Zymeworks' Royalty-Driven Pivot: From Canadian Biotech Aspirant to Hybrid Royalty Aggregator

Zymeworks Inc. (NASDAQ/TSX: ZYME) has formally abandoned its ambition to become "Canada's first Big Pharma" in favor of a royalty-driven business model that combines partnership economics with selective internal R&D. The November 2025 strategic pivot, catalyzed by positive Phase 3 data for its lead asset Ziihera (zanidatamab), transforms the Vancouver-based company into a hybrid royalty aggregator with $2.3 billion in remaining milestone potential and tiered royalties of 10-20% on partner sales.

This analysis examines the deal economics, regulatory milestones, competitive positioning, and structural risks of Zymeworks' transformation—drawing from SEC filings, earnings transcripts, and partnership disclosures to assess whether the hybrid model creates or destroys value for royalty-focused investors.

A Hybrid Strategy: Royalty Aggregation Plus In-House R&D

Zymeworks has strategically transitioned from a traditional biotech model into a royalty-driven organization that combines royalty aggregation with internal drug discovery. In practice, this means the company now emphasizes partnerships and out-licensing to generate milestone and royalty income, while still investing in early-stage R&D to cultivate novel candidates. This hybrid approach is designed to capture the best of both worlds: the financial stability and breadth of a royalty portfolio, and the innovation upside of an in-house pipeline.

The transformation represents a deliberate pivot executed over 2024-2025. The company broadened its business development team in 2024 and began returning capital to shareholders through buybacks, signaling a maturing business profile. By monetizing its Azymetric bispecific platform and pipeline through partnerships, Zymeworks has generated a growing stream of cash that funds further innovation and opportunistic royalty deals. Success is now measured in partnership milestones and royalty generation rather than solely product approvals.

| Strategic Element | Pre-Pivot Model | Post-Pivot Model |

|---|---|---|

| Development Focus | Discovery through Phase 3 | Discovery through Phase 1, then partner |

| Funding Source | Equity raises, debt | Partnership milestones, royalties |

| Pipeline Strategy | Advance wholly-owned assets | Partner early, acquire external royalties |

| Capital Return | None | $185M buybacks authorized (2024-2025) |

| Revenue Recognition | Future product sales | Near-term milestones + long-term royalties |

| R&D Funding | Dependent on equity/royalty cash | Self-funded via partnership payments |

| Risk Profile | Binary Phase 3 outcomes | Diversified milestone/royalty streams |

Three Pillars of Royalty Portfolio Expansion

Management has articulated three explicit mechanisms for building the royalty portfolio:

Acquire Existing Royalties: Purchase royalty rights from third parties, similar to XOMA's model of acquiring stakes from distressed or capital-constrained biotechs.

Create Synthetic Royalties: Structure financing deals where Zymeworks provides capital to biotechs in exchange for royalty stakes on their pipeline assets—functioning as a specialty royalty lender.

Unlock Trapped Royalties: Leverage Zymeworks' platforms to restructure or monetize undervalued royalty assets that are not being efficiently exploited.

To execute this strategy, Zymeworks appointed Scott Platshon (former EcoR1 Capital partner and board member) as Acting Chief Investment Officer in November 2025. Platshon brings experience in biotech investing and deal structuring to the royalty acquisition effort.

CEO Kenneth Galbraith described the approach on the Q3 2025 earnings call: internal R&D would focus on "early-stage development and strategic partnering," while cash flows would fund "de-risked external royalty stream" acquisitions and shareholder returns via buybacks.

The Hybrid Model Versus Traditional Approaches

In effect, Zymeworks is building a scalable royalty aggregator with a biotech engine attached. This contrasts with pure-play royalty companies that passively collect on others' drugs. Zymeworks' internal R&D capability gives it proprietary originations for new royalty streams (and potential higher returns), while the royalty-focus instills financial discipline and downside protection.

Management highlights the tax-efficient nature of royalty revenues and ability to redeploy them into innovation. The result is a diversified business model where partnered assets provide near-term cash flow and risk diversification, and the in-house pipeline provides long-term upside optionality.

The company can partner both wholly-owned internal programs and any acquired programs, blending the roles of traditional royalty buyers and traditional biotech in a single corporate strategy. Zymeworks' investor materials explicitly compare its model to these two traditional approaches, with Zymeworks positioning itself in the hybrid middle ground.

Ziihera (Zanidatamab): The Keystone Royalty Asset

Ziihera (zanidatamab)—a HER2-targeted bispecific antibody—exemplifies Zymeworks' new model, as it has been out-licensed to partners Jazz Pharmaceuticals and BeOne Medicines and now anchors the company's royalty portfolio. Zymeworks originally developed zanidatamab and in 2022 licensed global rights (ex-Asia) to Jazz, with BeOne (formerly BeiGene) holding Asia-Pacific rights. This asset has since achieved regulatory and commercial milestones that underscore its revenue potential for Zymeworks.

Clinical and Scientific Context

Zanidatamab is a first-in-class bispecific antibody targeting two distinct HER2 epitopes, developed using Zymeworks' Azymetric platform. The biparatopic design binds two non-overlapping epitopes on HER2 (the same domains targeted by trastuzumab and pertuzumab), inducing HER2 clustering, internalization, and downregulation without a cytotoxic payload. This mechanism differs fundamentally from antibody-drug conjugates like Enhertu, which deliver chemotherapy payloads.

The drug secured accelerated approval in the U.S. (November 2024) for second-line HER2-positive biliary tract cancer (BTC) and is now marketed by Jazz in that niche indication. In China, BeOne's conditional approval in BTC made zanidatamab the first dual HER2-targeted antibody available for Chinese patients with BTC. These initial approvals not only yielded milestone payments, but also inaugurated royalty revenues in 2025 as Jazz and BeOne commenced commercial sales.

