The Weekly Term Sheet (48)

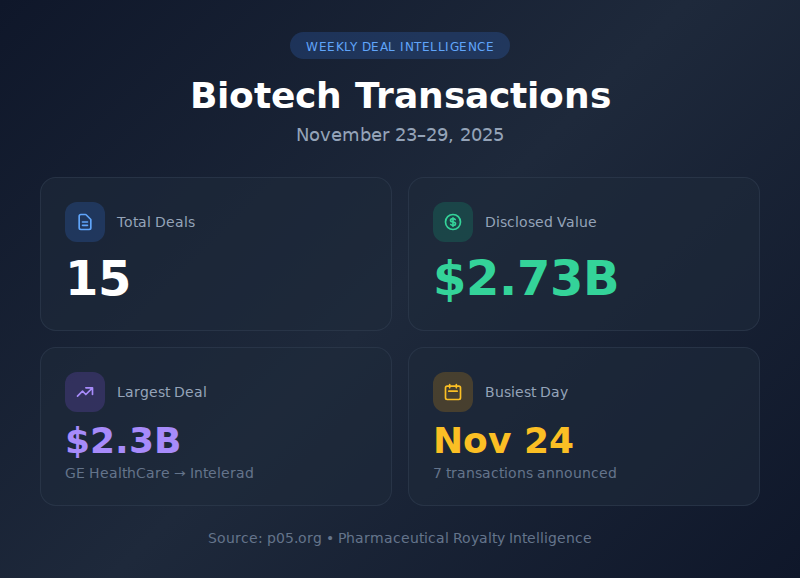

Biotech Transactions: November 23-29, 2025

GE HealthCare's $2.3 billion acquisition of Intelerad dominated a shortened Thanksgiving week that still managed to produce meaningful deal flow. Fifteen transactions closed or were announced within the seven-day window, representing over $2.7 billion in disclosed value. November 24 proved particularly active with seven major announcements, while the U.S. holiday effectively silenced deal-making from Thursday onward.

The week's activity revealed continued strategic appetite for immunology platforms, immuno-oncology mechanisms, and healthcare technology infrastructure. Meanwhile, Clearside Biomedical's bankruptcy filing underscored the persistent funding challenges facing ophthalmic drug developers.

Deal Dashboard

| # | Metric | Value |

|---|---|---|

| 1 | Total Transactions | 15 |

| 2 | Total Disclosed Value | $2.73B |

| 3 | Largest Deal | GE HealthCare-Intelerad ($2.3B) |

| 4 | Busiest Day | November 24 (7 deals) |

| 5 | Most Active Sector | Immunology/Immuno-oncology |

Weekly Deal Flow by Category

| # | Category | Count | Disclosed Value | Key Transaction |

|---|---|---|---|---|

| 1 | M&A | 1 | $2.30B | GE HealthCare-Intelerad |

| 2 | Licensing/Partnerships | 6 | ~$464M+ potential | Gilead-Sprint ($400M potential) |

| 3 | Milestone Payments | 1 | $200M | Arrowhead-Sarepta |

| 4 | Fund Closes | 1 | $150M | August Global Partners |

| 5 | VC/Private Financings | 4 | $103.5M | Vigil Neuroscience ($90M) |

| 6 | Restructurings | 2 | 580 jobs | Novartis, Valneva |

| 7 | Bankruptcies | 1 | — | Clearside Biomedical |

Deal Flow by Day

| # | Date | Day | Deals | Notable Announcements |

|---|---|---|---|---|

| 1 | Nov 23 | Sunday | 1 | Clearside Biomedical Ch. 11 filing |

| 2 | Nov 24 | Monday | 7 | Biogen-Dayra, Gilead-Sprint, Arrowhead milestone, Vigil Series C, BenchSci-Sanofi |

| 3 | Nov 25 | Tuesday | 3 | FluoGuide-ZEISS, BioMed X-AbbVie, August Global Partners |

