The Weekly Term Sheet (46)

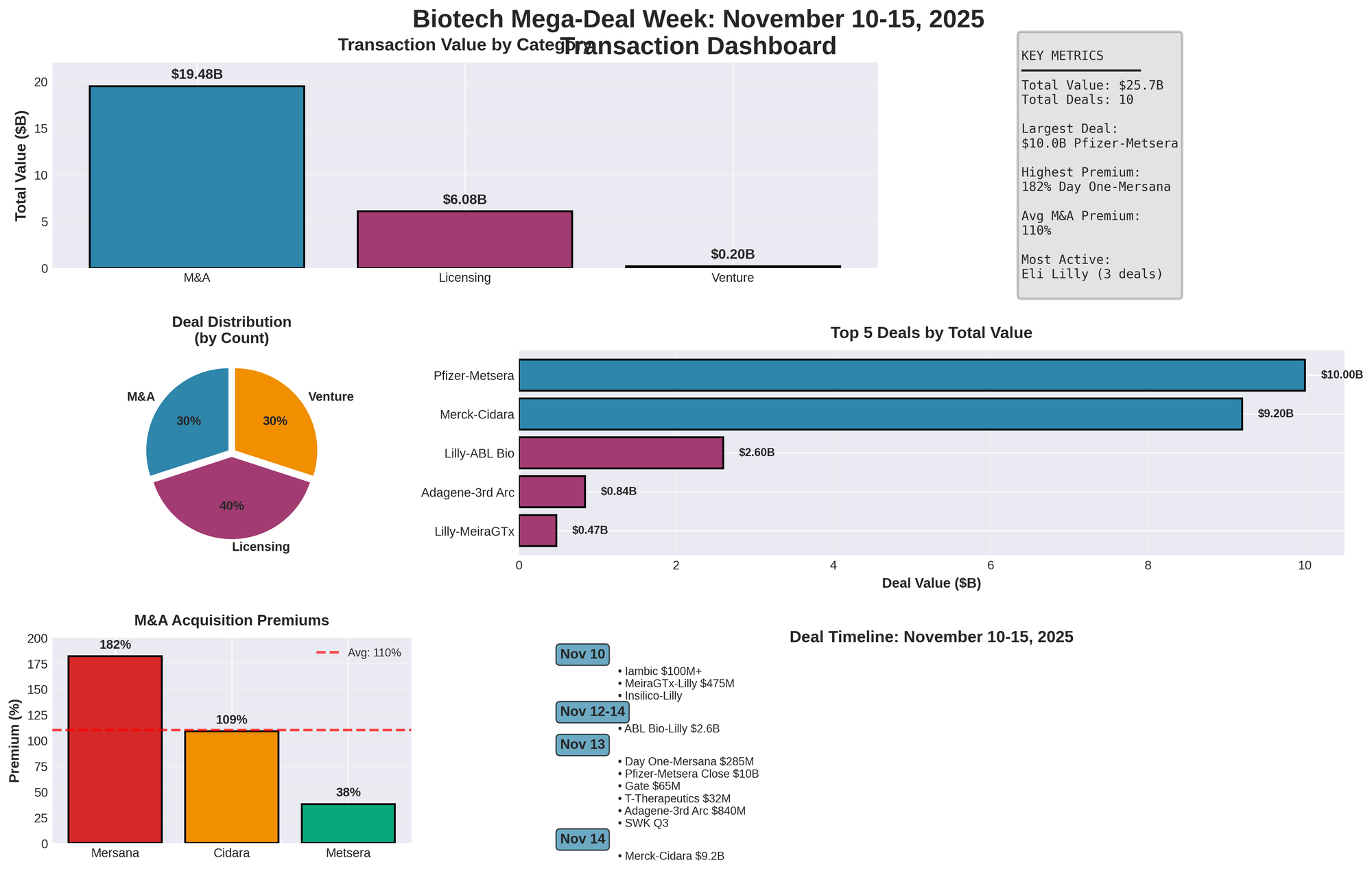

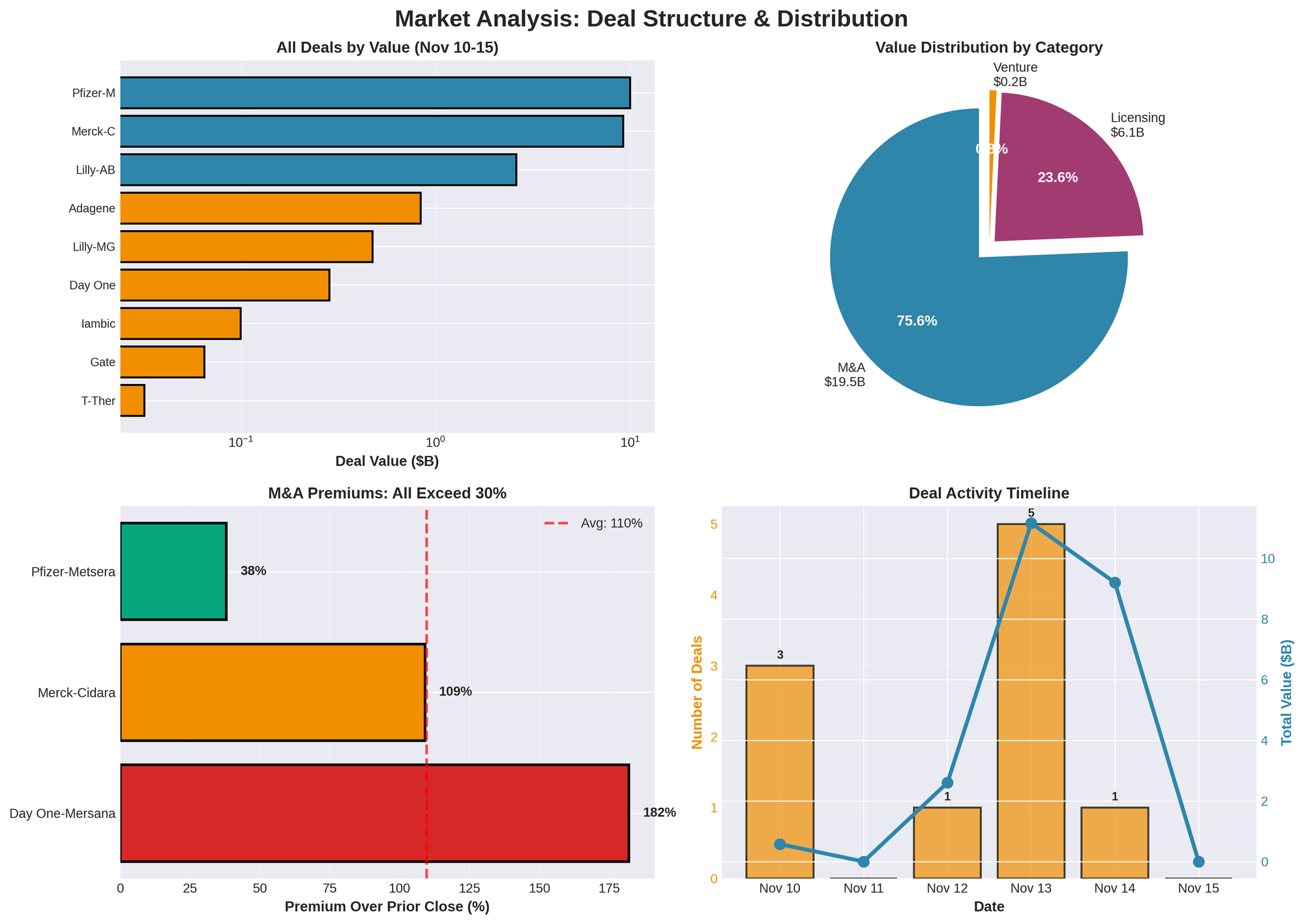

The biotech sector experienced one of its most intense dealmaking periods of 2025 during November 10-15, with over $25 billion in total transaction value across M&A, licensing, and venture financing. Eli Lilly emerged as the week's most aggressive dealmaker with three partnerships totaling $3.2 billion in potential milestones, while Merck's $9.2 billion acquisition of Cidara Therapeutics on November 14 capped a remarkable surge that signals profound shifts in pharmaceutical pipeline strategy.