Regulatory Approval Timeline

| Geography | Regulatory Body | Approval Date | Indication | Approval Type | Milestone Triggered |

|---|---|---|---|---|---|

| United States | FDA | Nov 20, 2024 | 2L HER2+ biliary tract cancer | Accelerated | $25M (Jazz) |

| European Union | EMA | Jun 27, 2025 | 2L HER2+ biliary tract cancer | Conditional | $25M (Jazz) |

| China | NMPA | May 29, 2025 | 2L HER2+ biliary tract cancer | Conditional | $20M (BeOne) |

The FDA granted accelerated approval based on HERIZON-BTC-01 data showing 52% objective response rate in the IHC 3+ population, with 14.9-month median duration of response and 18.1-month median overall survival. Confirmatory trial HERIZON-BTC-302 is ongoing as required for conversion to full approval.

BTC is a relatively small indication, but importantly it validated Ziihera's clinical and commercial viability while laying the groundwork for larger indications. Ziihera launched commercially in December 2024, generating $1.1 million in net product sales in Q4 2024—Zymeworks' first royalty-eligible revenue.

Jazz Pharmaceuticals Deal Economics

The October 2022 license agreement with Jazz Pharmaceuticals provides Zymeworks' richest royalty terms. The Ziihera deals are rich in both milestone payments and royalties, representing the cornerstone of Zymeworks' financial model.

Payment Structure and Milestones Received

| Component | Amount | Date | Status |

|---|---|---|---|

| Upfront payment | $50M | Oct 2022 | Received |

| Option exercise payment | $325M | Dec 2022 | Received |

| FDA BTC approval milestone | $25M | Nov 2024 | Received Q1 2025 |

| EU BTC approval milestone | $25M | Jun 2025 | Received Q3 2025 |

| Total received to date | $425M | — | — |

Remaining Milestone Potential

| Milestone Category | Amount | Trigger |

|---|---|---|

| US GEA approval | $250M | FDA approval for first-line gastroesophageal adenocarcinoma |

| EU GEA approval | $100M | EMA approval for GEA |

| Japan GEA approval | $75M | PMDA approval for GEA |

| China GEA approval | $15M | NMPA approval for GEA (via BeOne sublicense economics) |

| Additional regulatory milestones | ~$60M | Other indications/geographies |

| Commercial milestones | $862.5M | Sales threshold achievements |

| Total remaining potential | ~$1.36B | — |

Royalty Terms from SEC Filings

Per the FY2024 10-K filing, the deal provides tiered royalties with the following characteristics:

| Royalty Parameter | Terms |

|---|---|

| Rate range | 10% to 20% tiered on annual net sales |

| Territory | United States, Europe, Japan, and all territories excluding Asia-Pacific |

| Duration | Later of: (1) ten years after first commercial sale in each country, (2) expiration of the last valid licensed patent claim, or (3) expiration of regulatory exclusivity |

| Adjustments | "Customary reductions" under specified circumstances |

| Step-down provision | 0.5% reduction until a cap is reached, then full rate applies |

The exact tier breakpoints based on sales volume thresholds are not publicly disclosed, but the structure creates convex economics where Zymeworks' effective royalty rate increases as Jazz's sales grow.

Jazz has publicly projected Ziihera's annual peak sales potential to exceed $2.0 billion, implying hundreds of millions in annual royalty revenue for Zymeworks at maturity if that forecast is realized. At mid-teens effective royalty rates, $2B in annual sales would generate $300-400M in royalty revenue.

BeOne Medicines Asia-Pacific Deal Economics

The Asia-Pacific partnership with BeOne Medicines (formerly BeiGene's oncology spinoff) provides additional geographic coverage with slightly different royalty structures.

| Component | Amount/Rate | Status |

|---|---|---|

| Upfront payment | $25M | Received (2020) |

| Development milestones received | $36M | Various through 2024 |

| NMPA BTC approval milestone | $20M | Received May 2025 |

| Total received to date | $81M | — |

| Remaining development milestones | ~$144M | Pending |

| China GEA approval milestone | $15M | Pending |

| Royalty rate | Up to 19.5% (20% after cap) | Tiered on net sales |

A September 2023 amendment reduced royalty rates by 0.5% uniformly until a cap "in the low double-digit millions of dollars" is reached, after which rates increase to the full 20%. This structure provides BeOne with some margin relief during the initial commercialization phase while preserving Zymeworks' upside as sales scale.

HERIZON-GEA-01: The Commercial Catalyst

The major value driver for Ziihera is its ongoing Phase 3 program in first-line HER2-positive gastroesophageal cancer. The November 17, 2025 readout from the 920-patient HERIZON-GEA-01 Phase 3 trial substantially expands zanidatamab's commercial addressable market from the niche BTC indication to the much larger GEA population.

Trial Design and Results

| Parameter | Details |

|---|---|

| Patient population | 920 patients with first-line HER2-positive locally advanced or metastatic gastroesophageal adenocarcinoma |

| Experimental Arm A | Zanidatamab + chemotherapy + tislelizumab (BeOne's PD-1 inhibitor) |

| Experimental Arm B | Zanidatamab + chemotherapy |

| Control Arm | Trastuzumab + chemotherapy (standard of care) |

| Primary endpoint | Progression-free survival (PFS) |

| Key secondary endpoint | Overall survival (OS) |

Efficacy Results Summary

| Trial Arm | PFS Result | OS Result |

|---|---|---|

| Zanidatamab + chemo + tislelizumab | Highly statistically significant improvement vs. control | Statistically significant improvement vs. control |

| Zanidatamab + chemo | Statistically significant improvement vs. control | Clinically meaningful improvement with strong trend toward statistical significance |

| Trastuzumab + chemo (control) | Reference | Reference |

These positive outcomes position Ziihera to challenge the frontline HER2+ GEA standard of care, potentially expanding its patient population dramatically compared to the second-line BTC indication. Full data presentation is expected at a major medical conference in Q1 2026.