| 4 | Nov 26 | Wednesday | 2 | eXmoor-Royal Free London, Valneva restructuring |

| 5 | Nov 27 | Thursday | 2 | GE HealthCare-Intelerad, Pandorum Series B |

| 6 | Nov 28-29 | Fri-Sat | 0 | Thanksgiving holiday |

Therapeutic Focus Areas

| # | Therapeutic Area | Deals | Combined Value |

|---|---|---|---|

| 1 | Medical Imaging/HealthTech | 2 | $2.3B |

| 2 | Oncology/Immuno-oncology | 3 | $400M+ potential |

| 3 | Rare Disease | 2 | $203M+ |

| 4 | Immunology | 2 | $120M+ |

| 5 | Neurology/Neurodegeneration | 2 | $90M+ |

| 6 | Cell & Gene Therapy | 2 | Undisclosed |

| 7 | Ophthalmology | 1 | Bankruptcy |

Top Transactions

| # | Transaction | Type | Value | Date |

|---|---|---|---|---|

| 1 | GE HealthCare → Intelerad | M&A | $2.3B | Nov 27 |

| 2 | Gilead → Sprint TREX1 | License | $400M potential | Nov 24 |

| 3 | Arrowhead ← Sarepta | Milestone | $200M | Nov 24 |

| 4 | August Global Partners | Fund Close | $150M | Nov 25 |

| 5 | Vigil Neuroscience | Series C | $90M | Nov 24 |

| 6 | Biogen → Dayra Therapeutics | License | $70M+ | Nov 24 |

| 7 | Gilead → Sprint TREX1 | Upfront | $14M | Nov 24 |

| 8 | Pandorum Technologies | Series B | $10M | Nov 27 |

| 9 | BOOST Pharma | VC Round | €3.1M | Nov 24 |

| 10 | Clearside Biomedical | Ch. 11 | $64M liabilities | Nov 23 |

M&A

GE HealthCare Acquires Intelerad for $2.3 Billion

GE HealthCare moved to consolidate its position in enterprise medical imaging with an all-cash acquisition of Intelerad Medical Systems, the Montreal-based cloud imaging software provider backed by Hg Capital and TA Associates.

Deal Terms

| # | Element | Details |

|---|---|---|

| 1 | Acquirer | GE HealthCare Technologies Inc. (NASDAQ: GEHC) |

| 2 | Target | Intelerad Medical Systems (Montreal, Canada) |

| 3 | Deal Value | $2.3 billion (all-cash) |

| 4 | Financing | Cash on hand + debt financing |

| 5 | Expected Close | H1 2026 |

| 6 | Conditions | Regulatory approvals |

Asset and Technology Profile

Intelerad's cloud-native enterprise imaging platform represents one of the larger independent medical imaging software businesses globally. The technology stack encompasses:

- Enterprise Viewer: Zero-footprint, browser-based diagnostic viewing supporting radiology, cardiology, and other imaging specialties

- Workflow Orchestration: AI-enabled study routing, worklist management, and productivity tools

- Cloud Infrastructure: Vendor-neutral archive (VNA) capabilities managing approximately 8 billion medical images

- Interoperability Layer: DICOM, HL7, and FHIR integration enabling connectivity across disparate healthcare IT systems

The platform's scale metrics underscore its market position: more than 1,500 healthcare customers spanning academic medical centers, community hospitals, and imaging center networks; 230 million medical exams processed annually; and a SaaS-based revenue model providing recurring revenue visibility.

Strategic Rationale

For GE HealthCare, the acquisition addresses a strategic gap. While the company dominates medical imaging hardware—CT, MRI, ultrasound, and X-ray systems—it has historically underinvested in enterprise software compared to competitors like Philips and Siemens Healthineers. Intelerad provides immediate scale in cloud-based imaging informatics without the multi-year development timeline of organic build.

The deal also positions GE HealthCare for the ongoing shift toward value-based care models that reward workflow efficiency and care coordination. Intelerad's reading productivity tools and AI integration capabilities support radiologist efficiency gains that health systems increasingly demand.

Seller Context

Hg Capital and TA Associates acquired Intelerad in 2020 and subsequently executed a buy-and-build strategy, adding complementary capabilities through tuck-in acquisitions. The $2.3 billion exit represents a significant return on their investment and validates the premium valuations attached to scaled healthcare IT platforms.

Licensing and Partnerships

Biogen-Dayra Therapeutics Immunology Partnership

Biogen's $50 million upfront payment to newly-launched Dayra Therapeutics on November 24 signals continued expansion of the company's immunology ambitions following last year's $1.15 billion HI-Bio acquisition and October 2025's $70 million Vanqua Bio deal.

Deal Terms

| # | Element | Details |

|---|---|---|

| 1 | Partner | Biogen Inc. (NASDAQ: BIIB) |

| 2 | Licensor | Dayra Therapeutics (Toronto, Canada) |

| 3 | Upfront | $50 million |

| 4 | Option Payments | Undisclosed per-program fee |

| 5 | Milestones | Preclinical and clinical (undisclosed) |

| 6 | Dayra Launch Funding | >$70 million |

Platform Technology

Dayra emerges from Versant Ventures' Frontier Discovery Engine with a platform focused on oral macrocyclic peptides—a modality attempting to bridge the efficacy of biologics with the convenience of small molecule oral dosing.

