The Weekly Term Sheet (44)

Disclaimer: This article is for informational purposes only and does not constitute legal, financial, or investment advice. The author is not a lawyer or financial adviser. All information is derived from publicly available sources and may not be complete or current. Details regarding transactions, royalty structures, and financial arrangements may change. Readers should conduct their own due diligence and consult with appropriate legal and financial professionals before making any decisions.

The final days of October 2025 witnessed extraordinary transaction activity across the life sciences sector, from blockbuster multi-billion-dollar acquisitions to strategic venture financings and partnership agreements. Industry observers note that big pharma's appetite for deals is reviving amid lowered biotech valuations. This comprehensive digest consolidates 50 distinct transactions spanning mergers and acquisitions, venture capital financing, licensing partnerships, royalty monetizations, corporate restructurings, and strategic spinouts.

Mergers & Acquisitions

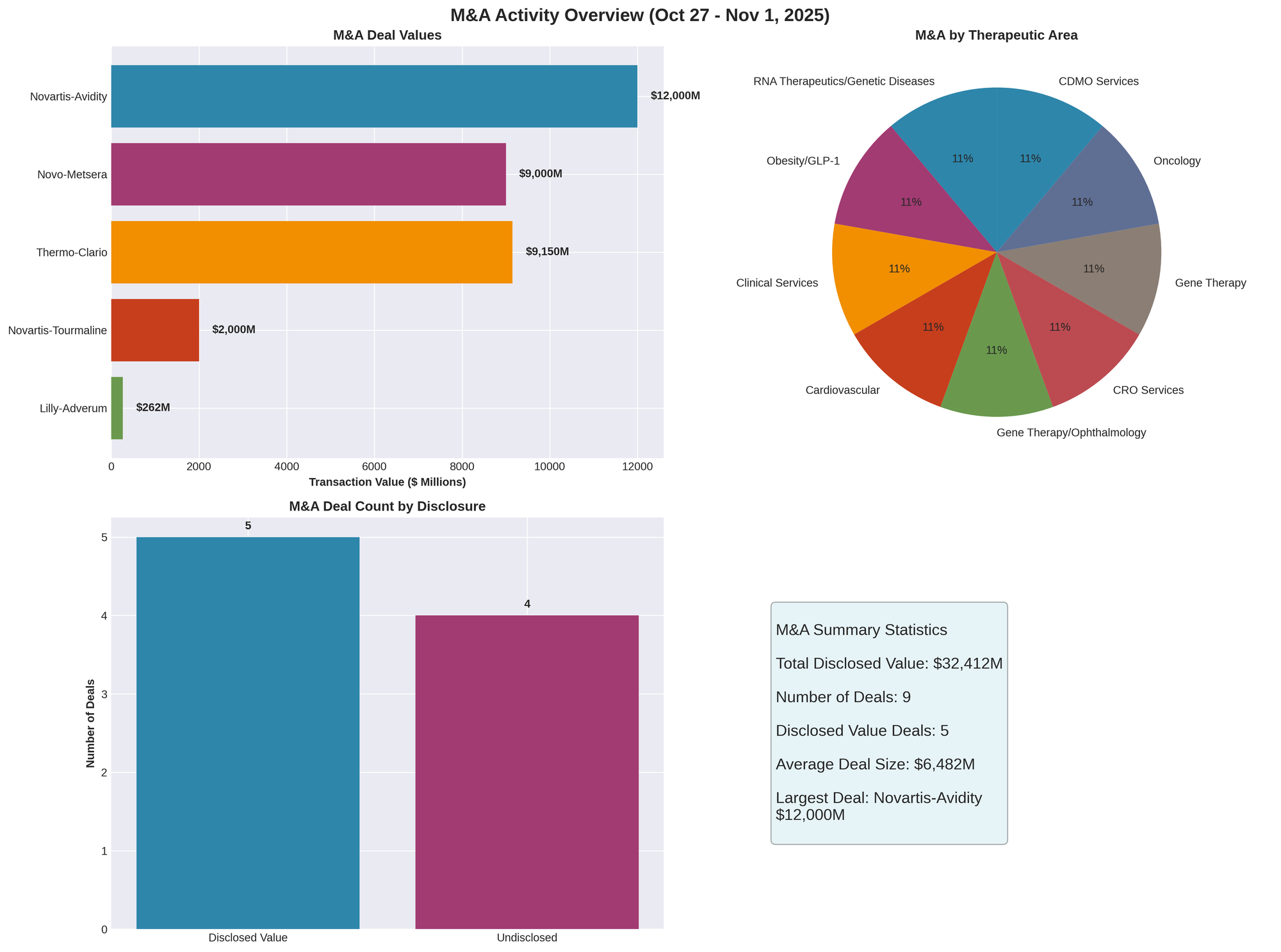

M&A deal-making surged this week with over $32 billion in announced transaction value, headlined by transformative acquisitions in RNA therapeutics and obesity treatment. The wave of consolidation reflects both strategic portfolio expansion and competitive positioning in high-growth therapeutic areas.

Figure 1: M&A transaction values, therapeutic area distribution, and deal summary statistics for October 27 - November 1, 2025

Novartis Acquires Avidity Biosciences for $12 Billion

Novartis announced a definitive agreement to acquire RNA-therapeutics pioneer Avidity Biosciences for $11.8 billion in cash ($50 per share) plus up to $2.5 billion in CVRs tied to future milestones. The deal, expected to close in H2 2026 pending regulatory approval, positions Novartis at the forefront of antibody oligonucleotide conjugate (AOC) technology for genetic diseases.

Strategic Rationale: Novartis CEO defended the deal as an "appropriate risk to take" despite Avidity's lead programs being pre-pivotal. The acquisition brings three clinical-stage AOC therapies targeting myotonic dystrophy type 1 (delpacibart zotadirsen, Phase 3 enrollment), facioscapulohumeral muscular dystrophy (Phase 1/2), and Pompe disease (preclinical).

Transaction Structure: Prior to closing, Avidity will spin out its early-stage precision cardiology programs into an independent entity (SpinCo) capitalized with approximately $270 million. Avidity shareholders will receive 1 SpinCo share per 10 Avidity shares owned, or equivalent cash proceeds if SpinCo's assets are sold before closing. Avidity's existing partnerships with Bristol Myers Squibb and Eli Lilly for cardiovascular programs will transfer to SpinCo.

Legal Counsel: Covington advised Novartis on the transaction.

Novo Nordisk Launches $9 Billion Bid for Metsera

In a dramatic escalation of obesity drug competition, Novo Nordisk launched an unsolicited competing offer on October 30 to acquire Metsera, countering Pfizer's pending agreement. Novo's proposal totals up to $9 billion ($6.5 billion upfront at $56.50 per share plus $2.5 billion in contingent value rights), significantly exceeding Pfizer's September agreement valued at $7.3 billion.

Key Assets: Metsera's portfolio includes MET-097i, a monthly GLP-1 receptor agonist injectable currently in Phase 2b trials, plus oral GLP-1 programs. Metsera's board declared Novo's offer "superior" to the existing Pfizer agreement, triggering a potential bidding war between two pharmaceutical giants.

Market Context: This aggressive move reflects intensifying competition in the obesity therapeutics market, where Novo's Wegovy faces growing rivalry from Eli Lilly's offerings. The acquisition would strengthen Novo's next-generation GLP-1 pipeline with longer-duration and oral formulations.

Eli Lilly Acquires Adverum Biotechnologies

Eli Lilly entered into a definitive agreement to acquire gene therapy developer Adverum Biotechnologies for up to $262 million. The transaction includes $214 million upfront ($5.20 per share) plus up to $48 million in contingent payments tied to development milestones.

CVR Structure: Adverum shareholders will receive one CVR per share, potentially worth $1.15 upon achievement of specified clinical milestones. This risk-sharing structure allows Lilly to mitigate uncertainty around early-stage gene therapy programs.

Pipeline Assets: The acquisition brings Adverum's lead candidate ADVM-022 (ixoberogene soroparvovec), an intravitreal gene therapy for diabetic macular edema currently in Phase 2 trials. The deal deepens Lilly's ophthalmology portfolio and gene therapy capabilities.