Regulatory and Commercial Implications

Jazz and BeOne plan to file for approvals in GEA in the first half of 2026. Jazz expects a U.S. sBLA filing in H1 2026, with potential approval in late 2026 or 2027. If approved in this much larger indication, Zymeworks would receive the hefty regulatory milestones noted above and, subsequently, a significant royalty uplift as GEA sales ramp.

| Regulatory Filing | Expected Timing | Potential Approval | Milestone Value |

|---|---|---|---|

| US sBLA (Jazz) | H1 2026 | Late 2026/2027 | $250M |

| EU MAA (Jazz) | H1 2026 | 2027 | $100M |

| Japan filing (Jazz) | 2026 | 2027 | $75M |

| China filing (BeOne) | 2026 | 2027 | $15M |

In essence, Ziihera provides Zymeworks both near-term cash infusions (milestones) and a long-tailed royalty annuity on what could become a blockbuster oncology product.

Sales Potential and Financial Outlook

Ziihera's penetration into HER2+ GEA (and possibly other HER2-expressing tumors under evaluation) is the key swing factor for Zymeworks' financial future. With Jazz forecasting greater than $2 billion peak sales, Zymeworks could eventually garner on the order of $200-400 million in annual royalties at peak (assuming mid-to-high teens effective royalty rates given the tiered structure).

Even before reaching that point, the upfront and milestone proceeds have greatly strengthened Zymeworks' balance sheet. Management notes that anticipated milestone payments from Ziihera's GEA approvals would extend its cash runway beyond 2028 (when combined with current cash on hand), without assuming any new partnerships.

In summary, Ziihera has evolved into a cornerstone royalty asset for Zymeworks—one that provides substantial downside protection (via multi-continent approvals in a known target like HER2) as well as upside optionality if frontline GEA and other trials unlock broader use cases.

Royalty Convexity: Understanding Tiered Structures

A noteworthy feature of Zymeworks' economics is the convexity introduced by tiered royalty rates. Unlike a flat royalty, tiered royalties mean that as a drug's sales grow, the royalty percentage increases at predefined thresholds—yielding disproportionate revenue growth for the royalty holder. This structure provides a built-in hedge against low sales (when royalties stay at a modest percentage) while rewarding success with higher profit share.

Mathematical Framework

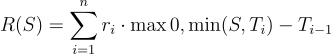

Mathematically, tiered royalties can be represented as a piecewise function. For a royalty that is 10% of annual sales up to threshold X, and 20% on any sales above X, if S is the annual sales level, the total royalty R(S) would be:

For S ≤ X: R(S) = 0.10 \times S

For S > X: R(S) = 0.10 \times X + 0.20 \times (S - X)

More generally, for a royalty with n tiers (rates r₁ < r₂ < ... < rₙ applying at increasing sales breakpoints T₁ < T₂ < ... < Tₙ₋₁), the formula becomes:

Where Tₙ = S if S is in the top tier, and T₀ = 0. This formulation sums the royalty earned in each bracket of sales.

Illustrative Scenario

Although the exact Jazz tier thresholds are confidential, the following example illustrates the convexity effect using hypothetical numbers. Assume the 20% top rate kicks in for annual sales above $1 billion:

| Annual Partner Sales | Royalty Calculation | Total Royalty | Effective Rate | Notes |

|---|---|---|---|---|

| $500M | $500M × 10% | $50M | 10.0% | All within lowest tier |

| $1B | $1B × 10% | $100M | 10.0% | At tier threshold |

| $2B | ($1B × 10%) + ($1B × 20%) | $300M | 15.0% | Top tier kicks in |

| $3B | ($1B × 10%) + ($2B × 20%) | $500M | 16.7% | Approaching peak rate |

| $4B | ($1B × 10%) + ($3B × 20%) | $700M | 17.5% | Strong convexity benefit |

Implications for Zymeworks

This royalty "step function" is convex—higher sales not only increase absolute royalties but also boost Zymeworks' percentage share. The upside impact is significant: in the above example, a 3× increase in sales (from $1B to $3B) results in a 5× increase in royalty revenue (from $100M to $500M).

Incremental sales beyond each threshold contribute at a higher margin, driving nonlinear growth in royalty dollars. For Zymeworks, which has several tiered agreements, this means that if its partners' drugs approach blockbuster volumes, the cash flow to Zymeworks could scale disproportionately fast.

It also underscores why management is focused on assets like Ziihera and pasritamig that have multi-billion dollar potential—the top royalty tiers only come into play if a drug truly succeeds commercially. Assets with modest commercial potential would remain in lower tiers, limiting the convexity benefit.

Diversified Royalty Portfolio Beyond Ziihera

While Ziihera is the flagship, Zymeworks has assembled a broader portfolio of royalty-bearing assets through its platform partnerships. The company's technology (Azymetric bispecifics, ZymeLink ADCs) has been licensed to multiple pharma partners over the past decade, yielding a pipeline of partnered drug candidates at various stages.

These partnerships typically feature milestone payments (for research achievements, IND filings, clinical progress, etc.) and downstream royalties if products reach the market. As of end of 2025, Zymeworks' disclosed partnerships include large-cap partners Janssen (J&J), Bristol Myers Squibb (BMS), GlaxoSmithKline (GSK), Daiichi Sankyo, and Merck, among others.

Collectively, these deals position Zymeworks to earn well over $3-4 billion in potential milestone payments across all programs, plus royalties on any commercial sales.

Partnership Portfolio Summary

| Partner | Asset/Program | Stage | Total Milestone Potential | Royalty Rate | 2025 Milestone Received |

|---|---|---|---|---|---|

| Jazz Pharma | Ziihera (zanidatamab) | Approved (US/EU/CN) | $1.36B remaining | 10-20% tiered | $25M (FDA), $25M (EU) |

| BeOne Medicines | Ziihera (APAC) | Approved (China) | ~$159M remaining | Up to 19.5% | $20M (NMPA) |

| Janssen (J&J) | Pasritamig (JNJ-78278343) | Phase 3 | ~$434M remaining | Mid-single digit | $25M (development) |

| Bristol Myers Squibb | Undisclosed (cytokine bispecifics) | Preclinical/Ph1 | Up to $1.7B (across 10 products) | Low-to-mid single digit | $7.5M |

| GlaxoSmithKline | Undisclosed (multispecific oncology) | Early clinical | Up to $1.1B | Low single digit | $14M |

| Merck & Co. | Undisclosed programs | Discovery | Up to $891M | Low single to ~10% | — |

| Daiichi Sankyo | Cross-license collaboration | Discovery | Up to $313M | Undisclosed | $3.1M |

Pasritamig (JNJ-78278343): The Second Major Partnered Asset

Pasritamig warrants detailed attention as Zymeworks' second most advanced partnered asset with significant commercial potential.