The scientific challenge is substantial. Peptides typically offer exquisite target selectivity and potency—advantages that have made injectable peptide drugs like GLP-1 agonists blockbusters—but suffer from poor oral bioavailability due to enzymatic degradation in the GI tract and limited membrane permeability. Macrocyclic peptides address these limitations through:

- Cyclization: Ring structures constrain conformational flexibility, reducing susceptibility to proteolytic cleavage

- N-methylation: Strategic backbone modifications decrease hydrogen bonding potential, improving membrane permeability

- Lipophilic Modifications: Side chain engineering enhances transcellular absorption

Dayra's approach targets immunological conditions where biologic-like efficacy is required but patient preference strongly favors oral administration—conditions like inflammatory bowel disease, rheumatoid arthritis, and psoriasis where injectable biologics dominate but compliance challenges persist.

Development Stage: Discovery/early research. Specific targets undisclosed.

Strategic Context

The deal extends Biogen's systematic immunology build-out under Jane Grogan, Head of Research. The company has signaled intent to diversify beyond neurology following the commercial challenges of its Alzheimer's franchise. Immunology represents both a scientific adjacency (neuroinflammation links the therapeutic areas) and a commercial opportunity in large, established markets.

Leadership: Rami Hannoush (Versant Venture Partner) serves as Dayra's Acting CEO.

Gilead Acquires Sprint Bioscience TREX1 Program

Gilead paid $14 million upfront on November 24 to acquire Sprint Bioscience's first-in-class TREX1 inhibitor program, with an additional $386 million in milestone payments possible.

Deal Terms

| # | Element | Details |

|---|---|---|

| 1 | Acquirer | Gilead Sciences, Inc. (NASDAQ: GILD) |

| 2 | Seller | Sprint Bioscience AB (Nasdaq First North: SPRINT) |

| 3 | Upfront | $14 million |

| 4 | Milestones | Up to $386 million |

| 5 | Total Potential Value | $400 million |

| 6 | Stock Impact | SPRINT +118-150% |

Target Biology and Mechanism of Action

TREX1 (Three-prime repair exonuclease 1) represents an emerging immuno-oncology target addressing tumor immune evasion at its mechanistic root.

Cancer cells accumulate cytosolic DNA through multiple mechanisms: chromosomal instability, replication stress, mitochondrial dysfunction, and DNA damage. Under normal circumstances, this cytosolic DNA would trigger innate immune activation through the cGAS-STING pathway—the cell's alarm system for detecting aberrant DNA. The cGAS enzyme senses cytosolic DNA and produces cyclic GMP-AMP (cGAMP), which activates STING, triggering a signaling cascade through TBK1 and IRF3 that ultimately produces type I interferons and other inflammatory cytokines.

Tumors hijack this system by overexpressing TREX1, a DNA exonuclease that degrades cytosolic DNA before cGAS can detect it. By clearing the immunogenic DNA, tumors silence the alarm and evade immune detection.

Therapeutic Hypothesis

Sprint's small-molecule TREX1 inhibitors block this immune evasion mechanism. With TREX1 inhibited:

- Cytosolic DNA accumulates in tumor cells

- cGAS detects the DNA and produces cGAMP

- STING activation triggers the TBK1-IRF3 signaling cascade

- Type I interferon production alerts the immune system

- CD8+ T cells and NK cells infiltrate the tumor

- Anti-tumor immune response ensues

Preclinical Data

Data presented at AACR IO 2025 demonstrated:

| # | Parameter | Result |

|---|---|---|

| 1 | Biochemical Potency | Sub-nanomolar IC50 |

| 2 | Immune Infiltration | Increased CD8+ T cells and NK cells |

| 3 | Efficacy Models | Tumor growth inhibition in colorectal cancer |

| 4 | Administration | Oral bioavailability confirmed |

| 5 | Development Stage | Preclinical with in vivo proof-of-concept |

Arrowhead Pharmaceuticals Earns $200 Million Sarepta Milestone

Arrowhead Pharmaceuticals received a $200 million milestone payment from Sarepta on November 24 for achieving the second development milestone in their Phase 1/2 clinical study of ARO-DM1/SRP-1003.

Deal Terms

| # | Element | Details |

|---|---|---|

| 1 | Milestone Recipient | Arrowhead Pharmaceuticals (NASDAQ: ARWR) |

| 2 | Milestone Payor | Sarepta Therapeutics (NASDAQ: SRPT) |

| 3 | Payment | $200 million |

| 4 | Trigger | Second development milestone in Phase 1/2 |

FluoGuide-ZEISS Precision Surgery Collaboration

Danish biotech FluoGuide announced a non-exclusive collaboration with Carl Zeiss Meditec on November 25 to develop their FG001 fluorescent imaging agent for head and neck cancer surgery.