Novartis Completes Tourmaline Bio Acquisition

Novartis completed its acquisition of Tourmaline Bio on October 28, with the tender offer expiring October 27. The deal valued at $48 per share captured 92.94% of outstanding shares (approximately $2 billion total transaction value). Tourmaline shares ceased Nasdaq trading and became a wholly owned Novartis subsidiary.

Key Asset: Tourmaline's lead candidate pacibekitug is an investigational anti-IL-6 antibody targeting residual inflammation in patients with atherosclerotic cardiovascular disease despite statin therapy. The acquisition strengthens Novartis's cardiovascular inflammation franchise.

Thermo Fisher Acquires Clario for $8.9-9.4 Billion

Thermo Fisher Scientific agreed to acquire clinical trial technology company Clario in a transaction valued between $8.9-9.4 billion (sources vary). The deal, expected to close in 2026, represents Thermo Fisher's largest acquisition since its 2016 purchase of FEI.

Strategic Rationale: The acquisition significantly expands Thermo Fisher's clinical research organization (CRO) capabilities, adding Clario's specialized technology platforms for endpoint adjudication, cardiac safety monitoring, eCOA (electronic clinical outcome assessments), and medical imaging. Clario processes data from over 24,000 clinical trials annually across 165 countries.

Sellers: Private equity firms Astorg and Nordic Capital are selling Clario, having backed the company through multiple acquisitions that consolidated the clinical data and technology sector.

Pharmaron Acquires Biortus Biosciences

China-based contract research organization Pharmaron acquired an 82.54% equity stake in Biortus Biosciences, a structural biology specialist, announced October 28-29. The acquisition enhances Pharmaron's capabilities in protein production, X-ray crystallography, cryo-EM structure analysis, and AI/ML-based computational platforms for structure-based drug design. Deal value was not disclosed.

Strategic Context: This transaction reflects ongoing consolidation in China's CRO sector, as leading players expand service offerings through strategic acquisitions of specialized capabilities.

BioMarin Announces Roctavian Divestiture

On October 27, BioMarin announced plans to divest its hemophilia A gene therapy Roctavian after severe commercial underperformance. The first-of-its-kind therapy generated only $23 million in the first nine months of 2025 versus initial peak sales forecasts of $2.2 billion.

Strategic Pivot: BioMarin is evaluating out-licensing options to ensure continued patient access while removing the asset from its portfolio. This decision represents a sobering reality check for first-generation gene therapies facing market adoption challenges despite regulatory approval.

I-Mab Completes Bridge Health Biotech Acquisition

U.S.-listed Chinese biotech I-Mab completed its acquisition of Bridge Health Biotech, a bispecific antibody developer, on October 29. Financial terms were not disclosed. The bolt-on acquisition expands I-Mab's oncology pipeline with additional bispecific antibody candidates in clinical development.

Lonza Acquires Redberry SAS

Swiss contract development and manufacturing organization (CDMO) Lonza agreed to acquire France-based Redberry SAS, a rapid microbial testing specialist. Financial terms were not disclosed. Expected to close by year-end 2025.

Technology Platform: Redberry's proprietary rapid microbial detection technology can identify contamination in biomanufacturing processes in approximately 4 days, compared to the industry-standard 14-day sterility testing protocol. This 10-day acceleration significantly reduces batch release times and inventory holding costs.

Strategic Rationale: The acquisition strengthens Lonza's quality control offerings for biopharmaceutical manufacturing clients, reflecting CDMOs' continued focus on improving efficiency and reducing time-to-market for drug products. Faster contamination detection also reduces risk of costly batch failures discovered late in the QC process.

M&A Summary Table

| Acquirer | Target | Transaction Value | Key Assets/Rationale | Status |

|---|---|---|---|---|

| Novartis | Avidity Biosciences | $11.8B + $2.5B CVRs | AOC platform; myotonic dystrophy, FSHD, Pompe programs | Announced Oct 27 |

| Novo Nordisk | Metsera | $9B ($6.5B + $2.5B CVRs) | Monthly GLP-1 injectable (MET-097i), oral GLP-1 programs | Bid launched Oct 30 |

| Eli Lilly | Adverum Biotechnologies | $262M ($214M + $48M CVRs) | Gene therapy for diabetic macular edema (ADVM-022) | Announced |

| Novartis | Tourmaline Bio | ~$2B ($48/share) | Pacibekitug (anti-IL-6) for cardiovascular inflammation | Completed Oct 28 |

| Thermo Fisher | Clario | $8.9-9.4B | Clinical trial technology, eCOA, cardiac safety, imaging | Announced |

| Pharmaron | Biortus Biosciences | Undisclosed | Structural biology, cryo-EM, AI drug design capabilities | Announced Oct 28-29 |

| I-Mab | Bridge Health Biotech | Undisclosed | Bispecific antibody oncology programs | Completed Oct 29 |

| Lonza | Redberry SAS | Undisclosed | Rapid microbial testing (4-day vs 14-day contamination detection) | Announced |

| BioMarin | Roctavian (Divestiture) | TBD | Hemophilia A gene therapy out-licensing | Announced Oct 27 |

Total Disclosed M&A Value: Over $32 billion

Venture Capital Financings

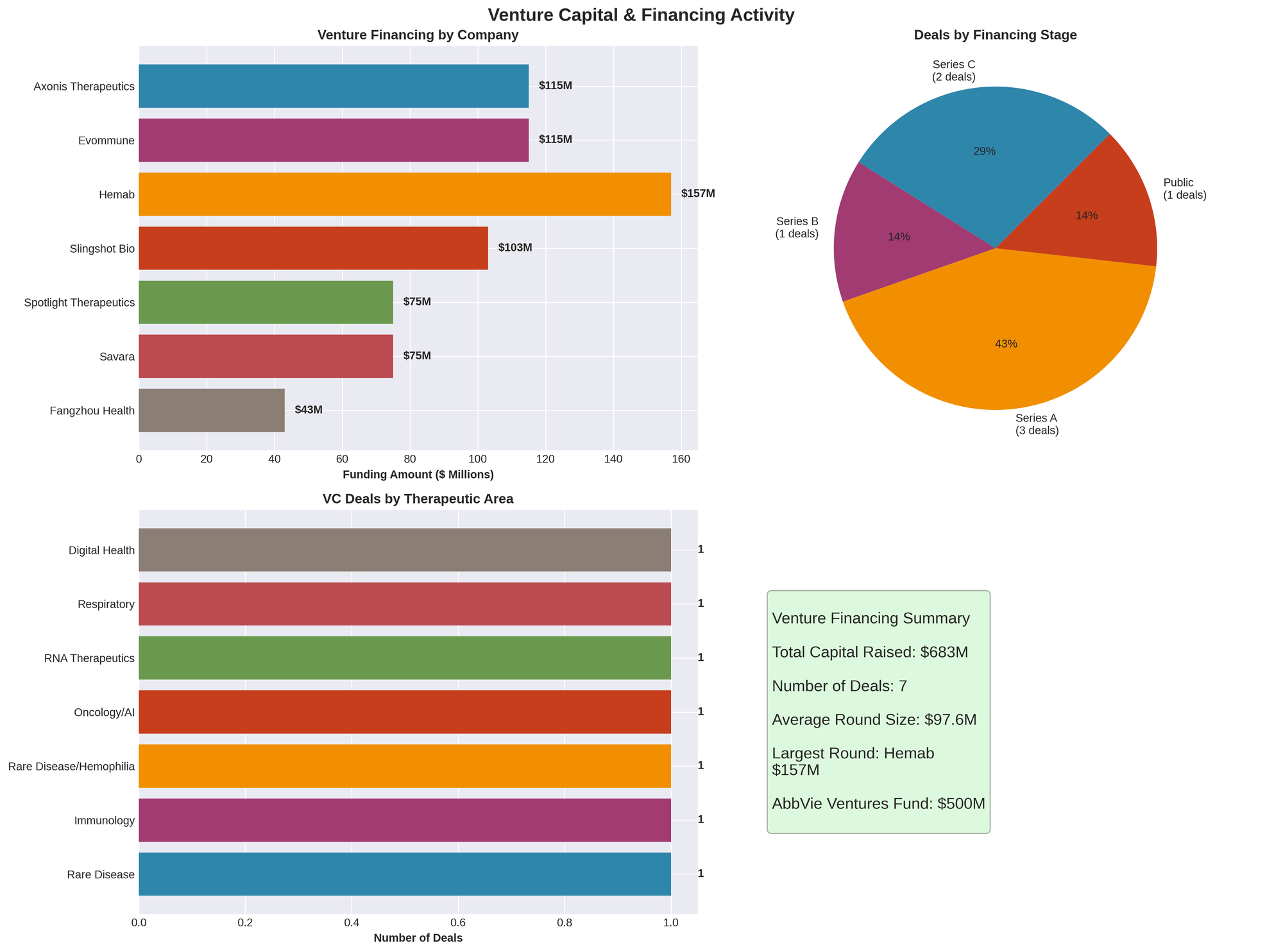

Investors deployed over $1 billion in venture capital across biotech startups during the week, spanning seed rounds to nine-figure late-stage financings. Notable patterns included strong support for rare disease therapies, novel modalities like antibody-drug conjugates, and AI-driven drug discovery platforms.