Clinical Profile

| Parameter | Details |

|---|---|

| Drug name | Pasritamig (JNJ-78278343) |

| Mechanism | First-in-class bispecific T-cell engager (KLK2 × CD3) |

| Target indication | Metastatic castration-resistant prostate cancer (mCRPC) |

| Partner | Janssen Biotech (Johnson & Johnson) |

| Current stage | Phase 3 (KLK2-comPAS trial initiated Q4 2025) |

| Regulatory designation | FDA Fast Track |

Phase 1 Efficacy Data

Early Phase 1 results presented at ASCO 2025 were encouraging:

| Endpoint | Result |

|---|---|

| PSA50 response rate | 42.4% in heavily pretreated patients |

| PSA response rate (any decline) | 20% in dose-escalation cohort |

| Safety profile | Manageable; consistent with T-cell engager class |

| Tolerability | Favorable for chronic dosing |

Development Timeline and Economics

| Milestone | Timing | Notes |

|---|---|---|

| Phase 3 initiation (monotherapy) | Q4 2025 | KLK2-comPAS trial in late-line mCRPC |

| Phase 3 initiation (combination) | 2026 | Pasritamig + chemotherapy |

| Potential Phase 3 data | 2028+ | Trials ongoing |

| Peak sales guidance (J&J) | — | $1-5 billion range |

For Zymeworks, the Janssen license has already delivered a $25 million development milestone in 2025, and up to $434 million in further milestones remain possible. Royalties are tiered in the mid-single digits percentage—lower than the Ziihera rates but still meaningful given J&J's $1-5 billion peak sales estimate.

The wide peak sales range ($1-5B) reflects the uncertainty inherent in prostate cancer market dynamics and competitive landscape, but the upper end would represent a major commercial success generating substantial royalties for Zymeworks.

Bristol Myers Squibb Collaboration

Zymeworks has a multi-target partnership with Bristol Myers (dating back to Celgene) focused on cytokine-receptor bispecifics for inflammatory and immunological diseases.

| Parameter | Details |

|---|---|

| Partnership origin | Celgene (pre-BMS acquisition) |

| Focus area | Cytokine-receptor bispecifics |

| Potential targets | IL-4R/IL-13 or IL-33 (not confirmed) |

| Therapeutic area | Inflammatory diseases |

| Total milestone potential | Up to $1.7 billion across up to 10 products |

| Royalty rates | Tiered low-to-mid single digit |

| 2025 milestone | $7.5M (likely IND acceptance or early clinical progress) |

This yielded at least one clinical candidate in 2025—Zymeworks earned the $7.5 million milestone from BMS in H1 2025. While specific molecules are not public, Zymeworks' pipeline suggests possible bispecific antibodies in inflammatory diseases. A Phase 1 trial or additional IND filing could occur by 2026, representing a catalyst to unlock further milestones.

This program remains a pipeline "stealth" asset providing optionality without requiring Zymeworks capital investment.

GlaxoSmithKline Partnership

GlaxoSmithKline entered a licensing deal (announced 2022) to develop a multispecific antibody using Zymeworks technology.

| Parameter | Details |

|---|---|

| Announcement | 2022 |

| Focus | Multispecific antibody (likely oncology) |

| Target | Undisclosed (likely solid tumor antigen) |

| Mechanism | Bi- or tri-specific |

| Total milestone potential | Up to $1.1 billion |

| Royalty rates | Tiered low-single-digit |

| 2025 milestone | $14M (clinical candidate nomination or trial initiation) |

In 2025, Zymeworks recognized a $14.0 million milestone from GSK, indicating progress (potentially a clinical candidate nomination or trial initiation). Although details are scarce, this program likely targets a solid tumor antigen with a bi- or tri-specific mechanism. Any Phase 1 data readouts or advancement to Phase 2 by 2026-27 would be incremental positives.

Daiichi Sankyo Partnership

Zymeworks and Daiichi Sankyo have a collaboration and cross-licensing agreement that provides strategic technology access for both parties.

| Parameter | Details |

|---|---|

| Structure | Collaboration and cross-licensing |

| Zymeworks receives | Access to certain ADC linkers |

| Daiichi receives | Access to Zymeworks' platforms |

| Total milestone potential | Up to $313 million |

| Royalty rates | Tiered (undisclosed percentage, likely single-digit) |

| 2025 milestone | $3.1M (research milestone) |

Zymeworks is eligible for up to $313 million in milestones from Daiichi and earned a $3.1 million milestone in 2025 (likely a research milestone). This partnership's focus has not been disclosed, and any compounds would be in early development. Near-term catalysts from this program are not anticipated; it represents longer-term upside if Daiichi advances a candidate into clinical trials.

Merck & Co. Partnership

Merck was an early collaborator with Zymeworks and in 2023 expanded the alliance by licensing additional multispecific antibody programs.

| Parameter | Details |

|---|---|

| Relationship duration | Over a decade ("longtime partner") |

| 2023 expansion | Additional multispecific antibody programs licensed |

| Total milestone potential | Up to $891 million (including $230M from 2023 expansion) |

| Royalty rates | Ranging from low-single digits up to ~10% on sales |

| Therapeutic areas | Likely oncology or immunology |

| Current stage | Discovery |

The new Merck programs come with up to $230 million in milestone payments and royalties ranging from low-single digits up to approximately 10% on sales. Given Merck's breadth, the targets could be in oncology or immunology. The partnership is still at discovery stage—no near-term readouts are expected—but Merck's continued engagement over a decade-long relationship underscores the value of Zymeworks' platforms. Any future IND filing by Merck would trigger milestones.