This concentration of mega-deals reflects strategic imperatives driving the industry: addressing looming patent cliffs (particularly Merck's Keytruda expiration in 2028), diversifying beyond obesity franchises through platform technology access, and securing late-stage de-risked assets to fill 2028-2032 revenue gaps.

Disclaimer: I am not a lawyer or financial adviser. This content is not investment or legal advice. Information comes from public sources and details may change. Consult professionals for specific guidance.

Deal Summary Dashboard

| Category | Deals | Total Value | Avg Deal | % of Total |

|---|---|---|---|---|

| M&A | 3 | $19.485B | $6.495B | 75.8% |

| Licensing | 4 | $6.075B | $1.519B | 23.6% |

| Venture | 3 | $0.197B | $0.066B | 0.8% |

| TOTAL | 10 | $25.7B | $2.57B | 100% |

Key Metrics:

- Largest Deal: $10.0B (Pfizer-Metsera closed Nov 13-14)

- Highest Premium: 182% (Day One-Mersana)

- Most Active: Eli Lilly (3 partnerships)

- Average M&A Premium: 110%

Major M&A Transactions

| Acquirer | Target | Date | Value | Upfront | CVR | Premium | Status |

|---|---|---|---|---|---|---|---|

| Pfizer | Metsera | Nov 13-14 | $10.0B | $65.60/sh | $20.65/sh | 38% | Closed |

| Merck | Cidara | Nov 14 | $9.2B | $221.50/sh | None | 109% | Pending Q1 |

| Day One | Mersana | Nov 13 | $0.285B | $25/sh | $30.25/sh | 182% | Pending Q1 |

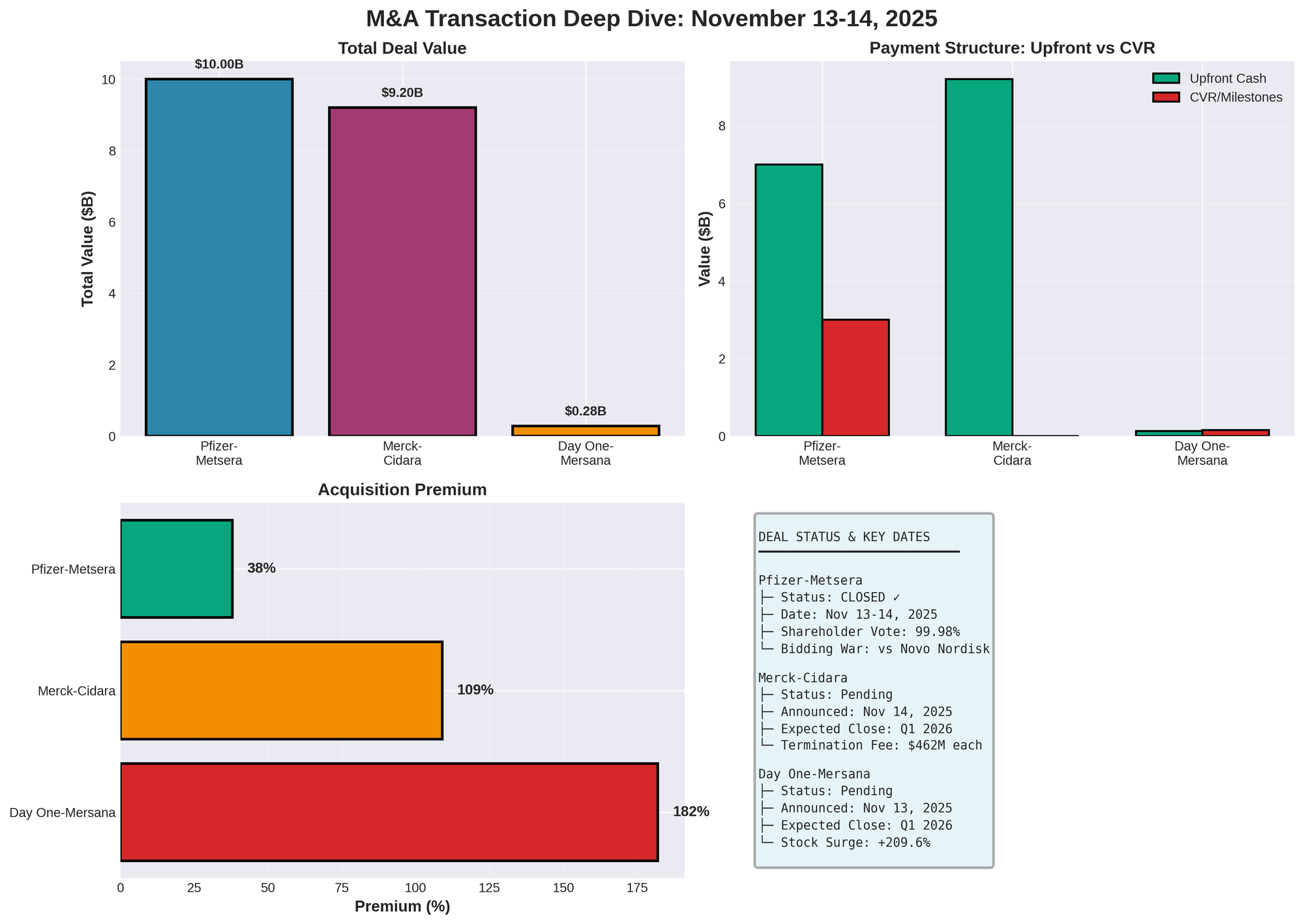

Merck-Cidara: $9.2B Defensive Play

Merck's $9.2 billion acquisition of Cidara Therapeutics (announced Nov 14) targets CD388, a late-stage influenza prevention drug with breakthrough designation and 76% efficacy. The all-cash $221.50/share offer represents a stunning 109% premium.

Transaction Details

- Cash/Share: $221.50 (Merck IR)

- Premium: 109% (TradingView)

- Enterprise Value: $9.2B (BioPharma Dive)

- Stock Surge: 105% day-of

- Merck Shares: -1.3%

- Expected Close: Q1 2026

Cidara shareholders saw shares surge 105% while Merck dipped 1.3% as investors digested what Bernstein's Courtney Breen called "essentially a single asset story." Termination fees of ~$462M each way (5% of deal value) suggest intense competitive dynamics.