Figure 2: Venture capital funding by company, financing stage distribution, therapeutic focus, and summary statistics

Late-Stage Financings ($100M+)

Hemab Therapeutics raises $157 million Series B

Danish-founded rare disease specialist Hemab Therapeutics secured one of the week's largest rounds with $157 million in Series B financing to advance Phase 3 trials for bleeding disorder therapies. The company is developing next-generation treatments for hemophilia and other coagulation disorders.

Pelage Pharmaceuticals raises $120 million Series B

Los Angeles-based Pelage Pharmaceuticals closed a $120 million Series B co-led by prominent technology and biotech venture firms to advance a novel hair-loss treatment into Phase 3 trials. The financing reflects growing investor interest in dermatology and aesthetic medicine applications.

Axonis Therapeutics secures $115 million Series A

Boston-based Axonis Therapeutics completed an oversubscribed $115 million Series A announced October 30, co-led by Cormorant Asset Management and venBio Partners. Additional investors include Sofinnova Investments, MRL Ventures Fund (Merck's venture arm), Perceptive Advisors, Lumira Ventures, and others.

Pipeline: Axonis targets epilepsy and chronic pain with lead candidate AXN-027, a first-in-class oral KCC2 potentiator that aims to restore inhibitory neurotransmission. The company plans to initiate first-in-human trials in late 2025.

Evommune announces $115 million Series C

Palo Alto-based Evommune closed a $115 million Series C announced October 31/November 1, co-led by RA Capital Management and Sectoral Asset Management. This brings total company funding to approximately $276 million.

Pipeline: Evommune develops treatments for immune-mediated inflammatory diseases including chronic urticaria and atopic dermatitis. Lead programs include EVO756 (oral MRGPRX2 antagonist) and EVO301 (IL-18 fusion protein), with multiple Phase 2 readouts anticipated in 2025-2026.

Mid-Stage Financings ($50M-$99M)

Kivu Bioscience raises $92 million Series A

San Francisco-based Kivu Bioscience announced a $92 million Series A on October 28 led by Novo Holdings. Other investors include Gimv, Red Tree Venture Capital, HealthCap, BioGeneration Ventures, M Ventures (Merck KGaA's venture arm), and BOM.

Platform: Kivu develops next-generation antibody-drug conjugates using proprietary Synaffix site-specific GlycoConnect™ technology for precision payload delivery. The company expects to initiate Phase 1 trials for its lead oncology candidate in 2025.

Zag Bio launches with $80 million Series A

Polaris Partners launched Zag Bio with $80 million in Series A financing to pursue thymus-targeted immune therapies for autoimmune diseases and immunodeficiency disorders. The round included participation from pharma venture arms including Johnson & Johnson Innovation, Novo Holdings, and others.

Science: Zag Bio's approach focuses on modulating thymic function to restore immune homeostasis, representing a novel mechanism for addressing both overactive and underactive immune states.

Pathos AI closes $62 million Series C

Announced October 29 and led by New Enterprise Associates (NEA), Pathos AI raised $62 million in Series C financing, bringing total funding to approximately $102 million.

Platform: Pathos operates an AI-driven precision oncology drug discovery platform and recently acquired two clinical-stage assets including P-500, a brain-penetrant PRMT5 inhibitor. The company plans to initiate its next clinical trial in 2025.

Seed and Early-Stage Financings

Rarity PBC raises $4.6 million seed round

Rarity PBC closed a $4.6 million seed financing on October 29 to advance gene therapy for adenosine deaminase-deficient severe combined immunodeficiency (ADA-SCID), a rare pediatric disorder. The public benefit corporation structure reflects the company's mission-driven approach to ultra-rare disease treatment.

Venture Financing Summary Table

| Company | Amount | Series | Lead Investors | Therapeutic Focus | Stage |

|---|---|---|---|---|---|

| Hemab Therapeutics | $157M | Series B | Undisclosed | Bleeding disorders (hemophilia) | Phase 3 prep |

| Pelage Pharmaceuticals | $120M | Series B | Tech/biotech VCs | Hair loss treatment | Phase 3 prep |

| Axonis Therapeutics | $115M | Series A | Cormorant, venBio Partners | Epilepsy, pain (KCC2 potentiator) | Phase 1 prep |

| Evommune | $115M | Series C | RA Capital, Sectoral | Chronic urticaria, atopic dermatitis | Phase 2 |

| Kivu Bioscience | $92M | Series A | Novo Holdings | Next-gen ADCs (GlycoConnect™) | Phase 1 prep |

| Zag Bio | $80M | Series A | Polaris Partners | Thymus-targeted immunotherapy | Preclinical |

| Pathos AI | $62M | Series C | NEA | AI precision oncology, PRMT5 inhibitor | Clinical |

| Rarity PBC | $4.6M | Seed | Undisclosed | Gene therapy for ADA-SCID | Preclinical |

