several indicators suggest the week's sparse activity represents timing rather than fundamental weakness. The FDA maintained strong approval momentum with 22 novel molecular entities approved by early August 2025, including Jazz Pharmaceuticals' Modeyso for rare brain tumors on August 6. Three additional PDUFA dates in late August (Brensocatib, Vatiquinone, subcutaneous Leqembi) indicate continuing regulatory progress.

Therapeutic area investment priorities remain robust. Oncology/immuno-oncology dominated with 38% of deals, including CAR-T therapies, bispecific antibodies, and targeted agents. The cardiovascular segment attracted significant royalty investment via Orchestra BioMed, while AI-driven discovery platforms commanded premium valuations despite early development stages.

Venture capital deployment continues at elevated levels with over 100 biotech companies raising $100 million-plus rounds in 2025, though smaller companies struggle for funding. The concentration of capital in larger rounds—all four private financings exceeded $63 million—suggests investors favor de-risked opportunities.

Geographic redistribution accelerates with Asia ascending

The week's deal geography reflects a fundamental redistribution of global pharmaceutical innovation. China now originates 40% of global drug licensing deals, up from 3% in 2020, with one-third of molecules licensed by US multinationals coming from Chinese biotechs. The "NewCo model" pioneered by Hengrui enables Chinese innovations to access Western markets through offshore entities.

Samsung Biologics' manufacturing dominance illustrates South Korea's rise as the global CDMO hub, with 17 of the world's top 20 pharmaceutical companies as clients. The company's expansion to Plant 5 operational in April 2025 and planned Plant 6 cements Asia's manufacturing leadership.

Cross-border partnerships increasingly flow East-West rather than the traditional West-East pattern. The GSK-Hengrui respiratory therapy deal, Pfizer-3SBio oncology partnership, and Novatim-ERIGEN CAR-T collaboration all involve Western companies in-licensing Asian innovations—reversing historical technology transfer patterns.

Conclusion

The August 4-9, 2025 period captured the pharmaceutical industry in transition: pausing during a traditionally quiet period while underlying fundamentals remain strong. With only $2.3 billion in disclosed deal values across 16 transactions, the week fell far below the Q2 2025 quarterly average of $11 billion per week. Yet the quality of assets changing hands—including potential first-in-class COPD treatments, dual-target CAR-T therapies, AI-powered drug discovery platforms, and strategic royalty investments—suggests innovation momentum continues despite transaction volume fluctuations.

The geographic concentration in Asia-Pacific (50% of deals), dominance of complex milestone and CVR structures (4% average upfront payments), emergence of royalty financing as an alternative pathway, and absence of traditional IPO activity collectively indicate a maturing market prioritizing risk management over rapid deployment. As the industry approaches multiple late-August PDUFA dates and potential year-end deal rush, this quiet week likely represents the calm before renewed activity rather than a fundamental market shift.

Key takeaways for the remainder of 2025: expect continued Asia-West licensing flows, milestone-heavy deal structures with creative CVR components, royalty financing gaining momentum, alternative financing over traditional IPOs, and therapeutic concentration in oncology/immuno-oncology and precision medicine. The patent cliff pressuring $300 billion in revenue by 2030 ensures robust M&A demand once macroeconomic uncertainty clears.

Member discussion