Merck CEO Robert Davis stated: "We continue to execute our science-led business development strategy, augmenting our pipeline with CD388, a potentially first-in-class, long-acting antiviral designed to prevent influenza in individuals at higher risk of complications. We are confident that CD388 has the potential to be another important driver of growth through the next decade."

Advisory Teams

Financial:

- Merck: BofA Securities

- Cidara: Evercore + Goldman Sachs (dual advisors)

Legal: (Global Legal Post)

- Merck: Gibson Dunn (Saee Muzumdar lead)

- Cidara: Cooley (Barbara Borden lead)

Dual sell-side advisors typically indicate competitive tension. Cooley previously advised Cidara on raising $240M and reacquiring CD388 rights from Janssen—critical prep for this transaction.

CD388 Asset Profile

| Attribute | Detail |

|---|---|

| Mechanism | Drug-Fc Conjugate (zanamivir + antibody fragment) |

| Target | Strain-agnostic flu prevention |

| Designation | FDA Breakthrough (Oct 2025) |

| Phase 2b | 76% prevention over 24 weeks |

| Phase 3 | ANCHOR study (NCT07159763), 6,000 patients |

| Market | 290,000-650,000 annual deaths globally |

| Key Advantage | Non-vaccine, immune-independent |

Sources: Merck, Business Wire

CD388's Drug-Fc Conjugate mechanism—multiple zanamivir molecules (GSK's Relenza active ingredient) conjugated to proprietary antibody fragment—provides strain-agnostic prevention working independently of immune status. Particularly notable given vaccine hesitancy trends.

The ANCHOR Phase 3 study dosed first participants September 2025, enrolling 6,000 across 150 Northern Hemisphere sites (US/UK), with Q1 2026 interim analysis to assess powering assumptions.

Janssen Background

CD388 history is complex: J&J's Janssen originally partnered but returned the asset April 2024 during its infectious disease/vaccine R&D wind-down. To recover rights, Cidara paid Janssen $85M upfront plus milestones. Cidara then secured up to $339M from BARDA ($58M confirmed over 2 years for US manufacturing/supply chain).

Analyst Views

Bernstein's Breen: deal provides "late-stage, lower-risk revenue" but requires building new market infrastructure since Cidara is "essentially a single asset story" tangential to Merck's hospital/specialty franchises. BioPharma Dive noted RBC projects $3.8B peak sales opportunity.

Day One-Mersana: $285M Rescue

Day One's acquisition of Mersana (announced Nov 13) for up to $285M ($129M closing + $156M CVRs) rescued a struggling ADC company. Deal provides Day One with Emi-Le, showing 31% ORR in TNBC and potential first-in-class status for ACC-1 (rare salivary gland cancer, no approved therapies).

Deal Structure

| Component | Value | Detail |

|---|---|---|

| Upfront | $25/share | $129M equity value |

| CVR Max | $30.25/share | $156M potential |

| Total | $55.25/share | $285M |

| Pre-Price | $8.87 (Nov 12) | Baseline |

| Premium | 182% | Over Nov 12 close |

| Day-of Surge | 209.6% to $27.48 | StockTitan |

| Volume | 2.9M (19x normal) | Massive interest |

| DAWN Reaction | -5.78% (-11-14% intraday) | Investor skepticism |

Sources: Day One IR, BioPharma Dive

The 182% premium reflects Mersana's distress: strategic review announced September 2024 while burning $12M monthly with limited financing options.

CVR Milestones

| Milestone | Payment | Timing | Probability |

|---|---|---|---|

| Phase 3 TNBC start | $5.00/sh | 2026 | High |

| ACC-1 accelerated approval | $10.00/sh | 2027 | Moderate |

| ACC-1 full approval | $15.25/sh | 2028-29 | Moderate |

Emi-Le Data

| Indication | Phase | ORR | Population | Status |

|---|---|---|---|---|

| TNBC | 2 | 31% | Post-topo-1 ADC | Phase 3 pending |

| Endometrial | 2 | 37% | Multiple therapies | Ongoing |

| ACC-1 | 1 | Early activity | ~1,200 US annual | Priority |

Sources: Fierce Biotech, BioPharma Dive

Day One's pivot prioritizes ACC-1 over TNBC. Company stated early anti-tumor activity in ACC-1 "may support a fast path to registration" given clear unmet need in aggressive cancer with well-defined population.

Mersana CEO Marty Huber: "This transaction provides near-term opportunity to support development of Emi-Le for adenoid cystic carcinoma, a population with very high unmet need."

Advisors

- Day One Financial: Gordon Dyal

- Mersana Financial: TD Cowen

- Day One Legal: Fenwick & West

- Mersana Legal: Wilmer Cutler Pickering Hale & Dorr

Analyst Response

Guggenheim slashed PT from $125→$30, viewing further bidders unlikely. Oppenheimer questioned if Emi-Le might replace Day One's PTK7 program management had been "talking down."

Strategic Context

Opportunistic by Day One, which just raised 2025 guidance to $145-150M for OJEMDA (pediatric glioma). Day One expects existing cash enables Emi-Le development through approval with no additional financing.

Pfizer-Metsera: $10B Bidding War Winner

Pfizer's $10B acquisition, closed Nov 13-14, capped fierce bidding vs Novo Nordisk. Originally announced Sep 22 at $4.9B, Pfizer revised to $10B Nov 7 after Novo's aggressive bids.

Transaction Terms

| Parameter | Value |

|---|---|

| Upfront | $65.60/sh ($7.0B) |

| CVR | Up to $20.65/sh ($3.0B) |

| Total | $10.0B ($86.25/sh max) |

| Original (Sep 22) | $7.3B ($47.50 + $22.50 CVR) |

| Revised (Nov 7) | 38% upfront increase |

| Approval | 99.98% (95.1M FOR, 20,655 AGAINST) |

| Close | Nov 13-14, 2025 |

CVR Milestones

| Milestone | Payment | Deadline |

|---|---|---|

| Phase 3 start: 097i+233i combo | $4.60/sh | Dec 2027 |

| FDA approval: Monthly 097i mono | $6.40/sh | Dec 2029 |

| FDA approval: Monthly combo | $9.65/sh | Dec 2031 |

Bidding War Timeline

| Date | Event | Value | Outcome |

|---|---|---|---|

| Sep 22 | Initial deal | $7.3B | Agreement |

| Oct-Nov | Novo bids | ~$10B multiple offers | Competition |

| Nov 5 | DE Chancery | Pfizer TRO denied | Legal battle |

| Nov 7 | Revised deal | $10.0B | Amended |

| Nov 8 | Novo exits | $86.20/sh final declined | Withdrew |

| Nov 13 | Vote | 99.98% approval | Pass |

| Nov 13-14 | Close | $10.0B | Complete |

Regulatory Drama

FTC intervened, having approved Pfizer's deal while concerned about Novo (already dominant with Wegovy) acquiring another obesity asset. Pfizer sought TRO Nov 5 in DE Chancery to block Novo consideration—denied.

Metsera's board cited antitrust risks in accepting Pfizer's revised offer, determining it superior "from standpoint of both financial value and certainty of closing."