Total Disclosed VC Funding: $745.6 million across 8 transactions

Licensing & Collaboration Deals

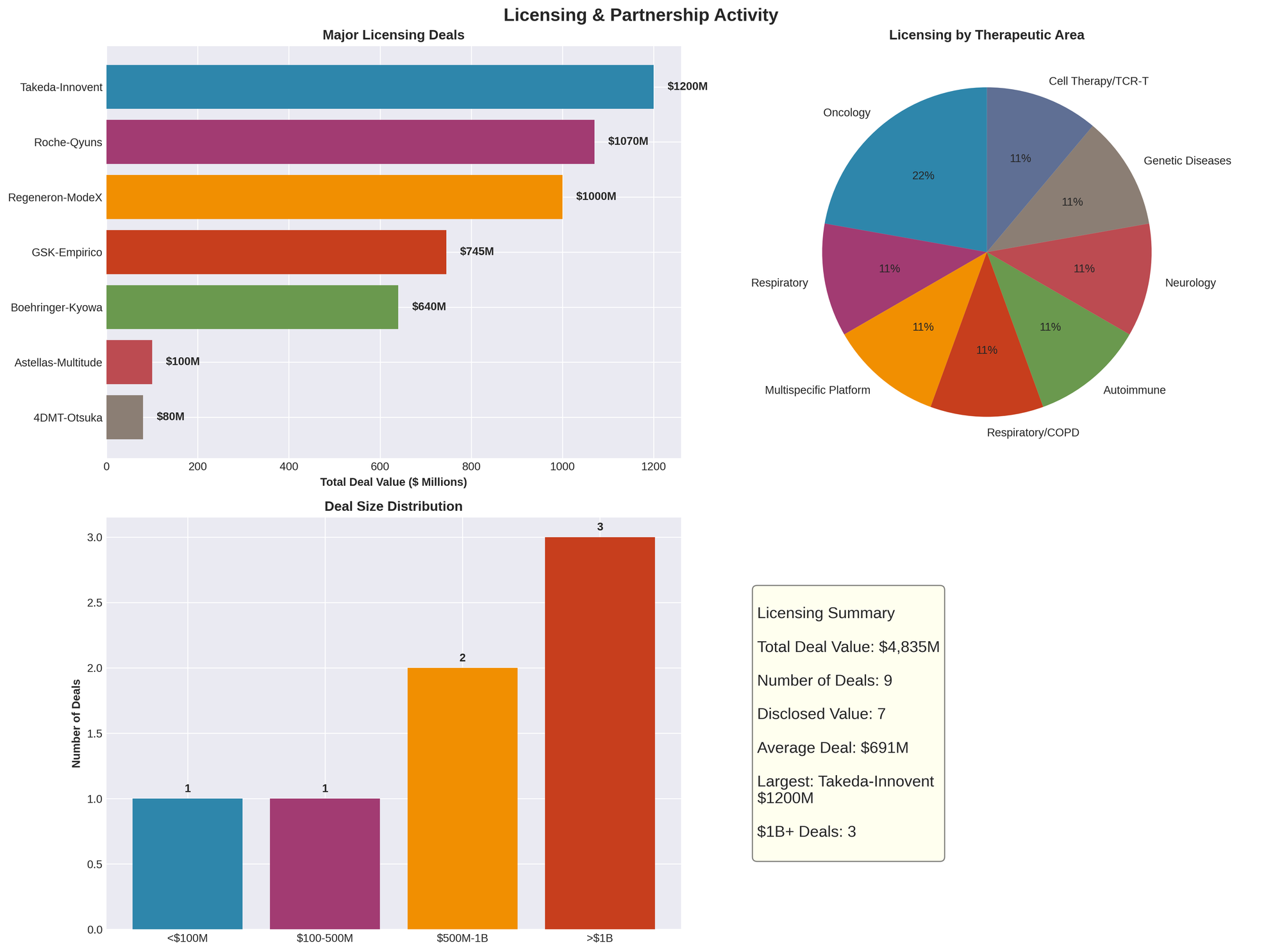

Partnership and licensing activity ranged from major pharma alliances valued at over $1 billion to strategic technology collaborations. AI integration emerged as a prominent theme across multiple deals. The week saw over $5 billion in total disclosed deal values across licensing transactions.

Figure 3: Major licensing deal values, therapeutic area distribution, deal size ranges, and partnership statistics

Billion-Dollar Pharma Partnerships

Roche-Qyuns Therapeutics: $1.07 Billion Bispecific Deal

Roche licensed global rights to QX031N, a clinical-stage bispecific antibody from China's Qyuns Therapeutics, targeting TSLP and IL-33 for respiratory diseases including COPD and asthma.

Deal Terms:

- $75 million upfront payment

- Up to $995 million in development and commercial milestones

- Tiered royalties on global net sales

- Total potential value: $1.07 billion

Strategic Context: QX031N simultaneously blocks thymic stromal lymphopoietin (TSLP) and interleukin-33 (IL-33), two key inflammatory pathways in respiratory disease. Roche described the bispecific as having "best-in-disease" potential. The deal comes as Roche seeks to rebuild its respiratory franchise following setbacks with its own COPD candidates.

Regeneron-ModeX Therapeutics: $1+ Billion Multispecific Antibody Alliance

Regeneron Pharmaceuticals formed a research collaboration with ModeX Therapeutics (an OPKO Health subsidiary) to develop multispecific antibodies across immunology, oncology, and metabolic disorders.

Deal Terms:

- $7 million upfront payment

- Regeneron will fully fund R&D activities

- Over $200 million per program in potential milestones

- Total potential value: Exceeding $1 billion across multiple programs

Technology Platform: ModeX's MSTAR (Multispecific Targeted Antibody Response) platform generates antibodies that can simultaneously bind multiple distinct targets, enabling more sophisticated immunomodulation than traditional monospecific or bispecific formats. Regeneron gains access to this technology to expand its already extensive antibody pipeline.

Takeda-Innovent Biologics: $1.2 Billion Oncology Alliance

Takeda entered a $1.2 billion strategic partnership with China's Innovent Biologics (announced October 21, just prior to this period) to gain ex-China rights to two late-stage oncology biologics plus an option on a third program.

Deal Terms:

- Upfront payment including $100 million equity investment in Innovent

- Up to $1.1 billion in additional milestone payments across programs

- Tiered royalties on net sales

Assets Licensed:

- IBI363 (PD-1/IL-2α bispecific immunotherapy) for solid tumors

- IBI3009 (CLDN18.2-targeted antibody-drug conjugate) for gastric cancer

- Option rights to an undisclosed third candidate

Strategic Rationale: The alliance rapidly expands Takeda's oncology pipeline with clinically advanced assets targeting high-value tumor types, while providing Innovent with validation and resources for global development.

Major Strategic Partnerships ($500M-$999M)

GSK-Empirico: $745 Million siRNA COPD Deal

GlaxoSmithKline paid $85 million upfront to Empirico for exclusive worldwide rights to EMP-012, a Phase 1 small interfering RNA (siRNA) oligonucleotide for chronic obstructive pulmonary disease (COPD).

Deal Terms:

- $85 million upfront

- Up to $660 million in development and commercial milestones

- Tiered royalties on net sales

- Total potential value: $745 million

Mechanism: EMP-012 targets a novel inflammatory pathway in COPD, offering potential benefits for patients with limited treatment options beyond current bronchodilators and corticosteroids. The siRNA approach allows precise gene silencing of disease-driving targets in lung tissue.

Strategic Fit: The deal aligns with GSK's strategy to expand beyond biologics into RNA-based therapeutics for respiratory disease, an area where GSK maintains market leadership through its extensive COPD and asthma franchises.

Boehringer Ingelheim-Kyowa Kirin: €640 Million Autoimmune Collaboration

Germany's Boehringer Ingelheim returned to partner with Japan's Kyowa Kirin on a preclinical small molecule for autoimmune diseases, paying up to €640 million (~$695 million USD).

Deal Terms:

- Undisclosed upfront payment

- Up to €640 million in development and regulatory milestones

- Geographic rights structure not disclosed

Pipeline: While the exact molecular target remains confidential, Boehringer cited the compound as a potential first-in-class immunology therapy addressing significant unmet needs in autoimmune disease treatment.

Partnership History: This deal extends Boehringer and Kyowa Kirin's relationship, following a prior €410 million fibro-inflammatory collaboration. The repeat partnership signals successful working dynamics and complementary capabilities between the two companies.

Mid-Tier Licensing Deals ($200M-$499M)

Otsuka-4D Molecular Therapeutics: $420+ Million Gene Therapy Alliance

Japan's Otsuka Pharmaceutical obtained Asia-Pacific rights to 4D Molecular Therapeutics' 4D-150, an investigational retinal gene therapy for wet age-related macular degeneration (AMD) and diabetic macular edema (DME).

Deal Terms:

- $85 million upfront payment

- Otsuka will co-fund approximately $50 million for clinical trials

- Up to $336 million in development and commercial milestones

- Tiered double-digit royalties on APAC net sales

- Total potential value: $420+ million

Development Plan: Partners will collaborate on Phase 3 development, with Otsuka handling Asia-Pacific commercialization while 4DMT retains rights for rest of world. The non-dilutive capital allows 4DMT to advance its ophthalmology gene therapy portfolio globally.

GSK-Syndivia: $357 Million Prostate Cancer ADC Deal

GlaxoSmithKline licensed a preclinical prostate cancer antibody-drug conjugate (ADC) from France-based Syndivia.

Deal Terms:

- Upfront payment (amount not disclosed)

- Up to £268 million (~$357 million USD) in development and commercial milestones

- Royalties on net sales

Preclinical Data: The ADC demonstrated potent tumor shrinkage in preclinical prostate cancer models, with the antibody component targeting a prostate-specific antigen while delivering a cytotoxic payload directly to cancer cells.

Strategic Rationale: This deal bolsters GSK's oncology pipeline with another tumor-targeted ADC, following the company's increased focus on antibody-drug conjugate therapies as precision cancer treatments. GSK gains rights to develop and commercialize the candidate globally.

Other Strategic Collaborations

Takeda-Innovent Biologics: $1.2 Billion Oncology Alliance

Takeda entered a $1.2 billion strategic partnership with China's Innovent Biologics (announced October 21, just prior to this period) to gain ex-China rights to two late-stage oncology biologics plus an option on a third program.

Deal Terms:

- Upfront payment including $100 million equity investment in Innovent

- Up to $1.1 billion in additional milestone payments across programs

- Tiered royalties on net sales

Assets Licensed:

- IBI363 (PD-1/IL-2α bispecific immunotherapy) for solid tumors

- IBI3009 (CLDN18.2-targeted antibody-drug conjugate) for gastric cancer

- Option rights to an undisclosed third candidate

Strategic Rationale: The alliance rapidly expands Takeda's oncology pipeline with clinically advanced assets targeting high-value tumor types, while providing Innovent with validation and resources for global development.