Portfolio Risk and Diversification Analysis

This diversified partner portfolio gives Zymeworks a similar profile to a mini-royalty fund. By 2025, it had 12 partnered assets in its "royalty pipeline" (including candidates across these alliances). Each asset is largely developed and funded by the partner, costing Zymeworks nothing further, but success could yield a stream of milestones and royalties.

Portfolio Characteristics

| Characteristic | Assessment |

|---|---|

| Number of partnered programs | ~12 |

| Partner quality | Large-cap pharma (J&J, BMS, GSK, Merck, Daiichi) |

| Stage distribution | Skewed early (discovery/preclinical) except Ziihera and pasritamig |

| Funding requirement | Zero (partners fund all development) |

| Therapeutic diversity | Oncology dominant, some immunology |

| Geographic diversity | Global (US, EU, Japan, China coverage) |

The flip side is that many of these programs are high-risk (early stage or novel biology), and some may never progress. However, the broad number of "shots on goal" provides a degree of risk pooling. Management explicitly benchmarks against royalty companies: Zymeworks' investor materials compare its model to "traditional royalty buyers" versus "traditional biotech," with Zymeworks aiming to occupy the hybrid middle ground.

Comparison to XOMA: Hybrid Versus Pure-Play Models

It is instructive to compare Zymeworks with XOMA Corporation, one of the best-known biotech royalty aggregators.

Business Model Comparison

| Attribute | XOMA | Zymeworks |

|---|---|---|

| Business Model | Pure royalty aggregator | Hybrid R&D + royalty |

| R&D Operations | None (zero R&D expense) | Active (~$135M annual spend) |

| Portfolio Size | 65+ assets, 11 therapeutic areas | ~12 partnered programs |

| Asset Origination | External acquisition only | Internal discovery + potential external |

| Revenue Sources | 100% royalties/milestones | Milestones + royalties + development support |

| Concentration Risk | Highly diversified | Ziihera-concentrated |

| Operating Expenses | Minimal (financial vehicle) | Substantial (biotech operations) |

| Capital Deployment | Royalty acquisitions + dividends | Buybacks + R&D + potential acquisitions |

XOMA's Pure-Play Approach

XOMA underwent a similar strategic pivot in 2017 to focus exclusively on acquiring milestone and royalty rights. Today, XOMA holds economic interests in over 120 partnered assets spanning 11 therapeutic areas, and it provides non-dilutive funding to emerging biotechs in exchange for slices of future royalties.

Notably, XOMA has no internal R&D—it is purely a financial vehicle. This model has proven successful: XOMA returned to profitability by 2025 and has received approximately $44M in partner payments in the first 9 months of 2025 alone. Recent acquisitions include wind-downs of Kinnate, Pulmokine, Turnstone, Mural Oncology, and HilleVax.

Zymeworks' Hybrid Differentiation

Zymeworks, by contrast, is not a pure financier; it originates its own assets and only then monetizes them. This difference means Zymeworks spends on R&D (whereas XOMA does not), but also that Zymeworks can potentially create more value per asset (since it owns the asset from inception and can negotiate favorable deal terms, as seen with Ziihera's high 10-20% royalty rate compared to typical single-digit acquired royalties).

Zymeworks also so far has a more concentrated portfolio—essentially anchored by one major commercial asset (Ziihera) and a handful of clinical-stage partner assets—whereas XOMA's portfolio is extremely broad and thus statistically less sensitive to any single program.

Investor Implications

| Factor | XOMA Advantage | Zymeworks Advantage |

|---|---|---|

| Diversification | ✓ 65+ assets reduce single-asset risk | |

| Operating leverage | ✓ Near-zero OpEx | |

| Royalty rate potential | ✓ Can negotiate higher rates on proprietary assets | |

| Upside optionality | ✓ Internal pipeline provides additional value creation | |

| Proven acquisition track record | ✓ Multiple deals executed | |

| Higher per-asset returns | ✓ Proprietary origination captures full value chain |

From an investor's perspective, Zymeworks offers a higher-risk, higher-reward twist on the royalty aggregator model. Its revenue base in the coming years will be dominated by one product (and a few mid-stage programs), but it also retains an internal pipeline that could produce the next Ziihera or be sold/licensed for additional upside.

In summary, Zymeworks is carving out a niche as a hybrid R&D-driven royalty company, whereas XOMA represents the pure-play royalty approach of monetizing others' inventions. Both models emphasize downside protection (via diversified royalty streams) and non-dilutive funding, but Zymeworks also emphasizes upside creation through selective internal innovation.

Capital Allocation: Buybacks, Reinvestment, and Royalty Deals

Zymeworks' management has been deploying capital in a disciplined, shareholder-friendly manner consistent with its hybrid business model. With the influx of cash from partnerships (notably the Jazz deal), the company initiated stock repurchases to return value to shareholders.

Share Repurchase History

| Authorization | Amount | Timing | Shares Repurchased | Avg. Price | Status |

|---|---|---|---|---|---|

| Initial program | $30M | 2024 | ~2.2M shares | ~$13.50 | Completed |

| Second program | $30M | Early 2025 | ~2.2M shares | ~$13.50 | Completed mid-2025 |

| Combined ($60M authorization) | $60M | Aug 2024 - Nov 2025 | ~4.4M shares (~6% of outstanding) | ~$13.50 | Completed |

| New authorization | $125M | Nov 2025 | TBD | — | Active |

In late 2025, Zymeworks announced the significantly larger $125 million share repurchase authorization, reflecting confidence in its long-term prospects and the strength of its cash position. Executing this full $125M buyback (at current market prices around $27) would retire a substantial portion of shares, potentially on the order of 10-15% of shares outstanding, thereby accreting value per share for remaining investors.

The aggressive buyback execution at $13.50 average versus the current ~$27 share price represents substantial value creation for remaining shareholders who benefited from the reduced share count.