Novo CEO Doustdar at White House event: "Our message to Pfizer is put your hand in the pocket and bid higher. It's a free market." Novo withdrew Nov 8: "will not increase offer" after "competitive process." Source: last bid was "maximum value"; characterized as "bolt-on acquisition, not make-or-break."

Advisory Teams

Financial:

- Pfizer: Citigroup

- Metsera: Goldman Sachs (lead) + Guggenheim + BofA + Allen & Company

Legal:

- Pfizer: Wachtell Lipton (David Lam, Steven Green leads)

- Metsera: Paul Weiss (Scott Barshay, Benjamin Goodchild, Andrew Krause)

Metsera Pipeline

| Asset | Mechanism | Dosing | Phase | Weight Loss |

|---|---|---|---|---|

| MET-097i | GLP-1 RA | Weekly/Monthly | → Phase 3 | Up to 14.1% |

| MET-233i | Amylin analog | Monthly | Phase 1 | Combo testing |

| Oral GLP-1 | GLP-1 RA | Daily | Phase 1 | Early dev |

| NSHs | Nutrient hormones | TBD | Discovery | Pipeline |

Sources: BioSpace, MarketScreener

MET-097i's 14.1% weight loss plus monthly dosing offers convenience vs Wegovy/Zepbound's weekly regimen. MET-233i amylin provides potential synergy.

CEO Bourla told Yahoo Finance: expects market entry "as early as 2028"; 097i expected "market-leading"; Pfizer "right company" citing "massive vaccine trial" expertise and "manufacturing at scale."

Pfizer Context

Pfizer discontinued two oral GLP-1s—lotiglipron (2023), danuglipron (2025)—due to liver safety, leaving no in-house obesity drugs. Expects $17-18B revenue hit annually from 2026-28 patent losses, making Metsera critical.

Analyst Views

Bernstein's Breen: $10B rests on optimistic assumptions—would need $11B revenue by 2040 (nearly double Metsera projections); noted pricing skepticism compressing margins. Leerink's Risinger: $5B peak sales for combined drugs. RA Capital's Kolchinsky: "Game of Thrones-level of play."

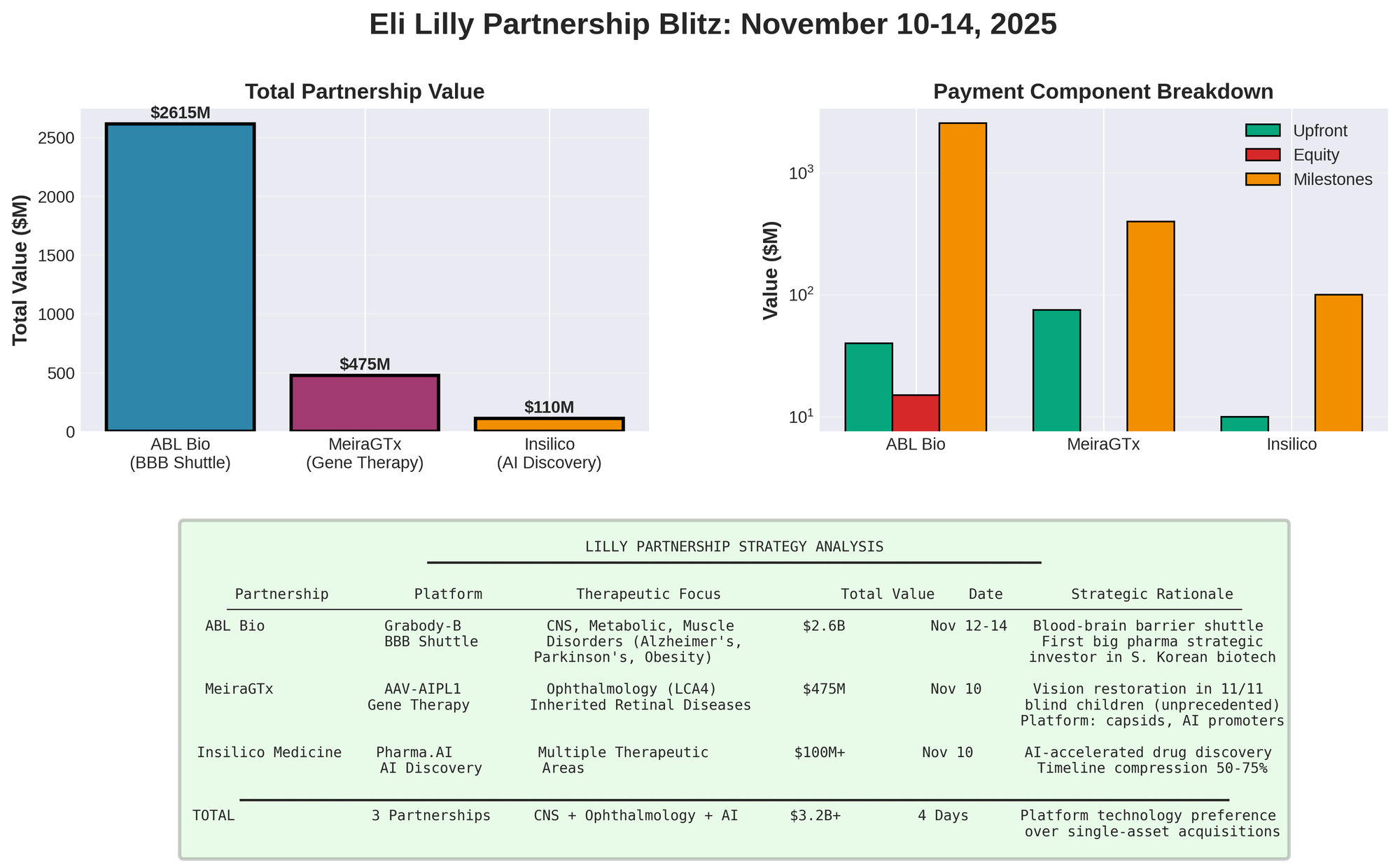

Eli Lilly Partnership Blitz: Three Deals in Four Days

Lilly executed aggressive November 10-14 partnership strategy: three collaborations totaling $3.2B+ in milestones, reflecting expansion into genetic medicine, blood-brain barrier tech, and AI discovery.

| Partner | Platform | Upfront | Equity | Milestones | Total | Focus | Date |

|---|---|---|---|---|---|---|---|

| ABL Bio | Grabody-B BBB | $40M | $15M | $2.56B | $2.6B | CNS/Metabolic | Nov 12-14 |

| MeiraGTx | AAV-AIPL1 | $75M | — | $400M | $475M | LCA4/Eye | Nov 10 |

| Insilico | Pharma.AI | Undisclosed | — | $100M+ | $100M+ | Multiple | Nov 10 |

| TOTAL | — | $115M+ | $15M | $3.06B+ | $3.2B+ | — | — |

ABL Bio: $2.6B Blood-Brain Barrier Platform

ABL Bio partnership (Nov 12-14 announcement, $2.6B potential) gives Lilly exclusive access to Grabody-B BBB shuttle platform targeting IGF1R for drug delivery across one of pharma's hardest challenges: the blood-brain barrier.

