How Europe Can Compete in the Global Biotech Race: Lessons from the Capital for Cures Event Series

If biotech were a footrace, Europe would be the competitor with flawless running shoes, world-class muscle tone—and one leg inexplicably tied to a lamppost labelled "structural inefficiencies." Meanwhile, the U.S. is sprinting ahead, cheered on by giddy pension funds tossing dollar bills like confetti.

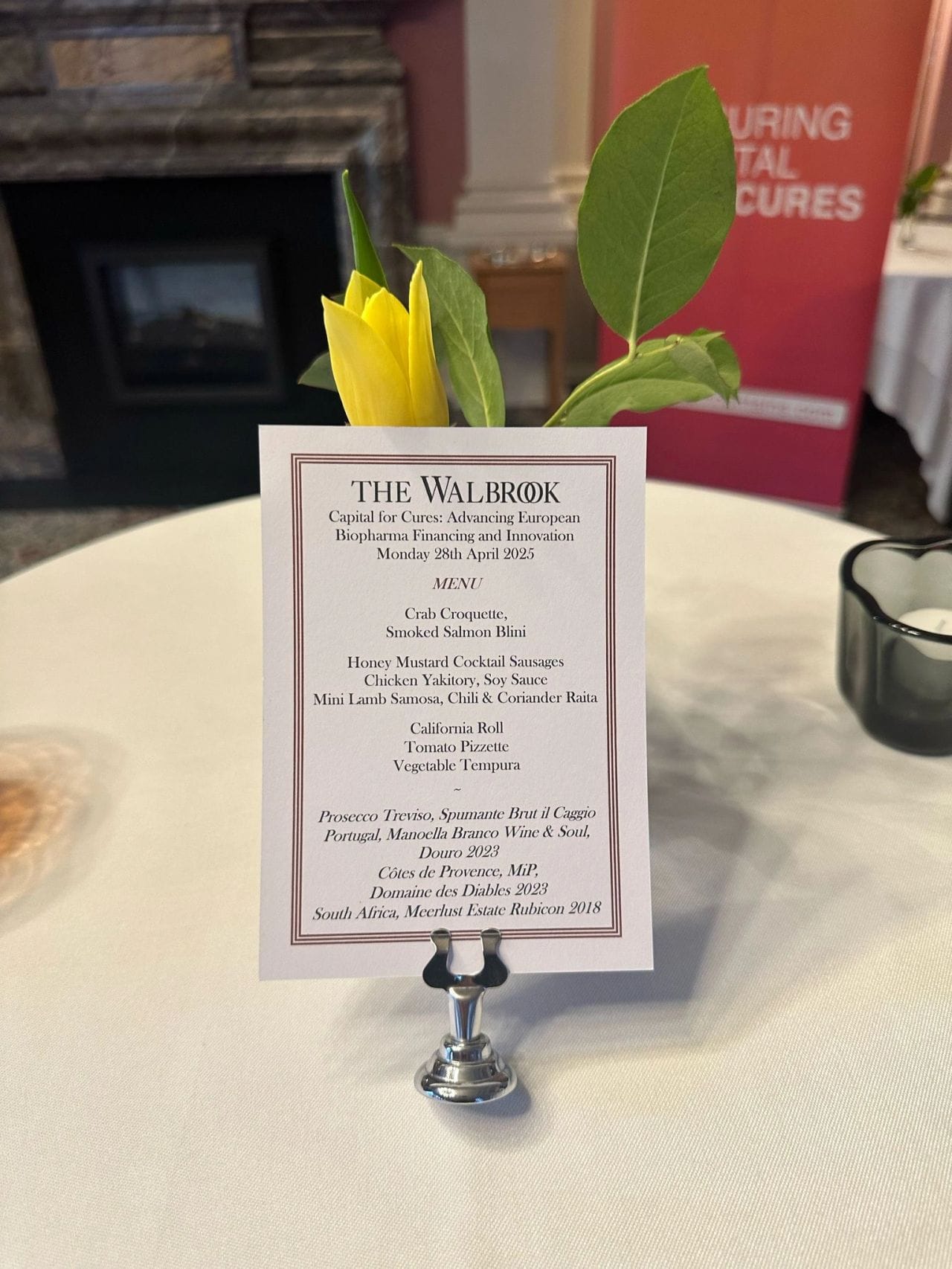

This—more or less—was the diagnosis served at Capital for Cures, a series of pan-European summits I’ve had the pleasure (and occasional cardiovascular strain) of organising. From Amsterdam’s canal-lined corridors to Basel’s precision-tuned biotech ecosystem, our roving event series brings together VCs, pharma execs, policymakers, and the kind of biotech founders who can explain CRISPR at a bar.

The core theme? Capital, or rather the conspicuous lack thereof. Europe has Nobel-grade brains and elegant regulatory slides, but when it comes to risk-tolerant capital—especially the kind that takes a 10-year view—it is in critically short supply.

At our Basel event, we chewed over this imbalance with particular zest. While 27% of early-stage U.S. biotech funding flows from pension funds, in Europe, that figure limps in at 1.5%. The difference is not merely arithmetic—it is existential. In biotech, where timelines rival geological epochs and success rates flirt with single digits, patient capital isn’t optional. It is the lifeblood. Or to stay with the wine metaphor several of our Swiss panellists preferred: good biotech, like good Pinot Noir, takes time—and a tolerant vineyard owner.

But we didn’t gather to moan. We gathered to plot. Across cities and time zones, Capital for Cures has become something of a travelling salon for unblocking Europe's innovation arteries. We’ve examined why European pension funds shy away from venture, debated how to rewire risk models that penalise high-beta sectors like biotech, and discussed how to merge capital allocation with market access reform.