Cash Runway and Milestone Expectations

Despite these buybacks, Zymeworks expects to maintain a robust cash runway through at least 2028, thanks to anticipated milestone receipts.

| Scenario | Cash Runway Projection |

|---|---|

| Current cash only | Into second half of 2027 |

| With GEA approval milestones ($440M) | Beyond 2028 |

| With full $125M buyback completed | Still extends beyond 2028 (with GEA milestones) |

The company projects that if Ziihera's GEA approvals come through as expected (delivering up to $440M in milestones over 2025-27), it can fund operations into 2029 even after completing the full $125M repurchase plan. This speaks to the cash-generative nature of the royalty business model: milestone payments can be redeployed both to shareholders and to pipeline investments without jeopardizing solvency.

Reinvestment Priorities

In terms of reinvestment, Zymeworks has been allocating capital to two main areas:

Internal R&D Projects: The company continues to invest in its next wave of proprietary candidates through the "5 by 5" strategy—five IND filings targeted by mid-2026. Current programs include:

| Program | Target | Modality | Stage | Notes |

|---|---|---|---|---|

| ZW191 | Folate receptor-α | ADC | Phase 1 | Ongoing |

| ZW251 | GPC3 | ADC | IND cleared | July 2025 |

| ZW220 | NaPi2b | ADC | Paused | Development hold |

| ZW209 | DLL3 | Trispecific T-cell engager | IND expected H1 2026 | Novel mechanism |

| ZW1528 | IL-4Rα × IL-33 | Bispecific | Preclinical | Respiratory diseases (beyond oncology) |

Management has indicated it will focus on areas of strength—such as multifunctional oncology biologics—and seek early proof-of-concept before partnering or deciding on internal development. The goal is to leverage Zymeworks' engineering platforms to create highly partnering-ready assets, repeating the zanidatamab playbook.

Business Development: Zymeworks is actively scanning for "industry opportunities for acquisition of new revenue streams." This could include purchasing royalty rights from third parties or structuring "synthetic royalty" financing deals. For example, if a smaller biotech has a promising clinical asset but needs cash, Zymeworks could provide funding in exchange for a royalty on that asset's future sales.

This is analogous to XOMA's approach and would allow Zymeworks to expand its royalty portfolio beyond just internally discovered drugs. So far, Zymeworks has not announced any major royalty acquisitions, but given its growing cash reserves and royalty-centric strategy, this remains an option. Any such deals would be evaluated against alternative uses of cash (like further buybacks or bolt-on technology acquisitions) with an eye toward maximizing risk-adjusted returns.

Financial Position and Operating Economics

Zymeworks' balance sheet reflects the transition from cash-burning biotech to milestone-funded royalty company.

Cash and Liquidity Position

| Date | Cash | Short-term Securities | Long-term Securities | Total | Key Events |

|---|---|---|---|---|---|

| Dec 31, 2024 | $66.1M | $159.7M | $98.4M | $324.2M | Post-FDA approval |

| Sep 30, 2025 | — | — | — | $299.4M | $25M J&J milestone pending |

| Pro forma | — | — | — | $700M+ | With $440M GEA milestones |

The company has zero debt, providing financial flexibility and avoiding interest expense or covenant constraints.

FY2024 Operating Results

| Line Item | Amount | % of OpEx | Notes |

|---|---|---|---|

| R&D Expense | $134.6M | 63% | Pipeline investment |

| G&A Expense | $61.5M | 29% | Corporate overhead |

| Impairment Charge | $17.3M | 8% | ZW49 ADC discontinuation |

| Total Operating Expense | $213.4M | 100% | — |

| Interest and Other Income | $20.5M | — | Cash/securities yield |

| Net Loss | $122.7M | — | — |

Quarterly Revenue Trends (2025)

| Quarter | Collaboration Revenue | Royalty Revenue | Total Revenue |

|---|---|---|---|

| Q1 2025 | $32.5M (includes $25M FDA milestone) | $0.3M | $32.8M |

| Q2 2025 | $14.3M | $0.8M | $15.1M |

| Q3 2025 | $70.0M (includes EU, China milestones, J&J) | $1.5M | $71.5M |

Royalty revenue remains modest in early commercialization but is expected to ramp as Jazz and BeOne execute on Ziihera launches.

Risk Monitoring

Financially, Zymeworks is in a solid position: it ended 2024 with substantial cash and zero debt. The upcoming Jazz/BeOne milestone tranche for GEA (potentially $440M from approvals) would further bolster the balance sheet. This gives Zymeworks optionality—it can afford to buy back shares and invest in growth.

The main risk to monitor is execution: if major milestones were delayed or if pipeline bets don't pan out, the company would need to adjust its spending (for instance, pacing the buyback or seeking additional partner deals). At present, however, the royalty-driven model is throwing off enough cash to comfortably fund operations and strategic initiatives, aligning with Zymeworks' vision of a self-sustaining biotech platform.

Competitive Landscape: HER2 Therapeutics

Zanidatamab competes in the increasingly crowded HER2-targeted therapy space, where Daiichi Sankyo/AstraZeneca's Enhertu (trastuzumab deruxtecan) has established commercial dominance.

HER2-Targeted Therapy Comparison

| Drug | Company | Mechanism | 2024 Sales | Key Differentiation | Safety Consideration |

|---|---|---|---|---|---|

| Enhertu | Daiichi/AstraZeneca | HER2-ADC (topoisomerase payload) | $3.75B | Tissue-agnostic approval, broad efficacy | ILD black box warning |

| Ziihera | Jazz/BeOne | Biparatopic HER2 bispecific (no payload) | Launch phase | Receptor clustering, no chemotherapy | No ILD signal |

| Herceptin | Roche | Monospecific HER2 antibody | ~$2B (declining) | Established standard | Cardiotoxicity |

| Perjeta | Roche | HER2 dimerization inhibitor | ~$4B | Combination standard | Used with Herceptin |

| KN026 | Alphamab | Biparatopic HER2 bispecific | — | Direct zanidatamab competitor | Limited Western data |

| Zenocutuzumab | Genmab (acquired) | HER2×HER3 bispecific | — | NRG1 fusion-specific | Acquired for $8B (Sep 2025) |