JW Therapeutics-Regeneron: TCR-T Cell Therapy Expansion

JW Therapeutics (China) and Regeneron (USA) expanded their cell therapy collaboration to co-develop a TCR-T therapy for solid tumors, announced October 30.

Deal Terms:

- Up to $50 million in development milestones and option fees paid by Regeneron

- JW retains Greater China commercialization rights

- Regeneron gains non-exclusive access to JW's lentiviral manufacturing platform for potential global use

Technology: The partnership focuses on JW's MAGE-A4-targeted engineered T cell receptor therapy (TCR-T), representing a "new phase" in solid tumor immunotherapy beyond traditional CAR-T approaches. Regeneron will fund R&D activities through clinical proof-of-concept.

Eli Lilly-NVIDIA: AI Supercomputer Partnership

Announced October 28, Eli Lilly partnered with chipmaker NVIDIA to build what Lilly claims will be "the most powerful supercomputer owned and operated by a pharmaceutical company."

Strategic Rationale: The technology investment aims to accelerate AI-enabled drug discovery across all therapeutic areas, from target identification through clinical trial optimization. While financial terms were not disclosed, the infrastructure commitment represents a major bet on computational approaches to R&D productivity.

Regional and Specialized Partnerships

Liquidia Technologies-Vectura: Pulmonary Hypertension Device License

Announced October 27, Liquidia Technologies secured exclusive US rights to develop and commercialize treprostinil products using Vectura's nebulizer device technology for pulmonary arterial hypertension and PH-ILD.

Deal Terms:

- $2 million upfront payment

- Up to $104.5 million in development and commercial milestones

- Tiered royalties on net sales

- Total potential value: $106.5+ million

Fangzhou-Fosun Pharma: AI Chronic Disease Management

Announced October 29 in Shanghai, Fangzhou and Fosun Pharma signed a strategic collaboration for AI-powered chronic disease management focused on psoriasis and autoimmune conditions.

Technology Platform: The partnership leverages Fangzhou's proprietary XingShi Large Language Model and "AI+H2H" (human-to-human) ecosystem combined with Fosun Pharma's Otezla® (apremilast) commercial platform. Deal terms were not disclosed.

4D Molecular Therapeutics-Otsuka Asia: Ophthalmology Gene Therapy

Announced October 31, 4D Molecular Therapeutics licensed Asia rights to an eye disease gene therapy asset to Otsuka Pharmaceutical.

Deal Terms:

- $85 million upfront payment

- Undisclosed development and commercial milestones

- Tiered royalties on Asia sales

Turn Therapeutics-Medline: Global Dermatology Distribution

Turn Therapeutics entered a multi-year global licensing and supply agreement with Medline Industries, announced October 30.

Transaction Structure: Medline will manufacture, distribute, and commercialize Turn's PermaFusion® dermatology and wound-care products globally using Medline's extensive distribution network. Financial terms were kept confidential.

Strategic Rationale: The deal allows Turn to focus on R&D while leveraging Medline's supply-chain infrastructure to reach both professional and consumer health markets. Turn described the collaboration as "transformative" for scaling FDA-cleared topical products.

Debiopharm-NetTargets: AI Antibiotic Discovery

Swiss specialty pharma Debiopharm announced an AI-driven drug discovery alliance with UK-based NetTargets on October 30 to develop dual-payload antibiotics addressing drug-resistant bacteria.

Technology Platform: NetTargets contributes its AI platform for in silico antibiotic design, while Debiopharm brings clinical development expertise. Financial terms were not disclosed.

PharmaJet-EVA Pharma: Polio Immunization Technology

Signed October 30 at CPHI Frankfurt meeting and announced October 31, PharmaJet granted EVA Pharma's affiliate ATR distribution rights plus technology transfer and manufacturing capabilities for Tropis® intradermal needle-free injection system.

Geographic Scope: Agreement covers polio immunization in Egypt and broader Middle East/Africa region, aiming to reduce immunization costs and increase coverage. Financial terms were not disclosed.

Licensing & Partnership Summary Table

| Deal Partners | Transaction Value | Key Terms | Therapeutic Area |

|---|---|---|---|

| Roche - Qyuns Therapeutics | $1.07B | $75M upfront + $995M milestones | Respiratory (COPD/asthma bispecific) |

| Regeneron - ModeX/OPKO | $1B+ | $7M upfront + $200M+ per program | Multispecific antibodies (multiple areas) |

| Takeda - Innovent Biologics | $1.2B+ | $100M equity + $1.1B milestones | Oncology (PD-1/IL-2α, ADC) |

| GSK - Empirico | $745M | $85M upfront + $660M milestones | COPD (siRNA) |

| Boehringer - Kyowa Kirin | €640M (~$695M) | Undisclosed upfront + milestones | Autoimmune (small molecule) |

| Otsuka - 4D Molecular | $420M+ | $85M upfront + $50M co-funding + $336M milestones | Retinal gene therapy (AMD/DME) |

| GSK - Syndivia | $357M (£268M) | Undisclosed upfront + milestones | Prostate cancer ADC |

| JW Therapeutics - Regeneron | $50M milestones | R&D funding, Greater China rights to JW | TCR-T for solid tumors |

| Liquidia - Vectura | $106.5M+ | $2M upfront + $104.5M milestones | Pulmonary hypertension |

| Eli Lilly - NVIDIA | Undisclosed | AI supercomputer infrastructure | AI drug discovery |

| Fangzhou - Fosun Pharma | Undisclosed | AI chronic disease management | Psoriasis, autoimmune |

| Turn - Medline | Confidential | Global distribution, manufacturing | Dermatology, wound care |

| Debiopharm - NetTargets | Undisclosed | AI antibiotic discovery | Antimicrobial resistance |

| PharmaJet - EVA Pharma | Undisclosed | Tech transfer, MENA distribution | Polio immunization |

Total Disclosed Partnership Value: $5.6+ billion in upfront payments and milestones

Public Offerings & Structured Finance

Initial Public Offerings

MapLight Therapeutics IPO raises $296.3 million

MapLight Therapeutics priced its IPO on October 27 and began trading on Nasdaq (ticker: MPLT) as the first biotech IPO to price during the 2025 federal government shutdown, utilizing Section 8(a) automatic effectiveness provisions.

Offering Details:

- $251 million gross proceeds from initial offering at $17.00 per share

- $8 million concurrent private placement with Goldman Sachs

- Full underwriter option exercise adding proceeds

- Total shares sold: 16,962,500

- First-day performance: Opened at $17.00, closed at $18.34 (+8%)

Pipeline: MapLight is a clinical-stage company developing therapies for neuropsychiatric and CNS disorders including schizophrenia and Alzheimer's disease psychosis.

Underwriters: Morgan Stanley, Jefferies, Leerink Partners, and Stifel served as joint book-runners.

Private Investment in Public Equity (PIPE)

ADC Therapeutics closes $60 million PIPE

Commercial-stage biotech ADC Therapeutics closed a $60 million private placement on October 27, led by TCGX with participation from Redmile Group.

Use of Proceeds: Funds will expand commercial efforts for ZYNLONTA, a CD19-directed antibody-drug conjugate, and strengthen the balance sheet. Post-PIPE cash position expected to reach $292.3 million.

At-The-Market Offerings

Quantum BioPharma launches $21.225 million ATM

Announced October 31, Canadian biopharmaceutical company Quantum BioPharma established an at-the-market offering facility through H.C. Wainwright & Co. allowing sale of up to $21.225 million in Class B Subordinate Voting Shares on Nasdaq at the company's discretion.

Pipeline Focus: Quantum develops treatments for neurodegenerative disorders, metabolic disorders, and alcohol misuse disorders. Proceeds will fund clinical trials, R&D activities, and working capital.

Royalty Monetization

Nanobiotix: $71 Million Royalty Financing with HealthCare Royalty

French oncology biotech Nanobiotix entered a strategic royalty monetization agreement with HealthCare Royalty Partners to support its lead radiotherapy-enhancing drug NBTXR3 (partnered with Johnson & Johnson as "JNJ-1900").