Deal Terms

| Component | Value | Detail |

|---|---|---|

| Upfront | $40M | Immediate |

| Milestones | $2.56B | Dev + regulatory + commercial |

| Equity | $15M (175,079 sh @ 125,900 KRW) | $85.80/sh strategic stake |

| Royalties | Tiered | Sales-based |

| Historic | First big pharma strategic investor | In S. Korean biotech |

| Scope | Worldwide | All markets |

Sources: BioWorld, Korea Biomedical

First case globally of big pharma serving as strategic investor in S. Korean biotech. Lilly moved swiftly without prior MTA—signaling confidence post-Roche's 2023 positive BBB shuttle data.

Market Reaction

| Date | Price (KRW) | Daily Change | Cumulative | Market Cap |

|---|---|---|---|---|

| Nov 12 | Baseline | — | — | Pre-deal |

| Nov 13 | — | +30% | +30% | → 10T KRW |

| Nov 14 | — | +29% | +67.7% | ~10T KRW |

| Nov 15 | 174,200 | — | — | 10T KRW ($6.56B) |

Source: KED Global

ABL surged 30% Nov 13, 29% Nov 14, reaching 10T won ($6.56B) Nov 15.

Analyst: Kyobo Securities (Jung Hee-ryeong): Buy, 190,000 KRW PT. Cumulative Grabody-B deals now 9.2T KRW (~$6.3B) including GSK.

Grabody-B Technology

| Attribute | Detail |

|---|---|

| Mechanism | Bispecific antibody: IGF1R for BBB transcytosis |

| vs Transferrin | Minimized signal interference, better safety |

| Validated | Alzheimer's, Parkinson's, brain mets, lysosomal storage |

| Emerging | Obesity (central), muscle diseases |

| Clinical Proof | Roche Trontinemab Phase 1/2 positive (2023) |

| Versatility | RNA, antibodies, small molecules, gene therapies |

Sources: HIT News, Business Korea

The BBB protects brain from harmful substances but blocks therapeutic penetration—major obstacle for neurodegenerative treatments. Global interest surged since Roche's 2023 positive trontinemab data using BBB shuttle tech.

vs transferrin-based shuttles, Grabody-B minimizes signal interference and safety issues. ABL advancing for Parkinson's, Alzheimer's, brain metastases, lysosomal storage disorders.

Existing Partnerships

| Partner | Year | Value | Asset/Application | Status |

|---|---|---|---|---|

| Sanofi | 2022 | $1.06B | ABL301 (α-synuclein) Parkinson's | Phase 2 (positive Ph1 US) |

| GSK | 2024 | $2.8B | Platform tech, CNS pipeline | Preclinical/IND |

| Lilly | 2024 | $2.6B | Platform, multiple modalities | Just announced |

Sources: HIT News, Korea Biomedical

Sanofi's ABL301 recently announced positive Phase 1 US results (safety/tolerability confirmed), moved to Phase 2.

Lilly Rationale

Lilly focusing on CNS/neurodegeneration. Kisunla (donanemab) approved/commercialized in US, Korea trials underway. Expanding across CNS including ALS.

ABL CEO Lee Sang-hoon: "Agreement reaffirms strong commercialization potential of Grabody platform and expanding versatility across modalities. Will extend into high-unmet-need indications including obesity and muscular diseases."

Complements Lilly's obesity leadership (Zepbound/Mounjaro) while providing CNS breakthrough potential. Beyond RNA, ABL aims for obesity/muscle disorders—aligns with Lilly priorities.

MeiraGTx: $475M Vision Restoration

MeiraGTx collaboration (Nov 10, $475M potential) secures $75M upfront + $400M milestones for AAV-AIPL1, gene therapy that restored vision in all 11 children <4yo born legally blind from Leber congenital amaurosis 4 (LCA4).

Deal Structure

| Component | Value |

|---|---|

| Upfront | $75M |

| Near-term milestones | Up to $135M (regulatory/approval) |

| Total milestones | $400M+ |

| Royalties | Tiered on sales |

| Rights | Worldwide exclusive AAV-AIPL1 |

| Platform access | Intravitreal capsids, AI promoters, riboswitch |

Sources: MeiraGTx IR, Fierce Biotech

Clinical Results (Lancet Feb 2025)

| Metric | Result |

|---|---|

| Enrollment | 11 children <4yo |

| Vision Restoration | 100% (11/11) |

| Baseline | Legally blind at birth (light perception only) |

| Benefits | Vision + communication, behavior, learning, mood, social |

| Designation | FDA Orphan + Rare Pediatric, EC Orphan |

Sources: MeiraGTx, BioXconomy

MeiraGTx CEO Zandy Forbes: "11 children with LCA4 from AIPL1 mutations were treated. All 11 born blind, when treated under 4 years, 100% gained vision. This data is unprecedented, and no further studies being conducted prior to filing with MHRA and FDA."

Beyond vision effects, AAV-AIPL1 resulted in "life-changing benefits in vital areas of development including communication, behavior, learning, mood, psychological benefits and social integration."

LCA4 & AAV-AIPL1 Profile

- LCA4: Severe inherited retinopathy from AIPL1 gene deficiency. AIPL1 protein critical for rod/cone photoreceptor function. Mutations→retinal degeneration.

- Prevalence: ~20% of legally blind children

- Current Treatments: None

- AAV-AIPL1: Adeno-associated viral vector delivering functional AIPL1 gene copies to central retina photoreceptors. One-time subretinal injection.

Sources: MedCity News

Regulatory Timeline

MeiraGTx preparing UK Marketing Authorization Application and US Biologics License Application for AAV-AIPL1. Based on MHRA/FDA discussions and 11-patient results. Q4 2025 US submission expected.

Broader Collaboration

Deal extends beyond AAV-AIPL1: Lilly gains rights to develop/commercialize preclinical MeiraGTx candidates for other inherited retinal dystrophies (undisclosed). Exclusive license to proprietary intravitreal capsids for up to 5 ophthalmology targets selected by Lilly. Access to riboswitch platform for controlled gene expression.

Lilly's Andrew Adams: "Ophthalmology is emerging area of interest for Lilly. Excited to partner with MeiraGTx to bring transformative treatments to patients worldwide suffering from eye diseases, starting with AAV-AIPL1, which has shown unprecedented ability to restore vision in children born legally blind."

Strategic Context for Lilly

This is Lilly's second eye gene therapy deal in weeks, following October acquisition of Adverum Biotechnologies for ixo-vec (Phase 3 wet AMD).

Lilly's broader 2025 gene therapy push: April licensing deal with Sangamo ($1.4B) for neurology-targeting gene therapy; May acquisition of Rznomics (RNA-based gene therapy); June acquisition of Verve Therapeutics ($1.3B gene editing). Lilly's R&D push contrasts with big pharma generally retreating from cell/gene therapy (Galapagos wound down CGT division; Takeda abandoned cell therapy; Gilead's Kite terminated Shoreline collaboration).

Insilico Medicine: AI Discovery Platform

Lilly-Insilico partnership (Nov 10) leverages Pharma.AI platform for drug discovery across multiple therapeutic areas. Undisclosed upfront + $100M+ milestones. While limited public details available, this represents Lilly's continued embrace of AI-accelerated discovery following broader industry trends toward technology platforms.

Platform Licensing: Adagene-Third Arc ($840M)

Adagene-Third Arc deal (Nov 13, $840M potential) licenses two masked CD3 T cell engagers using SAFEbody precision antibody masking technology.