Zanidatamab's Competitive Positioning

Zanidatamab's differentiated mechanism—biparatopic binding without cytotoxic payload—positions it as potentially complementary to Enhertu rather than directly competitive in many settings:

| Attribute | Enhertu | Ziihera |

|---|---|---|

| Mechanism | ADC delivers chemotherapy payload | Bispecific induces receptor internalization |

| Payload toxicity | Yes (topoisomerase inhibitor) | No payload |

| ILD risk | Black box warning | Not observed |

| Prior therapy positioning | First/second line in many indications | Post-Enhertu option in development |

| Combination potential | Limited by toxicity | Favorable for combinations |

The EmpowHER-303 Phase 3 trial specifically targets patients who progressed on Enhertu in metastatic breast cancer, positioning zanidatamab as a post-T-DXd option rather than a direct competitor. This sequencing strategy could expand zanidatamab's addressable market to include Enhertu failures.

Bispecific Landscape Intensification

Nature Biotechnology reported nearly 250 multispecific candidates in clinical trials by late 2025, signaling intensifying competition in the bispecific space. Genmab's $8 billion acquisition of Merus (for zenocutuzumab) in September 2025 underscores the strategic value placed on differentiated bispecific platforms.

Risk Factors and Bear Case Analysis

Partner Concentration Risk

Leerink Partners estimates existing Ziihera royalties and milestones represent approximately $29 per share of Zymeworks' valuation—the substantial majority of enterprise value at a ~$2 billion market cap. This concentration creates meaningful partner execution risk:

| Risk Factor | Description | Mitigation |

|---|---|---|

| Jazz commercial execution | Zymeworks has no control over Jazz's sales force effectiveness or pricing strategy | Jazz has oncology commercial infrastructure |

| Confirmatory trial execution | HERIZON-BTC-302 must succeed for full approval | Trial design based on prior efficacy data |

| BeOne China market access | Pricing, reimbursement, and distribution in China | BeOne has local market expertise |

| Competitive response | Enhertu label expansions could pressure market share | Differentiated mechanism, sequencing opportunity |

Internal R&D Track Record

Recent program discontinuations raise questions about Zymeworks' drug discovery capabilities:

| Program | Outcome | Financial Impact | Implications |

|---|---|---|---|

| ZW49 (zanidatamab zovodotin ADC) | Discontinued 2024 | $17.3M impairment | ADC payload selection challenges |

| ZW171 (mesothelin T-cell engager) | Terminated 2025 | Not disclosed | "Unfavorable benefit-risk profile" |

| ZW220 (NaPi2b ADC) | Paused | Development hold | Target validation concerns |

These failures validate the pivot toward early partnering (offloading late-stage risk to partners) but challenge the thesis that internal R&D creates value. The "5 by 5" pipeline strategy depends on successful discovery and early development execution.

Unproven Royalty Acquisition Strategy

Despite articulating a royalty acquisition strategy and appointing a CIO, Zymeworks has announced no external royalty deals. Analyst David Martin (Bloom Burton) noted: "Until they do a royalty deal like what they're contemplating, we can't tell if it would be positive or negative to the valuation."

| Execution Question | Status |

|---|---|

| Has Zymeworks completed any royalty acquisitions? | No |

| Is the CIO role proven? | New appointment (Nov 2025) |

| What is the target deal size? | Not disclosed |

| What return thresholds are required? | Not disclosed |

Valuation Considerations

| Metric | Current Value | Context |

|---|---|---|

| Share price | ~$27 | Near 52-week highs |

| Market cap | ~$2.0B | — |

| P/S Ratio | 14.67× | Elevated vs. historical range |

| P/B Ratio | 6.18× | Premium to book value |

| Insider Ownership | 0.76% | Limited management skin in game |

| Institutional Ownership | 93%+ | Concentrated institutional base |

| Analyst consensus | Strong Buy (13 analysts, 0 sells) | $34.82 average price target |

Recent insider buying from EcoR1 Capital ($1.5 million in late 2024) signals board-level confidence, but overall insider ownership remains low.

Dual Listing: Nasdaq and TSX Considerations

Zymeworks is dual-listed on the Nasdaq (ticker: ZYME) and the Toronto Stock Exchange (TSX: ZYME). This dual listing reflects the company's Canadian roots (headquartered in Vancouver, BC) while also catering to the deep pool of U.S. biotech capital.

Listing Characteristics

| Attribute | Nasdaq | TSX |

|---|---|---|

| Trading currency | USD | CAD |

| Primary volume | Majority of trading | Secondary venue |

| Investor base | U.S. biotech funds, global institutions | Canadian institutions, retail, index funds |

| Options availability | Yes | Limited |

| Index inclusion | U.S. biotech indices | S&P/TSX Composite (historically) |

Implications for Investors

Liquidity: The primary trading venue for Zymeworks is Nasdaq, which generally accounts for the majority of share volume given the larger U.S. investor base and healthcare-focused funds. The TSX listing provides additional liquidity during Canadian market hours and allows Canadian institutional and retail investors (some of whom have mandates or preferences for domestic listings) to participate more easily.

Investor Base: Being listed in Toronto means Zymeworks can be included in Canadian stock indices (it has been part of the S&P/TSX Composite in the past). This attracts passive flows from index-tracking funds. Moreover, Canadian healthcare/biotech specialist funds often prefer or require TSX-listed names. The dual listing essentially maximizes the company's exposure to North American investors.

Currency Exposure: Zymeworks' shares trade in two currencies—U.S. dollars on Nasdaq and Canadian dollars on TSX. The underlying financials of the company are reported in USD (and most of its revenue streams, like milestone payments from partners, are dollar-denominated). Therefore, the TSX price in CAD will naturally arbitrage against the Nasdaq price based on USD/CAD exchange rates.

For investors, there is minimal direct currency risk as the two listings reflect the same intrinsic value (any divergence is quickly arbitraged by traders). However, Canadian investors effectively hold a U.S. dollar asset; if the USD were to weaken significantly against the CAD, the TSX price of ZYME (in CAD) could decline even if the USD price is stable, and vice versa.