Deal Structure:

- $50 million upfront payment (immediate)

- $21 million contingent payment in approximately 12 months

- Total potential proceeds: $71 million non-dilutive capital

Repayment Terms:

- HCRx receives portion of future royalties/milestones from NBTXR3's first $1 billion in sales

- Return capped at ~$124 million (1.75× principal) if achieved by end of 2030

- Alternative cap of ~$178 million (2.5× principal) if repayment extends beyond 2030

- After cap reached: smaller royalty tail of up to $14.9 million per year for maximum 10 years

Legal Structure: Royalty streams routed through French law trust structure to ensure bankruptcy remoteness.

Financial Impact: Extends Nanobiotix's cash runway into early 2028, supporting Phase 3 development of NBTXR3 for advanced soft-tissue sarcoma and other solid tumors without equity dilution.

Savara-RTW Investments: $75 Million FDA-Contingent Launch Financing

Savara Inc., a rare respiratory disease biotech, announced a $75 million royalty financing agreement with funds managed by RTW Investments to support the potential commercial launch of MOLBREEVI for autoimmune pulmonary alveolar proteinosis (autoimmune PAP).

Deal Structure:

- $75 million total funding contingent on FDA approval

- Funding disbursement upon approval of MOLBREEVI (BLA resubmission due December 2025)

- RTW receives tiered single-digit royalty on U.S. net sales

- Royalty payments capped at specified level

Strategic Context: MOLBREEVI is an inhaled granulocyte-macrophage colony-stimulating factor (GM-CSF) therapy for autoimmune PAP, a rare and potentially fatal lung disease with limited treatment options. Phase 3 IMPALA-2 trial demonstrated statistically significant improvement in arterial oxygenation at Week 24.

Investor Confidence: RTW CEO Roderick Wong stated the financing reflects "confidence in MOLBREEVI's Phase 3 data and commercial potential in this niche indication." The non-dilutive structure shores up Savara's balance sheet for potential 2026 product launch and commercialization.

Launch Financing Trend: Such FDA approval-contingent deals have become a lifeline for late-stage biotechs preparing to commercialize orphan drugs, providing capital timed precisely with regulatory success while avoiding dilution during clinical development.

Public Offerings & Finance Summary Table

| Company | Transaction Type | Amount Raised | Key Terms | Therapeutic Focus |

|---|---|---|---|---|

| MapLight Therapeutics | IPO (MPLT) | $296.3M | $17/share, 16.9M shares | CNS, neuropsychiatric |

| ADC Therapeutics | PIPE | $60M | Led by TCGX, Redmile | CD19 ADC (ZYNLONTA) |

| Quantum BioPharma | ATM Offering | $21.2M facility | H.C. Wainwright | Neurodegenerative, metabolic |

| Nanobiotix | Royalty Financing | $71M ($50M+$21M) | HCRx, 1.75-2.5× cap | Radiotherapy enhancer |

| Savara | Royalty Financing | $75M | RTW, FDA-contingent, single-digit royalty | Autoimmune PAP (MOLBREEVI) |

Total Capital Raised: $523.5 million

Corporate Restructuring & Workforce Reductions

The week saw significant restructuring activity as companies adjusted operations to extend cash runways, sharpen strategic focus, and respond to pipeline setbacks. Combined workforce reductions exceeded 9,500 positions across multiple organizations.

Major Workforce Reductions

Novo Nordisk: 9,000 Global Job Cuts

The Danish insulin and obesity drug giant confirmed elimination of 9,000 positions worldwide (approximately 15% of total workforce) as part of a company-wide restructuring begun in September. By October 31, Novo's CEO reported that most affected employees had been notified.

Strategic Rationale: The cuts aim to reduce costs amid fierce competition in the obesity treatment market, where Novo's Wegovy faces intensifying rivalry from Eli Lilly. Novo is refocusing resources on high-growth areas (obesity and diabetes) and "commercial execution" to maintain margins following recent rapid growth.

Genentech: Third Round of Bay Area Layoffs (118 positions)

Roche's U.S. subsidiary Genentech announced a third round of South San Francisco layoffs, terminating 118 employees effective November 28. This follows two earlier 2025 cuts (87 positions in July, 143 in May), bringing total Bay Area headcount reduction to 348 roles.

Context: The latest layoffs come shortly after Genentech ended its collaboration with Adaptive Biotechnologies (August). Aggregate Roche/Genentech reductions have exceeded 800 staff since April 2024 amid portfolio reprioritization and integration of acquired programs.

Ferring Pharmaceuticals: 64 U.S. Layoffs (500 Global)

Following an early-October announcement of up to 500 global job cuts, Ferring's U.S. subsidiary disclosed it will lay off 64 employees at its New Jersey site (Parsippany) by January 2026.

Strategic Rationale: The privately held mid-sized pharma is "sharpening strategic focus" and freeing resources to reinvest in innovation, including recent FDA-approved gene therapy launches for bladder cancer. Restructuring targets back-office and certain commercial roles.

Alector: 49% Workforce Reduction (~75 people)

Announced October 23 (just prior to this period), neurology biotech Alector will terminate approximately 49% of staff (~75 people) after failure of its lead Alzheimer's/Parkinson's candidate latozinemab (anti-TREM2 antibody partnered with GSK).

Timeline: Workforce reduction to be completed in H1 2026. This represents Alector's second major cut in 2025 (following 13% reduction in March). The company will refocus on earlier-stage immuno-neurology pipeline assets.

Strategic Wind-Downs

Sensei Biotherapeutics: Potential Liquidation

Micro-cap cancer vaccine developer Sensei Biotherapeutics announced on October 30 plans to lay off most remaining employees while "reviewing strategic alternatives" including sale, merger, or dissolution.

Pipeline Decision: The company is discontinuing development of its Phase 1/2 cancer immunotherapy due to insufficient efficacy. Sensei had only 15 employees as of early 2025 (down 46% from prior year) and will retain just a skeleton team for regulatory and administrative obligations during strategic review.

Context: This reflects continued shake-out among undercapitalized small biotechs with unsuccessful trials, many opting for drastic downsizing or exploring reverse mergers to extract remaining value.

Restructuring Summary Table

| Company | Positions Cut | Percentage | Rationale | Timeline |

|---|---|---|---|---|

| Novo Nordisk | 9,000 | ~15% | Obesity market competition, margin protection | Most notified by Oct 31 |

| Genentech | 118 (348 YTD) | N/A | Portfolio reprioritization, partnership ends | Effective Nov 28 |

| Ferring Pharma | 64 US (500 global) | N/A | Strategic focus, innovation reinvestment | By January 2026 |

| Alector | ~75 | ~49% | Lead program failure (latozinemab) | H1 2026 |

| Sensei Biotherapeutics | Most staff | ~80%+ | Phase 1/2 failure, strategic alternatives | Q4 2025 |

Total Workforce Reductions: 9,500+ positions

Corporate Spinouts & Strategic Separations

Two significant corporate separation transactions completed or advanced during the week, reflecting large companies' strategic decisions to unlock value and resolve structural conflicts.

Samsung Biologics: Biosimilars Division Spinout

Samsung Biologics completed the spin-off of its entire biosimilars division into a new standalone entity, Samsung Epis Holdings, effective November 1, 2025. Shareholders approved the split at an October 17 extraordinary general meeting.

Post-Separation Structure:

- Samsung Biologics will concentrate exclusively on contract development and manufacturing (CDMO) services

- Samsung Bioepis (biosimilar drug developer) will operate under Samsung Epis Holdings as parent company

- Both entities will be relisted on Korea Exchange by November 24

Strategic Rationale: The separation addresses a perceived conflict of interest—some Samsung Biologics' pharma clients were uneasy that the company was simultaneously running a "competing" biosimilars development business. The split is also expected to unlock value by giving the R&D-centric Bioepis business a more appropriate valuation distinct from the steady-revenue CDMO operation.

Avidity Biosciences: Cardiology Programs SpinCo

As part of the Novartis acquisition agreement, Avidity Biosciences will spin out its early-stage precision cardiology programs into an independent entity (temporarily nicknamed "SpinCo") prior to closing.

SpinCo Capitalization: Approximately $270 million in funding, with Avidity's current cardiology program chief as CEO.

Shareholder Treatment: Avidity shareholders will receive 1 SpinCo share per 10 Avidity shares owned, or equivalent cash proceeds if SpinCo's assets are sold before the acquisition closes.