Indeed, a recurring motif has been that capital alone won’t suffice. What’s the use of funding a brilliant therapy if the regulatory pathway makes a Tolstoy novel look like a beach read? Speakers repeatedly called for a pan-European market with accelerated approval processes and mutual recognition—not just for the convenience of companies, but for the health of citizens. A medicine delayed is a medicine denied.

Another crowd-pleaser—if such a term applies to a room full of health economists—was the rise of decentralised capital models. DAOs, IP tokenisation, and patient-investor hybrids were no longer fringe ideas but featured on mainstage panels. Imagine a neurodegeneration DAO with thousands of micro-investors globally selecting pipelines by vote. Imagine tokenised royalties offering liquidity for previously inert IP. Imagine, in short, an investment ecosystem not defined by gatekeepers in Mayfair or Manhattan, but by distributed belief and networked conviction.

These might sound fantastical, but in an industry where a Phase 2 failure can shave $500 million off a company’s value, distributed resilience isn’t just sexy—it’s necessary. Traditional capital models are increasingly brittle. Venture funds are stretching their timelines. IPO markets are anaemic. The case for rethinking not just who invests but how we define an "investor" is gaining traction.

At the heart of it all is this: Europe’s biotech potential is vast, but its financing model is neither fit for purpose nor fit for scale. That’s why we created Capital for Cures. Not just to commiserate, but to convene. Not just to analyse, but to act.

And it is working—slowly, deliberately, and very Europeanly. Relationships are forming. Syndicates are building. Ideas once laughed out of the room are now on plenary agendas.

What we’ve discovered is that progress in biotech finance, like the molecules we chase, often mutates unpredictably. But by bringing the right people into the same room—and sometimes the same vineyard—we’re beginning to close the gap between potential and performance.

The next instalment of Capital for Cures is already in motion. If you’re interested in being part of a movement that treats biotech not as a speculative gamble but as civilisation-level infrastructure, do get in touch. Just don’t expect us to serve wine that hasn’t matured properly. We do, after all, believe in long-term value.

Member discussion