Structure

| Component | Value | Rights |

|---|---|---|

| Upfront | $5M | Two masked CD3 TCEs |

| Dev/Commercial Milestones | $840M | Clinical progress + sales |

| Royalties | Tiered | End-user sales |

| Geography | Worldwide (ex-Greater China region) | |

| Adagene Option | No-cost dev/commercial | Greater China, Singapore, S. Korea |

Source: Globe Newswire

Market Reaction

Adagene initially spiked 8.5% at open but settled +1.69% to $1.80 by close (profit-taking). Market cap ~$85M (micro-cap).

SAFEbody Validation

Transaction validates SAFEbody's clinical relevance following positive Phase 1b/2 data for lead program ADG126 (muzastotug, masked anti-CTLA-4) in microsatellite stable colorectal cancer.

Third Arc CEO Peter Lebowitz: collaboration advances "highly innovative molecules with superior therapeutic index" that "expands reach of our ARCStim Platform to additional novel targets."

Third Arc Profile

- Founded: 2022

- Series A: $165M oversubscribed (July 2024)

- Leads: Vida Ventures (lead), Cormorant, Hillhouse (co-leads)

- Lead Program: ARC101 (CLDN6-targeting bispecific)

- Stage: Phase 1 ovarian/endometrial cancers

China Innovation Trend

Partnership joins growing trend of Western biotechs accessing Chinese innovation. H1 2025 China partnership deals reached $48.5B—surpassing all of 2024 ($44.8B), +8.3% growth in 6 months vs full prior year.

Venture Capital: AI & Novel Modalities

Iambic Therapeutics: $100M+ AI-Driven Oncology (Nov 10)

Iambic led venture activity with oversubscribed financing exceeding $100M (Nov 10), bringing total raised >$300M across Series A ($53M/2021), Series B ($100M/Oct 2023), Series B extension ($50M/Apr 2024).

Financing History

| Round | Date | Amount | Use |

|---|---|---|---|

| Series A | 2021 | $53M | Platform development |

| Series B | Oct 2023 | $100M | Clinical entry |

| Series B Extension | Apr 2024 | $50M | Pipeline expansion |

| Series B+ | Nov 2025 | $100M+ | Clinical advancement |

| TOTAL | — | $300M+ | — |

Pipeline

| Program | Target | Mechanism | Stage | Timeline |

|---|---|---|---|---|

| IAM1363 | HER2 | Brain-penetrant inhibitor | Phase 1/1b | Active (ESMO Oct 2025 data) |

| KIF18A | KIF18A | Undisclosed | Approaching clinic | Enter 2026 |

| CDK2/4 | CDK2/4 | Dual inhibitor | Approaching clinic | Enter 2026 |

CEO Tom Miller: anticipates KIF18A and CDK2/4 entering clinic, expects three drugs in clinic during 2026.

Investors

Life Science: Abingworth, Ascenta, Illumina Ventures Tech: ARK, Sequoia

Growth: Alexandria Venture, Alumni Ventures Sovereign: Qatar Investment Authority, Mubadala

Balanced syndicate reflecting AI validation + domain expertise + long-term capital.

Technology

NeuralPLexer: Best-in-class protein-ligand structure prediction

Enchant: Multimodal transformer predicting clinical/preclinical endpoints

Cycle Time: Design-make-test weekly vs months-long traditional

Platform executes weekly vs traditional months-long iterations. October 2025 Jazz Pharma collaboration for IAM1363 combinations; July 2025 Revolution Medicines deal providing NeuralPLexer access (up to $25M).

Gate Bioscience: $65M Molecular Gates (Nov 13)

Gate raised $65M Series B (Nov 13) led by Forbion with new investor Eli Lilly and existing Versant, a16z Bio, GV, ARCH.

Financing

| Metric | Value |

|---|---|

| Series B | $65M (oversubscribed) |

| Series A | $60M (Nov 2023) |

| Total | $135M |

| Lead | Forbion (European healthcare specialist) |

| New Investor | Eli Lilly (strategic validation) |

Total raised $135M since inception.

Platform

Brisbane, CA company develops "molecular gates"—small molecule medicines eliminating disease-causing proteins at source through oral administration with whole-body distribution including brain penetration.

Forbion Principal Vanessa Carle joined board: "Gate represents rare opportunity to invest in truly differentiated therapeutic modality with significant advantages over existing treatments. Molecular gate platform addresses high-value, clinically validated targets across multiple therapeutic areas with oral small molecule approach, which has eluded the field until now."

Use of Proceeds

- Lead programs: IND-enabling studies, Phase 1 trials

- Platform expansion: Inflammation indications

- Platform expansion: Neurological disease indications

T-Therapeutics: $32M TCR Bispecific Extension (Nov 13)

T-Therapeutics secured $32M Series A extension (Nov 13) bringing total Series A to $91M, with new investors Tencent and BGF joining all existing shareholders.

Investors

Series A Co-Leads: Sofinnova Partners, F-Prime Capital, Digitalis Ventures, Cambridge Innovation Capital

Series A Participants: Sanofi Ventures, University of Cambridge Venture Fund

Extension New: Tencent, BGF

Platform

Cambridge, England spinout develops first-in-class TCR-CD3 bispecific drug candidates using OpTiMus® TCR platform generating high-specificity fully human TCRs accessing validated but previously undruggable intracellular targets.

Focus

Application: T cell subset depletion (selective immune cell elimination)

Sofinnova: "One of most exciting areas in immunology"

Therapeutic Areas: Oncology, autoimmune diseases

CEO Theodora Harold: proceeds will "drive pipeline of first-in-class TCR-CD3 bispecifics across oncology and autoimmune diseases towards clinic" with particular emphasis on T cell subset depletion.

BGF Partner Luke Rajah: "leadership team with outstanding track record building successful drug discovery businesses and translating science into medicines."

Strategic Themes & Market Implications

The November 10-15 transaction surge reveals dominant strategic themes:

1. Patent Cliff Defensive Positioning

- Merck: Keytruda 2028 expiration→$18B sales erosion driving Cidara ($9.2B) + Verona acquisitions

- Pfizer: $17-18B revenue hit 2026-28→Metsera ($10B) acquisition for obesity entry

- Willingness to pay triple-digit premiums for late-stage de-risked assets

2. Platform Technology Over Single Assets

- Lilly: 3 partnerships ($3.2B) demonstrate preference for broad platform access vs one-time asset acquisitions

- Provides optionality across multiple programs/therapeutic areas while leveraging partner expertise

3. AI-Accelerated Discovery

- Iambic/Insilico: Partnerships showcase industry shift toward AI-driven platforms compressing timelines 50-75%

- Design-make-test cycles accelerating from months→weeks

4. Blood-Brain Barrier Focus

- ABL Bio-Lilly: $2.6B validates BBB shuttle as critical enabling technology

- Addresses one of drug development's hardest challenges

- Applications span CNS disorders, obesity, muscle diseases

5. Geographic Diversification

- S. Korea: ABL Bio first big pharma strategic investor landmark

- China: H1 2025 deals ($48.5B) surpassed full 2024 ($44.8B)

6. M&A Market Characteristics

- Premiums: 100%+ becoming standard (Cidara 109%, Mersana 182%)

- Competitive Processes: Public bidding wars (Pfizer-Novo-Metsera)

- Regulatory Scrutiny: FTC intervention adding complexity

- Dual Advisors: Sophisticated sell-side (Cidara: Evercore + Goldman)Conclusion

The November 10-15 transaction window represents a watershed in biotech dealmaking, with $25+ billion signaling fundamental shifts in pharmaceutical R&D strategy. The week demonstrates industry leaders' willingness to deploy massive capital ($10B+ single transactions), engage in public bidding wars, and embrace transformative platforms spanning AI discovery, gene therapy, blood-brain barrier penetration, and ultra-long-duration metabolics.

