When the Deal Is the Discovery: Platform Biotechs as Perpetual Option Sellers

Introduction – Deals as the New Discovery

Platform biotech companies today often make headlines not for proven drugs, but for deals – multi-million (or billion) dollar partnerships that monetize future possibilities. These startups have cutting-edge discovery platforms (AI-driven design, novel biology engines, etc.), yet few validated products. Instead of selling medicines, they sell options on medicines.

In other words, they thrive by striking milestone-heavy deals with larger pharma, effectively selling optionality rather than outcomes. This model has led some to liken platform biotechs to “investment banks in lab coats,” brokering high-value transactions based on prospective returns. The result is a biotech ecosystem where the deal itself is often the biggest discovery a platform company makes.

Milestone-Heavy Deal Structures and Optionality

These partnerships are typically structured with modest upfront payments and outsized contingent milestones – payments that only come if certain R&D or regulatory milestones are hit. The headline “deal value” can be misleading, as most of it is biobucks (biotech-speak for potential future dollars). In fact, a STAT analysis of ~700 deals found that on average only 14% of the announced deal value is paid at signing, with the rest being milestone “lottery tickets” that pay out only upon success (statnews.com).

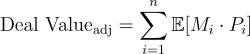

To understand the true worth of such deals, one must adjust for the probability of achieving each milestone. A useful formula is:

where each milestone payment Mi$ is weighted by the probability $Pi of hitting that milestone. In plain terms, the expected value is the sum of each milestone multiplied by its success likelihood.

For early research alliances, $Pi can be very low (new drug targets might have <10% chance to reach market). Thus, a deal trumpeted as “worth $1B” might have an expected value only a fraction of that. Platform biotechs essentially act as perpetual option sellers: they collect upfront premiums and near-term fees, while big pharma buys the option to a future drug.

If the drug fails (the option expires worthless), the platform still keeps the upfront “premium.”

If it succeeds (the option “exercises”), the platform earns the milestone payouts and royalties. It’s a risk-sharing setup that bridges science and finance.

Case Study: Generate:Biomedicines’ Billion-Dollar Alliances

One emblematic example from the past year is Generate:Biomedicines, a Flagship Pioneering-backed startup using generative AI to design protein therapeutics. In late 2024, Generate inked a multi-target collaboration with Novartis that had eye-popping headline numbers despite no marketed products. Novartis paid $65 million upfront (including $15M as equity), while offering over $1 billion in potential milestone payments plus tiered royalties (fiercebiotech.com).

This means Novartis is essentially buying an option on Generate’s AI platform – paying a relatively small amount now for the chance to reap new drugs later. The deal did not specify any particular drug upfront; it’s a broad “discovery alliance” across multiple disease areas, putting the onus on Generate’s platform to deliver viable candidates.

Such deals illustrate how platform biotechs monetize unvalidated science. The science remains to be proven in the clinic, but the company secures cash and validation through the partner’s commitment. For Generate, the Novartis partnership followed a 2022 deal with Amgen (up to $1.9B for several programs) – again heavy on biobucks. Notably, these arrangements often front-load the reward for the platform company: e.g. that $1B+ Novartis deal gave only $65M now, with the rest contingent.

If none of the partnered programs pan out, Novartis will never pay most of those milestones. In effect, Generate has sold Novartis the option to pick and develop some drugs from its platform in the coming years. This strategy has infused platform biotechs in AI-driven drug discovery with big cash infusions despite minimal clinical proof.

As one roundup noted, in September 2024 alone multiple AI/techbio startups landed deals with headline values nearing or above $1B (e.g. Generate–Novartis; Lilly–Haya Therapeutics; Novartis–Lindy), nearly all structured with small upfronts and large downstream milestones (labiotech.eu). It’s clear that pharma’s appetite for new technology has created a seller’s market for optionality.

Case Study: Evotec’s Endless Partnership Loop

If Generate represents a single big alliance, Evotec represents a business model built on serial partnerships. Germany-based Evotec is often called a biotech-CRO hybrid, as it operates both a drug discovery platform and contract research services (fiercepharma.com).

For over a decade, Evotec has continuously spun up collaborations with pharma companies across therapy areas – essentially an “options portfolio” strategy at company scale. Instead of advancing its own drugs to market, Evotec co-develops dozens of programs with partners, each deal bringing in upfront fees, R&D funding, and milestone possibilities.