Deal Terms

| # | Element | Details |

|---|---|---|

| 1 | Technology Provider | FluoGuide A/S (STO: FLUO) |

| 2 | Partner | Carl Zeiss Meditec AG (XETRA: AFX) |

| 3 | Upfront Payment | None |

| 4 | Structure | Non-exclusive collaboration |

| 5 | Focus | Head and neck cancer surgery |

BioMed X-AbbVie Neuroscience Research Collaboration

BioMed X Institute and AbbVie launched their third collaboration since establishing their partnership in 2015, this time focusing on anhedonia research.

BenchSci-Sanofi Platform License

Sanofi licensed the Ascend drug development platform from BenchSci on November 24 for deployment across its global research organization.

eXmoor Pharma-Royal Free London CGT Manufacturing Partnership

Bristol-based CDMO eXmoor Pharma Concepts and the Royal Free London NHS Foundation Trust announced a strategic partnership on November 26.

Venture Financings

Vigil Neuroscience Closes $90 Million Series C

Boston-based Vigil Neuroscience secured $90 million in Series C financing on November 24.

Deal Terms

| # | Element | Details |

|---|---|---|

| 1 | Company | Vigil Neuroscience (Boston, MA) |

| 2 | Round | Series C |

| 3 | Amount | $90 million |

| 4 | Lead Investor | RTW Investments |

| 5 | New Investors | Forbion, OrbiMed, Deep Track Capital, BVF Partners, Commodore Capital |

| 6 | Existing Investors | Atlas Venture, Hatteras Venture Partners, Access Biotechnology |

Pandorum Technologies Closes $10 Million Series B

Bengaluru-based Pandorum Technologies raised Rs 85 crore (approximately $10 million) in Series B financing announced November 27.

BOOST Pharma Adds €3.1 Million

Stockholm's BOOST Pharma, founded on research from Karolinska Institute, added €3.1 million to its existing syndicate during the week.

Fund Closes

August Global Partners Healthcare Fund Reaches $150 Million

Singapore-based August Global Partners closed its second fund at $150 million on November 25.

Bankruptcies and Restructurings

Clearside Biomedical Files Chapter 11

Clearside Biomedical filed for Chapter 11 bankruptcy protection on November 23 in Delaware, seeking a strategic sale of its suprachoroidal drug delivery platform and ophthalmology pipeline.

Filing Details

| # | Element | Details |

|---|---|---|

| 1 | Debtor | Clearside Biomedical, Inc. (NASDAQ: CLSD) |

| 2 | Headquarters | Alpharetta, Georgia |

| 3 | Case Number | 25-12109 |

| 4 | Court | U.S. Bankruptcy Court, District of Delaware |

| 5 | Filing Date | November 23, 2025 |

Corporate Restructurings

Novartis — 550 Swiss Positions (November 25, 2025)

Valneva — 30 Roles, Site Closure (November 26, 2025)

Adviser League Table

By Deal Count

| # | Adviser | Role | Deals | Clients |

|---|---|---|---|---|

| 1 | Cooley LLP | Legal | 1 | Clearside Biomedical |

| 2 | Richards, Layton & Finger | Delaware Counsel | 1 | Clearside Biomedical |

| 3 | Berkeley Research Group | Financial Advisor | 1 | Clearside Biomedical |

| 4 | Piper Sandler | Investment Banking | 1 | Clearside Biomedical |

| 5 | Epiq Bankruptcy Solutions | Claims Agent | 1 | Clearside Biomedical |

| 6 | FNCA Sweden AB | Certified Advisor | 1 | Sprint Bioscience |

By Deal Value (Disclosed Transactions)

| # | Adviser | Transaction | Role | Deal Value |

|---|---|---|---|---|

| 1 | FNCA Sweden AB | Sprint Bioscience-Gilead | Certified Advisor | $400M potential |

| 2 | Piper Sandler | Clearside Biomedical | Investment Banker | $64M liabilities |

Summary Statistics

| # | Category | Count | Total Disclosed Value |

|---|---|---|---|

| 1 | M&A | 1 | $2.3 billion |

| 2 | Licensing/Collaborations | 6 | ~$464 million+ potential |

| 3 | Milestone Payments | 1 | $200 million |

| 4 | Fund Closes | 1 | $150 million |

| 5 | VC/Private Financings | 4 | ~$103.5 million |

| 6 | Bankruptcies | 1 | $64M liabilities |

| 7 | Restructurings | 2 | 580 employees affected |

| 8 | Total Transactions | 15 | ~$2.73 billion disclosed |

I am not a lawyer or financial adviser. This content is not investment or legal advice. Information derives from public sources and may have changed since publication.

Disclaimer: I am not a lawyer or financial adviser. This content is not investment or legal advice. Information comes from public sources and details may change. Consult professionals for specific guidance.

Member discussion