For royalty investors, the robust deployment pace validates the asset class's maturation. For biotech entrepreneurs and investors, premium valuations and competitive dynamics confirm that late-stage clinical validation combined with differentiated technology platforms commands extraordinary strategic value where major pharmaceutical companies face urgent needs to address patent cliffs and diversify revenue streams.

The integration of artificial intelligence across the discovery-to-development continuum, evidenced by Lilly's Insilico partnership and Iambic's venture raise, suggests the industry is entering a new era where technology platforms become as valuable as individual drug candidates—a paradigm shift accelerating through 2026 and beyond.

Deep Dive: Strategic Analysis

The Keytruda Cliff Effect

Merck's $9.2 billion Cidara acquisition exemplifies the pharmaceutical industry's most pressing challenge: the looming patent cliff. Keytruda generated over $25 billion in annual sales, representing nearly one-third of Merck's total revenue. The 2028 patent expiration creates an $18 billion revenue hole over five years that no amount of internal R&D can fill quickly enough.

This urgency explains several aspects of the Cidara transaction:

Premium Pricing Justified: The 109% premium reflects not just CD388's commercial potential but Merck's strategic desperation. Paying $9.2B for a single Phase 3 asset would have been unthinkable five years ago. Today, it's rational given the alternative: watching revenue evaporate while competitors capture influenza prevention market share.

Speed Over Diligence: Lilly's decision to proceed without a Material Transfer Agreement signals a broader industry trend—major pharma can no longer afford lengthy evaluation periods when late-stage assets become available. The risk of losing a bidding war outweighs traditional due diligence concerns.

Non-Overlapping Assets Acceptable: Historically, pharma preferred "bolt-on" acquisitions that leveraged existing sales forces and market access. CD388 requires building entirely new infrastructure (primary care reach, seasonal demand management, payer negotiations distinct from oncology). Merck's willingness signals that revenue replacement trumps operational efficiency.

The GLP-1 Gold Rush

The Pfizer-Metsera bidding war illustrates how obesity has become pharmaceutical's hottest franchise, commanding premium valuations even for clinical-stage assets.

Market Size Driving Desperation: The global obesity market could reach $100+ billion annually by 2030. Novo and Lilly dominate with weekly injectables generating tens of billions. Pfizer, despite two failed oral programs, cannot afford to sit out this opportunity—hence the willingness to increase its bid by 37% mid-process.

Monthly Dosing as Differentiation: MET-097i's monthly administration schedule represents meaningful differentiation versus weekly Wegovy/Zepbound. While 14.1% weight loss trails Lilly's tirzepatide, convenience could drive market share. Pfizer's calculation: monthly dosing × oral backup option × combination potential = sufficient differentiation to justify $10B.

Amylin Combination Upside: The MET-233i amylin analog provides additional strategic value beyond GLP-1 monotherapy. Amylin-GLP-1 combinations could deliver superior efficacy with better tolerability—potentially offering best-in-class profiles if data materializes.

Novo's Withdrawal Calculus: Despite Wegovy's dominance, Novo walked away when Pfizer's revised offer exceeded Novo's internal valuation ceiling. This discipline reflects confidence in its own pipeline (CagriSema combination, oral semaglutide improvements) and recognition that overpaying for Metsera risked shareholder backlash.

Platform Economics: The ABL Bio Model

ABL Bio's accumulation of $9.2 billion in total BBB platform deals (GSK $2.8B, Lilly $2.6B, Sanofi $1.1B, others) demonstrates the power of enabling technology platforms versus single-asset models.

Platform Leverage: Rather than developing individual drugs to commercialization (capital-intensive, high-risk), ABL Bio licenses its BBB shuttle technology to multiple partners. Each partnership provides upfront cash, milestones across the partner's entire program portfolio, and royalties on every successful product.

Risk Distribution: If GSK's programs fail, Lilly's or Sanofi's might succeed. ABL Bio's platform approach diversifies risk across multiple shots on goal, reducing binary outcome exposure inherent in single-asset biotech.

Margin Expansion: Once the BBB shuttle platform achieves technical validation (Roche's 2023 data accomplished this), each new partnership requires minimal incremental investment. ABL Bio's fixed costs (platform R&D, manufacturing know-how transfer) get amortized across growing partnership revenue—creating operating leverage as deals accumulate.

Strategic Investor Premium: Lilly's $15M equity investment at 125,900 won per share ($85.80) represents 30%+ premium to then-current trading levels. Strategic investors accepting such premiums signals conviction in platform value beyond current deal terms—expecting follow-on expansions, additional targets, or future combination opportunities.

Gene Therapy's Selective Survival

MeiraGTx's $475M Lilly deal stands in stark contrast to broader gene therapy sector struggles (Galapagos wound down CGT division, Takeda abandoned cell therapy, Gilead-Kite terminated Shoreline collaboration).

What's Working: Ultra-rare, severe, single-intervention diseases with clear endpoints. AAV-AIPL1 checks every box:

- Orphan disease (~1,200 US annual diagnoses)

- Severe from birth (legally blind)

- Unmet need (zero approved therapies)

- Clean endpoint (vision restoration measurable)

- One-time treatment (no adherence issues)

- Pediatric (lifetime benefit justifies high price)

What's Not: Chronic diseases requiring repeat dosing, competitive indications with existing treatments, immunogenicity concerns limiting re-dosing, manufacturing scale challenges.

Lilly's Thesis: Ophthalmology gene therapy offers sustainable competitive advantages:

- Local administration (subretinal injection) → lower doses → better safety

- Immune-privileged site (eye) → less immunogenicity → potential re-dosing

- Clear clinical endpoints → faster approvals

- Orphan pricing → sustainable economics

- First-mover advantages → durable market position

The MeiraGTx platform access (intravitreal capsids, AI promoters, riboswitch tech) provides optionality across additional retinal dystrophies—de-risking the upfront investment beyond AAV-AIPL1 alone.

AI Discovery Inflection Point

Iambic's $100M+ raise and Lilly's Insilico partnership signal AI-driven drug discovery graduating from hype to reality.

Productivity Gains Materializing: Iambic's NeuralPLexer + Enchant platform executes design-make-test cycles weekly versus months. This isn't incremental improvement—it's order-of-magnitude acceleration enabling:

- More iterations in same timeframe

- Faster hypothesis testing

- Higher-quality clinical candidates

- Reduced development costs

Clinical Validation Required: Unlike pure-AI platforms still in discovery, Iambic has IAM1363 in Phase 1/1b with ESMO 2025 data. Two additional programs entering clinic 2026. Investors demand this proof—computational predictions must translate to actual patient benefit.