A recent example is Evotec’s multi-year alliance with Sandoz (the generics and biosimilars giant). The partnership began in 2023 to use Evotec’s AI-driven biologics discovery platform Just – Evotec Biologics for biosimilar development. Sandoz paid a “double-digit-million” upfront sum (tens of millions) initially, with milestones that could bring the deal’s value up to $640 million (fiercepharma.com).

By mid-2024, the collaboration was expanded to include long-term manufacturing, essentially Sandoz exercising and extending its option. Crucially, Evotec noted it expects additional “appropriate remuneration” once early scientific validation is shown, and more payments as development milestones are met into 2025 (fiercepharma.com). In other words, as Evotec delivers certain R&D results, Sandoz pays incrementally – a stepwise option exercise.

Evotec has numerous such loops. Its partnership with Bristol Myers Squibb (BMS) in the field of molecular glues (protein degraders) started in 2018, was expanded in 2022, and is ongoing. In August 2024, that collaboration hit a milestone when a program advanced, triggering a $75 million payment to Evotec (contractpharma.com).

This sizable payout – years after the deal was signed – is essentially an option payoff for a specific success. Evotec’s pipeline of partnerships (with BMS, Bayer, Boehringer Ingelheim, and others) means it frequently announces new deals or milestone achievements, creating a steady revenue stream from deals themselves. It’s a bit like an investment bank continuously structuring new financing deals – except here the currency is drug candidates.

By spreading bets across many partnered programs, Evotec reduces its reliance on any single drug’s success while regularly replenishing its coffers with upfront fees and milestone hits. The flip side is that Evotec gives away slices of the upside on each program (shared ownership or royalties with partners) rather than keeping full rights to a potential blockbuster. This trade-off – breadth of shots on goal vs. depth of any one win – is inherent to the option-seller model.

The Investment Bank in a Lab Coat – Implications for Investors and Science

For investors and observers of the biotech industry, the rise of these option-centric deals carries both promise and caution. On one hand, platform biotechs can fund their R&D with non-dilutive capital from partners, extending their runway without tapping public markets as heavily. Each big-pharma partnership also serves as external validation of the platform’s potential (“Company X signed a $500M+ deal with us” is a powerful signal).

The strategy can de-risk the startup – even if one program fails, the company has other deals and revenue coming in. In a sense, the platform company’s product is the platform, and pharma partnerships are the monetization strategy much like a tech company would sell software licenses.

However, this model also means that true scientific validation is often delayed. A platform might cycle through many alliances before any drug reaches patients. If the science underlying the platform is unproven, a company could burn years selling options that never get exercised in a meaningful way.

The “perpetual option seller” can thrive as long as the market (big pharma) believes in the future promise – but that sentiment can sour quickly if too many programs disappoint. The STAT analysis of past deals showed how a hyped billion-dollar deal (like BMS’s with uniQure in 2015) resulted in only $50M paid and a terminated program (statnews.com).

Thus, investors should discount headline deal values and focus on what has to go right for those milestones to materialize. The formula above – summing $M_i \times P_i$ – is a reminder to think in probabilities.

In the current environment (past 12 months) we see no slowdown in milestone-rich platform deals: big pharmas are hunting for innovation, and platform biotechs are willing to share upside to get cash now. Companies like Generate:Biomedicines, Evotec, and others (e.g. Exscientia, Isomorphic Labs, Relay Therapeutics, etc.) are essentially operating as discovery ecosystems-for-hire. They resemble investment banks in that their success comes from structuring and selling lucrative agreements (instead of bonds or IPOs, it’s drug programs).

For the scientific community, one positive is that this model fosters collaboration: platform firms team up with disease-area experts at pharma, potentially accelerating research. But it also raises a question: Are we monetizing hype over substance? The answer will become clear as some of these options either pay off in new medicines – or expire unfulfilled.

Platform companies can sustain themselves by monetizing optionality, effectively transferring certain risks to willing pharma partners. It’s a fine balancing act: part scientific innovation, part financial engineering. For investors, understanding the anatomy of these deals – and doing the probabilistic math – is crucial. And for the platform biotechs, long-term value will ultimately require that some of these high-priced options eventually convert into tangible medical breakthroughs, not just headline deals.

Member discussion