Pipeline Transfer: SpinCo will continue Avidity's partnerships with Bristol Myers Squibb and Eli Lilly focused on cardiovascular gene therapy programs. Novartis granted a partner right-of-first-negotiation on certain SpinCo assets.

Strategic Rationale: The carve-out ensures non-core cardiology pipeline assets find appropriate funding and focus without burdening Novartis, which prioritized Avidity's muscle disease AOC platform. SpinCo itself could become an acquisition target for companies seeking cardiovascular gene therapy capabilities.

Other Notable Spinout Developments

CSL Limited (Australia): Industry analysts reported CSL is planning a future spin-off of its vaccines business by 2026, alongside major job cuts. Details remain preliminary.

Johnson & Johnson: The previously announced orthopedics spin-out (to be named DePuy Synthes) continues progressing toward 2025–2026 separation, though publicized earlier in October.

Spinout Summary Table

| Parent Company | Spun Entity | Business Separated | Capitalization | Effective Date |

|---|---|---|---|---|

| Samsung Biologics | Samsung Epis Holdings | Biosimilars R&D (Samsung Bioepis) | N/A (shareholder distribution) | November 1, 2025 |

| Avidity Biosciences | SpinCo | Early-stage cardiology gene therapy | ~$270M | Prior to Novartis acquisition close |

| CSL Limited | TBD Vaccines Co | Vaccines division | TBD | Planned 2026 |

| Johnson & Johnson | DePuy Synthes | Orthopedics | N/A | In progress 2025-26 |

Deal Terminations

Biogen Terminates Karyopharm ALS Asset Agreement

Announced October 27, Biogen terminated its January 2018 asset purchase agreement with Karyopharm Pharmaceuticals for KPT-350 (BIIB100) in amyotrophic lateral sclerosis (ALS).

Original Deal Terms:

- $10 million upfront payment

- Up to $270 million in potential development and commercial milestones

- Tiered royalties on net sales

Termination Impact: The Phase 1 candidate is being discontinued. Karyopharm loses all future milestone and royalty entitlements from the program. This termination reflects Biogen's continued strategic pruning of its neurology pipeline following multiple late-stage failures and strategic reprioritization.

Bankruptcies & Wind-Downs

No major biotech or pharmaceutical bankruptcy filings were announced during the Oct 27–Nov 1, 2025 period. While some small-cap biotechs like Sensei Biotherapeutics signaled potential liquidation or wind-down if strategic alternatives fail, none formally filed for Chapter 11 protection this week.

Industry Consolidation Dynamics

The sector's 2025 trends reflect a Darwinian culling where:

- Well-capitalized companies with strong clinical data are surviving and attracting follow-on investment

- Underfunded biotechs with weak trial results are folding, filing for bankruptcy, or selling assets at distressed valuations

- Royalty aggregators and opportunistic investors are accumulating portfolios of promising but undercapitalized assets

- Strategic acquirers are selectively purchasing technologies and programs from distressed sellers

While the pace of outright Chapter 11 filings slowed toward year-end, the broader trend of attrition continues through out-of-court wind-downs, strategic alternatives processes, and fire-sale M&A transactions. Investors and acquirers continue to triage troubled biotechs, suggesting further restructurings may emerge in 2026 as companies exhaust remaining cash reserves.

Alternatives to Formal Bankruptcy

Many biotechs are pursuing alternatives to court-administered bankruptcy:

- Reverse mergers into cash-rich shell companies

- Drastic workforce reductions (50-90% cuts) to preserve remaining cash

- Strategic alternative processes seeking merger partners or asset sales

- Royalty monetizations to extend runway (as exemplified by Nanobiotix and Savara deals this week)

- PIPE financings at significant discounts to prop up balance sheets

Transaction Summary & Market Analysis

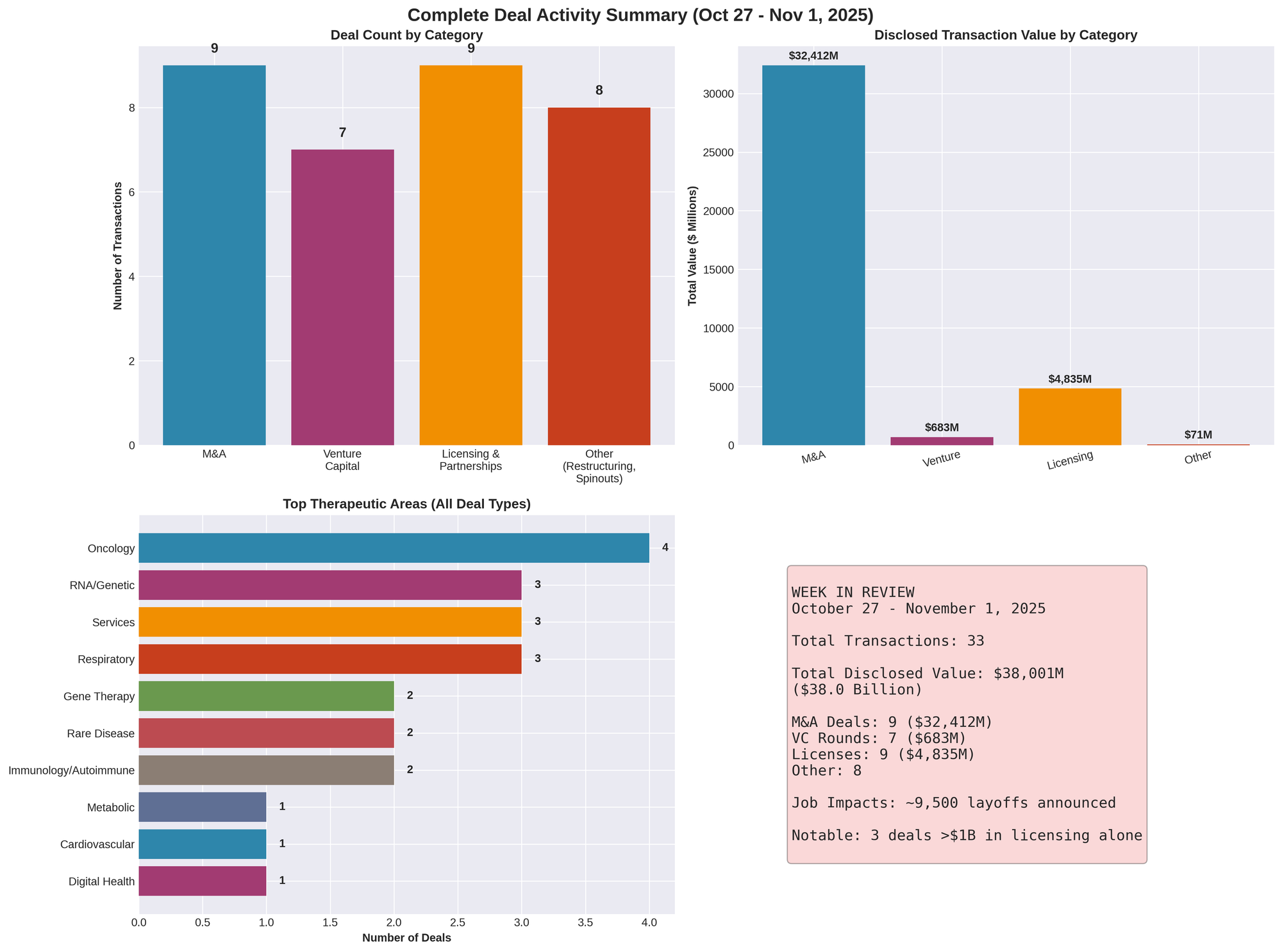

Deal Volume and Value Overview

Figure 4: Comprehensive overview of all transaction types, deal counts, disclosed values, and therapeutic area distribution across the week

Total Transactions Tracked: 50 distinct deals across all categories

Total Disclosed Transaction Value: Over $38 billion

- M&A: $32+ billion (9 transactions)

- Venture Capital: $745.6 million (8 transactions)

- Licensing/Partnerships: $5.6+ billion (14 transactions)

- Public Offerings/Finance: $523.5 million (5 transactions)

- Spinouts: 2 major separations

- Restructurings: 5 companies, 9,500+ positions eliminated

- Terminations: 1 asset agreement

- Bankruptcies: 0 new filings (18 YTD 2025 context)