Sovereign Wealth Participation: QIA and Mubadala joining Iambic's syndicate reflects institutional validation. Sovereign funds deploy capital with decade+ horizons, accepting years-to-exit timelines that venture funds struggle with. Their presence signals conviction in AI drug discovery's long-term transformation of pharmaceutical R&D.

Venture Capital Market Dynamics

The three venture deals (Iambic $100M+, Gate $65M, T-Therapeutics $32M) total ~$197M—tiny versus M&A/licensing but strategically significant.

Platform Preference: All three companies offer platforms (AI discovery, molecular gates, TCR engineering) rather than single drugs. VCs learned from 2021-2023's one-asset biotech crashes—platforms provide multiple shots on goal, pivot optionality, and partnership revenue potential.

International Syndicates: T-Therapeutics adding Tencent reflects globalized biotech capital. Chinese tech giants view life sciences as strategic diversification from regulated internet businesses. European growth equity (BGF) balances US-centric VC.

Strategic Investor Validation: Lilly investing in Gate Bioscience's Series B provides more than capital—it signals technical validation. When big pharma writes checks alongside VCs, it de-risks subsequent rounds and attracts corporate partnership interest.

Modality Innovation: Gate's molecular gates, T-Therapeutics' TCR bispecifics represent novel therapeutic modalities—not incremental antibody or small molecule improvements. VCs bet on category-creation upside: if these modalities work, they enable entirely new target classes (undruggable intracellular proteins, disease-causing protein elimination).

Market Structure Implications

Advisor Dynamics

The week's transactions showcase sophisticated advisory strategies:

Dual Sell-Side Advisors (Cidara): Engaging both Evercore and Goldman Sachs signals competitive process management. Dual advisors create internal competitive dynamics, ensure comprehensive buyer coverage, and demonstrate "Revlon duties" (maximizing shareholder value). The 5% termination fees ($462M) suggest Goldman and Evercore structured aggressive go-shop provisions, likely triggering bidding beyond Merck.

Consortium Buy-Side Advisors (Metsera): Goldman Sachs + Guggenheim + BofA + Allen & Company represents unusual breadth for ~$3B biotech. This structure typically indicates: (1) multiple competing processes running simultaneously, (2) complex transaction structures requiring specialized expertise, or (3) relationship management across diverse shareholder bases (growth equity, venture capital, institutions, founders).

Strategic vs Financial Counsel Split: Wachtell Lipton and Paul Weiss commanding Pfizer-Metsera legal work reflects M&A elite. These firms charge premium rates justified by: Delaware Chancery Court expertise (critical when Pfizer sought TRO), takeover defense/offense experience, regulatory navigation (FTC coordination), and board fiduciary duty counseling. Boutique science-focused counsel (Cooley, Fenwick, Wilmer) handle IP diligence and FDA regulatory matters.

Deal Structure Evolution

CVR Prevalence: Day One-Mersana ($156M CVRs) and Pfizer-Metsera ($3B CVRs) both use contingent value rights extensively. This structure:

- Bridges valuation gaps (sellers demand premium for pipeline potential, buyers demand risk-sharing)

- Aligns incentives (sellers motivated to support development post-close)

- Provides tax efficiency (potential capital gains treatment vs ordinary income)

- Signals buyer confidence (willingness to pay more if milestones hit)

The CVR trend reflects buyers' reluctance to pay full value upfront for clinical-stage assets, while sellers leverage multiple bidder dynamics to extract milestone-based premiums.

Equity Kickers in Licensing: ABL Bio's $15M equity component in the Lilly deal represents strategic alignment beyond traditional licensing economics. Lilly becomes invested in ABL Bio's overall success, not just Grabody-B. This creates:

- Board access/influence opportunities

- Informal collaboration channels

- Potential M&A pathway (if partnership succeeds, equity stake provides acquisition foothold)

- Enhanced due diligence (equity investment triggers deeper financial/operational assessment)

Regulatory Environment

FTC Activism: The Pfizer-Metsera bidding war highlighted aggressive antitrust enforcement. FTC warning Novo about potential HSR violations demonstrates willingness to intervene pre-transaction. This creates:

- Strategic advantages for non-dominant players (Pfizer vs Novo)

- Regulatory risk premiums in valuations

- Longer deal timelines (HSR reviews extending)

- Creative structure requirements (potential divestitures, behavioral remedies)

Breakthrough Therapy Designations: CD388's October 2025 breakthrough designation proved critical to Merck's acquisition thesis. BTD signals FDA receptivity to novel mechanisms, potentially accelerating approval timelines and improving commercial probability. Buyers increasingly require such regulatory validation before mega-deals—pure science no longer sufficient.

Technical Deep Dives

Drug-Fc Conjugate Technology (CD388)

CD388 represents sophisticated protein engineering beyond traditional antibodies or small molecules:

Mechanism: Multiple copies of zanamivir (neuraminidase inhibitor) conjugated to Fc antibody fragment. The Fc portion provides:

- Extended half-life (weeks vs hours for zanamivir alone)

- FcRn receptor-mediated recycling (reducing clearance)

- Potential for multiple neuraminidase binding events per molecule

Strain Agnosticism: Unlike vaccines requiring annual reformulation for circulating strains, CD388's mechanism-based approach (blocking neuraminidase across all influenza A/B types) provides universal coverage. This:

- Eliminates vaccine mismatch risk

- Enables single annual production run

- Supports pandemic preparedness (works on novel strains)

Non-Vaccine Advantages: Immune-independent activity means:

- Works in immunocompromised patients (cancer, transplant, HIV)

- No prior vaccination history required

- Potential for passive prophylaxis in outbreak settings

- Pediatric utility (before vaccination possible)

BBB Shuttle Mechanisms

Grabody-B's IGF1R-targeting approach differs from traditional transferrin receptor (TfR) shuttles:

TfR Limitations:

- High CNS expression creates competitive inhibition (endogenous transferrin competes)

- Potential for iron homeostasis disruption

- Immunogenicity concerns with repeated dosing

IGF1R Advantages:

- Lower baseline receptor occupancy (less competition)

- Well-characterized safety profile (decades of IGF pathway research)

- Suitable for chronic dosing (critical for neurodegenerative diseases)

Bispecific Design: Grabody-B's two binding domains:

- IGF1R arm: Mediates BBB transcytosis without triggering receptor signaling

- Therapeutic arm: Delivers drug payload (antibody, small molecule, nucleic acid, enzyme)

This modularity explains the platform's versatility—the IGF1R shuttle remains constant while therapeutic arms swap based on target disease.

AAV Vector Engineering

AAV-AIPL1's subretinal delivery represents sophisticated gene therapy design:

Capsid Selection: AAV serotype selection determines:

- Tropism (which cell types infected)

- Immunogenicity (host immune response)

- Manufacturing yield (production scalability)

Promoter Engineering: Tissue-specific promoters (MeiraGTx's AI-designed variants) ensure:

- Expression limited to photoreceptors (avoiding off-target effects)

- Appropriate expression levels (too low = no effect, too high = toxicity)

- Durability (sustained multi-year expression)

Dose Optimization: Subretinal injection allows:

- Smaller doses (vs systemic delivery)

- Direct photoreceptor targeting

- Immune-privileged site advantages

Member discussion