In practical terms, the dual listing has had negligible downsides. The company has been listed on both exchanges since its 2017 IPO. From a governance perspective, Zymeworks reports to both U.S. SEC and Canadian securities regulators, and it must comply with both exchanges' listing requirements.

In summary, the Nasdaq/TSX dual listing is a net positive for Zymeworks: it enhances liquidity and diversifies the shareholder base without introducing meaningful currency or regulatory complications.

2026 Catalysts and Timeline

| Timeline | Catalyst | Category | Financial Impact |

|---|---|---|---|

| Q1 2026 | HERIZON-GEA-01 full data presentation | Clinical | Validates commercial thesis |

| H1 2026 | Ziihera US sBLA submission (GEA) | Regulatory | De-risks approval pathway |

| H1 2026 | ZW209 (DLL3 trispecific) IND filing | Pipeline | Internal optionality |

| H1 2026 | ZW251 (GPC3 ADC) Phase 1 initiation | Pipeline | Platform validation |

| 2026 | Pasritamig Phase 3 enrollment progress | Clinical | J&J execution visibility |

| 2026 | Potential royalty acquisition announcement | Strategy | Model validation |

| 2026 | Additional BMS/GSK pipeline milestones | Partnered | $5-15M range potential |

| Late 2026 | EU Ziihera GEA approval (potential) | Regulatory | $100M milestone |

| Late 2026/2027 | US Ziihera GEA approval | Regulatory | $250M milestone |

| 2027 | Japan Ziihera GEA approval | Regulatory | $75M milestone |

| 2027 | China Ziihera GEA approval | Regulatory | $15M milestone |

Appendix: Partnered Assets Detail Table

| Asset (Partner) | Development Stage | Economics to Zymeworks | 2026 Expected Catalysts |

|---|---|---|---|

| Ziihera (Jazz Pharma & BeOne) | Approved (US, EU, China) for 2L HER2+ BTC; Phase 3 completed in 1L HER2+ GEA with positive PFS/OS results | Jazz: $425M received; up to $1.36B remaining; 10-20% tiered royalties. BeOne: $81M received; up to $159M remaining; up to 19.5% royalties | HERIZON-GEA-01 data presentation (Q1); US sBLA submission (H1); Ongoing BTC launch royalty ramp |

| Pasritamig (Janssen/J&J) | Phase 3 ongoing (KLK2-comPAS initiated Q4 2025); Additional Phase 3 (+ chemo) planned 2026; Phase 1 demonstrated 42.4% PSA50 response | Up to ~$434M remaining milestones; mid-single-digit tiered royalties; J&J $1-5B peak sales guidance | Second Phase 3 initiation; Enrollment updates; Potential interim analysis late 2026 |

| BMS Bispecific Program | Preclinical/IND-enabling (likely IL-4Rα/IL-13 or IL-33 targets); $7.5M milestone suggests clinical progress | Up to $1.7B across 10 products; low-to-mid single-digit royalties | Potential IND filing and Phase 1 initiation; Initial Phase 1 data possible late 2026/2027 |

| GSK Multispecific Program | Early clinical or late preclinical (undisclosed oncology target); $14M milestone suggests IND or Phase 1 start | Up to ~$1.1B milestones; tiered low-single-digit royalties | Phase 1 results or progress update possible late 2026 |

| Merck Multi-Asset Partnership | Discovery/preclinical on newly licensed programs (2023 expansion); Longtime partnership since mid-2010s | Up to $891M milestones; tiered royalties from low-single to ~10% | No specific 2026 catalysts expected; Early-stage research progress |

| Daiichi Sankyo Partnership | Discovery stage (platform cross-licensing); Initial research milestone achieved 2025 | Up to $313M milestones; tiered royalties (undisclosed) | No near-term catalysts; Potential IND beyond 2026 |

Conclusion

Zymeworks' transformation from traditional biotech to royalty-driven hybrid represents a rational strategic pivot given the company's partnership economics, but execution risk remains substantial. The investment thesis rests on three core questions:

Can Jazz execute Ziihera's commercial potential? With peak sales estimates of $2-3 billion and 10-20% tiered royalties, zanidatamab's commercial success is the primary value driver. Jazz must successfully launch in biliary tract cancer, complete confirmatory trials, and win first-line GEA approval against entrenched competition from Enhertu and established HER2 therapies.

Will Zymeworks execute external royalty acquisitions? The company has articulated a strategy and appointed a CIO, but announced no deals. Demonstrating competence in royalty acquisition would validate the hybrid model and provide diversification away from Ziihera concentration. The quality and terms of any acquired royalties will significantly impact whether the strategy creates or destroys value.

Does retained R&D add or subtract value? The "5 by 5" pipeline consumes approximately $135M annually in R&D expense. Historical failures (ZW49, ZW171) challenge the thesis that internal origination creates value, though early partnering reduces binary development risk. The ZW191, ZW251, and ZW209 programs represent the next test of Zymeworks' discovery capabilities.

For pharmaceutical royalty investors, Zymeworks offers higher concentration risk than pure-play aggregators like XOMA but also higher potential returns if zanidatamab achieves blockbuster status. The tiered royalty structure creates convex upside where incremental partner sales growth generates disproportionate royalty revenue growth. The $440M GEA milestone tranche provides near-term catalysts that could substantially extend cash runway and fund continued buybacks.

The hybrid model's ultimate success depends on execution in both royalty aggregation and selective R&D—an ambitious combination that remains unproven. Investors comfortable with single-asset concentration and partner execution risk may find the risk-reward attractive at current valuations; those seeking diversified royalty exposure may prefer pure-play alternatives.

Disclaimer: The author of this article is not a lawyer or financial advisor. The content herein is provided for informational purposes only and does not constitute investment, legal, or financial advice. Past performance does not guarantee future results. Readers should conduct their own due diligence and consult qualified professionals before making investment decisions.

Member discussion