Therapeutic Area Breakdown

Leading Categories:

- Oncology/Cancer: Kivu ADCs, Pathos AI, ADC Therapeutics PIPE, Takeda-Innovent alliance ($1.2B), GSK-Syndivia prostate ADC ($357M), Debiopharm antibiotic ADCs

- Respiratory Diseases: Roche-Qyuns bispecific ($1.07B), GSK-Empirico COPD siRNA ($745M), Savara autoimmune PAP royalty ($75M)

- Obesity/Metabolic: Novo-Metsera bidding war ($9B), GLP-1 competition intensifying, Regeneron-ModeX multispecific ($1B+)

- Cardiovascular: Tourmaline acquisition (anti-IL-6 for ASCVD), Avidity SpinCo cardiology programs, Liquidia PAH therapy

- Neurology/CNS: Axonis epilepsy/pain therapy ($115M), MapLight neuropsychiatric IPO ($296M), Quantum neurodegenerative programs, Alector restructuring

- Rare Diseases: Hemab bleeding disorders ($157M), Rarity gene therapy for ADA-SCID, Avidity muscle diseases

- Inflammatory/Autoimmune: Evommune chronic urticaria/atopic dermatitis ($115M), Fangzhou-Fosun psoriasis management, Zag Bio thymus modulation ($80M), Boehringer-Kyowa (€640M)

- Ophthalmology: Lilly-Adverum gene therapy acquisition ($262M), Otsuka-4DMT retinal gene therapy ($420M+)

- Gene Therapy: Multiple deals (Lilly-Adverum, BioMarin Roctavian divestiture, Rarity, Otsuka-4DMT), reflecting both opportunity and commercial reality

- CDMO/Services: Lonza-Redberry rapid testing, Thermo-Clario clinical trials ($8.9-9.4B)

Notable Strategic Trends

1. Intensifying Obesity Market Competition

The Novo Nordisk vs. Pfizer bidding war for Metsera signals that GLP-1 receptor agonist competition is entering a new phase. Companies are paying massive premiums for next-generation assets (monthly dosing, oral formulations) to maintain market positioning. The $9 billion Novo bid represents one of the highest valuations for Phase 2 assets in recent biotech history.

2. AI Integration Across the Value Chain

AI emerged as a prominent theme spanning drug discovery (Lilly-NVIDIA supercomputer, Pathos AI platform, Debiopharm-NetTargets), patient management (Fangzhou-Fosun chronic disease platform), and clinical trial operations (Thermo Fisher-Clario acquisition including AI-enhanced endpoint adjudication).

3. Risk-Sharing Transaction Structures

Multiple deals incorporated contingent value rights (CVRs) to mitigate valuation uncertainty:

- Novartis-Avidity: $2.5B in CVRs tied to milestones

- Novo-Metsera: $2.5B CVR component

- Lilly-Adverum: $48M development-contingent payments

This structure allows buyers to pay for success while managing downside risk on pre-pivotal or early-commercial assets.

4. Gene Therapy Reality Check

BioMarin's decision to divest Roctavian after generating only $23M revenue (vs. $2.2B forecasts) provides sobering context for first-generation gene therapies facing market access and adoption challenges despite regulatory approval. Simultaneously, acquirers (Lilly-Adverum) continue betting on next-generation approaches using risk-mitigated structures.

5. Royalty Monetization as Alternative Financing

Nanobiotix's $71M structured royalty deal with HealthCare Royalty exemplifies growing use of non-dilutive capital to bridge funding gaps. The capped return structure (1.75-2.5× depending on timing) provides biotech runway extension while offering investors attractive risk-adjusted returns from late-stage assets.

6. CRO and Services Sector Consolidation

Thermo Fisher's $8.9B+ acquisition of Clario represents continued consolidation in clinical research services, particularly technology-enabled platforms. The deal reflects recognition that AI-enhanced clinical trial infrastructure creates defensible competitive advantages and steady revenue streams.

7. China Cross-Border Activity

Multiple transactions involved Chinese companies either as acquirers (Pharmaron-Biortus consolidation, I-Mab-Bridge Health), licensors (Takeda-Innovent $1.2B alliance, Roche-Qyuns $1.07B respiratory deal, JW Therapeutics-Regeneron TCR-T partnership), or strategic partners (Fangzhou-Fosun). China continues playing dual roles as both innovative R&D source and attractive commercial market. The Roche-Qyuns and Takeda-Innovent deals represent Chinese biotechs successfully licensing billion-dollar assets to Western pharma, validating China's emergence as a global innovation hub.

8. Workforce Rationalization Continues

9,500+ job cuts across major pharma (Novo Nordisk, Genentech, Ferring) and struggling biotechs (Alector, Sensei) reflect ongoing pressure to demonstrate operating efficiency to investors. Restructurings balance between preserving innovation capacity and extending cash runways.

9. Corporate Simplification Through Spinouts

Both Samsung Biologics (biosimilars separation) and Avidity (cardiology carve-out) exemplify large organizations creating focused pure-plays to unlock value and resolve structural conflicts. This trend allows:

- Better strategic alignment for each business

- Elimination of customer/partner conflicts

- More appropriate valuations for disparate business models

- Increased M&A optionality for separated entities

10. Late-Stage Venture Rounds Remain Strong

Despite broader biotech funding challenges, companies with differentiated platforms or late-stage rare disease assets raised substantial rounds ($115M+ for Axonis, Evommune; $157M for Hemab). Investors continue backing clinical-stage assets with clear paths to approval and addressable markets.

11. Billion-Dollar Licensing Resurgence

The week saw a remarkable concentration of mega-licensing deals ($745M-$1.2B range) as major pharma seeks external innovation:

- Roche-Qyuns: $1.07B for respiratory bispecific

- Regeneron-ModeX: $1B+ for multispecific antibody platform

- Takeda-Innovent: $1.2B for late-stage oncology assets

- GSK-Empirico: $745M for COPD siRNA

- Boehringer-Kyowa: €640M for autoimmune small molecule

This represents over $5 billion in partnership value in a single week, signaling that big pharma is aggressively filling pipeline gaps through licensing rather than relying solely on M&A.

12. Respiratory Disease Focus Intensifies

Three major respiratory deals (Roche-Qyuns $1.07B, GSK-Empirico $745M, Savara launch financing $75M) reflect renewed focus on COPD, asthma, and rare lung diseases as aging populations and environmental factors drive market growth. New modalities (bispecifics, siRNA) are challenging traditional inhaled corticosteroid approaches.

Geographic Distribution

North America: Dominated M&A (Novartis-Avidity, Lilly-Adverum, Thermo-Clario), venture financings (7 of 8 deals), and public offerings

Europe: Samsung Biologics spinout (South Korea), Nanobiotix royalty financing (France), Debiopharm-NetTargets partnership (Switzerland-UK)

Asia: Strong activity including China CRO consolidation (Pharmaron-Biortus), major licensing (Takeda-Innovent, 4DMT-Otsuka), cell therapy partnerships (JW-Regeneron), and AI chronic disease management (Fangzhou-Fosun)

Cross-Border Partnerships: Increasing frequency of multi-region partnerships and licensing deals, particularly US-China and US-Asia collaborations

Outlook and Implications

The October 27 - November 1 transaction period demonstrates that life sciences deal-making remains robust across categories despite broader market volatility. Several patterns suggest the coming months may see continued activity:

- Elevated M&A appetite from cash-rich pharma facing patent cliffs and seeking pipeline replenishment

- Competitive intensity in obesity/metabolic franchises likely to drive additional premium valuations

- Selective venture funding concentrated on differentiated platforms and late-stage rare disease assets

- Continued restructuring as companies balance innovation investment with financial discipline

- Alternative financing structures (royalties, CVRs) becoming standard tools for bridging valuation gaps

For investors and industry analysts, this week's transactions reinforce that strategic fit, clinical de-risking, and innovative financing structures are increasingly determining which deals get completed in today's environment.

Methodology Note & Disclaimer: All information is drawn from verified company announcements, regulatory filings, and reputable financial news sources published between October 27 and November 2, 2025. Transaction values represent disclosed terms at announcement; actual realized values may differ based on milestone achievement, market conditions, and other contingencies. This is not investment advice.

Member discussion